4 Ways to Invest in SpaceX Stock in 2025

SpaceX is a company unlike any other.

Among other things, it:

- Delivers satellites into orbit

- Takes individuals for rides into space

- Serves high-speed satellite internet via Starlink

- Shuttles astronauts to the International Space Station

But that's nothing compared to its ultimate objective: to transport people to, and eventually colonize, Mars.

Revenue and profits have soared in recent years, propelling the company's valuation to $350 billion and making it the world's most valuable private company.

Despite its size, SpaceX is not a public company, and its mission to colonize Mars will likely prevent it from going public before that goal is met.*

*If it were to go public before then, shareholders would have the power to force the company to give up on this goal in pursuit of more profitable, but less ambitious, ventures.

Elon Musk (SpaceX's founder and CEO) knows this and will keep the company private for as long as he can. This way, he can make strategic decisions without needing to answer to shareholders.

Unfortunately, that means investors aren't able to buy shares of its stock in their traditional brokerage accounts.

But there are a few other ways to gain exposure to SpaceX.

Here are 4 ways to buy SpaceX stock today, while it's still a private company.

1. Buy shares directly (from existing shareholders)

You can invest in shares of SpaceX through Hiive, an investment platform where accredited investors can buy shares of private, pre-IPO companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

As of the time of this writing, there are 25 unique listings for SpaceX on Hiive:

Each of these 25 listings was created by a unique seller who may be a current or former employee, a venture capital fund, or an angel investor. Each seller sets their own asking price and quantity of shares available.

Buyers can accept a seller's asking price as listed or place bids and negotiate directly with sellers. Buyers can also add companies to their watchlist and receive notifications of any new listings or transactions.

You can see the current price of SpaceX shares by creating a free account with the button below:

Unfortunately, Hiive is only available for accredited investors — retail investors can't directly invest in SpaceX. However, there are other ways to gain exposure.

2. Invest in the ARK Venture Fund

Cathie Wood's ARK Venture Fund invests in the "most innovative companies" in the world.

