The Top 6 Websites for IPO Information

Initial public offerings (IPOs) are some of the most highly anticipated events in the stock market.

But keeping up with upcoming offerings — and their related details — can be surprisingly difficult.

Details shift constantly, timelines change with little notice, and, when the IPO market heats up, public offerings often arrive in rapid succession, making it even harder to stay on top of it all.

Whether you're looking to track upcoming IPOs, research valuations, or analyze potential investments, here are six of the best websites for reliable, up-to-date IPO information.

Summary view

| Website | Best for | Key feature(s) |

| Renaissance Capital | Best overall | Pricing, calendar, news, polls, stats, and research |

| IPOScoop | Best for performance predictions | Upcoming offerings, predicted performance, and post-IPO performance |

| Stock Analysis | Best for free, general research | Calendar, news, lists, screener |

| SEC EDGAR | Best for raw, first-hand company details | Primary source for all U.S. IPO-related documents |

| Nasdaq & NYSE IPO centers | Best for simple IPO previews | Official listing dates and price ranges |

| Seeking Alpha | Best for IPO analysis | Analyst research and opinions |

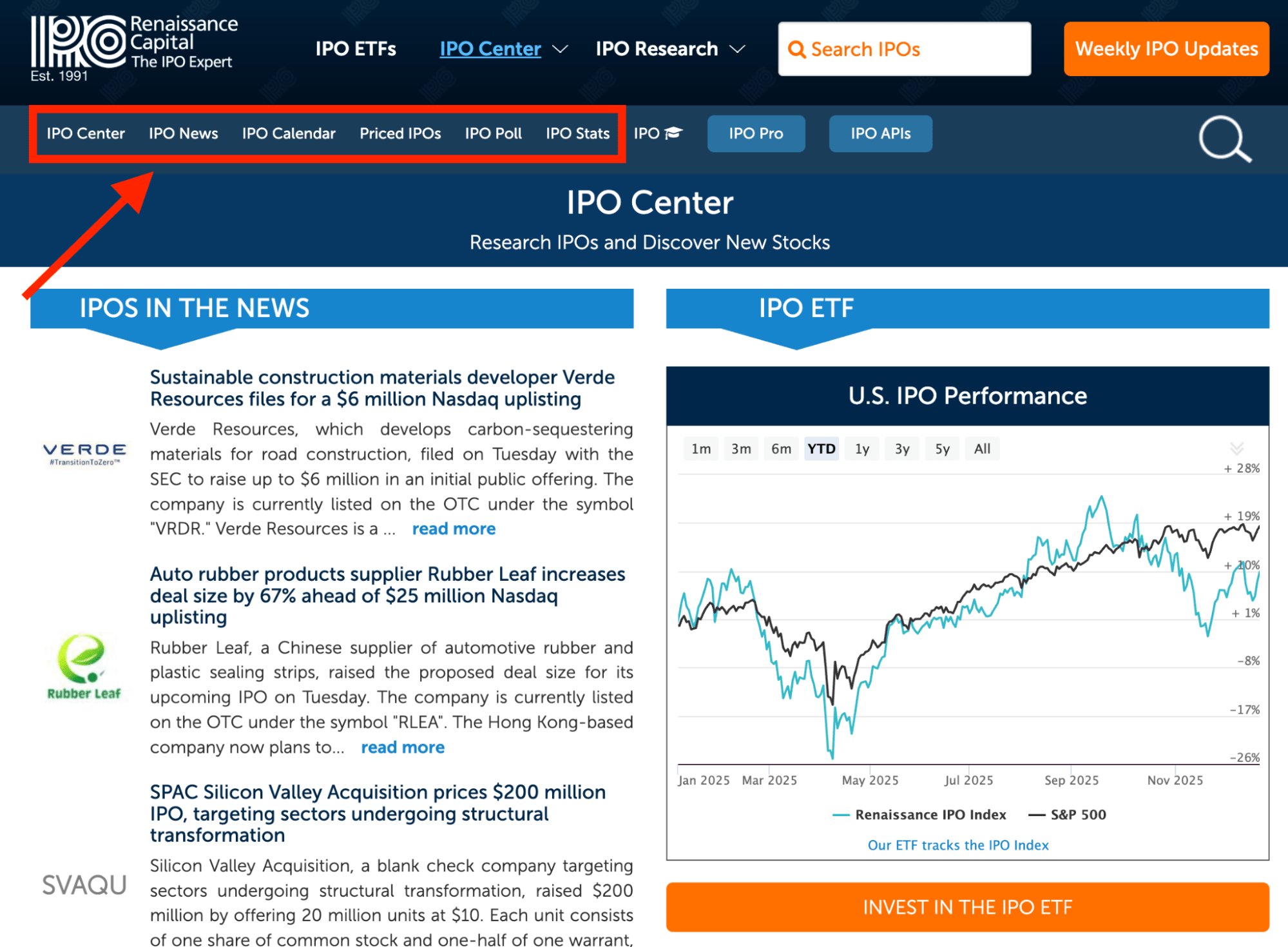

1. Renaissance Capital: Best overall

- Key feature(s): U.S. and global IPO pricing, calendar, news, polls, stats, and research

- Pricing: Primarily free

Renaissance Capital's IPO Center is one of the most comprehensive resources for IPO information online. If you only bookmark one IPO site, this is the one.

The site offers a simple, well-organized, and up-to-date dashboard with plenty of depth.

You can read the latest news, browse upcoming offerings, track the performance of recently listed companies, check valuation stats, see investor sentiment polls, and more.

All of this is available for free, but to take your IPO research to the next level, you can upgrade to IPO Pro.

With IPO Pro, you get proprietary, institutional-grade insights, enhanced company profiles, downloadable data, real-time news and exclusive content, and deal trackers to keep you up to date on your favorite offerings.

If you're serious about IPO investing, this is a great tool.

But even without the upgrade, the free tools inside Renaissance Capital's IPO Center are more complete than what most sites offer.

The site design is a little outdated, but it's an extremely reliable place for tracking the IPO market.

