The 9 Best Stock Market Simulators to Practice Trading

Trading is incredibly difficult, which is why almost every new trader loses money.

But you don't need to lose money to learn how to trade.

Stock market simulators allow you to practice trading with virtual money (known as "paper trading") so you can test your trading strategies under live conditions without risking any of your own money.

This is a serious advantage.

Paper trading gives you the freedom to develop your strategies and skill without the pressure of trying to make a profit. It takes all the emotion out of the learning process.

For many, this is a massive shortcut to successful trading.

There are many trading simulators to choose from, but some are significantly better than the rest. Here are my 9 favorite simulators to practice trading and investing.

Summary of the best stock market simulators

| Our pick | Best for |

| TradingView | Best overall |

| eToro | Beginner long-term investors |

| thinkorswim | Schwab customers |

| TradeStation | Backtesting + algorithmic trading |

| Moomoo | Mobile trading + free stock bonus |

| MarketWatch | Group investing games |

| NinjaTrader | Futures & forex trading |

| HowTheMarketWorks.com | Education and games |

| Pilot Trading | Algorithmic trading |

1. TradingView

- Overall rating:

- Best for: Active traders (day and swing traders)

- Platform: Desktop

- Cost: $16.95/month for Essential (after a 30-day free trial)

TradingView is at the top of this list for one reason: it's the one I use.*

*Me and 100 million other users.

TradingView is the platform I do all of my charting in and is what I'm most familiar with, so it makes sense for me to practice my trading in it too.

Its trading simulator is found under a feature called “Bar Replay” mode. You can set the day, timeframe, indicators, and then start “trading” using its Long or Short drawing tools.

Here's how it looks when I use it:

You can see I'm in a short trade with my entry at 4390.75, my stop at 4394.50, and my price target at 4368.75. Then I let the trade play out, see if my price target is hit or if I get stopped out, and then mark down the result of the trade and move on.

It's a little bit of work to manually track your results, but I've found it helps slow me down just enough to get more out of my practice.

Once you familiarize yourself with TradingView and Bar Replay mode, the process is seamless. I've likely spent more than 150 hours in TradingView's Bar Replay mode, and I can't tell you how big of a difference it's made in my trading.

Despite how feature-rich and powerful it is, TradingView is exceptionally intuitive — it feels like an extension of myself (it reminds me of my iPhone's user experience). It's fast, smooth, and easy to use.

The biggest downside to TradingView is that it's not free — you'll need TradingView Essential to practice trading, which costs $16.95 per month. That said, it's a great product, and has more than paid for itself in my trading “career.”

Plus, if you're serious about becoming a trader, there's a good chance you'll end up using it as your charting platform anyways. So you might as well start familiarizing yourself with it now.

You can use the link below to try it free for 30 days. Then you can decide for yourself if it's worth the cost or not.

2. eToro

- Overall rating:

- Best for: New investors who want to practice placing trades on a real brokerage

- Platforms: Desktop and Mobile

- Cost: Stock simulator is free (additional fees may apply for other features)

For beginner investors who've never placed a trade, eToro offers a Demo Account to all of its users which allows you to practice investing with $100,000 in virtual currency.

By using eToro's Demo Accounts, you will get experience placing orders and watching your account balance rise and fall on its platform without risking your own money.

You can invest in stocks, ETFs, and cryptocurrencies on eToro (and in its Demo Accounts) from your computer or its mobile app.

Note: If you're going to practice trading from your phone and not a computer, eToro is a much better choice than TradingView.

Practicing on eToro will also give you access to its social investing features like CopyTrader, its feature which you can use to copy the moves of experienced traders.

eToro's social features also allow you to exchange ideas with and learn from investors from all over the world.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

3. thinkorswim

- Overall rating:

- Best for: Schwab customers and/or traders who want to use thinkorswim software

- Platforms: Desktop and Mobile

- Cost: Free

Note: thinkorswim is only available to Schwab clients. People without Schwab accounts can try it for 30 days with a Guest Pass.

Schwab's thinkorswim has long been the benchmark for active trading platforms.

In recent years, many brokerages have built competing products, but thinkorswim is still the platform of choice for hundreds of thousands of traders.

Its free trading simulator, paperMoney, can be accessed from inside thinkorswim:

You can simulate trading stocks, options, futures, currencies, cryptocurrencies, and more. thinkorswim's power and countless charting capabilities and indicators will give you an unlimited combination of strategies to test.

The main downside to thinkorswim is its complexity. There will be a learning curve, and if you're not planning on using thinkorswim as your trading platform or don't already have a Schwab account, I'd probably choose another simulator.

That said, not many traders ever have a reason to leave thinkorswim after getting started on it.

Plus, the thinkorswim mobile app is surprisingly easy to trade on.

