How to Invest in Zipline Instant Delivery & Logistics

Zipline Instant Delivery & Logistics is a company that designs, makes, and operates the largest drone delivery network in the world.

In 2014, Zipline was created to deliver medicine to hospital patients in critical condition. Since then, it has grown into a vast commercial drone delivery system that runs on an autonomous logistics network.

Zipline drones deliver medicine, food, products, and other goods to hospitals, businesses, and homes. To date, Zipline has delivered over 9 million items and its drones have flown more than 63 million miles.

The company also generated $25.2 million in revenue in 2022, with estimates over $180 million over the next 12 months.

The future of delivery is drones — they're faster, cheaper, more accurate, autonomous, and can work 24/7. Not to mention, Zipline's delivery system produces up to 97% fewer emissions than gas-powered delivery vehicles.

I don't need to convince you how valuable drones will be for businesses and their customers in the future. The only question is: how can you invest in Zipline stock now?

Is Zipline publicly traded?

Zipline is not publicly traded, which means you can't buy it in your regular brokerage account.

There is no Zipline stock symbol because it's still a private company that hasn't yet made its shares available to the public via an initial public offering (IPO).

Rumors have been circulating that Zipline will have its IPO sometime in the near future.

However, if you're not willing to wait for it to become publicly traded, there is a way to buy Zipline stock before its IPO.

How to buy Zipline stock in 2024

Are you an accredited or retail investor?

You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

If you're an accredited investor, the first section is for you. If you don't qualify as an accredited investor, skip to the second section, which is for retail investors.

How to buy Zipline stock as an accredited investor

An alternative to the secondary market is Equitybee, an investment platform that gives accredited investors access to high-growth, VC-backed startups like Zipline:

By funding employee stock options, accredited investors can gain investment exposure to private companies at past valuations.

In exchange for funding the options, you will receive a percentage of future proceeds from any successful liquidity events.

Shares of Zipline are currently trading for $16.24 at a $4.2 billion valuation.

Equitybee is also offering accredited investors access to a data-driven, index-like venture fund.

The Equitybee Venture Portfolio Fund (VPF) provides access to a broadly diversified portfolio of 100+ late-stage, pre-IPO companies, invested at discounts to the last known common share price.

Hit the button below to register and access the Equitybee Venture Portfolio Fund:

Disclaimer: Subject to availability. Investments involve risk; Equitybee Securities, member FINRA.

How to invest in Zipline stock as a retail investor

If you're not an accredited investor, there's still a way to get exposure to Zipline's business before its IPO.

The only public company that has invested in Zipline is Goldman Sachs (GS), which participated in Zipline's Series C and D funding rounds.

Goldman Sachs is a $125 billion company, so even if it owned 10% of Zipline, its stake would still be worth just ~0.3% of the entire business, which makes it a poor vehicle for gaining exposure to Zipline (unless you want to own Goldman Sachs anyway).

A better way for retail investors to get exposure is via venture capital funds, like the ARK Venture Fund, which owns Zipline. The minimum investment is just $500, and all U.S.-based investors are eligible to invest.

However, if you're going to invest in this fund, be sure you're comfortable investing in the rest of the companies the fund also owns.

Who owns Zipline company stock?

To date, Zipline has raised over $900 million and has about 40 investors.

