Fundrise Innovation Fund Review 2026

Venture capital investing is opening up.

Through Fundrise's Innovation Fund, retail investors can now gain exposure to some of the world's most valuable private technology companies via a single venture capital fund.

The fund holds a diversified mix of AI, machine learning, data infrastructure, and adjacent technologies, with current investments including Anthropic, Databricks, and OpenAI.

However, because the fund is still relatively new, you may have questions about its performance, investment strategy, and whether it's a sound investment.

In this review, I break down how the fund works, what it owns, how it's performed so far, and whether it makes sense as part of a long-term portfolio.

Innovation Fund review summary

- Overall rating:

- Service type: Venture portfolio

- Availability: Open to all U.S. residents

- Best for: Long-term, risk-tolerant investors

- Fees: 1.85% annual management fee

In my opinion, the Innovation Fund is the most accessible way for retail investors to gain exposure to leading private technology companies.

It's easy to get started, has delivered solid early results (with average annual returns of +15%), and requires a minimum investment of just $10.

That said, venture capital investing is inherently risky. Many VC-backed companies never generate positive returns for their investors, and the Innovation Fund isn't immune to this risk.

Additionally, the fund is only three years old, so both its performance and operating structure have yet to be tested over a full market cycle.

For investors who understand these risks and want to dedicate a small portion of their portfolio to private venture investments, the Innovation Fund could be a great option.

Disclosure: I'm an investor in the Innovation Fund.

What is Fundrise?

Fundrise is an investment platform that gives regular investors access to residential and commercial real estate, private credit, and venture capital investments.

The company was founded in 2010 by brothers Ben and Dan Miller, real estate developers who wanted to create a way for individual investors to invest in their projects.

Their first project raised $325,000 from 175 investors and was the first crowdfunded real estate project in the United States.

Fifteen years later, Fundrise now manages over $2.87 billion in equity on behalf of 385,000+ individual investors.

Fundrise investors can invest in all three of its private asset classes (real estate, private credit, and venture capital) from the same account.

You can look at your portfolio as a whole or drill down into each asset class and individual investments, making it easy to evaluate your investments and track your returns.

I've found both the website and the mobile app to be very user-friendly. I also use the platform's recurring investment feature to make regular contributions to my Fundrise portfolio.

If you're looking for one platform to allocate some of your portfolio into alternative assets, Fundrise should be near the top of your list.

What is the Innovation Fund?

Launched in July 2022, Fundrise's Innovation Fund is a venture capital fund that's open to all investors.

As of January 2026, the fund has more than 74,000 active investors and manages approximately $457 million in net asset value (NAV).

The Innovation Fund is structured as an evergreen, or permanent, fund. Rather than raising capital once and shutting down after a fixed timeline, the fund continuously raises capital, makes new investments, and returns capital to investors over time.

This differs from traditional venture capital funds, which typically raise capital over a limited window, invest it over several years, and return capital after 5–10 years before closing the fund and launching a new one.

The fund's objective is to deliver long-term growth by providing diversified exposure to private, high-growth technology companies through a single investment vehicle.

Investment strategy

The Innovation Fund primarily invests in late-stage companies, though it may also invest in companies at other stages in their life cycles.

According to Fundrise, the fund's investment decisions are guided by five core strategy drivers:

- Technology adoption waves: The team looks for industries where software adoption is still early — where productivity gains and cost savings remain untapped — and invests in the companies providing the new software.

- Companies staying private longer: Today's top technology companies can raise large amounts of capital privately, allowing them to delay going public until much later in their growth cycle. This fund is designed to give individual investors access to that otherwise hard-to-reach phase.

- Thematic focus: The portfolio concentrates on areas with strong long-term macro tailwinds, including artificial intelligence, machine learning, data infrastructure, software, and property technology. The portfolio's primary themes are flexible and adjusted as market conditions evolve.

- Private index approach: Rather than making a small number of concentrated bets, the fund seeks broad exposure across many private companies to diversify risk and increase the odds of capturing outsized winners. The approach is similar in spirit to indexing, but applied to later-stage private technology businesses.

- Opportunistic investing: The team maintains flexibility to take advantage of changing market conditions, dislocations, or attractive private-market valuations or deal structures as they arise.