4. TradeStation

- Overall rating:

- Best for: Active traders who want a free simulator and need a brokerage account

- Platforms: Desktop and Mobile

- Cost: Free

TradeStation is a brokerage geared toward active traders. If you're going to be a trader and still need a brokerage with a built-in free trading simulator to practice on, here's your solution.

The best part about practicing on TradeStation's simulator is that the interface and order ticket is the exact same as its live trading, so you'll know exactly what you need to do to place orders when you're ready to start trading for real. Here's a look:

You can practice placing stock, option, and futures trades. Its simulator offers real-time data, unlimited paper trading dollars, and complete backtesting capabilities.

If you're a programmer, TradeStation is also the best brokerage for creating your own algorithmic trading program, which you can then run simulations on.

Like thinkorswim, TradeStation will also keep track of your profits and losses for all of your virtual trades, something you'll have to manually do if you use TradingView.

Plus, TradeStation is one of the top-rated brokerages for active traders, so you'll be set up with one of the top platforms when you're ready to start trading real money.

5. Moomoo

- Overall rating:

- Best for: New traders who want a free stock bonus

- Platforms: Desktop and Mobile

- Cost: Free

Moomoo is another broker that is geared toward active traders and new investors.

While it's primarily used by international traders, the brokerage is becoming increasingly popular in the U.S., mainly because of its rotating free stock offerings (right now, new users can get up to $1,000 in Nvidia stock).

