How to Buy The Boring Company Stock

The Boring Company — one of Elon Musk's lesser-known ventures — is building underground tunnel systems designed to ease urban congestion.

The company digs tunnels, literally “boring” holes.

In Musk's view, solving traffic problems will require 3D roads — which means either flying cars or multi-leveled, underground tunnels. To him, tunnels seem like the more practical solution.

The company's goal is to reduce traffic, reshape cities, and make everyday transportation faster and more efficient.

These are massive problems that affect hundreds of millions of people every day, and the market size is in the billions (if not trillions).

Here's how to invest in The Boring Company's stock today, well before its IPO.

Is The Boring Company publicly traded?

No, The Boring Company is not publicly traded, which means you can't buy it in a traditional brokerage account.

There's no Boring Company stock symbol because the company is still private and hasn't made shares available through an initial public offering (IPO). And there's little indication that this will change anytime soon.

Including Musk's initial $100+ million investment, The Boring Company has raised just over $900 million to date, with its last round closing in April 2022.

Since then, it has been able to cover its expenses through its existing operations and paid contracts for active projects, which generate revenue as work progresses.

At this point, there's no reason for it to go public until it successfully completes more projects and further proves its viability.

Fortunately, you don't need to wait for The Boring Company to go public to invest. If you qualify, there's a way to buy its stock right now.

How to buy The Boring Company stock in 2026

Accredited investors* are able to invest in The Boring Company on Hiive.

*You are considered an accredited investor if you have had annual income of $200,000 (individually) or $300,000 (jointly) over the past two years, or if you have a net worth exceeding $1,000,000, excluding your primary residence.

Hiive is an investment platform that gives accredited investors access to high-growth, venture capital-backed startups and private companies, including The Boring Company:

Hiive connects sellers (usually employees, venture capitalists, or angel investors) who want to sell their shares with accredited investors who want to buy their shares.

Each seller creates a listing by setting their asking price and quantity of shares for sale. Buyers can accept a seller's asking price as listed or place bids and negotiate directly with the seller.

Buyers can also add companies to their watchlist and get notified of any new listings or transactions.

Click the button below to create an account on Hiive and see the current offerings for The Boring Company:

Can retail investors invest in The Boring Company?

If you don't qualify as an accredited investor, you cannot buy Boring Company stock at this time. That said, you can get indirect exposure to The Boring Company by investing in Tesla (TSLA).

The Boring Company depends on Tesla's vehicles, batteries, drive units, and software to operate its tunnels.

Its core product — the Loop — shuttles passengers through underground tunnels in modified Teslas, a setup often referred to as “Teslas-in-tunnels.”

As The Boring Company expands, it will likely continue purchasing vehicles and components directly from Tesla.

That means Tesla stands to benefit financially from TBC's growth, making it a way for investors to get indirect exposure before The Boring Company goes public.

That said, The Boring Company would have to grow massively before its purchases move the needle for a company as large as Tesla.

More about The Boring Company

Projects

The Boring Company has six active projects, seven R&D tunnels, and two projects currently being designed.

Five of its six active projects are in Las Vegas, including the Vegas Loop, the Las Vegas Convention Center Loop, and three connectors.

The Vegas Loop project has been approved for up to 68 miles of tunnels and 104 stations, though just 8 miles have been completed. The Las Vegas Convention Center Loop reduces a 45-minute walk to ~2 minutes.

The company has also received contracts to construct tunnels in Nashville and Dubai, both of which are in the design phase.

Products

1. Loop

Loop is the company's main product, branded as “all-electric, high-speed, underground public transportation” — basically a highway in a tunnel where passengers board individual vehicles and are brought directly to their destination station.

The Las Vegas Convention Center Loop (LVCC Loop) is the best example of this product in action. It's a 3-station loop which consists of 1.7 miles of tunnel.

At its peak, it has transported 4,500 passengers per hour and over 32,000 passengers per day. The system cost $47 million and took one year to build.

The Boring Company plans to use self-driving Teslas moving at up to 150 mph, but it currently requires human drivers and speed limits of 35 mph.

The city of Las Vegas pays TBC $167,000/month, plus additional amounts based on the number of passengers served, to operate the project.

2. Hyperloop

Similar to its Loop systems, a Hyperloop is a high-speed transportation system involving electric pods that would carry passengers at 600+ mph.

So far, only a test track has been built, where speeds of up to 288 mph have been recorded. There's been no indication of when (if ever) the system will be deployed.

