Best Bloomberg Terminal Alternatives: Free & Paid

Over the last 40 years, the Bloomberg Terminal has become a fixture on Wall Street desks.

More than 350,000 financial professionals use it every day, from hedge fund managers and investment bankers to portfolio analysts and traders.

But the most staggering number isn't how many people use it — it's the price. A single Terminal license costs $32,000 per year, or more than $2,600 per month.

For independent investors and small firms, that's simply out of reach.

Fortunately, there are a number of platforms that replicate much of Bloomberg's power — data feeds, analytics, news, and charting — at a fraction of the cost.

But before we get into the alternatives, let's take a closer look at what a Bloomberg Terminal actually is, and why so many people are paying $32,000 a year to use one.

What is a Bloomberg Terminal?

A Bloomberg Terminal is a powerful all-in-one data, research, and communication platform used by investment firms, banks, hedge funds, and corporations to make trading and investment decisions.

Michael Bloomberg, a former partner at Salomon Brothers (one of Wall Street's largest investment banks before its collapse during the Great Financial Crisis in 2008), launched Bloomberg LP, a financial data and news vendor, in 1981.

Its first product was the Bloomberg Terminal.

Decades before the widespread adoption of the internet and personal computers, Bloomberg Terminals provided a groundbreaking information-delivery service that completely changed the industry.

With it, users could access financial data, analytics, and news in near real-time.

Today, Bloomberg Terminals are still the gold standard for market data.

Is a Bloomberg Terminal worth it?

Here's what a Bloomberg Terminal does exceptionally well (and why it costs $32,000 per year):

- Seemingly infinite data, charting tools, and research

- Near immediate earnings reports, filings, and breaking news

- Direct communication with the people who move markets via Bloomberg Chat, the platform's built-in messaging network

Of these, I'd argue Bloomberg Chat is the most valuable feature.

It connects institutional investors — the ones making multi-million-dollar trades — into a single live conversation, and allows them to share sentiment and feel the market's collective pulse in real time.

Unfortunately, that also means there's no true substitute. Since most major institutions use Bloomberg Chat, it's the one feature that can't be replicated elsewhere.

That said, nearly everything else Bloomberg offers — from data and research to analytics and news — can now be replaced with a combination of modern tools. And unless you're managing tens of millions of dollars, Bloomberg is likely overkill.

For most investors and smaller firms, the following platforms deliver much of the same functionality for a fraction of the cost (or for free).

Summary of the best Bloomberg Terminal alternatives

Below, I've listed the best Bloomberg Terminal alternatives.

Some are all-in-one platforms that mirror Bloomberg's functionality, while others are specialized tools you can use to build your own custom setup.

| Category | Tool | Description | Cost |

| All-in-one | Fiscal.ai | Retail investor Bloomberg alternative | $49–$249/month |

| All-in-one | Eikon | Institutional-level Bloomberg alternative | $3,600–$22,000/year |

| All-in-one | Koyfin | Retail investor Bloomberg alternative | $49–$110/month |

| Stock & ETF research | Stock Analysis | Stock research, analyst ratings & forecasts | Primarily free |

| News | X (Twitter) | Breaking news | Free |

| News | Benzinga Pro | Real-time newsfeed | $37–$197/month |

| News | thinkorswim | Real-time newsfeed | Free |

| Investment research | Seeking Alpha | Investment reports | $299/year |

Keep reading for details on each one of these tools.

1. All-in-one Bloomberg alternatives

If you don't want to combine multiple tools together to form a makeshift terminal, there are several companies that offer all-in-one alternatives.

Fiscal.ai — best BT substitute for retail investors

Fiscal.ai is a web-based research terminal designed for retail investors who want institutional-grade data without the price tag.

The platform aggregates global financial statements, analyst estimates, 13F filings, KPI data, hedge fund letters, and more into one modern, intuitive dashboard.

Beyond its breadth of coverage, Fiscal.ai stands out for data quality, speed (financials are updated within minutes of a company's earnings report), and usability.

You can search for and surface key metrics in seconds, or use its integrated AI Copilot to query data in plain English, asking questions like “Which semiconductor stocks have the fastest revenue growth this quarter?” and getting instant, sourced answers.

With more than 350,000 users, Fiscal.ai has quickly become one of the most popular research tools among both retail and professional investors.