I like that the fund's managers have clearly defined their "sandbox" from which they make investments.

This focused approach should lead to deeper expertise in the types of companies they target and allow the team to move quickly when attractive opportunities arise.

It also gives investors a clearer sense of what kinds of companies the fund is likely to own over time.

Which companies does the fund own?

Before getting into the list of companies it owns, here's a high-level overview of how the portfolio is divided:

| Asset type |

|

| Industry |

|

As of January 2026, the fund has 22 positions — 7 in modern data infrastructure and 8 in artificial intelligence & machine learning.

Here's a look at all of its holdings, broken down by industry:

| Industry | Companies |

| Modern data infrastructure |

|

| Artificial intelligence & machine learning |

|

| Financial technology |

|

| Real estate & property technology |

|

| Other |

|

Performance

Due to the nature of private, venture-backed, high-growth technology companies, you should expect returns to vary substantially over the near term. And, as a result, the Fund is intended only for long-term investors who understand the risks associated with illiquid investments.

Unlike public stocks, private companies aren't marked to market daily and are usually revalued only during new funding rounds. As a result, reported valuations often stay flat for long periods and tend to rise when updated, unless a down round occurs.

That dynamic worked in the fund's favor in 2025, as private market valuations were exceptionally strong, particularly across AI and data infrastructure companies. The Innovation Fund benefited from this strength, delivering a +43.5% return for the year.

