The 7 Best Options Analysis Software and Tools in 2026

As if day trading wasn't difficult enough on its own, trading options adds yet another layer of complexity.

But the right tool stack can eliminate a lot of this added complexity.

Whether you need:

- A platform for researching options,

- An options-focused brokerage,

- An alert service,

- Or something else,

There are dozens of tools, apps, and software to choose from.

In this article, I'll guide you through seven of the best softwares and help you find the perfect solution for your options trading.

Summary view

- Best backtest-based trade alert service: Stock Market Guides

- Best for options market research: Market Chameleon

- Best brokerage for options trading: tastytrade

- Runner-up brokerage for options trading: thinkorswim

- Simplest brokerage for options trading: Robinhood

- Best for actionable options market information: LiveVol

- Best options API: IVolatility

Bonus: At the end, I've put together a bonus list of my favorite quick-reference tools that didn't quite make the main list but still deserve to be mentioned.

1. Stock Market Guides: Best backtest-based trade alert service

- Category: Alert service

- Rating:

- Cost: $69/month

Stock Market Guides is a stock and options trade alert service that was built on seven years of backtested data, research, and analysis.

The brains behind the operation: Eric Ferguson.

Ferguson is a Stanford graduate with a degree in economics. After teaching himself to code, he spent several years performing backtests to find strategies with historically profitable edges.

From there, he turned it into software to alert him anytime a trade sets up based on one of his strategies.

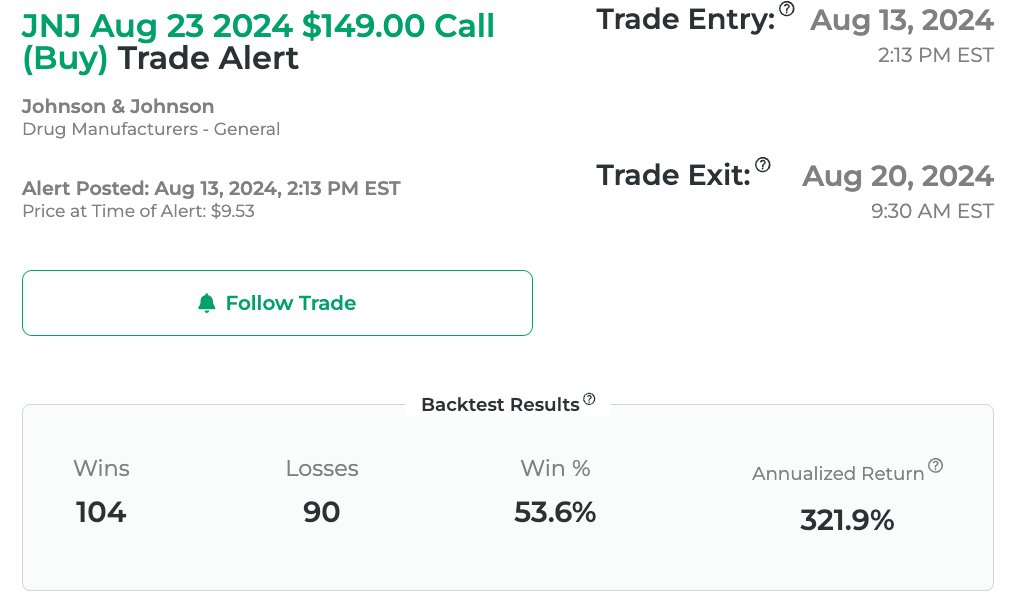

With Stock Market Guides, you can get access to these same trade alerts. Here's an example alert:

This alert was triggered on the software's “Base Pullback” strategy, one of their most popular swing trading alerts.

You can see within the alert that when JNJ stock triggered the strategy in backtests, the trade was a winner 53.6% of the time and generated an annualized return of 321.9%.

The alert also comes with a profit target ($12.45, not pictured) and an exit date (if the profit target hasn't been reached).

You're likely interested in options analysis software to find profitable trade setups. As you can see, Stock Market Guides does the heavy lifting for you — no coding or backtesting required — which is why it's also our top ranked options alert service.

2. Market Chameleon: Best for options market research

- Category: Research and analysis platform

- Rating:

- Cost: $99/month

Market Chameleon is the best platform to get a wide range of analytics, research, market trends, options flow, screeners, strategies, P/L calculators, and more.

The website — which is a bit outdated — is fairly intuitive and easy to navigate.

As long as you're not a complete beginner to options, you can expect to become familiar with all the relevant information on the platform in the first 20–30 minutes.

