Top 9 Stock Portfolio Trackers in 2026

It's time to ditch the spreadsheet.

Your portfolio probably includes a mix of assets — stocks, bonds, options, currencies, and more — spread across multiple accounts like 401(k)s, IRAs, and savings.

Tracking it all can be a hassle, but you need to know what's going on in your portfolio.

That's where portfolio trackers come in.

Below, I cover the 9 best online portfolio trackers. Most of these are online platforms, but some are apps. Some focus on traditional assets like stocks and bonds, while others handle everything from altcoins to real estate. Some are free, others are paid.

In short, there's something for everyone on this list.

Summary of the best portfolio trackers

| Our pick | Best for | Cost |

| Empower | Best portfolio tracker overall | Free |

| Snowball Analytics | Best portfolio tracker for dividend investors | $14.99/month |

| Stock Analysis | Best free stock tracker website | Free |

| Kubera | Best for HNWIs, founders, and private market investors | $360/year |

| Sharesight | Best for international investors | $216/year |

| Seeking Alpha | Best for investment research | $269/year |

| Fidelity | Best portfolio-tracking brokerage | Free |

| Ziggma | Best for portfolio simulations | $14.99/month |

| Delta | Best for crypto-focused investors | Free |

Keep reading for more details on each of the top investment trackers in 2026.

1. Best online portfolio tracker overall: Empower

- Overall rating:

- Platform(s): Website, iOS, Android

- Best for: Net worth tracking

- Price: Free (register here)

About Empower

Empower (formerly Personal Capital) is the best place to track your entire financial picture, and it's completely free.

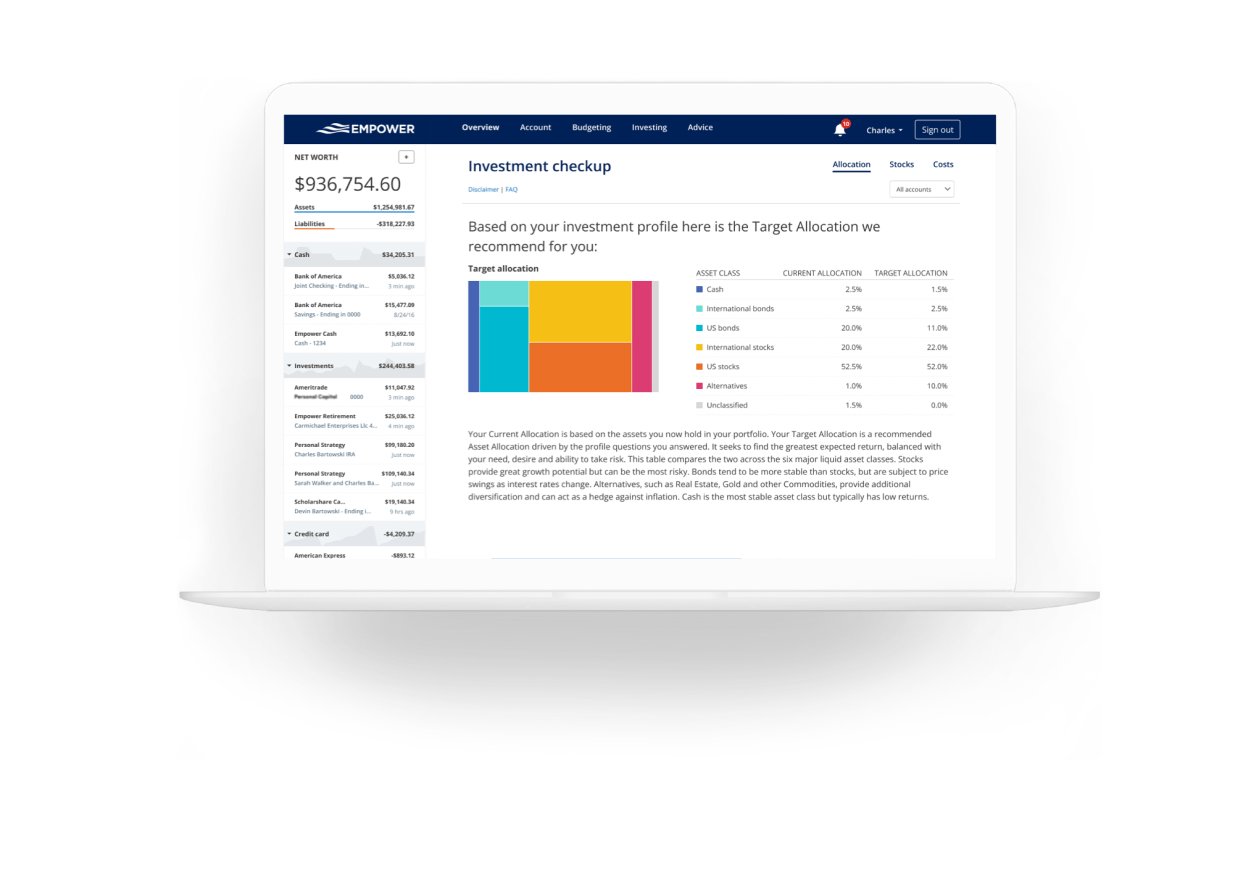

Its Financial Dashboard allows you to add your credit cards, savings, checking account, savings account, loans, investments, and more to one place, allowing you to easily track your net worth, spending patterns, and investment performance:

You'll have a complete picture of your finances in a matter of minutes.

Plus, after creating your free account, you'll have access to the rest of Empower's free tools — a retirement planner, net worth calculator, and budget planner (you can read about each of these in my Empower Review).

You'll also get access to its Investment Checkup tool, which assesses your total portfolio's risk, analyzes past performance, and allows you to model individualized asset allocations:

This is one of the best ways to check if your mix of stocks, bonds, cash, and other investments is still aligned with your financial goals and risk tolerance.

And you get all of this with your free Empower account. Click the button below to get started.

2. Best portfolio tracker for dividend investors: Snowball Analytics

- Overall rating:

- Platform(s): Website, iOS, Android

- Best for: Dividend-centric investors

- Price: $14.99/month (after a 14-day free trial)

About Snowball Analytics

Snowball Analytics is one of the most in-depth portfolio trackers there is and, if you're a dividend investor, the obvious first choice.