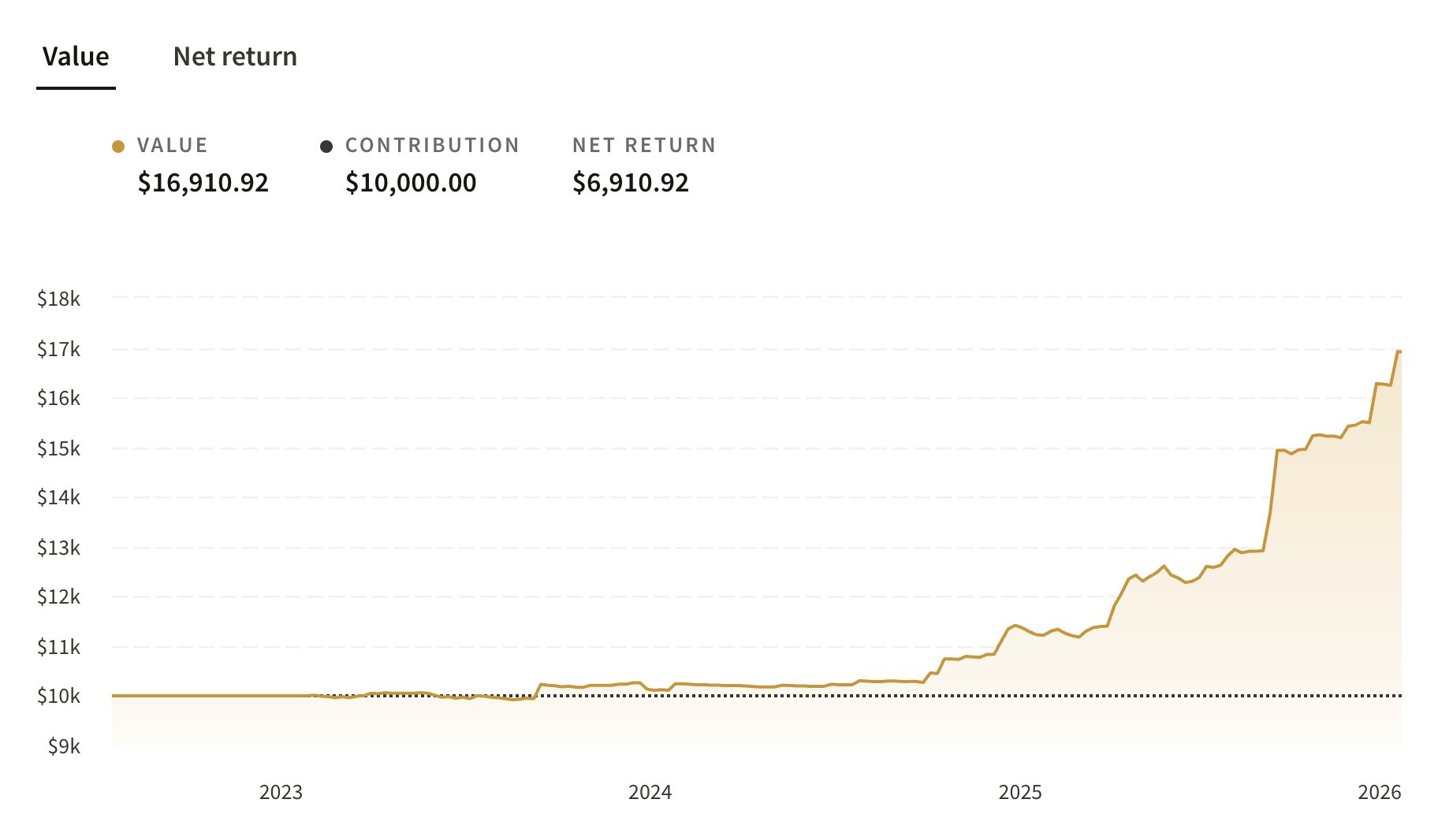

As a result, the total net return of the fund jumped to +69.11%:

Source: Fundrise

The Innovation Fund has an annualized return of ~15%, net of fees, since its inception in July 2022.

Innovation Fund fees

The Innovation Fund charges a 1.85% annual management fee on invested assets.

For example, a $10,000 investment would incur about $185 in annual fees.

Compared to traditional venture capital funds, this is relatively low. Most VC firms use a “2-and-20” fee structure, which includes a 2% annual management fee plus a 20% share of profits, often referred to as carried interest.

Withdrawing funds

Personally, I don't consider Fundrise's Innovation Fund to be a liquid investment. While redemptions are typically processed quarterly, they are not guaranteed.

Because the fund invests in private companies, much of its capital is tied up in long-term holdings. While the fund typically maintains a cash buffer, often around 10–15% of NAV, it is not designed to meet large-scale or simultaneous redemption requests.

Therefore, redemptions are handled through Fundrise's internal redemption program rather than an open market. Investors can submit a request to redeem shares, but Fundrise retains discretion over whether and when those requests are fulfilled.

In normal conditions, redemption requests are processed on a quarterly basis. In stressed market conditions, however, redemptions may be limited, paused, or restricted if demand exceeds available liquidity.

This potential illiquidity is one of the fund's primary risks.

If private market valuations decline and many investors request redemptions at the same time, the fund may be unable to meet all requests, meaning you could face delays or be unable to withdraw some or all of your invested capital when you want to.

Because of this, the Innovation Fund is best suited for capital you can commit for the long term.

Pros and cons

| Pros | Cons |

| Access to private, VC-backed technology companies | Venture investing is risky |

| Available to all U.S. investors | Limited track record |

| Minimum investment of $10 | Redemption risk |

| Easy sign-up process |

Is the Fundrise Innovation Fund legit?

Yes, the Innovation Fund is legit.

The fund is publicly registered with the SEC under the Investment Company Act of 1940 as a non-diversified, closed-end management investment company that is operated as a tender offer fund.

As mentioned above, Fundrise has been around since 2010 and has invested nearly $3 billion on behalf of 385,000+ investors. The Innovation Fund itself has a net asset value of $457 million and 74,000+ investors.

Regarding security, Fundrise uses bank-level security to protect your personal information. Your information is encrypted with an AES bit symmetric key, the same level of encryption used by the largest commercial banks.

Fundrise applications and data are physically located in multiple secure data centers, and the company utilizes Amazon Web Services (AWS) for its hosting, which is compliant with numerous security certifications.

All of that said, its investments (like all investments) involve risk and may result in partial or total loss of funds.

Final verdict

So, should you invest in the Innovation Fund?

Personally, I've allocated roughly 3–5% of my portfolio to the fund and may increase that exposure over time.

I want access to the companies it owns, I'm comfortable with the 1.85% annual management fee, and I understand the risks, including the possibility of losing capital or being unable to withdraw funds when I want to.

This reflects my personal view and how I've chosen to allocate my own capital. This isn't investment advice.

As always, you should do your own due diligence and decide whether the Innovation Fund is a good fit for your portfolio.

.png)