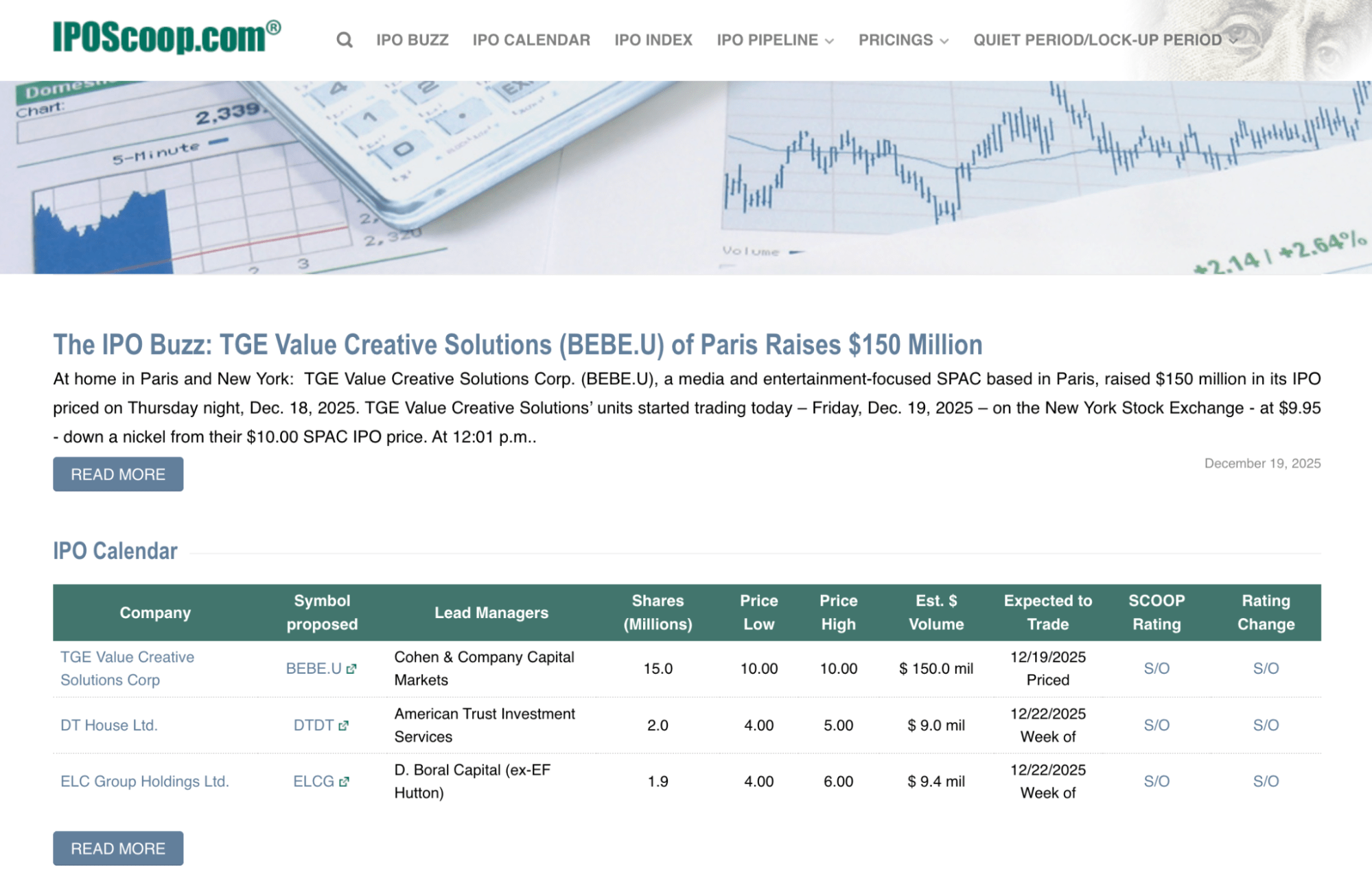

2. IPOScoop: Best for performance predictions

- Best for: Upcoming offerings, predicted performance, and post-IPO performance

- Pricing: Primarily paid

IPOScoop focuses less on headlines and more on how IPOs are likely to perform once they start trading. The site tracks upcoming offerings and assigns each one a SCOOP Rating, which is a 5-star rating system that estimates opening-day performance.

SCOOP Ratings are based on consensus input about how well an IPO might perform when it starts trading, provided by Wall Street analysts and other investment professionals.

- 5 Stars = a potential double

- 4 Stars = $4 per share and higher

- 3 Stars = $1–$3 per share

- 2 Stars = $0.50–$1 per share

- 1 Star = flat to $0.49 per share

Since 2000, SCOOP Ratings have accurately predicted IPO price performance (hitting or exceeding their estimated range) ~89% of the time. These ratings are IPOScoop's standout feature, but you'll need a paid subscription to access them.

That said, the site also offers several free tools, including an IPO calendar, a running news feed, and deal previews.

However, its best free feature is the detailed post-IPO performance data, which tracks how hundreds of recent offerings have fared after going public.

It's an easy way to get a feel for how the overall IPO market is trending, and which types of deals have been outperforming.

IPOScoop offers a niche set of performance tools that you won't find anywhere else.