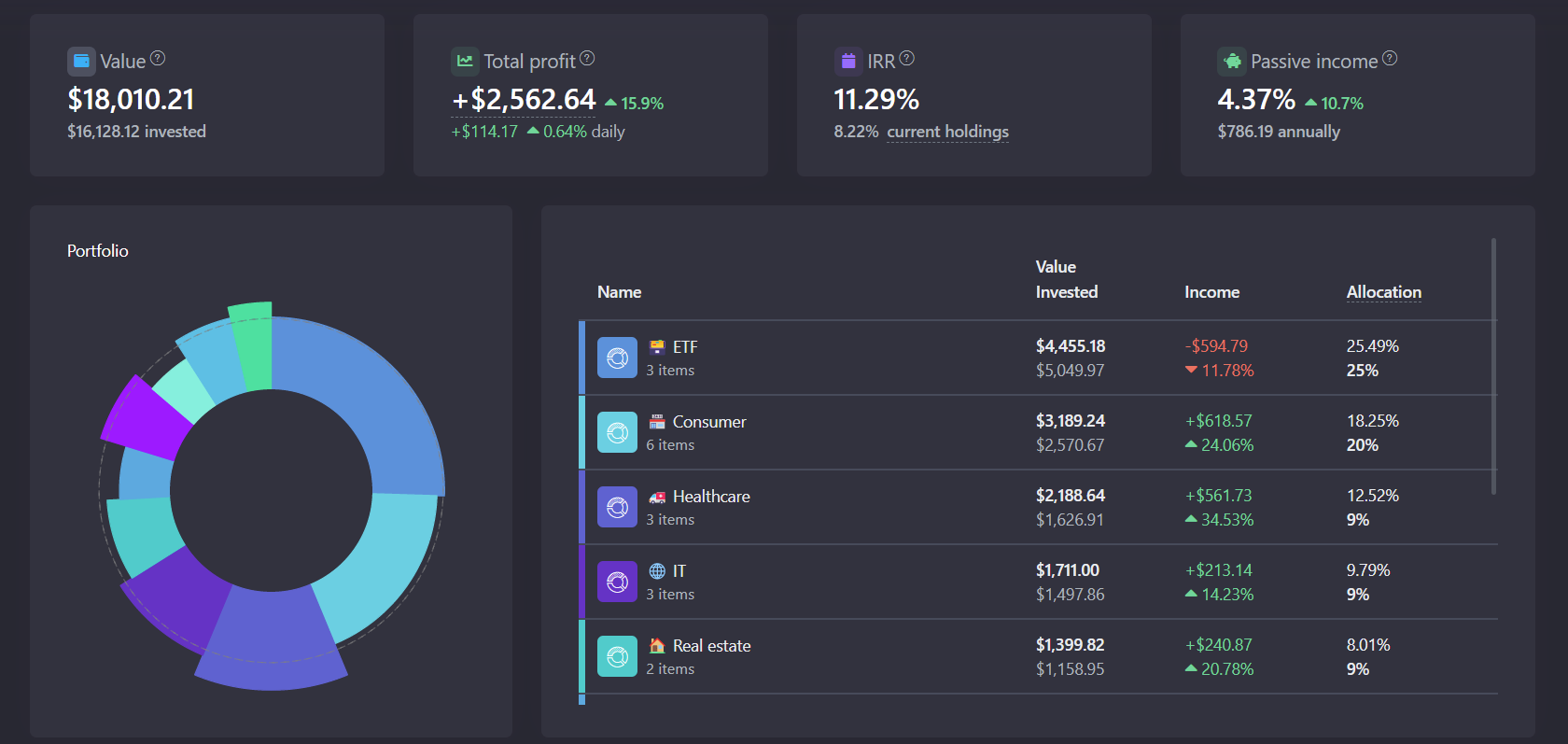

After using its automatic brokerage connection to link your accounts in minutes, users can track thousands of stocks, ETFs, mutual funds, REITs, precious metals, and custom assets (like real estate and cars) in over 25 currencies.

If you're not already a dividend investor, Snowball Analytics will make you want to become one. The tracker will make you very aware of your portfolio's dividend income and cash-on-cash return.

You can view your portfolio's monthly distributions, annual payout, yield, cumulative dividends, and more. The software also shows a dividend rating for every stock you own:

For these reasons, we rated Snowball the best dividend tracker.

For me, the biggest downside of Snowball Analytics is how many features it has. If I'm not careful, I can spend all day tinkering, customizing, and playing with the product. There's something to be said about using something simpler.

Additionally, while you can use the product for free, you'll be limited to 1 portfolio and 10 holdings. So if you're going to use Snowball, I'd recommend the 'Investor' subscription tier, which is $14.99/month (or $12.50/month when billed annually).

3. Best free stock tracker website: Stock Analysis

- Overall rating:

- Platform(s): Website

- Best for: Stock and ETF investors

- Price: Free (start here)

About Stock Analysis

If you're still thinking you're going to stick with your spreadsheet, I'm about to change your mind.

