Fisher Investments Review

If you're considering Fisher Investments as your financial advisor, you're not alone.

Thanks in large part to its massive advertising efforts in the last 5 years, the firm now serves more than 185,000 individuals, businesses, and employees around the world, and manages over $332 billion in assets.

But is Fisher Investments the right firm for you? And is it worth the fees?

Here's everything you need to know about Fisher Investments, whether it's the right firm for you, and three alternatives to consider before making your decision.

What is Fisher Investments?

Ken Fisher founded Fisher Investments in 1979.

Prior to launching his firm, Ken was an innovator in investment theory and wrote the "Portfolio Strategist" column for Forbes for 30+ years.

More than 45 years after starting Fisher Investments, the company still has the same goal: to “help clients achieve their investment objectives with tailored solutions, a high degree of care, and a transparent fee structure.”

While the firm offers some 401(k) solutions and works with a few institutional investors, it primarily serves private clients (individual investors) through personal wealth management.

Fisher is known for its personalized asset allocations and active approach to money management. It creates tailored investment mixes for each client and frequently adjusts client portfolios based on the firm's constantly evolving market outlook.*

*As you'll read later on, however, its "personalized" financial advice may not be all that personalized.

Fisher is a fee-only firm, meaning it only makes money by charging a percentage fee on the assets it manages (more details on its fee structure below).

Fee-only firms are more likely to maintain their fiduciary responsibility to always work in your best interest.

How does Fisher Investments work?

Below is an overview of what to expect when working with Fisher, including the target clientele, the new client process, the company's investment philosophy, and the fee structure.

Target clientele

Fisher Investments has a stated minimum requirement of $1,000,000 of investable assets. Investable assets are defined as any funds in brokerage, retirement, or cash accounts.

The firm targets high-net-worth individuals and those at or approaching retirement age. It also wants clients who agree with its long-term, goal-oriented investment philosophy, which is discussed in more detail below.

That said, Fisher will take on clients with less than $1,000,000 on a case-by-case basis.

New clients

New clients are assigned an Investment Counselor who they can meet with in person or online. Fisher has offices in several U.S. states as well as a few global offices.

The Investment Counselor will start by getting a general understanding of your financial situation.

From there, they will help you set up an account with a custodian (such as Schwab or Fidelity), make an asset allocation recommendation, and implement that recommendation on your behalf.

Investment philosophy

Fisher offers three things to its clients:

- Personalized service

- A portfolio tailored to your goals

- An asset management approach based on its investment philosophy

As mentioned above, Fisher starts by assessing each client's current financial situation and goals.

After that, they will put you into an investment strategy based on your age, risk tolerance, current needs, and future objectives.

Generally, clients' accounts fall into the categories of equity (stocks and cash), fixed income (fixed income and cash), or blended (combination of stocks, fixed income, and cash).

Unlike some fee-only advisors, Fisher takes an active management approach. Its Investment Policy Committee (IPC) monitors economic conditions and market sentiment to regularly devise new investment strategies and update its allocations.

For example, if the IPC determines international equities are undervalued, it may decide to tilt several of its growth strategies more heavily toward stocks outside of the U.S. These changes affect every account invested in that particular strategy at once.

In my opinion, if you're deciding whether or not to use Fisher Investments, the entire decision comes down to whether you have confidence in Fisher's IPC and want to use its models. More on this below.

Note: The company does not publicly disclose its strategies' returns.

Fee structure

Fisher Investments' fees are higher than the industry average.

It charges an annual fee — ranging from 1.00% to 1.50% — based on the total amount of assets it manages on your behalf and what account type you have.

Accounts with > $1 million

Here's a look at Fisher's fees for typical clients with at least $1 million in assets:

| Assets | Annual management fee |

|---|---|

| First $1 million | 1.25% |

| Next $4 million | 1.125% |

| Additional amount over $5 million | 1.00% |

This is a progressive, bracketed fee structure (similar to the U.S. tax system). So, if you have a portfolio of $15 million, you will be charged:

- 1.25% on $1 million = $12,500

- 1.125% on $4 million = $45,000

- 1.00% on the remaining $10 million = $100,000

In this scenario, your total annual fee would be $157,500 (or 1.05%).

If you have a portfolio of $2 million, your annual fee would be $23,750 (or 1.1875%, $12,500 + $11,250).

Accounts with < $1 million

As mentioned above, Fisher Investments will take clients with less than $1 million of investable assets on a case-by-case basis.

The fees on these accounts are a flat 1.50% per year:

| Assets | Annual management fee |

|---|---|

| Up to $1 million | 1.50% |

Other fees

Clients may also pay trading commissions or fees to third-party brokerage firms utilized to custody and make trades for their accounts.