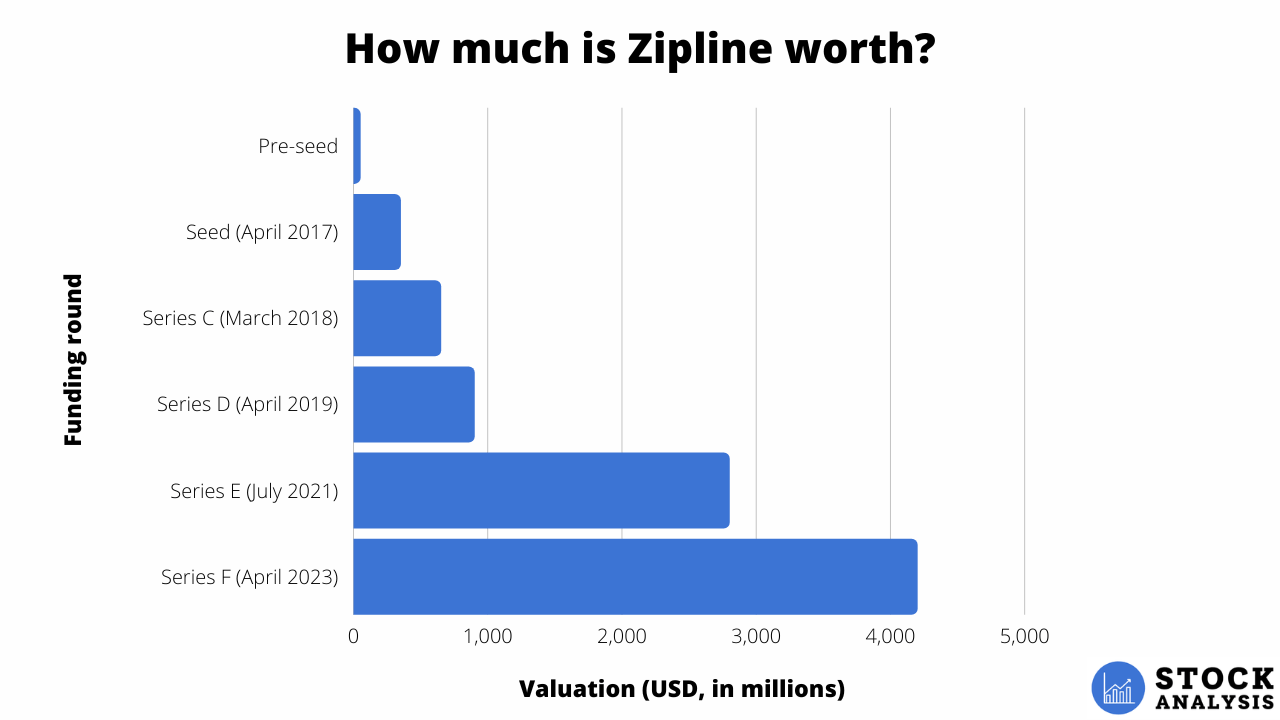

The company's most recent round of funding came in April 2023 and raised $330 million at a valuation of $4.2 billion, a 55% increase from its previous valuation, which was set in 2021.

Some of the company's investors are Sequoia Capital, Andreessen Horowitz, Katalyst Ventures, Emerging Capital Partners, and Reinvent Capital, though how much of the company any of these firms own is unknown.

CEO Keller Rinaudo Cliffton and CTO Keenan Wyrobek also own stock, as do other key employees, but their exact splits are also unknown.

How to buy the Zipline IPO

The Zipline IPO date has not yet been set, but after its initial public offering, you will be able to look up its stock symbol and buy it in your brokerage account.

If you don't have a brokerage account, we recommend Public. Invest in stocks, ETFs, Treasuries, corporate bonds, and cryptocurrencies all under the same login. Create a Public account for free here.

Zipline price chart

Here is an overview of Zipline's previous funding rounds and valuations:

*Pre-seed, Seed, and Series C valuations are estimates.

Frequently asked questions

Below are a few more questions people often ask about Zipline.

How can I buy Zipline stock?

Zipline stock has not been made available to the public via an IPO or SPAC. The only way to invest in Zipline currently is by investing through a platform like Equitybee or investing indirectly in companies that own stakes in Zipline or will benefit from its business.

How much is Zipline stock?

Zipline stock is currently $11.74 per share on Equitybee, but the stock is not yet publicly traded.

What is the Zipline stock symbol?

Zipline is still a privately held company, so there is no Zipline stock symbol.

Who owns Zipline Delivery & Logistics?

Zipline is partially owned by CEO Keller Rinaudo Cliffton, CTO Keenan Wyrobek, key employees, and about 40 other investors and investment firms.

.png)