3. Prufrock

Prufrock is the company's proprietary tunnel borer. It is capable of digging a 12-foot diameter tunnel at a rate of 1 mile per week.

Its one-of-a-kind design allows it to “porpoise,” meaning it can enter and leave the ground on its own — a massive breakthrough in tunneling technology.

Who owns The Boring Company stock?

The Boring Company has raised $908 million in four funding rounds.

In addition to Musk's stake (which I would estimate around ~70%) and early employees (who probably own a cumulative 10%), there are 8 other investors.

These include Vy Capital, Sequoia Capital, Founders Fund, 8VC, Valor Equity Partners, and Craft Ventures.

The Boring Company valuation

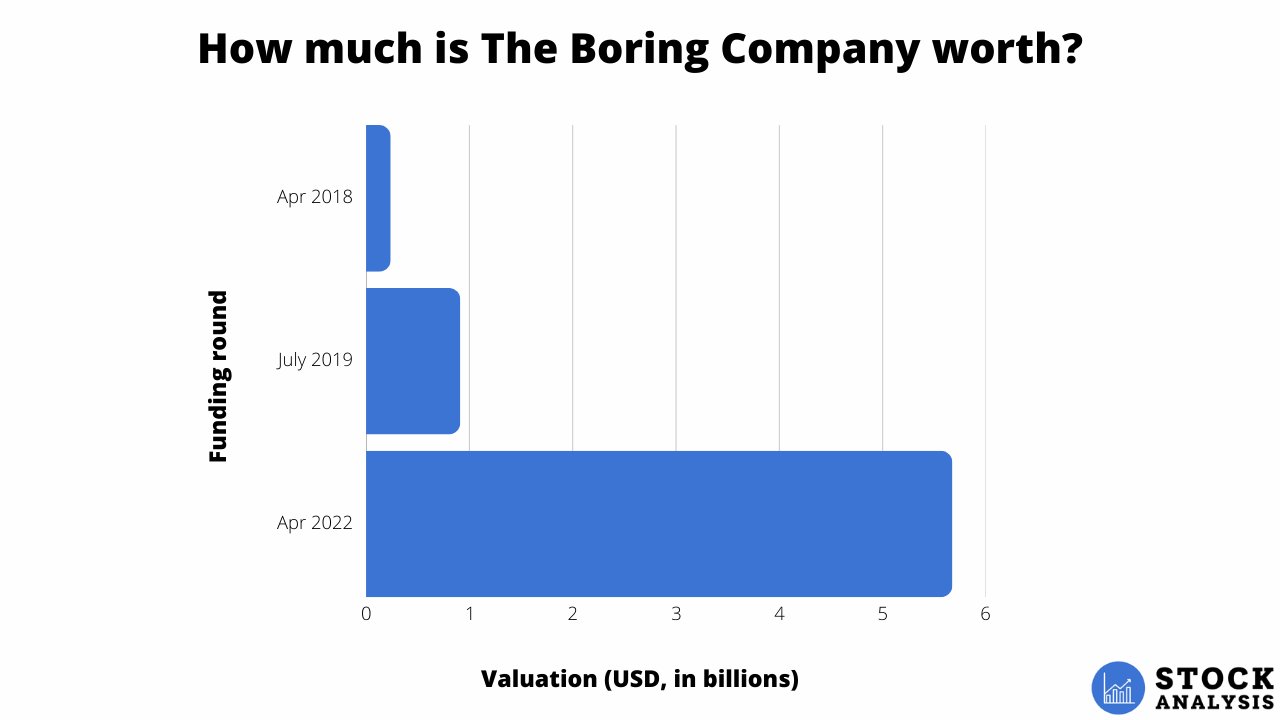

The Boring Company's most recent external funding round (its Series C) came in April 2022 when it raised $675 million at a $5.675 billion valuation.

In October 2023, some investors and employees took part in a secondary share sale, which valued the company at $7 billion, up 22% from the valuation set in April 2022.

Here's a look at how the company's valuation has changed over time (not including the secondary transaction):

Frequently asked questions

When will The Boring Company IPO?

The Boring Company IPO date has not yet been set, and Musk hasn't made any comments about a potential timeline.

After its initial public offering, you will be able to look up its stock symbol and buy it in your brokerage account. If you don't have a brokerage account, we recommend Public.

Is The Boring Company profitable?

As a privately-held company, TBC does not need to report its financial performance. However, given it hasn't raised external funding since 2022, we can assume it operates around breakeven.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)