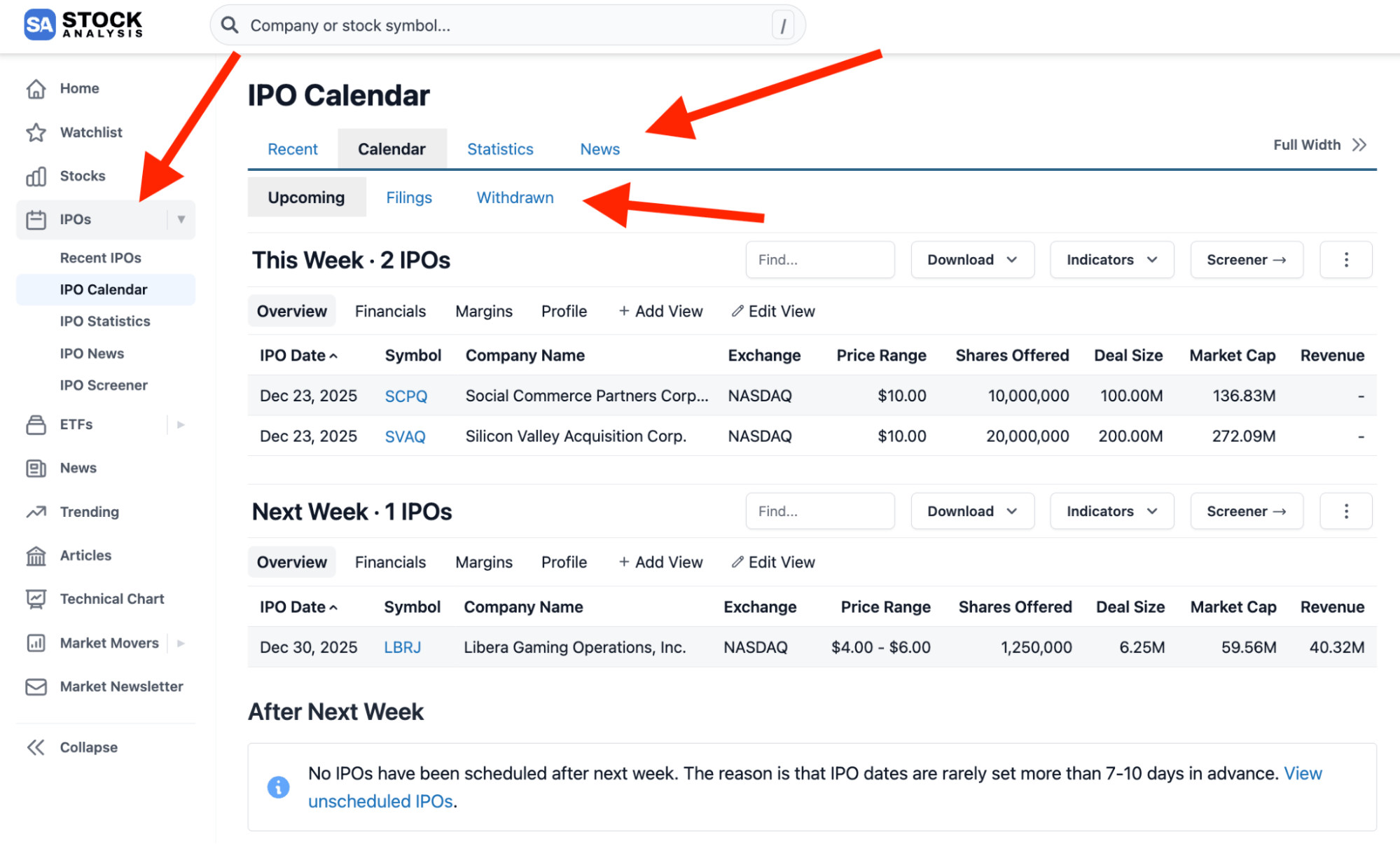

3. Stock Analysis: Best for free, general research

- Best for: Calendar, news, recent IPOs, IPO screener

- Pricing: Free

Stock Analysis is a fast, clean stock research website with a solid set of IPO tools.

It tracks recent and upcoming IPOs, new filings, and withdrawn listings — all updated daily — along with a live newsfeed covering the latest developments.

It also shows high‑level IPO statistics, like the number of offerings per year, making it easy to spot broader market trends at a glance.

Additionally, the Stock Analysis IPO screener lets you filter offerings by sector, market cap, price range, and more. You can click on any of the surfaced stocks and drill down into recent news, stats, deal terms, profiles, and SEC filings.