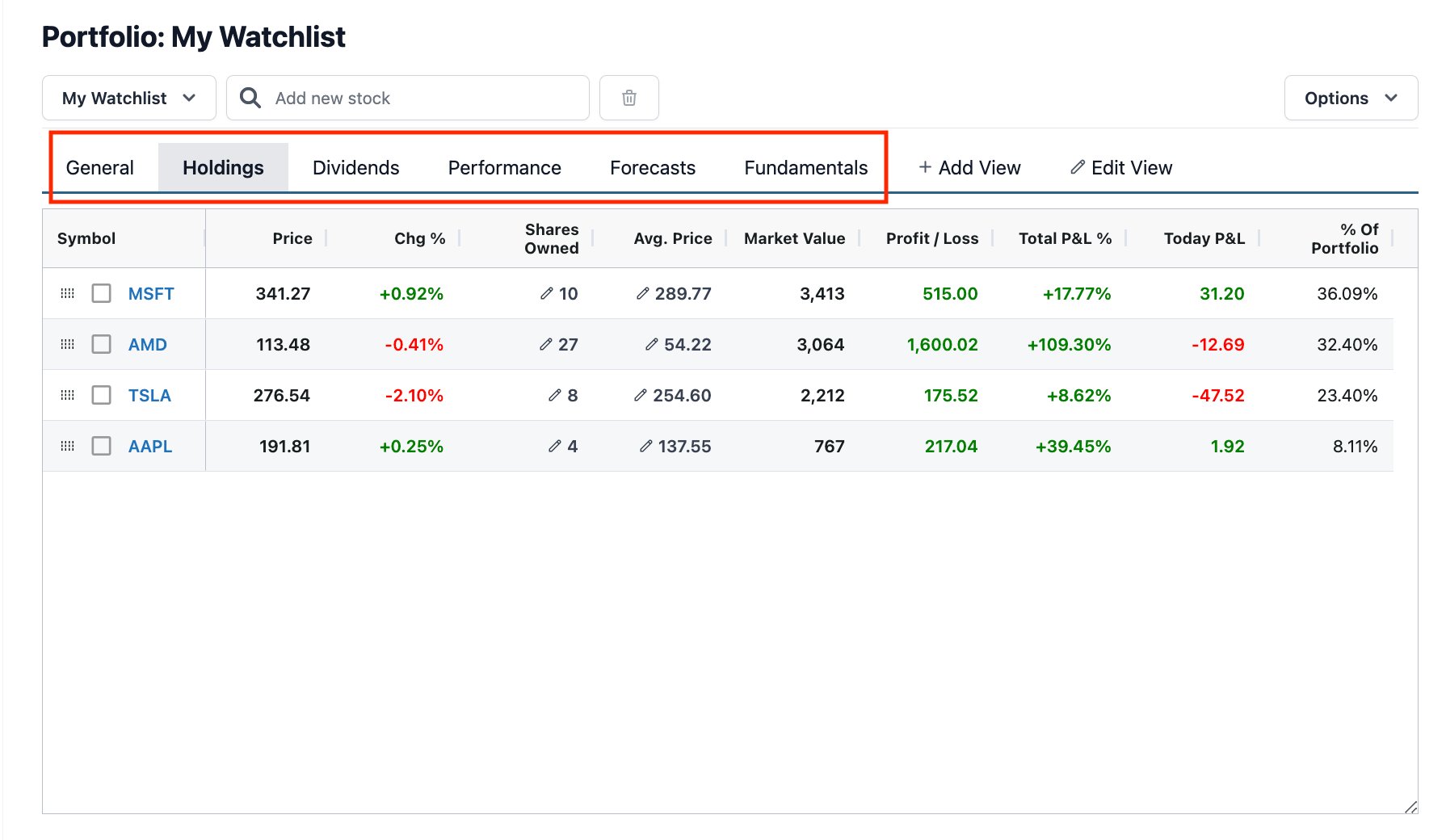

For investors who only invest in stocks and ETFs, you can create a free watchlist on Stock Analysis (the site you are currently on) and add your portfolio holdings, how many shares you own, and your cost basis, then let our site do the rest:

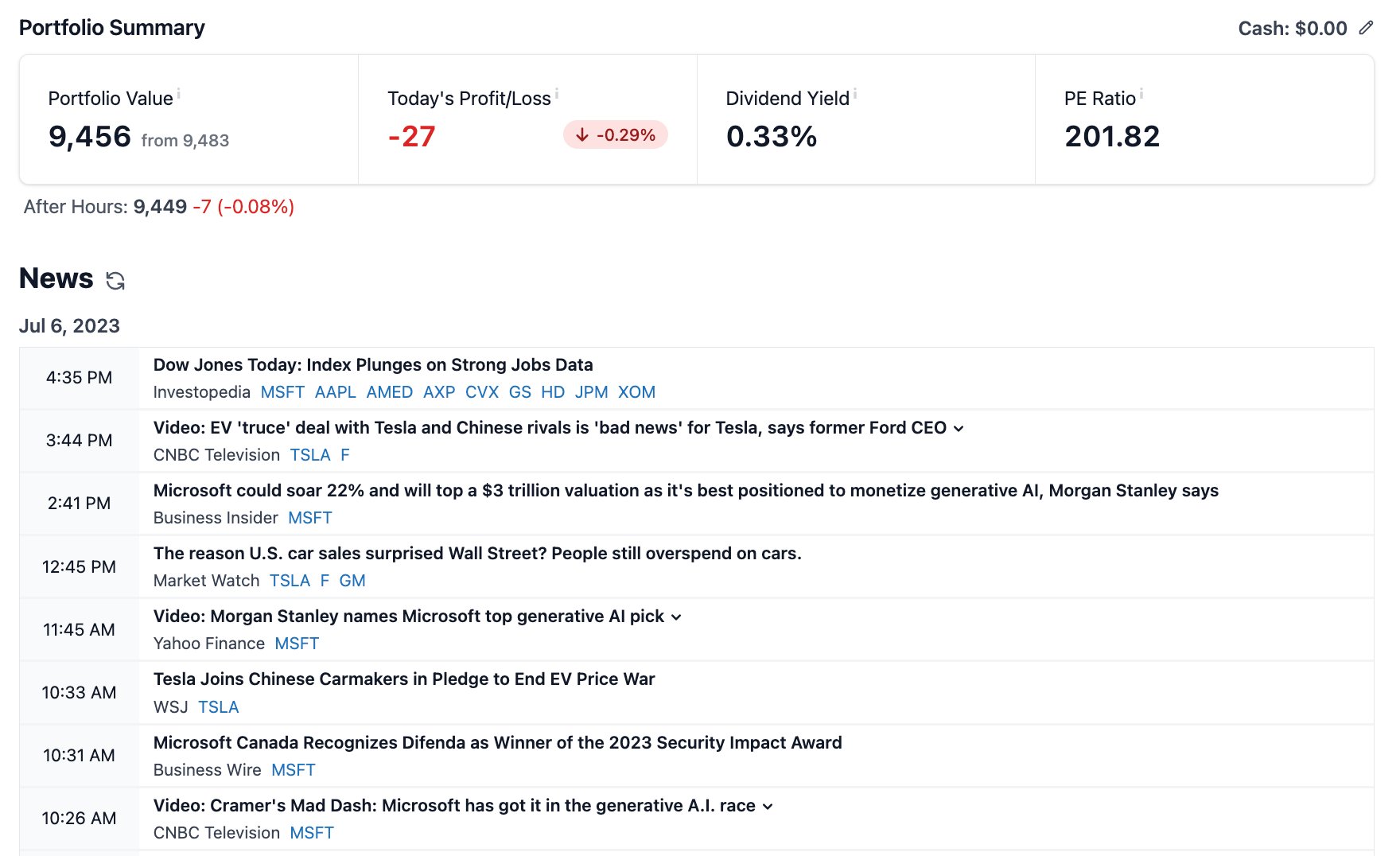

You'll find all of our analysis, analyst ratings, and data related to your holdings. You will also have a portfolio summary and a newsfeed with the latest news about your stocks:

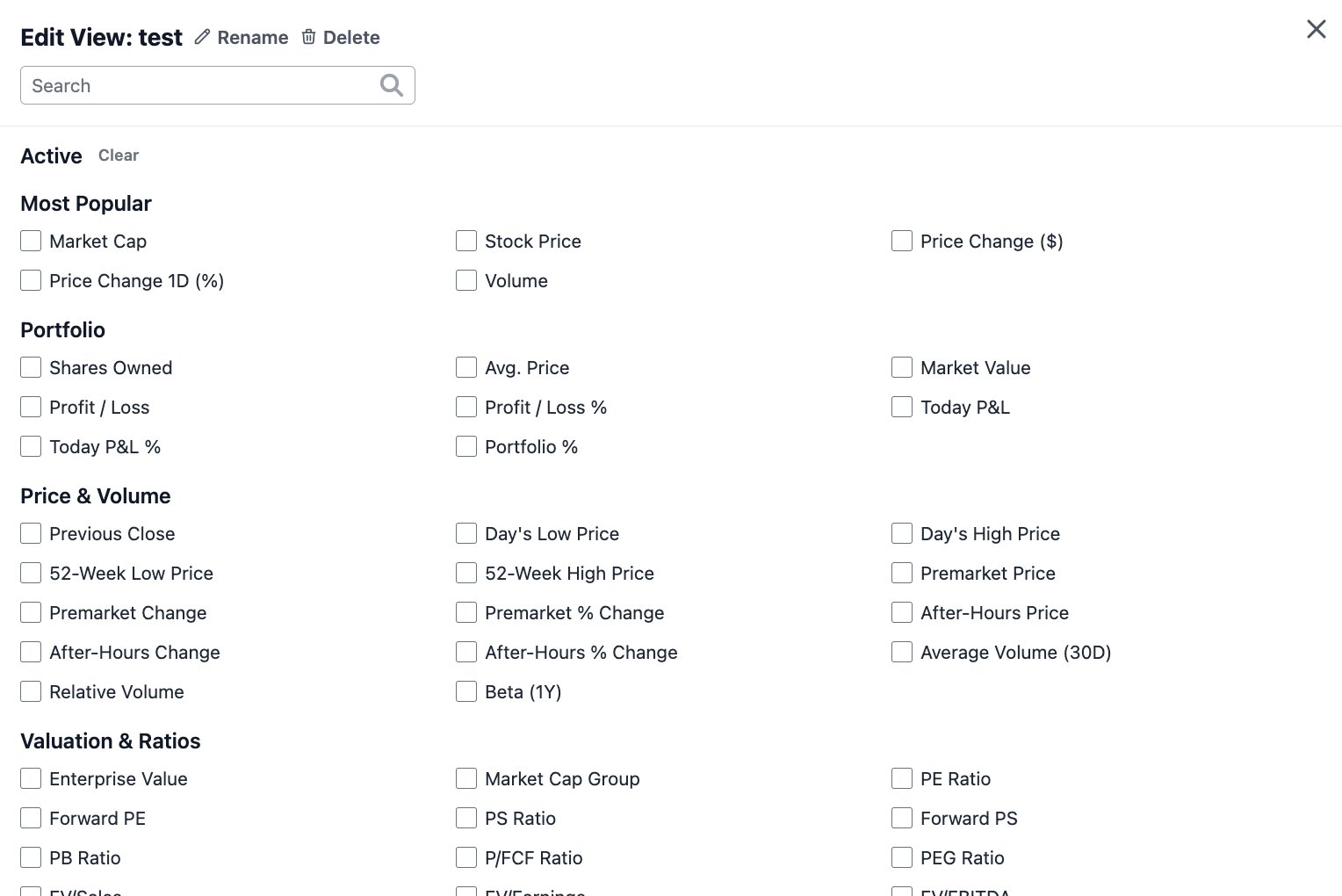

If you'd like to track specific data or if there are certain metrics you pay special attention to, you can create a custom view to fit your exact needs:

It's fast, simple, powerful, and (best of all) completely free for up to five watchlists and 25 symbols per watchlist.

If you want to unlock more watchlists and symbols (along with many other features), you can upgrade to Stock Analysis Pro for just $79/year (or $9.99/month).

4. Best for HNWIs, founders, and private market investors: Kubera

- Overall rating:

- Platform(s): Website, iOS, Android

- Best for: HNWIs, founders, and private market investors

- Price: $360/year (after a free 14-day trial)

About Kubera

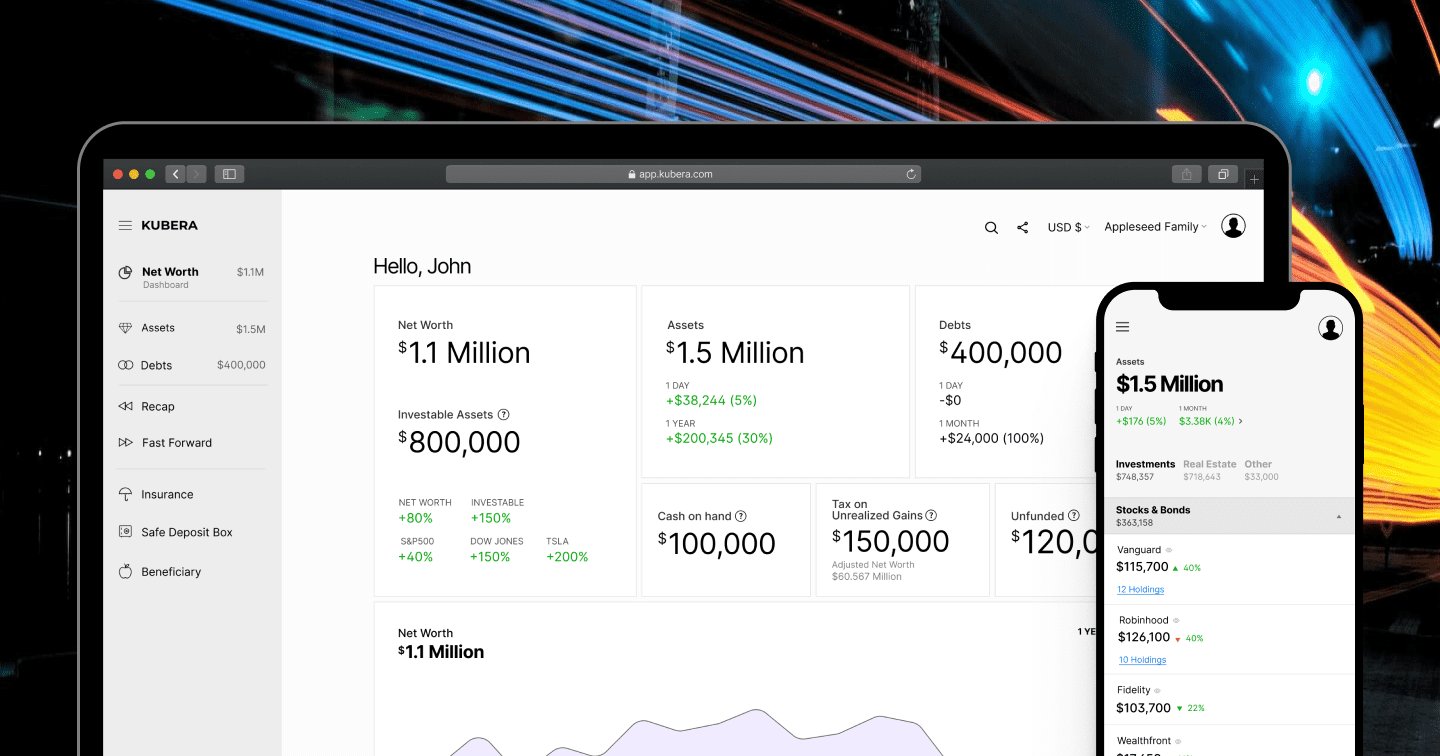

Kubera is the best net worth tracker for high net worth individuals (HNWIs) because, in addition to tracking stock and bond investments, users can track dozens of private market investments.

💡 As an added bonus, Kubera has the most attractive user interface of any tracker on this list.

This includes business equity, stock options and RSUs, real estate, hedge funds, private equity, angel investments, commodities, crypto, NFTs, DeFi, life insurance, and more — assets that may make up a large share of your balance sheet and are critical to track.

Kubera is known for its connectivity technology, which allows users to connect with over 30,000 institutions — including global banks, crypto wallets, brokerage accounts, and more — worldwide.

For assets that can't be automatically linked (private market investments and "offline" assets), you can easily add them and keep your full net worth in one place.