You can upgrade to Pro for $49/month or Enterprise for $249/month — a fraction of the cost of a Bloomberg Terminal but powerful enough to serve as an all-in-one hub for the vast majority of investors.

Eikon — best BT substitute for institutional investors

LSEG's (formerly Refinitiv's) Eikon is the most direct competitor to the Bloomberg Terminal.

Eikon offers much of the same financial data, charting capabilities, modeling, and news services as Bloomberg, though it uses Reuters as its news source, which is often a half-step slower than Bloomberg in reporting breaking news*.

*Bloomberg has a reputation for breaking critical news stories first, which, along with its Chat, is its biggest (and most valuable) differentiator. When you're trading tens of millions of dollars, every second matters.

While Bloomberg dominates the hedge funds, investment banks, and large asset managers, Eikon is popular among financial analysts, portfolio managers, and other financial officers at smaller institutions.

Eikon is also more affordable than Bloomberg, but since it also targets institutions and professional investors, it's still too expensive for most retail investors. Depending on the set of features you want, the annual price can range from $3,600–$22,000.

This article primarily covers the best Bloomberg alternatives for retail investors. If you're a professional investor and are interested in Eikon, you may also want to look into Capital IQ and FactSet.

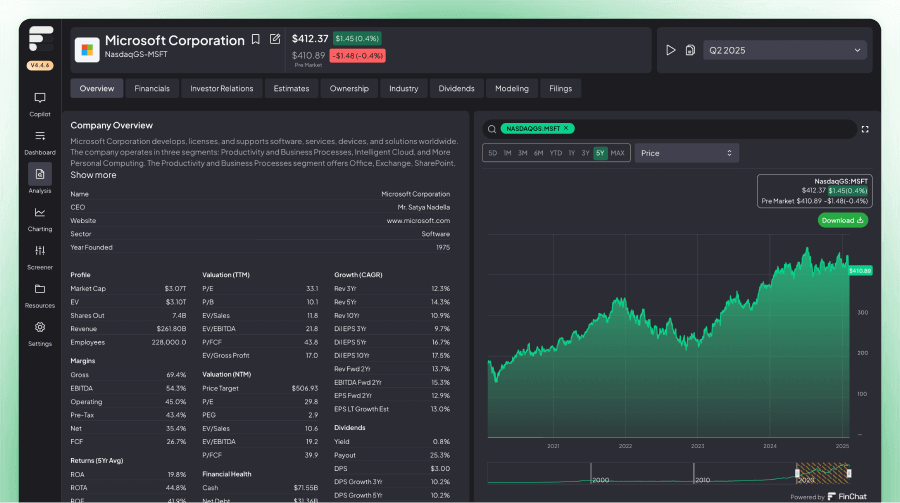

Koyfin — second-best BT substitute for retail investors

Koyfin is another great Bloomberg alternative for retail investors, which is exactly why it was made.

Frustrated by Bloomberg's cost and wanting to make a more user-friendly alternative for retail investors, Koyfin's founders modeled its features, data coverage, and user experience after the industry leader, all the way down to the keyboard shortcuts.

Koyfin has custom dashboards, thousands of chart configurations, stock comparison graphs, data visualizations, market news, analytics, company filings, and more. The more you use it, the more features you'll find.

You can use some of Koyfin's features for free, but most users will want to upgrade to a Plus ($49/month) or Pro ($110/month) plan.

You can learn more about their plans here.