Stock Analysis also manually gathers historical financial data for IPOs, which is not easy to find on other platforms.

Not only is Stock Analysis a great place to do fast, free IPO research — you can also do it right alongside your public company analysis.

With IPO tools built into the same platform and quick ticker lookups, you can find everything you need with just a few clicks.

Looking for the best app for IPO information?

All of these IPO tools are also available on the Stock Analysis app, making it easy to track new listings, filings, and performance data on the go.

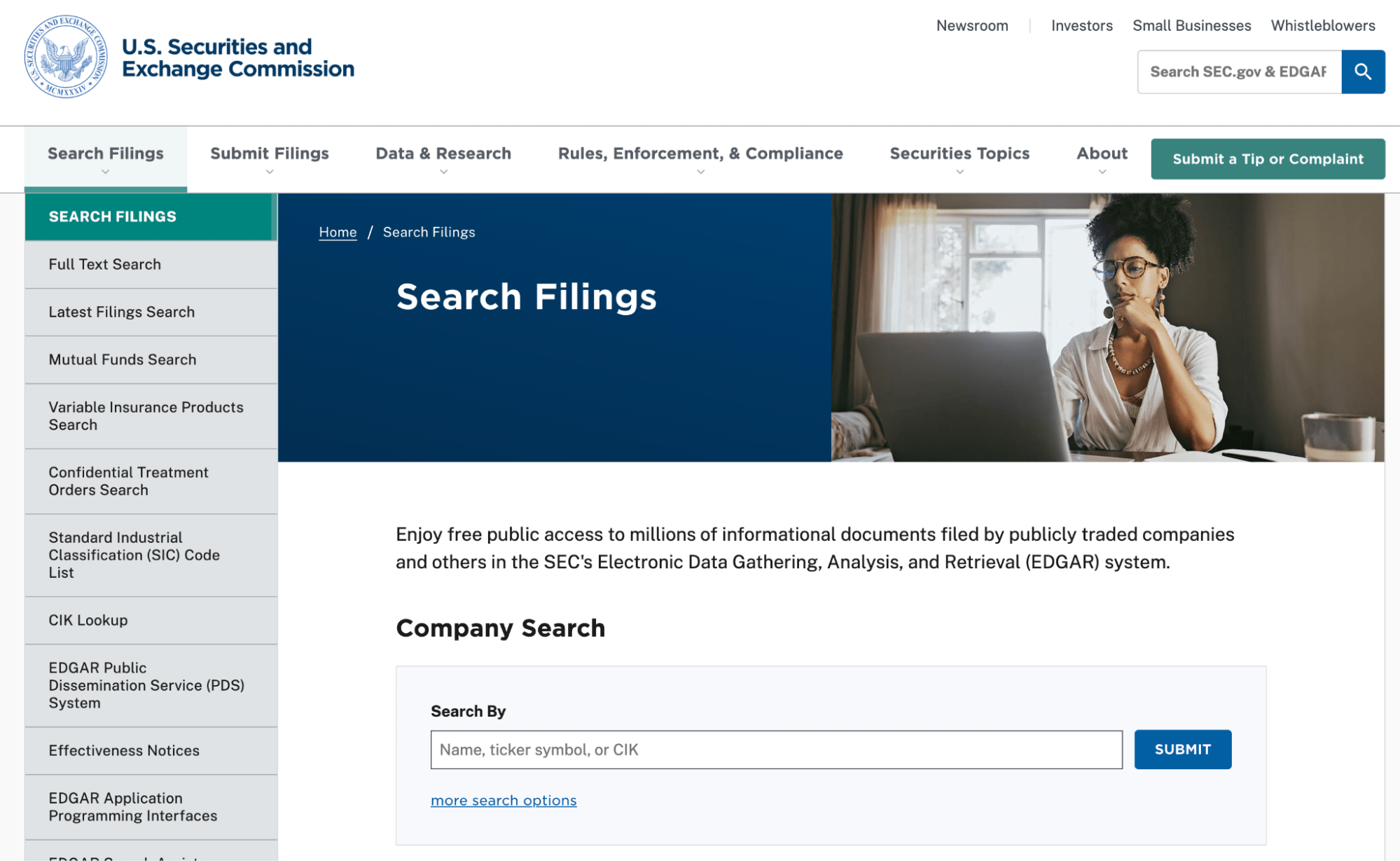

4. SEC EDGAR: Best for raw, first-hand company details

- Best for: Primary source for all U.S. IPO-related documents

- Pricing: Free

EDGAR is the official SEC database that houses every IPO-related filing made in the U.S., including S‑1s, amendments, pricing updates, and prospectuses. If a company plans to go public, its paperwork will show up here first.

While it's not built for user-friendliness, EDGAR is the most reliable and direct source of IPO information available. You can search by company name or ticker, filter by filing type (like S‑1 or 424B4), and read documents in full.

If you've never used EDGAR, you may be surprised at the level of detail you can find in these filings.

S‑1s and prospectuses often include everything from financial statements and business risks to executive compensation, customer concentration, and revenue breakdowns.

EDGAR is also extremely useful for researching public companies. You can read more about it in this article.

For the closest look at how a company operates before it goes public, complete with raw numbers and details before they're interpreted by other sources, EDGAR is where you go.