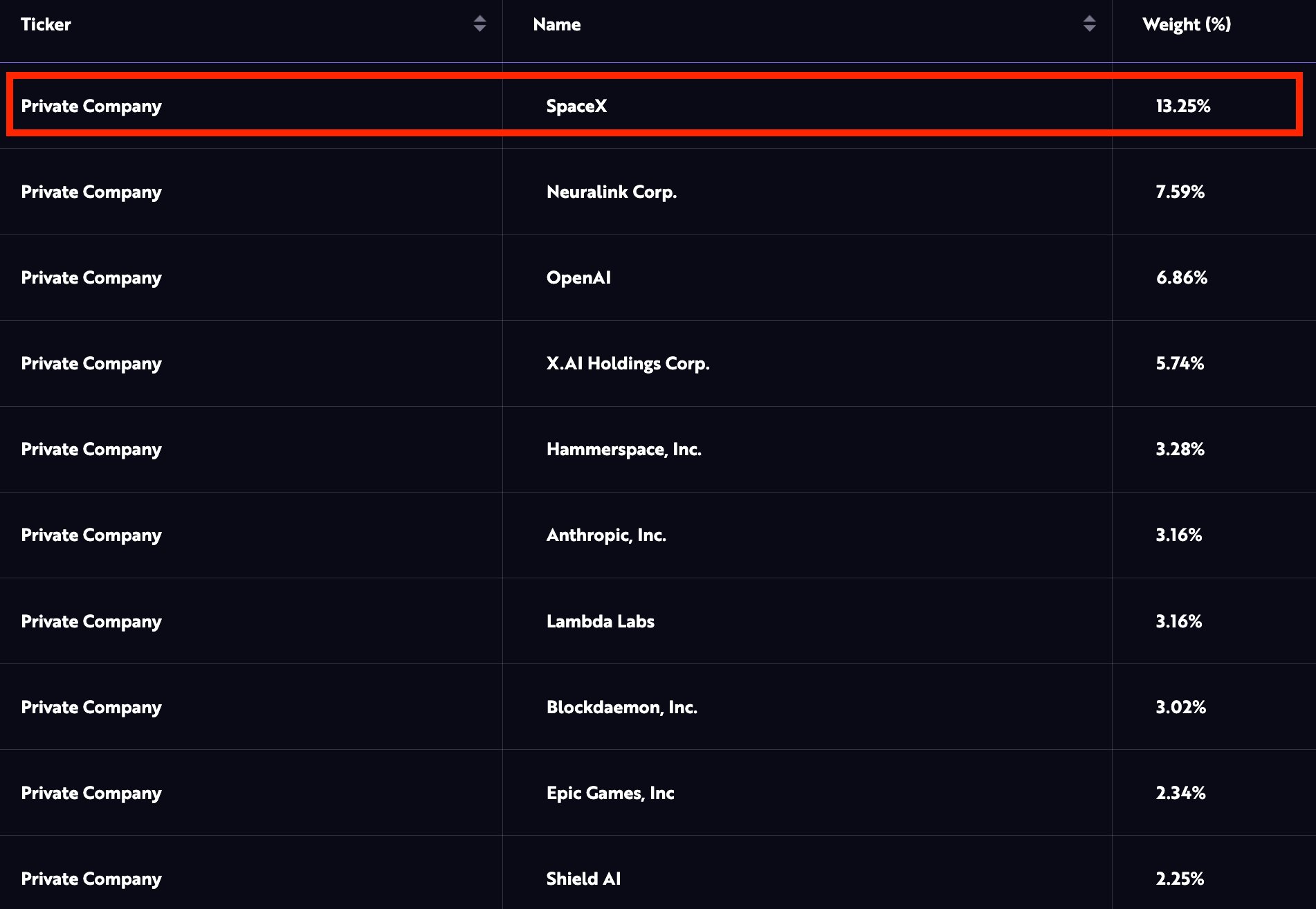

At the time of this writing, SpaceX is the fund's largest holding, making up 13.25% of the fund.

Although the fund invests in both publicly traded and privately held companies, its top 10 holdings are all private companies. Behind SpaceX, its next largest positions are in Neuralink, OpenAI, xAI, Hammerspace, and Anthropic.

And, since the fund is available to both accredited and retail investors, the ARK Venture Fund is one of the best ways for individual investors to gain exposure to many of today's hottest startups.

Accredited investors can invest via the Ark website, while retail investors need to open an account with SoFi to invest in the fund.

If you do decide to invest in this fund, be sure you like the rest of the companies that make up the fund, too. There is a 2.90% annual management fee for investing in the fund.

You may also be interested in Ark's Space Exploration ETF, ARKX.

3. Invest indirectly via public companies

Another option is to buy shares of a public company that has invested in SpaceX.

So far, only two public companies have invested in one of its funding rounds: Alphabet (the parent company of Google) and Bank of America.

Alphabet's (GOOG, GOOGL) first investment was in January 2015, when it invested $900 million at a valuation of $12 billion. It also participated in another funding round in December 2021, which increased its total stake to about 6.99%.

Given SpaceX's current valuation of $350 billion, Alphabet's investments are probably worth ~$24.5 billion.

Bank of America (BAC) invested $250 million in its November 2018 round at a valuation of ~$30 billion. This stake is likely worth about $2.9 billion.

You can buy shares of Alphabet or Bank of America in your brokerage account. If you don't have a brokerage account, I recommend checking out Public.

The downside to investing in Alphabet or Bank of America to gain exposure to SpaceX is that each of these companies' stakes represents a tiny fraction of their businesses.

Alphabet is a $2 trillion company, so its $24.5 billion stake in SpaceX is only about 1.2% of its total business. Bank of America's market capitalization is $342 billion, so its $2.9 billion stake in SpaceX is just 0.8% of its total business.

Still, if you like either of these companies and want to own them anyway, getting exposure to SpaceX is an added benefit.

4. Invest in competitors and partners

If none of the above methods interest you (or if you can't stomach SpaceX's 14x P/S ratio — more on that below), you may be interested in investing in its competitors.

Here are a few options:

While SpaceX develops the vast majority of its parts internally, there are also a handful of companies that SpaceX does business with who will directly benefit from any future success the company has:

You can buy any of these stocks in your regular brokerage account.

How much is SpaceX worth?