2. Stock & ETF research

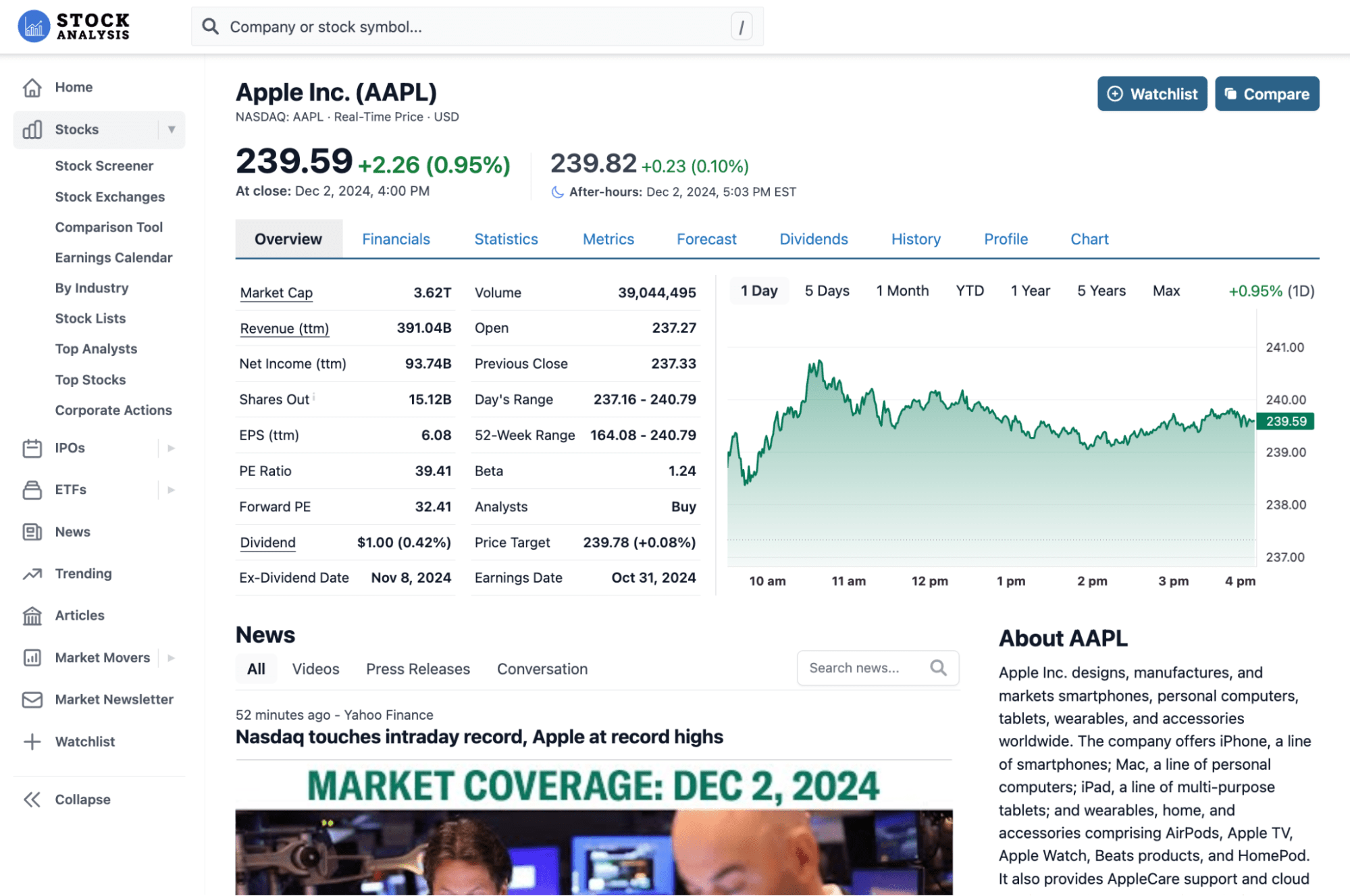

Stock Analysis — best for stock research and analyst info

If you're looking for stock quotes, financial statements, business metrics, dividend information, and analyst ratings, forecasts, and price targets, we've got you covered at Stock Analysis.

Our site is known for its fast loading times, simple user interface, and connections to the highest-quality data sources.

We hope you're as serious about data as we are, because we pay a premium to get the most comprehensive and accurate data we can from sources like S&P Capital IQ and Nasdaq Data Link.

One of our most popular features is Top Analysts, where we track Wall Street's most profitable analysts and show you their latest recommendations. You can use it to research your existing positions and find new stock ideas.

We also have a stock screener, a newsfeed, and a free daily market newsletter that can help you stay on top of the latest market news.

The vast majority of the website is completely free to use (which makes it the best Yahoo Finance alternative), but you can go Pro ($9.99/month or $79/year) to unlock all our features and the full financial history for every stock.

3. News sources

X (Twitter) — best for breaking news

Here's a money-saving hack: you can create your own custom news feed by making a list of a few X (Twitter) accounts.

Many accounts on X publish every headline from leading, proprietary news sources (like Bloomberg and Reuters) within seconds of those articles being released on their native (very expensive) terminals.