Additionally, clients may incur other custodian fees and other expenses related to investing in exchange traded funds or structured notes.

None of these fees are paid to Fisher Investments.

Fees summary

Its annual management fees (ranging from 1.00% to 1.50%) are higher than the industry average, especially for those with large portfolios.

Most local financial advisors will charge 1.00% on the high end and as little as 0.40% (or less) for clients with over $10 million in investable assets.

Some people will find the higher fees worthwhile to gain exposure to Fisher's active investment style, while others will find the above-average cost isn't justified.

A note on fee-only advisors:

Fisher Investments is a fee-only advisor, meaning it only makes money based on the value of your assets. This is what you want.

Other money managers (like Edward Jones) may earn both fees and commissions from investment products they place in your portfolio, which may create a misalignment of incentives.

For example, if an advisor would earn a $1,000 commission for Product A but believes Product B (no commission) is a better fit for your portfolio, they may be tempted to use Product A to the detriment of your goals.

If you do choose to work with a financial advisor, be sure they are fee-only.

Why I don't recommend Fisher Investments

As someone who has worked for a financial advisor, even though Fisher Investments does a lot of things right, I don't recommend them for most people.

To sum up the pros and cons:

- Pros: Fee-only advising, experienced Investment Policy Committee

- Cons: Misaligned business model, lack of personalized advice, so-so new client experience, high fees

In my opinion, the pros do not outweigh the cons. Here's why.

Misaligned business model

Unlike most traditional financial advisors, Fisher Investments employs more than 6,300 people and serves over 185,000 clients. This is a massive, high-volume, marketing- and sales-driven organization.

What does that scale mean for clients?

According to a former employee (unverified), the average Investment Counselor manages 190 households — a number that makes it difficult to deliver highly personalized advice.*

*Something you should expect from a financial advisor.

Another former employee (unverified) put it more bluntly, saying, "Nothing about that place is financial advising. They have wholesalers who bring clients on and then pass them off to Investment Counselors who basically regurgitate the same information that the Investment Policy Committee tells them to say every 3 months."

While this business model is undeniably successful from a financial standpoint, it may come at the expense of personalized service.

Lack of personalized advice

Fisher markets itself as offering tailored portfolios but, in my opinion, the advice may be less customized than what you'd get from a higher-touch, local financial advisor.

One former employee (unverified) said new clients were often given fairly standardized allocations — either 100% stock or 70/30 stock/bond portfolios — even when a higher allocation to bonds would be more suitable for the client.

Another former employee (unverified) said something similar, stating that the "majority of clients are thrown into the same exact portfolio, give or take some allocation towards fixed income ETFs as a means of 'mitigating volatility'."

These comments may be over-generalizations, but they're worth considering, especially given how central a role asset allocation plays in financial planning.

So-so new client experience

When you become a client, Fisher assigns you an Investment Counselor. To me, this feels backward.

You should be interviewing advisors, not having one assigned to you.

I'm sure you could request a new Counselor if you don't like the one you're assigned, but that misses the point. You should work with a financial advisor who really knows and cares about you and will take the time to make recommendations tailored to you.

Additionally, because of high turnover, clients are often passed from IC to IC. Another former employee (unverified) recalls, "I had one client who I took on upon starting that had 4 different ICs in the matter of a year. He shortly left us because he was tired of having a new IC every few months (can you blame him?)."

That said, if you're a believer in Ken Fisher and the rest of the Investment Policy Committee and believe their performance will beat the market net of fees, you may not care about who your individual advisor is.

Three alternatives to Fisher Investments

Here are three recommended alternatives to Fisher Investments:

1. Traditional financial advisors

In my opinion, most independent financial advisors are much better options than Fisher Investments.

As mentioned above, Fisher Investments places each one of its clients into an investment strategy based on their age, risk tolerance, and portfolio size.

Good financial advisors, on the other hand, build a unique plan for each of their clients. These plans are highly customized to their clients' income needs, balance sheets, and financial goals.

In addition to investment management services, they may provide tax guidance, insurance recommendations, and advice on any real estate or other investments you may have — you have an advisor for your entire financial picture.

Plus, despite providing a much higher-touch service, they typically charge lower fees than Fisher (typically between 0.40-1.20%). This is especially true for high-net-worth clients, who may pay around 0.40% at a typical advisor (vs 1.00% at Fisher).

While I'm a proponent of self-directed online investing (next section), there are good reasons to choose a financial advisor instead:

- Convenience: If you have no interest in managing your money or simply don't want to spend the time, a good financial advisor is a great investment.