And for business owners with complex ownership structures and personal assets, Kubera lets you manage each balance sheet separately while still giving you a clear picture of your total net worth.

Join thousands of households tracking $47+ billion of total assets on Kubera.

5. Best portfolio tracker for international investors: Sharesight

- Overall rating:

- Platform(s): Website, iOS, Android

- Best for: International investors, tax-reporting

- Price: $216/year (after a 7-day free trial)

About Sharesight

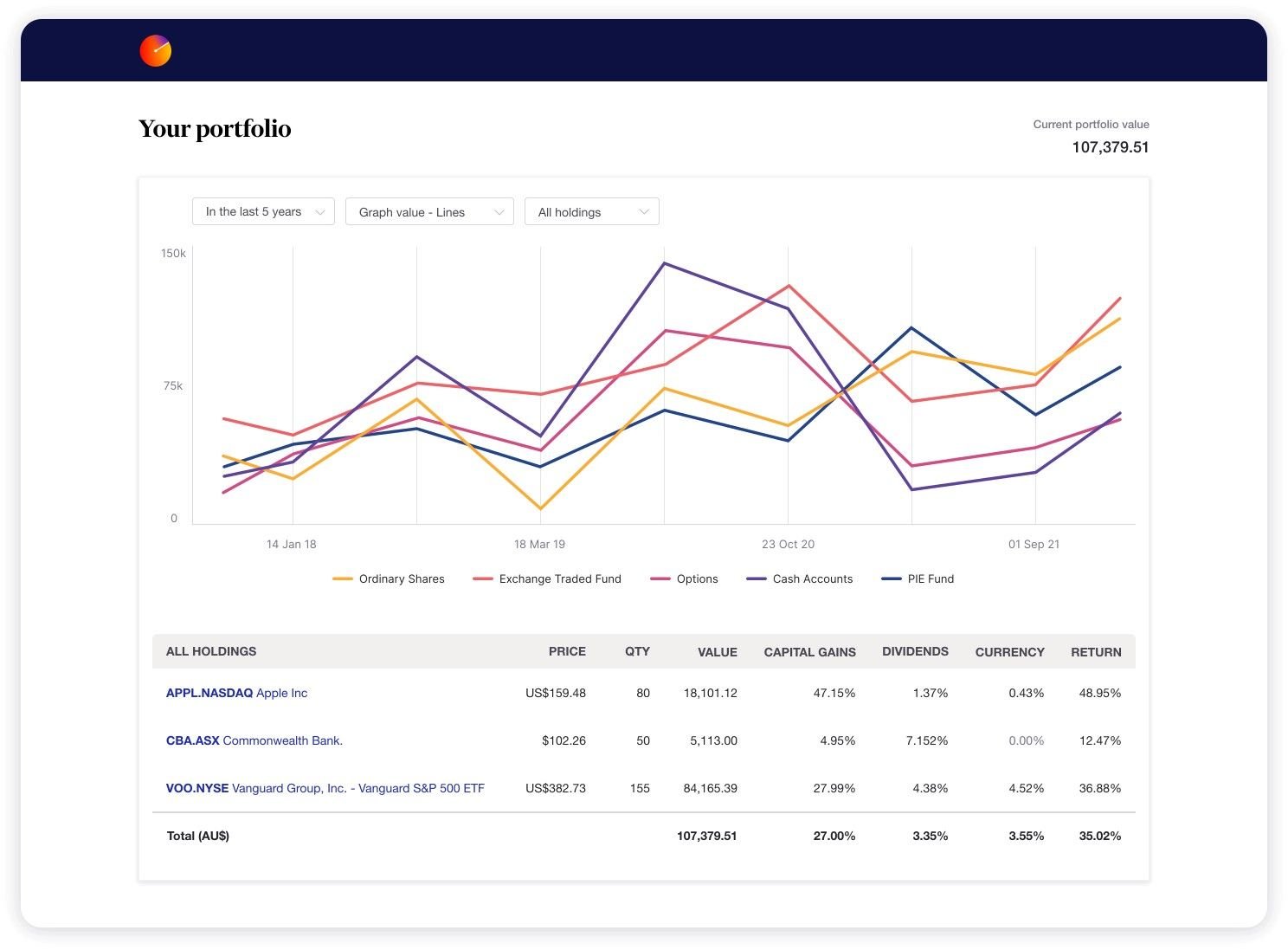

Sharesight is an all-in-one portfolio tracker and tax-reporting product that tracks your performance, dividends, and diversification across 50 international exchanges (and their local currencies).

Sharesight shines in four key areas:

- International investing: Sharesight has coverage for more than 250,000 stocks, ETFs, and funds from global markets and over 100 global currencies.

-

Performance tracking: Compare your results across brokers and assets with in-depth reporting, charts, and live price updates.

-

Dividend tracking: Corporate actions, dividend updates, DRPs, and share splits are automatically updated in your portfolio.

-

Tax reporting: Whether you file your own taxes or want to share your tax reports with your accountant, Sharesight will save you time, money, and headaches during tax season.

It also automatically integrates with 200+ global brokers.

For international investors who invest in multiple markets and/or currencies, there isn't a better portfolio tracker out there.

If you're currently managing your investment performance, tax implications, dividends, and general portfolio maintenance with a spreadsheet (or two or three), Sharesight is worth every penny.

6. Best portfolio tracker for investment research: Seeking Alpha

- Overall rating:

- Platform(s): Website, iOS, Android

- Best for: Research-driven investors

- Price:

$299/year$269/year introductory offer (after a 7-day free trial)