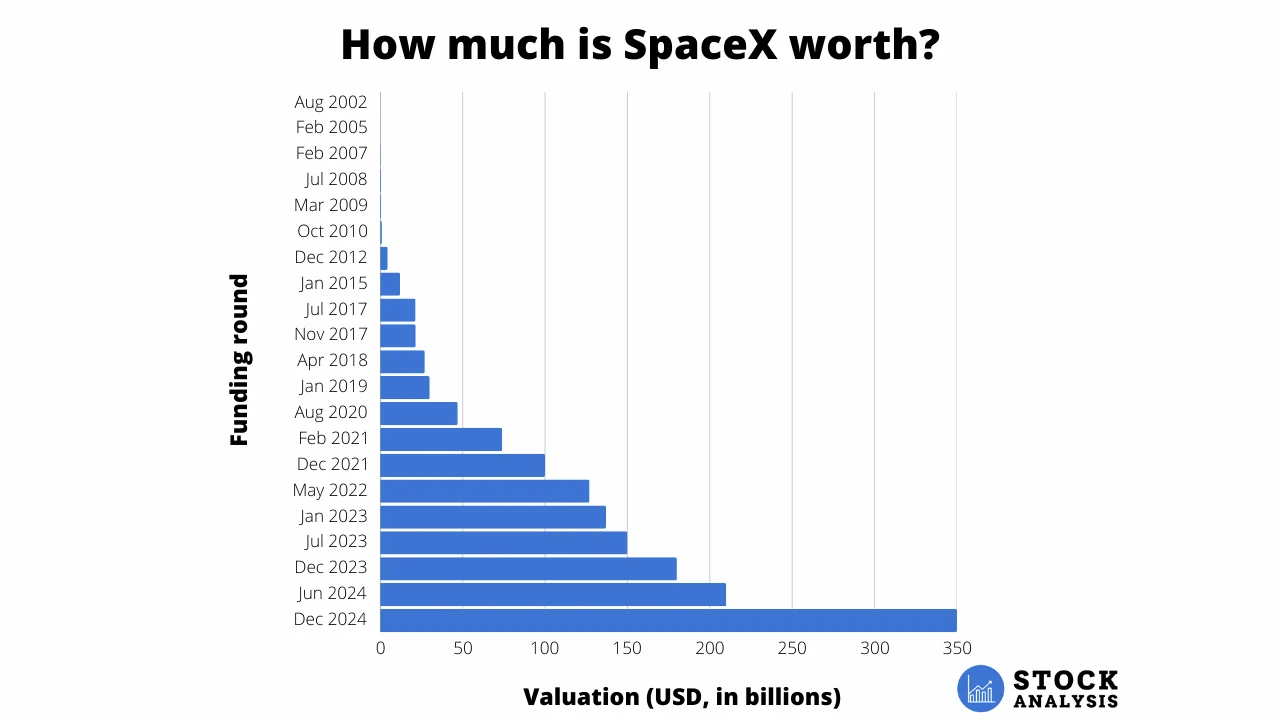

SpaceX has had 30 funding rounds and has raised $9.8 billion thus far, making it the most well-funded private company in the aerospace industry.

The company was most recently valued at $350 billion in a secondary share sale in December 2024, up 67% from the $210 billion it received in a similar transaction back in June 2024.

SpaceX also held secondary share sales in June and December 2023, at valuations of $150 billion and $180 billion, respectively.

Its most recent funding round (non-secondary transaction), which came back in January 2023, raised $750 million and valued the company at $137 billion.

Here's a look at how the company's valuation has grown over time:

Not only does its $350 billion valuation make SpaceX the world's most valuable private company, but it would be the 23rd largest company in the S&P 500 if it were publicly traded.

SpaceX is projected to generate $15.5 billion in revenue in 2025, up from the estimated $11.8 billion it generated in 2024. At a $350 billion valuation (which Starlink stock makes up about half of), the company is trading at 22.6x revenue.

For the sake of comparison, Raytheon (RTX) generated $82 billion in revenue last year and has a market capitalization of $195 billion (2.4x revenue).

Frequently asked questions

Below are a few more questions people often ask about investing in SpaceX stock.

How to buy SpaceX stock?

SpaceX has not been made available to the public via an IPO or SPAC, but it is available on Hiive, our recommended pre-IPO investing platform. You can also invest in it via the ARK Venture Fund or by buying shares of Alphabet or Bank of America.

How much is SpaceX stock?

SpaceX stock is not yet publicly traded and has no price per share. Its last external round of funding valued the company at $137 billion. More recently, however, insider sales have valued the company at $350 billion.

What is the SpaceX stock symbol?

SpaceX is still a privately held company. There is no stock symbol yet.

Who owns SpaceX?

SpaceX is partially owned by Elon Musk (its founder and CEO, who is estimated to own 42% of the company) and a host of other private equity firms, a few publicly traded companies, and other investment firms.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)