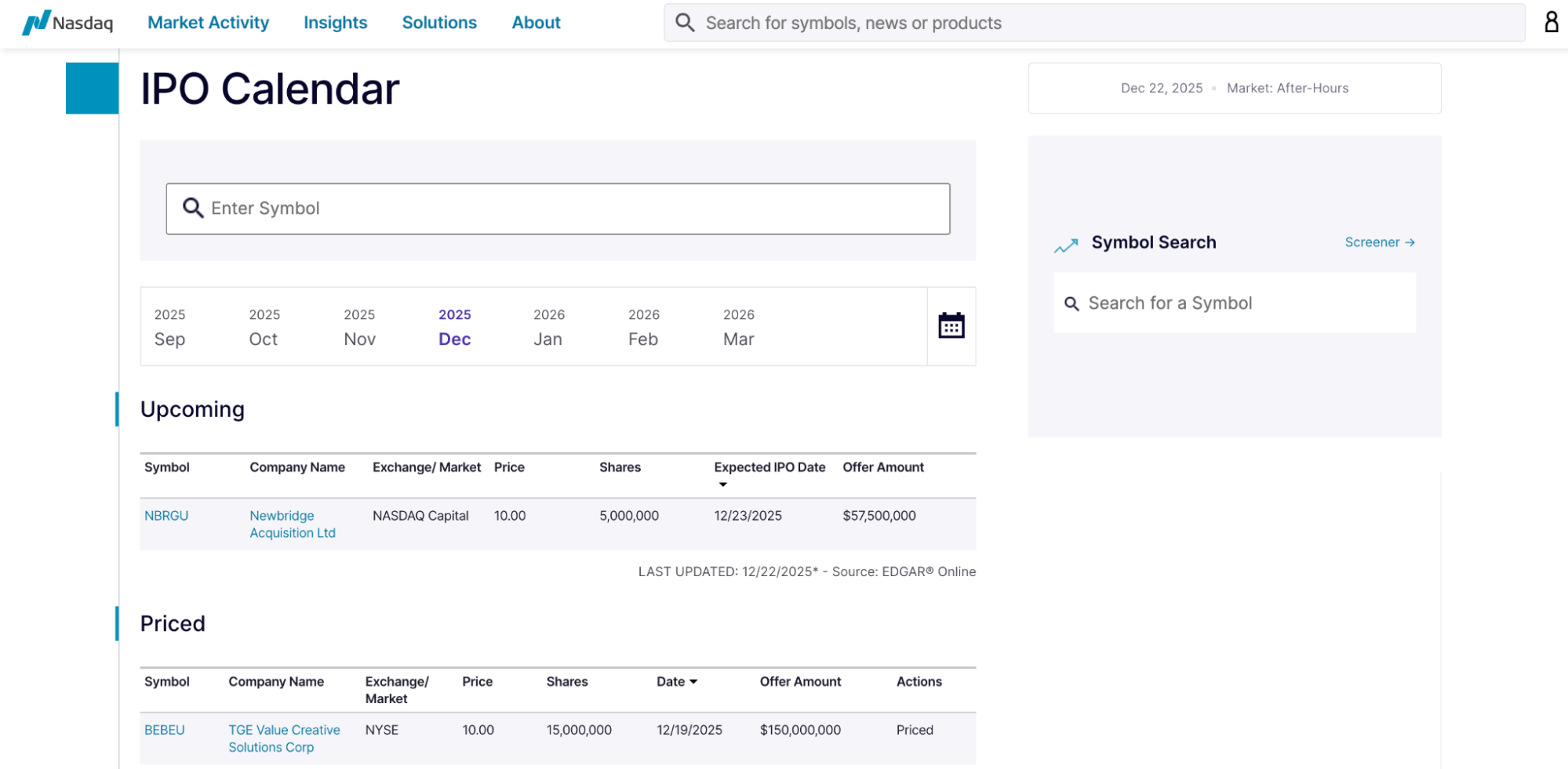

5. Nasdaq and NYSE IPO centers: Best for simple IPO previews

- Best for: Official listing dates and price ranges

- Pricing: Free

Both Nasdaq and the New York Stock Exchange maintain official IPO preview pages that list companies scheduled to go public on their respective exchanges.

These pages include expected listing dates, price ranges, ticker symbols, and links to company websites and filings.

Neither of these sites is overly detailed, but they're both extremely reliable for basic deal info straight from the source. And they become increasingly valuable as IPO dates approach (as terms are finalized).

You'll often see final pricing updates here before they're widely reported elsewhere.

If you just want a quick snapshot of upcoming listings with confirmed exchange data, these are worth bookmarking.