Here are a few accounts to follow:

- Walter Bloomberg (@DeItaone)

- First Squawk (@FirstSquawk)

- FinancialJuice (@financialjuice)

- The Spectator Index (@spectatorindex)

You'll get your news a few seconds behind the professionals, but it'll be free.

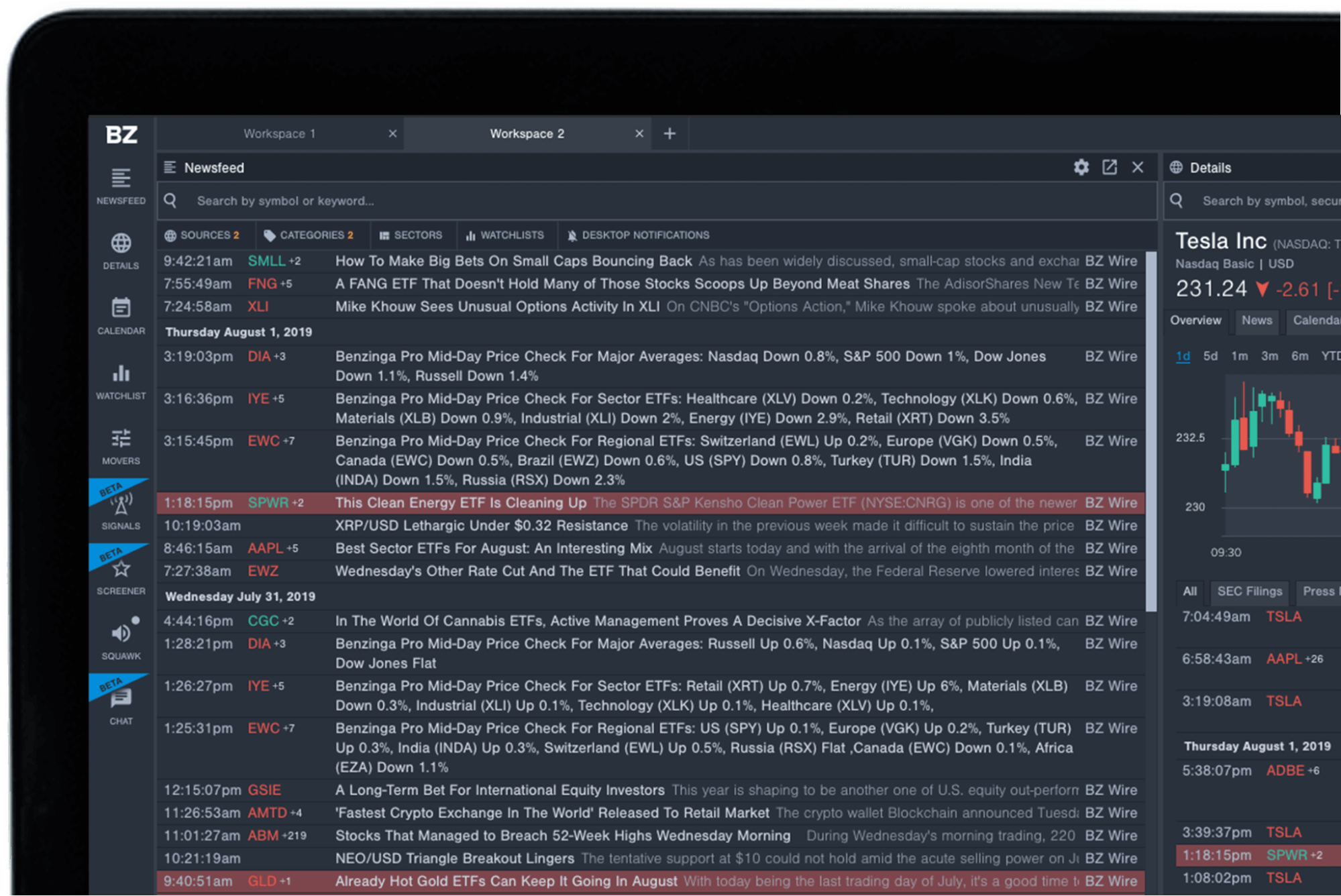

Benzinga Pro — best real-time newsfeed

For day traders and other investors heavily reliant on an up-to-the-minute news feed, Benzinga Pro is my top pick.