About Seeking Alpha

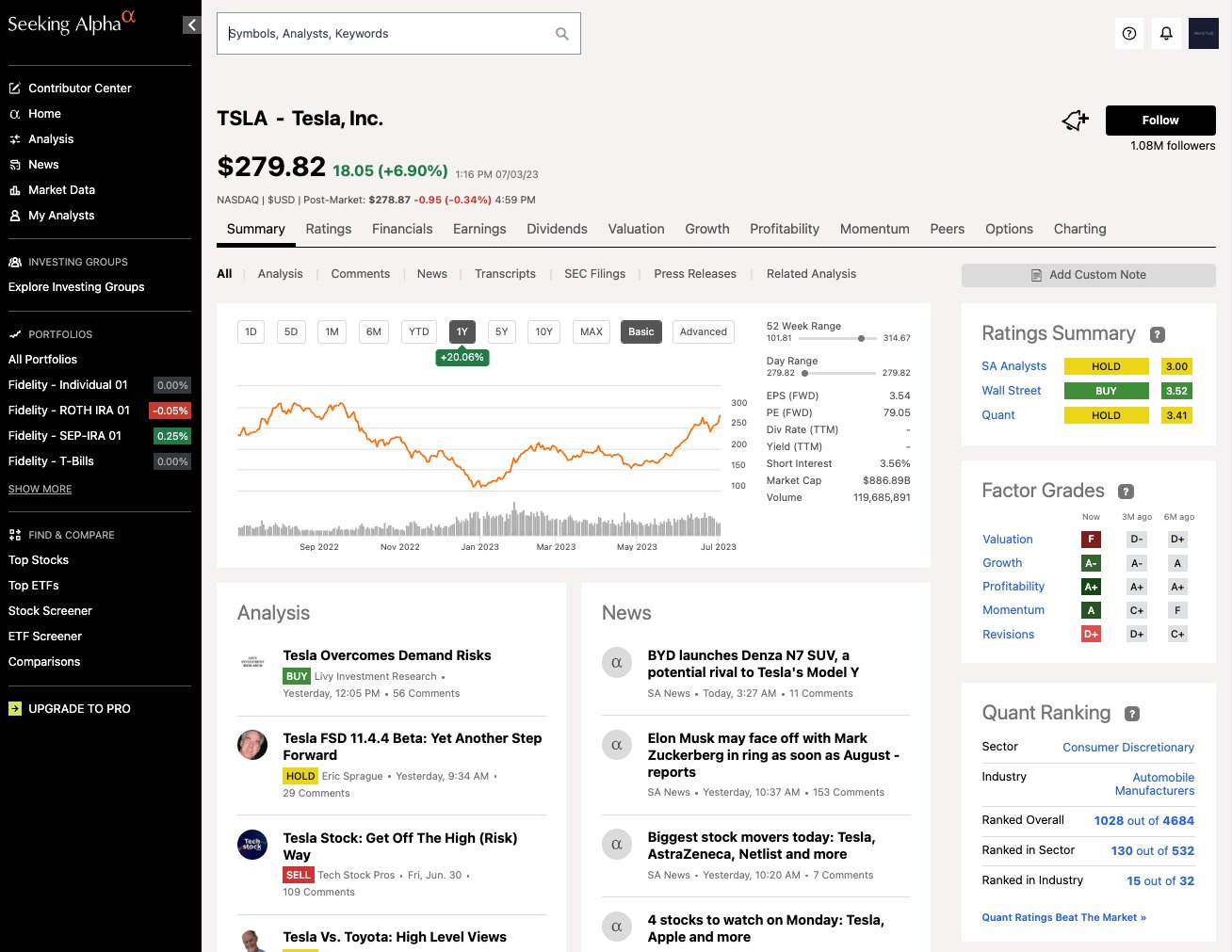

If you're only looking for a portfolio tracker and nothing more, I would probably choose another option.

But if you are also looking for investment research information, then you should look into Seeking Alpha. It is one of the best investment research platforms available, and the only one I've been a paying customer of for the last 6+ years.

It's best known for crowdsourcing investment analysis and research from 20,000+ contributors who produce more than 10,000 articles each month. It also provides quantitative research, Wall Street analyst ratings, financial data and history, and more.

In addition to investment research, which is the main reason I subscribe, Seeking Alpha also has a solid portfolio tracker and its automatic brokerage connection makes linking your accounts simple.

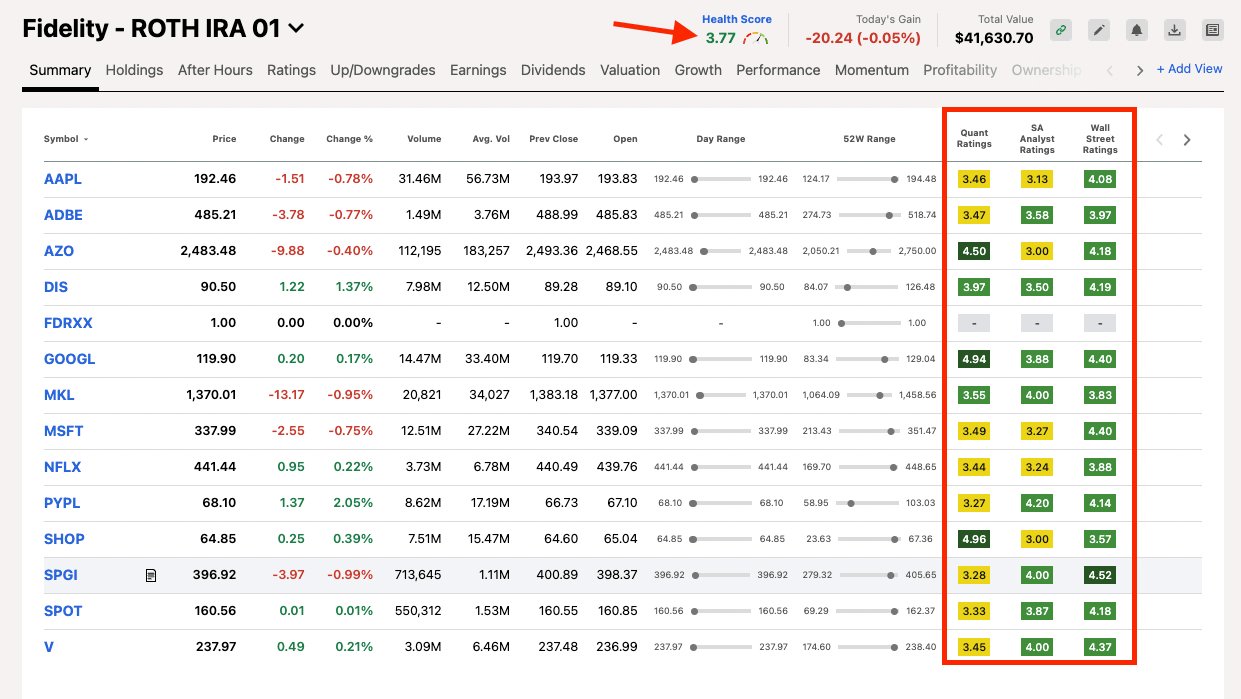

In fewer than five minutes, you can start receiving portfolio insights based on Quant ratings, Seeking Alpha authors' sentiment, and Wall Street analysis.

You'll also see a Health Score for your overall portfolio (which is 3.77 for my Roth IRA):

In seconds, I'm easily able to flag any positions that may need my attention. From this screen, I can also view key statistics, upgrades and downgrades, the latest news, and the most recent articles written about any of my positions.

If you're only interested in a portfolio tracker, Seeking Alpha is overkill. But I personally don't foresee a day when I won't be a member of Seeking Alpha — it's that good.

And right now, new members can get Seeking Alpha Premium for just $299 $269, plus a 7-day free trial, through our link:

7. Best portfolio-tracking brokerage: Fidelity

- Overall rating:

- Platform(s): Website, iOS, Android

- Best for: New investors

- Price: Free (start here)

About Fidelity

If you're new to investing and also in need of a brokerage, I'll recommend my own: Fidelity.

Obviously, its primary function is as a brokerage account — where you can invest in stocks, bonds, funds, options, and more in both traditional and retirement accounts — but it also has some handy portfolio tracking tools.