- Financial advice: While you can learn much of what your financial advisor knows, many advisors are experts in their fields. It can be invaluable to receive regular advice on your full financial life — estate planning, tax planning, insurance, charitable giving, and more — from an unbiased but interested third party.

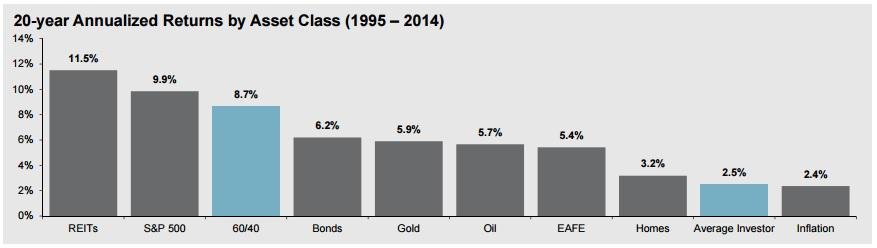

- Emotional barrier: As you can see in the image below, most investors underperform the market because they are constantly jumping from asset to asset, chasing returns and selling at market lows. A financial advisor acts as a buffer between you and your money.

Source: J.P. Morgan Asset Management. This chart shows that the average investor earns returns of 2.5% per year, compared to 8.7% for a 60/40 portfolio or 9.9% for the S&P 500.

If you are going to use a financial advisor, find one that is fee-only and knows about tax planning. You want someone who will oversee your entire financial picture, not just your investments.

After meeting that criteria, find someone you like and trust. Interview multiple advisors and choose your favorite.

Scratch Capital is a fee-only financial advisor located in Boise, Idaho. The firm serves individuals and families across the US. I interviewed Scratch's founder, Drew Lunt, for this section of the article.

You can get a free, custom financial plan built by Drew's team by filling out this form.

2. Self-directed investing

If you talk to a financial advisor who is truly honest, they will tell you there's nothing they do that you can't do on your own — so long as you're willing to invest the time to educate yourself and are disciplined enough to stay calm during market volatility.

There are plenty of books, articles, videos, and other resources you can use to plan and manage your own retirement, and all will cost you a lot less than the 1%+ a financial advisor will charge.

A few of my favorite books are Simple Wealth, Inevitable Wealth by Nick Murray and The Psychology of Money by Morgan Housel.

Paying a 1% fee may not sound like much, but that's $10,000/year on a $1,000,000 portfolio (not to mention the cost of lost compound interest).

If you are at all interested in managing your own money, it can be one of the highest ROI skills to learn.

As for where to manage it, you can use either a free or paid portfolio tracker to get a good overview of your assets, returns, and net worth.

For example, Empower's free Financial Dashboard can help you aggregate your net worth and easily manage all of your investments in one place:

Empower also offers a Retirement Calculator, Investment Checkup, and more, all completely free.

3. Robo-advisors

Robo-advisors are computer algorithms that create portfolios based on your age, investment horizon, and future objectives.

While they won't offer tax or estate planning, they do a surprisingly good job of asset allocation and are also quite good at tax loss harvesting.

In short, they do at least 70% as well as a financial advisor for much lower fees — typically between 0.25–0.50%.

So, if you're young and your financial life is pretty simple, a robo-advisor may be the right option for you (I like Betterment).

However, if you have a larger net worth or are nearing retirement and want to take a hands-off approach, you should probably consider using a financial advisor.

Final verdict

Having worked for a financial advisor myself, I would not use Fisher Investments.

Any financial advisor that advertises on TV has a mass-market business model that cannot effectively create the most customized solutions for its clients.

In my opinion, most people would be better off learning to become their own money managers (using free tools like those offered by Empower), hiring a local financial advisor, or using a robo-advisor.

Frequently asked questions

Below are a few more questions people often ask about Fisher.

How trustworthy is Fisher Investments?

Fisher Investments has been in business for more than 45 years, has a large client base, and continues to grow. Reviews about the company are mixed, with some good and some bad, which isn’t uncommon for financial advisors.

Is Fisher Investments worth the fee?

This is a matter of opinion. I personally do not think it’s worth it, but many of Fisher’s clients are more than happy to pay the fees, which are slightly higher than the industry average, to gain access to its Investment Policy Committee and other financial planning services.

What is the average return on Fisher Investments?

The firm does not share performance data publicly, though it does disclose it uses the MSCI World Index for many of its private clients’ stock portfolios.

What do people say about Fisher Investments?

Fisher Investments has 3/5 stars on Trustpilot, which isn’t uncommon for financial advisors. However, it does have 175,000+ clients, so a lot of people are content with the level of service it provides.

How does Fisher Investments make money?

Fisher Investments is a fee-only advisor, which means it makes money by charging a percentage fee based on its clients’ assets.