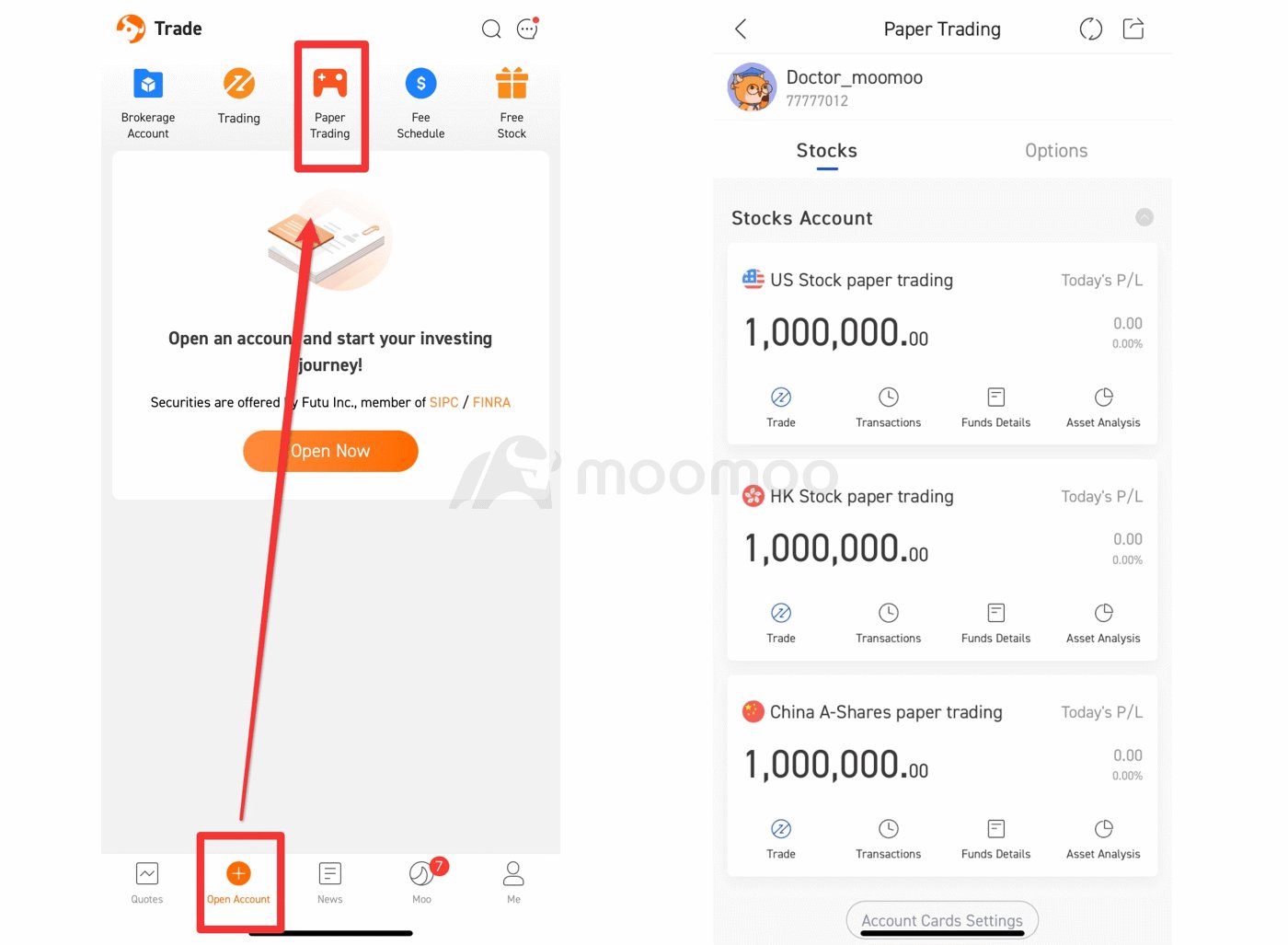

Moomoo's Paper Trading is essentially a crossover between TradeStation and eToro — it's good for both traders and new investors. Here's a look:

You can practice trading stocks, ETFs, futures, and options in the U.S., Hong Kong, and China-A-shares markets.

Moomoo was really built for a younger audience of active traders who are primarily trading from their mobile devices. If that describes you, and if you want to score some free shares as a bonus, Moomoo might be best for you.

Honorable mentions:

6. MarketWatch

MarketWatch makes this list because of its game features. You can create an account and set up parameters for an investing game, which you can invite your friends to participate in.

As a senior in high school, my finance class started with us all entering an investing game set up on MarketWatch by my teacher.

I placed dead last, but have been hooked on investing ever since. In my opinion, this is one of the best ways to introduce young people to investing.

Why I'd choose it: To create or participate in investing games.

7. NinjaTrader

NinjaTrader is another broker focused on active traders. You can trade stocks, futures, and forex on NinjaTrader, and it's my broker for futures trading.

When logging in, I'm prompted with an option to go to "Live Trading" or "Simulated Trading."

From there, the experience is identical, giving me the perfect way to practice placing orders and setting stops and profit targets, all from a fast, web-based platform.

Why I'd choose it: Futures traders should choose NinjaTrader.

8. HowTheMarketWorks.com

The mission behind HowTheMarketWorks is to teach beginner investors how the market works.

To that end, this site is a fantastic educational resource, and it was one of the first to launch a trading simulator. The site also has investing games to compete with and learn alongside your friends.

Why I'd choose it: If you prefer the interface, games, and education over MarketWatch's resources.

9. Pilot Trading

Pilot Trading is another brokerage for active investors, though its distinguishing feature is algorithmic trading signals.

Coupled with these signals is a lifelike trading simulator, which allows you to practice using its signals before risking any of your own money.

Even if its trading signals isn't your thing, the simulator is still a great tool to help you hone your skills.

Why I'd choose it: If you're somewhat interested in algorithmic trading, Pilot Trading is worth trying out.

What is a stock market simulator?

A stock market simulator is software that simulates trading and investing in the stock market while using virtual currency.

The process of learning to trade with virtual currency is also known as "paper trading."

You can test investment strategies in real-time or by backtesting historical price movements. You can practice on essentially any asset (stocks, ETFs, options, commodities, currencies, and more) without risking any of your own cash.

Given the volatility of the market, the emotions we deal with while investing, and the psychology of it all, getting some risk-free experience is immensely helpful.

Should you use a simulator to practice trading stocks?

Yes, in my opinion, using a paper trading simulator is the most effective way to learn how to trade.

You can get experience deploying your trading strategies under real market conditions without risking any of your own money. This is invaluable.

Even advanced traders use simulators to get extra practice or to test new strategies.

While most simulators are built for active traders, long-term investors can also benefit from using them.

Virtual trading gives you experience placing orders and seeing how stock prices fluctuate, and since stocks don't always go up, you can get used to seeing red in your portfolio and not panicking.

If you're an aspiring trader, a good trading simulator will be your best friend.

In my opinion, it is the single most valuable tool you can use to improve your trading — something I wish I would have discovered before I started trading.

How we chose the best stock market simulators

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good is the product or service?

- Price: Overall price, value for money, average cost per month, and any hidden fees.

- Usability: What the interface looks like, whether the site is easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of information and data as well as company and brand reputation.

- Audience: Who the product is for, the range of uses and applications, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

I cannot overstate how important and practical I find stock market simulators to be, for investors and active traders alike.

Personally, I use TradingView to practice my trading. It's my charting platform and where I spend most of my time while trading, so paper trading on it makes the most sense for me.

If you want to follow my lead, you can sign up for a free 30-day trial of TradingView Essential. For more information on TradingView, check out my TradingView Review.

That said, paper trading on an actual brokerage would also be beneficial to practice placing real trades. For this, I'd recommend eToro, thinkorswim, or TradeStation.

For mobile-first traders, eToro, thinkorswim, and Moomoo are your best options.

.png)

.png)