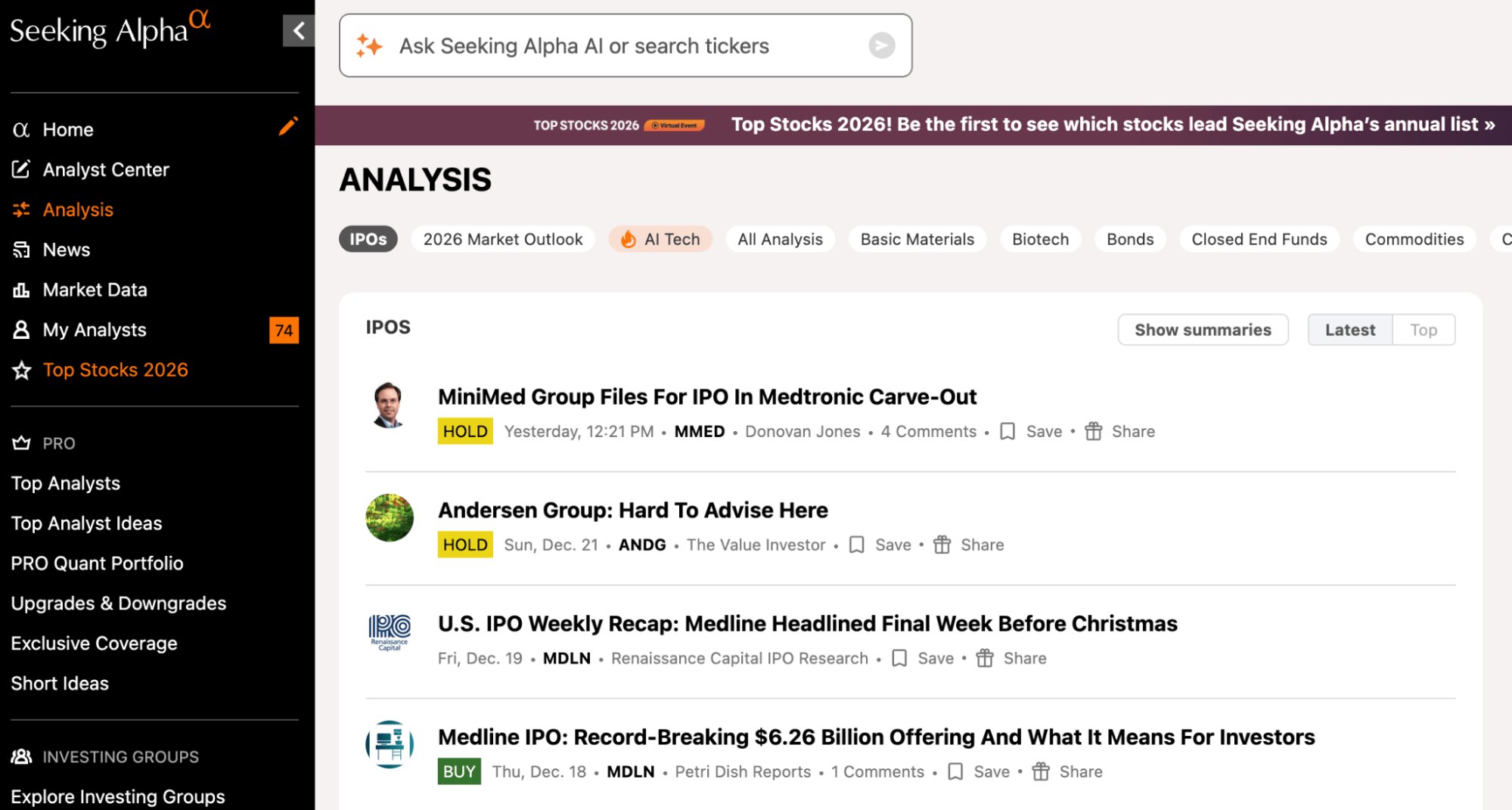

6. Seeking Alpha: Best for IPO analysis

- Best for: Analyst research and opinions

- Pricing: Paid

While most of the other websites on this list focus on dates and pricing, Seeking Alpha adds another layer: analyst commentary and opinion pieces.

Seeking Alpha has a network of over 10,000 contributors who publish research and investment commentary.

While most articles focus on public companies, the platform also features coverage of upcoming IPOs, including deep dives into S‑1 filings, valuation breakdowns, and early investor sentiment.

This kind of analysis helps you go beyond the numbers and understand how a company is being looked at by other investors.

It can reveal red flags, highlight overlooked strengths, and give you a clearer sense of how the market might react once the stock begins trading.

You can read a few articles per month for free, but full access requires a Seeking Alpha Premium subscription. Still, it's one of my favorite stock research websites and one of the only places you'll find qualitative takes on new IPOs.

What to know when investing in IPOs

IPO investing can be a great way to invest right away in newly traded public companies.

However, investing in early-stage public companies has some differences compared to investing in older, more established companies.

Here is a quick summary of the pros and cons to be aware of when investing in IPOs.

| Pros | Cons |

| Opportunity to invest early in a company's public journey | Limited financial history and trading data |

| Potential to buy shares below long-term fair value | Higher volatility, especially in the early days of trading |

| Access may be restricted for most retail investors |

Interested in investing pre-IPO?

Depending on your status as an investor, you may also be able to invest in some companies before they debut publicly. Learn all about pre-IPO investing here.

Final verdict

You can keep track of upcoming IPOs, the latest news and pricing updates, market sentiment, and more by using the websites on this list.

Together, they give you a full view of the IPO landscape, from basic calendars and listing details to deep-dive research and post-IPO performance.

Most of the surface-level information is available for free, which makes it easy to follow the market casually.

But if you're planning to invest regularly in IPOs, it may be worth upgrading to a paid subscription with Renaissance Capital, IPOScoop, or Seeking Alpha for access to premium insights, performance ratings, commentary, and real-time deal tracking.