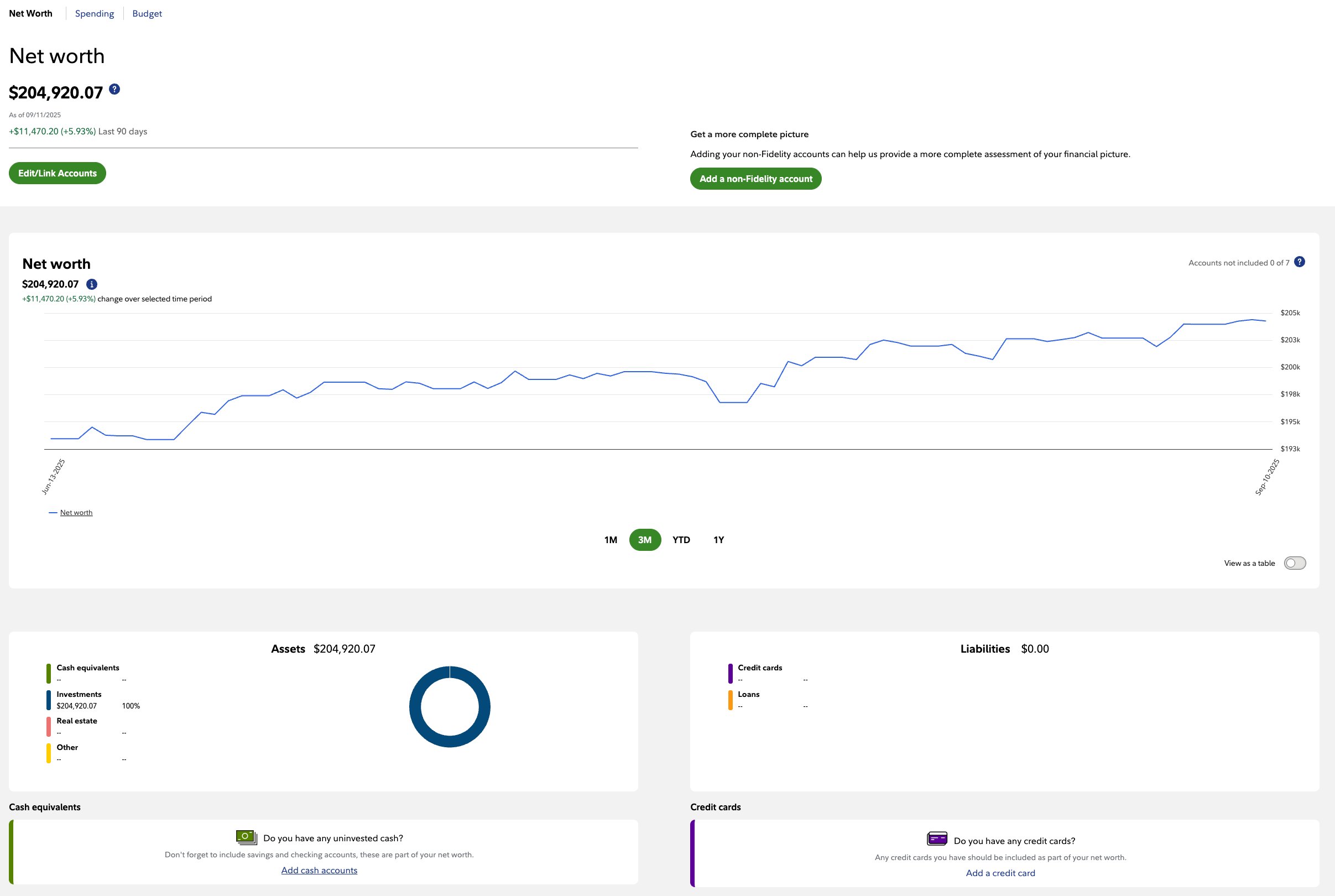

In addition to the traditional portfolio view (cost basis, returns, etc.), Fidelity Full View allows you to link both Fidelity and non-Fidelity accounts and track all of your investments in one place.

Users can monitor investments, bank accounts, credit cards, loans, and real estate holdings.

There are three tabs inside Full View: Net Worth, Spending, and Budget, with helpful tools, interactive dashboards, and analysis inside each one.

The Spending tab allows you to link your credit cards and bank accounts to help you track where your money is going, while the Budget tab keeps you on target for your savings goals.

Fidelity is one of my favorite brokerages, and has both the security and functionality of legacy brokers and an attractive and user-friendly interface. Its mobile app is also very good.

While I wouldn't recommend its net worth tracker if you're not a client, it's a great option for existing (or soon-to-be) Fidelity customers.

8. Best for portfolio simulation: Ziggma

- Overall rating:

- Platform(s): Website

- Best for: Investors interested in portfolio optimization

- Price: $14.99/month (get started)