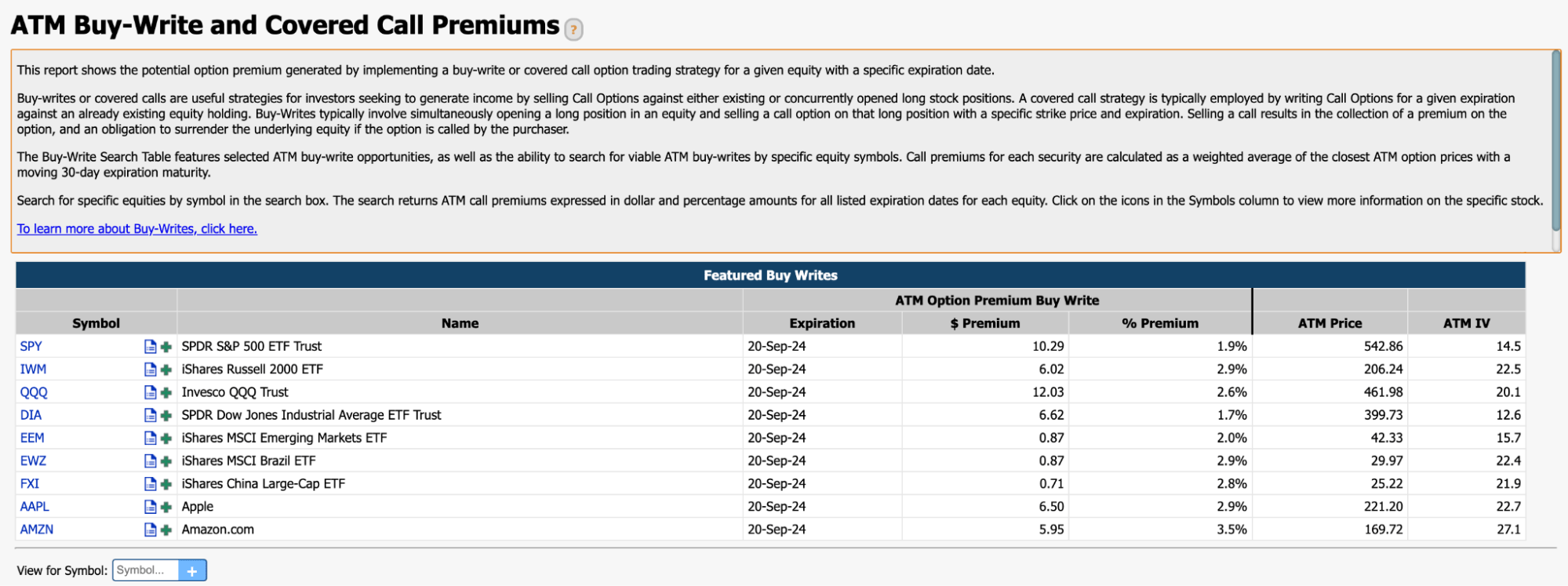

I used to sell options fairly often, and frequently used Market Chameleon's “Buy-Write” search to quickly compare a handful of stocks' call premiums, prices, and IVs in order to find the best risk-reward trades:

The site's Order Flow sections show which stocks traders are most bullish and bearish on, and can also give you a good idea of the market's general sentiment.

Plus, its Unusual Options Activity screener, which shows larger than normal positions, can be used to find interesting trade ideas.

As you can see, it's a very versatile tool for analyzing options. If you're looking for a website where you can sift through the noise of the options market and identify specific trade opportunities, Market Chameleon may be the perfect tool for you.

3. tastytrade: Best brokerage for options trading

- Category: Brokerage

- Rating:

- Cost: Free, $1 per contract (on opening trades only)

tastytrade is hands-down the best brokerage for serious options traders.

The platform was built by the same team who created thinkorswim (#4 on this list), and this time they placed an even greater importance on giving high-volume options traders a great experience.

Plus, the technology is top-notch. Every part of the website and app is streamlined, meaning fewer clicks and faster executions.

The technology also includes portfolio risk analysis, an open API, liquidity ratings, and automatic P/L tracking of rolled options (you can ditch the spreadsheet you've been using).

While the platform was primarily built for options traders, you can also buy U.S. stocks and ETFs, futures, options on futures, and cryptocurrencies.

Simply put, if you're an options trader, you won't find a brokerage with better technology, rates, and support.

4. thinkorswim: Runner-up brokerage for options trading

- Category: Brokerage

- Rating:

- Cost: Free, $0.65 per contract (on open and close)

thinkorswim is the long-standing gold standard for trading platforms.

It was acquired by TD Ameritrade in 2009 (which was acquired by Charles Schwab in 2020) and almost overnight, the brokerage became a favorite for stocks, options, and futures traders. The platform makes it easy to chart, analyze, and place orders.

For options traders, thinkorswim provides real-time Level II data on order prints. You can add filters to this data to create your own options flow, similar to Market Chameleon's.

You can also see in-depth options chains, probability analysis, and risk-reward profiles on options trades you're considering.

However, the platform is a bit outdated (in terms of UX and UI) and can be a bit cumbersome to use. For these reasons, I've placed tastytrade ahead of it on this list.

Anyone who has a Charles Schwab account (which you can create for free) can use all the tools thinkorswim has to offer.