Benzinga Pro delivers breaking news faster than any other provider I've tried. In addition to being timely, the information is clear, reliable, and objective.

It also has a price sentiment engine, which lets you know how likely certain news is to move the underlying stock and in which direction. It's simple, but I've found it can save me 5–10 seconds, which can matter quite a bit when I'm day trading.

Additionally, its live chat room is filled with savvy traders who share trade ideas.

You can try Benzinga for free, but if you like it, you'll want to upgrade to a paid plan. Benzinga Pro has three tiers: Basic ($37/month), Streamlined ($147/month), and Essential ($197/month).

If you're an active trader, I would recommend Streamlined or Essential.

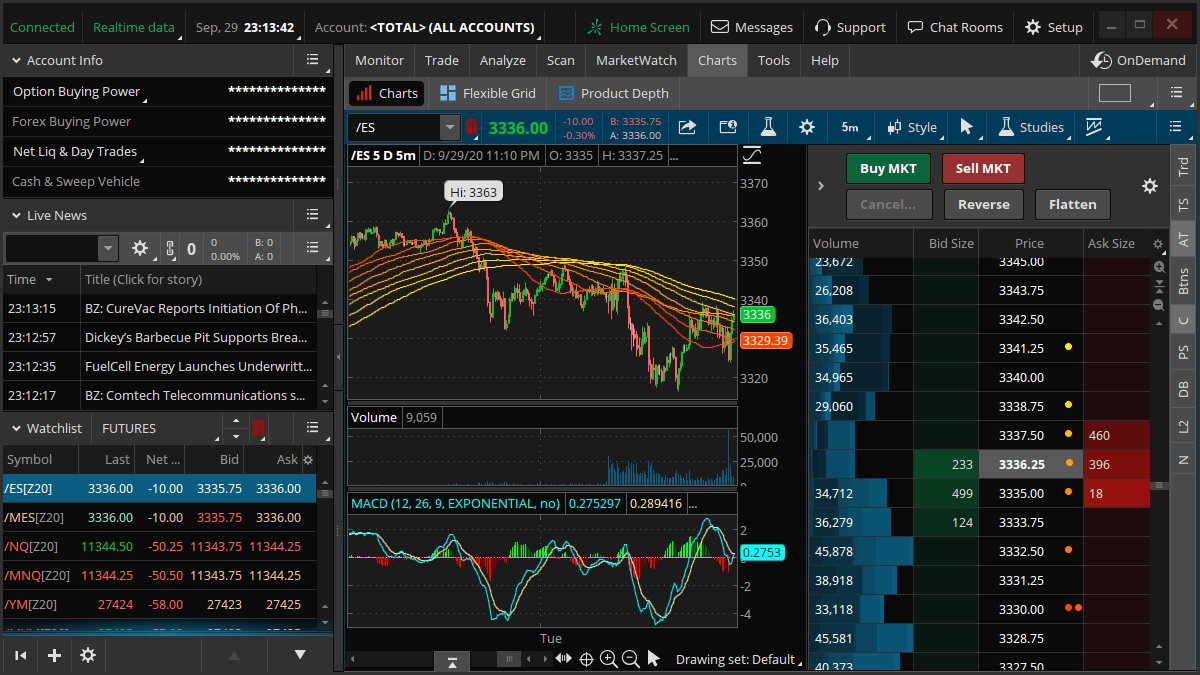

thinkorswim — best free real-time newsfeed

thinkorswim is the trading platform that's now owned by Charles Schwab (which bought TD Ameritrade in 2020).

thinkorswim has long been one of the most popular trading platforms for day traders. It's fast, powerful, and infinitely customizable.

Along with all of its other features, it also has a real-time newsfeed.

While it may not be quite as timely as a Bloomberg terminal or Benzinga Pro, it's still very fast and a great option for someone looking for a combination of trading platform and built-in newsfeed.

thinkorswim is completely free to use for anyone with a Charles Schwab account. You can get started with it here.