About Ziggma

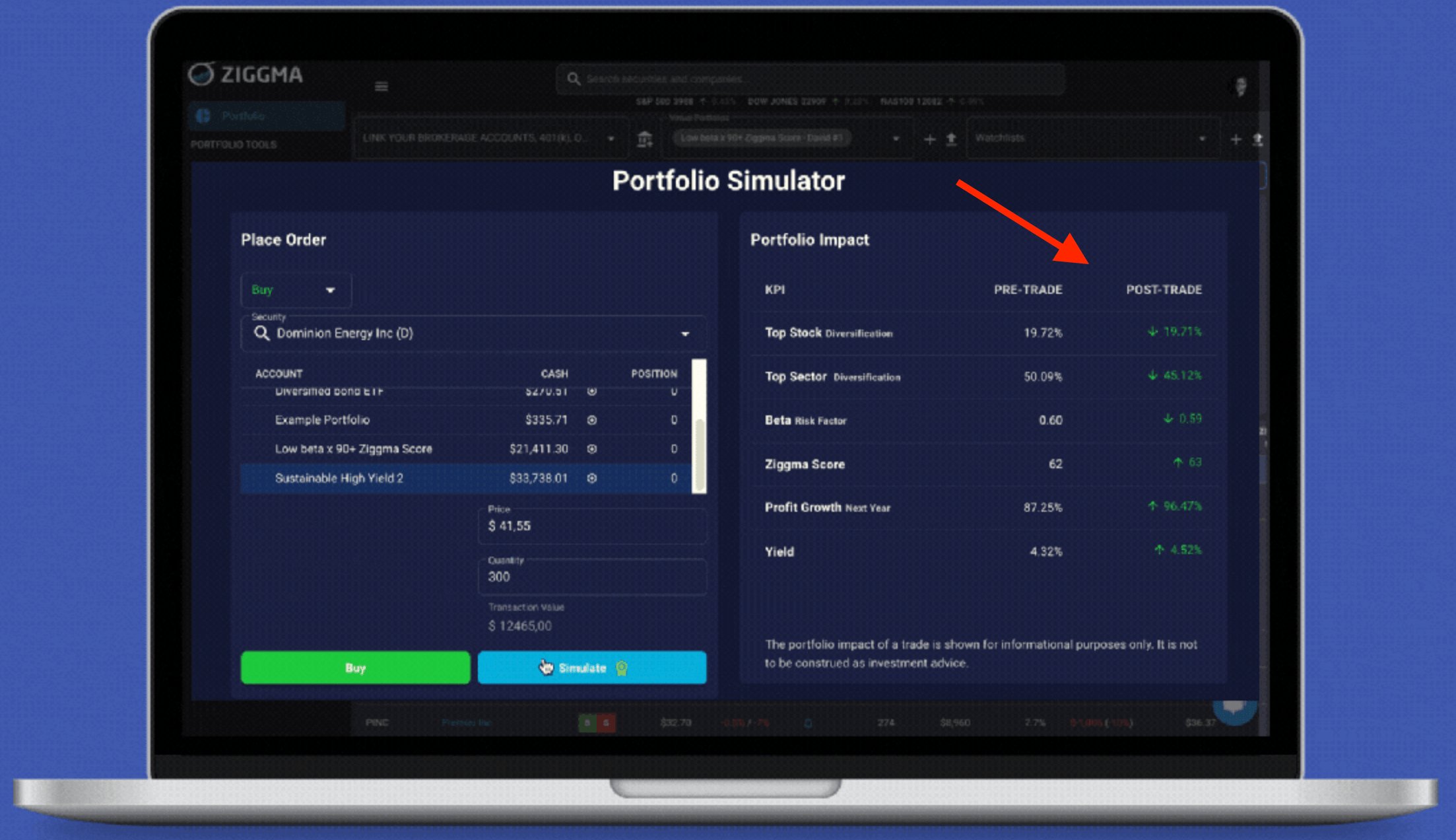

Ziggma not only tracks your positions — it also allows you to simulate how new positions will impact your portfolio.

By inputting a hypothetical trade, you can see how your portfolio's diversification, Beta, and several other KPIs are affected:

Ziggma assigns every stock a Stock Score, which compares it against its peers in terms of growth, profitability, valuation, and financial stability.

Its Business Performance Tracker also makes it easy to track key business metrics like profitability and growth over time, so you can stay on top of the true drivers of stock performance.

Ziggma also computes your projected dividend income for the next year and offers Smart Alerts, which will notify you when a stock you own moves above or below a predetermined price, P/E ratio, or dividend yield.

Its Plaid integration makes it easy to connect accounts, and the "All Account" gives you a holistic look at your portfolio — a necessary feature for investors with multiple accounts.

9. Best portfolio tracker for crypto-focused investors: Delta

- Overall rating:

- Platform(s): Website, iOS, Android

- Best for: Crypto investors who also own other assets

- Price: Free (or $13.99/month for Pro+, get started)

About Delta

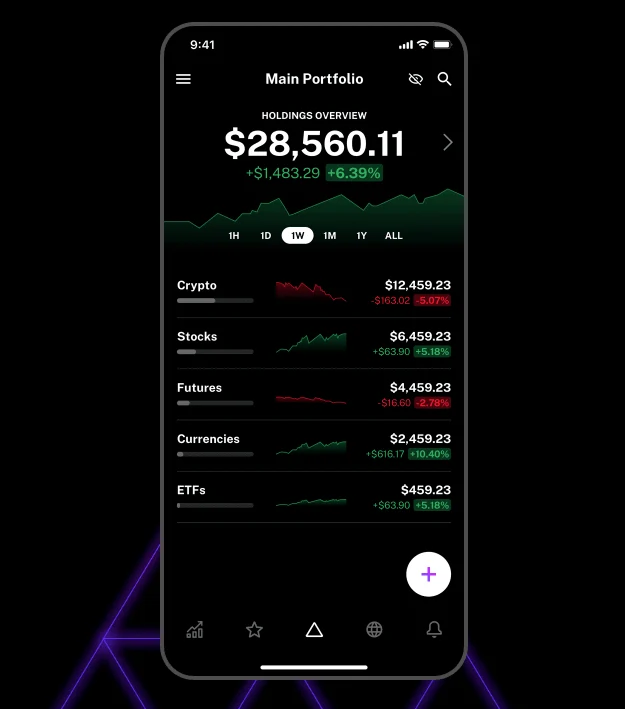

Delta is a portfolio-tracking app that allows you to track cryptocurrencies, NFTs, stocks, currencies, bonds, mutual funds, ETFs, options, and futures.

Delta is popular among crypto investors, especially those who also have investments in stocks and ETFs.

If you invest in both crypto and equities, you likely have at least 2 accounts you need to open to see your total portfolio. You can simplify this process with Delta.

After manually entering your transactions (opening and closing transactions for each investment), Delta will automatically track live prices and calculate your performance data.

Plus, the app will show you advanced metrics about each of your holdings, all in one central location.

It's not as sophisticated as Kubera, but it's a much cheaper alternative ($13.99/month vs $360/year), and allows up to two broker connections for free.

What's a portfolio tracker?

A portfolio tracker is software or an app that allows you to input a combination of stocks, bonds, options, currencies, futures, and/or other assets that you hold across multiple investment accounts and monitor all of them from a single login.

Most investors have more than one investment account. For example, you may have a 401(k), an IRA, an individual brokerage account, and a crypto portfolio. And if you do, you likely have more than one brokerage where these assets are held.

Personally, I have seven investment accounts spread across three different brokerages (a couple of which gave me free stocks for signing up), plus a handful of other assets (cash in bank accounts, real estate, and private investments) that I need to track.

Instead of logging in to all of your individual accounts to check on your portfolio, a portfolio tracker aggregates all of these holdings and gives you a holistic view of your total portfolio.

Plus, it will automatically track your performance, making it easy to stay on top of each of your investments.

How we chose the best portfolio trackers

When evaluating investing products and services, we take the following into consideration:

- Price: Overall price, value for money, average cost per month, and any hidden fees.

- Usability: What the interface looks like, whether the site is easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of information and data, as well as company and brand reputation.

- Audience: Who the product is for, the range of uses and applications, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

Without a good portfolio tracker, it's hard to keep tabs on the performance of all of your investments. You may also end up over-concentrated in an asset or forget about investments you made.

In any case, you need a reliable place to see all of your accounts in one place.

While a spreadsheet may work for a while, I would recommend an upgrade to one of the free or paid tools above. You will save yourself time and headaches, and it may prevent you from making a costly mistake.

And when you're managing hundreds of thousands or millions of dollars, even a small mistake can be costly.

You already have good personal finance habits, a dedication to saving and investing, and a long-term outlook. Adding in a great portfolio tracker will make your journey to wealth creation that much easier.

Frequently asked questions

Below are a few more questions often asked about portfolio trackers.

Is a portfolio tracker free?

There are several free portfolio trackers. Empower is my personal favorite, but M1 Finance and Fidelity (which are brokerages) also have free options.

How do you keep track of your stock portfolio?

The easiest way to keep track of a stock portfolio is with a portfolio tracker. My favorites are Kubera, Empower, Seeking Alpha, Stock Analysis, and Sharesight.

What is the best app to keep track of your stock portfolio?

The best app for keeping track of a stock portfolio is Kubera, but it costs $360/year. The best free portfolio tracker is Empower.

.png)