If you don't have a Schwab account, you can try thinkorswim for 30 days with a Guest Pass.

5. Robinhood: Simplest brokerage for options trading

- Category: Brokerage

- Rating:

- Cost: Free, $0 per contract

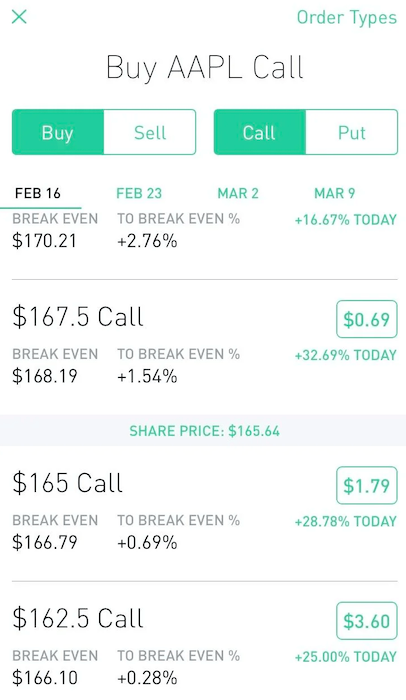

Robinhood is the easiest brokerage to get started trading options on.

Its user interface is simple — especially on its mobile app — it does not charge fees or commissions, and its options chains and profit and loss charts are informative and helpful.

Robinhood also allows you to add options to your watchlist, which is a handy feature that I have yet to find on any other brokerage platform.

However, despite all the good things Robinhood does, I do have a couple of complaints.

For starters, Robinhood tends to gamify the entire trading experience. Secondly, it's also almost too easy to start trading options. Both of these can lead to unnecessary trading losses, especially for new investors.

Still, its user interface is so good that I find myself regularly looking at options chains and building trades on its app, despite it not being my primary brokerage.

6. LiveVol: Best for actionable options market information

- Category: Research and analysis platform

- Rating:

- Cost: $413/month

LiveVol provides real-time market activity, time and sales data, statistics, and more to assist with your options trading.

The software was created by CBOE (Chicago Board Options Exchange), which runs the options exchange in the U.S., as well as many other exchanges around the world. In fact, it's the leading provider of derivatives exchanges.

Those credentials make it a pretty natural fit to run an options analysis software.

LiveVol breaks down its data into three categories:

- Market: Stocks, options, futures, trade tape, watchlist, earnings calendar, alerts

- Analytics: Time and sales, flow, news, volume, options calculator, scanners, fundamentals, earnings analysis, statistics

- Chart: Charts, graphs, skew

You're most likely interested in the Analytics section, which contains tools to help you analyze existing or potential positions, build and execute trades, and scan for setups.

For example, the Statistics tab is a dashboard for the current day's trading activity that gives you insight into market sentiment and how money is flowing.

LiveVol is primarily sold to professional traders and institutions, which is why its price is much higher than the other software on this list.

7. IVolatility: Best options API

- Category: In-depth analysis software

- Rating:

- Cost: $150/month

If you're 50% trader, 50% engineer, then this one's for you.

IVolatility is another platform that provides charts, options chains, intraday volatility visualizations, scanners, probability calculators, and risk analysis for options traders.

However, it's not because of any of these features that I included it on this list — it makes the list because of its data.

IVolatility provides data in two forms:

- Historical options data: Access comprehensive options and futures datasets with varying degrees of granularity. You can also get data on fixed income, interest rates, earnings, dividends, and more.

- API: Access all of the above data via an API call.

This data can be used to create your own machine learning and algorithmic trading strategies, backtesting, risk assessments, trading applications, market research websites, or anything else you can think of.

IVolatility has market coverage for the U.S., Asian, and European markets.

If you're wondering why someone would want access to this data and how they would even go about manipulating it, you can ignore this one — it's not for you.

Bonus tools

Here's a bonus list of a number of free tools I find myself referring to on a regular basis:

- Options Profit Calculator: Provides visualizations for modeling the potential profit/loss of different strategies at various closing prices.

- Cboe Trade Optimizer: Input a symbol, your sentiment, a target price, and an expiration date, and the tool will provide a number of potential strategies and their relevant stats.

- OptionStrat: There is a paywall, but all of the profit/loss graphs (under the "Build" pulldown) are free.

Other than those, I want to reiterate how good the options analysis tools are inside tastytrade and thinkorswim, and all you need to do to access them is open a brokerage account.

Final verdict

As you can tell from the list above, there are many types of options analysis software, each with its own value.

Some help you filter through stocks and find trade setups, others help you analyze risk and probabilities, and others allow you to build your own trading models based on the data they provide.

Hopefully, you've narrowed down the list to know what type of software you need.

The next step: Try one! Many of the tools on this list offer free trials or money-back guarantees, so there's no risk in testing it out.

Your litmus test for whether or not the software is worth it is pretty straightforward — does it make you a better, more profitable trader? If so, it's probably worth the cost.