4. Investment research

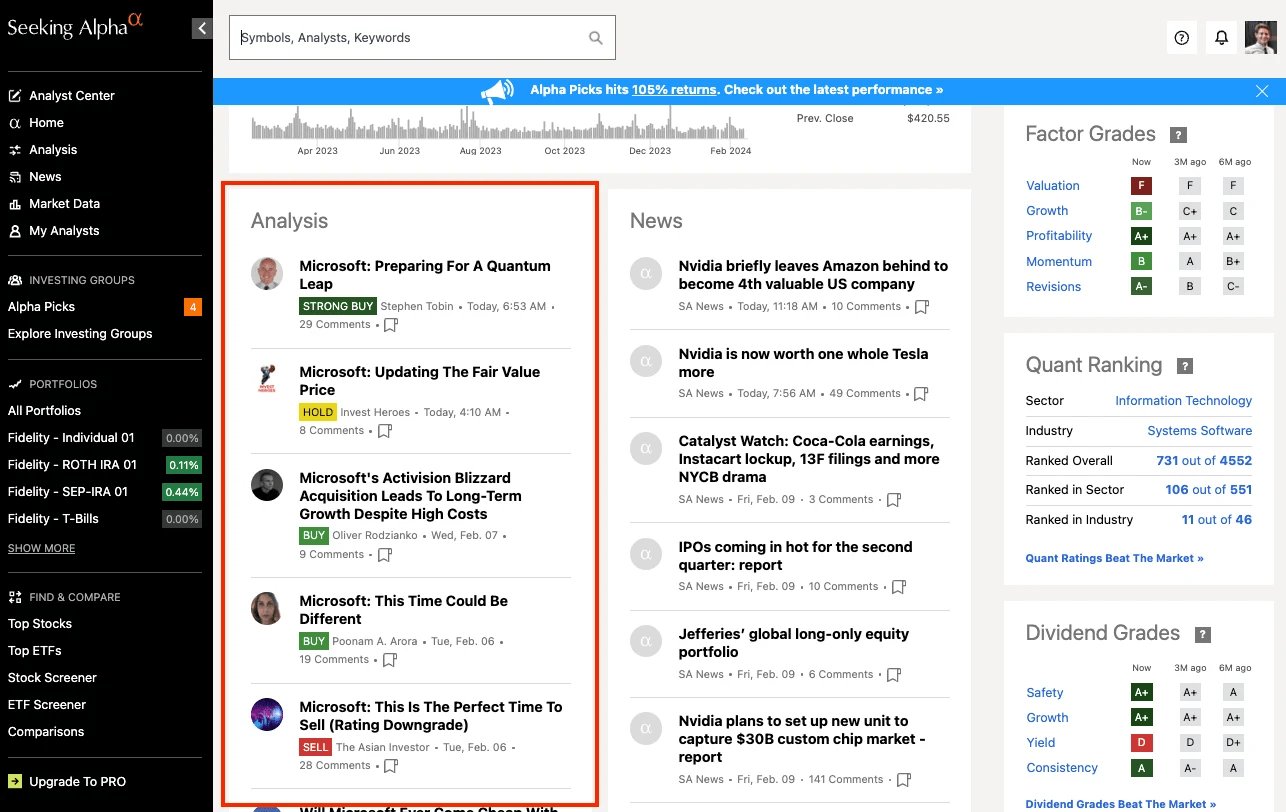

Seeking Alpha — best for investment reports

Bloomberg Terminal users can also write research reports and share them with other institutional investors. Again, like Bloomberg Chat, this is a way for investors to stress-test their ideas, get a feel for sentiment, and find new investment ideas.

The best way to replace this aspect of a Bloomberg Terminal is with Seeking Alpha.

Each month, thousands of contributors write detailed investment research reports and grade stocks with Strong Buy, Buy, Hold, Sell, and Strong Sell ratings.

These articles are my favorite place to research my current investments — to uncover risks I may have missed in my own analysis and to read others' thoughts on ongoing developments and quarterly reports — and to find new investment ideas.

Seeking Alpha allows me to dig far deeper into companies than I ever could on my own, in just a couple of hours per month.

You can get a couple of articles per month for free, but you'll bump into a paywall for Premium ($299/year) beyond that.

Final verdict

You may not be able to completely replace a Bloomberg Terminal — there's a reason it costs $32,000 per year and generates more than $11 billion in annual revenue — but you can replace parts of it with a number of tools that are built for retail investors.

Besides, for the vast majority of investors, a Bloomberg Terminal is completely overkill. Once you know what specific features you actually need, you can easily find viable alternatives at much lower prices.