Top 10 Investments with 10% Returns

First off, it's worth noting that there's no such thing as a guaranteed return on investment.

The stated returns of every asset class are based on its historical performance, and past performance does not guarantee future results.

So what you really should be looking for are the investments that have most consistently averaged 10% returns in the past — because these are the investments that are most likely to earn 10% returns in the future.

And as you'll see below, some assets are much more likely to generate double-digit returns than others.

Here's my list of the 10 best investments to get a 10% return on your investment.

Summary of the best investments with 10% ROI

| Investment | Yield* | Risk level* | Timeframe |

| 1. Private credit | 13.76% | 2/5 | Short |

| 2. Stocks | 9.6% | 3/5 | Long |

| 3. Real estate | 8.94% | 2.5/5 | Long |

| 4. Fine art | 12.6% | 4/5 | Long |

| 5. Paying off debt | varies | 0/5 | Immediate |

| 6. Buying a business | varies | 4/5 | Long |

| 7. Private startups | varies | 4.5/5 | Long |

| 8. Cryptocurrency | varies | 5/5 | Medium-to-long |

| 9. Collectibles | varies | 3/5 | Medium-to-long |

| 10. Junk bonds | 7.34% | 3/5 | Medium-to-long |

*Disclaimer: I've given each investment below an overall rating, as well as a risk score of 0 (low) to 5 (high). These are personal opinions. Return information based on sources linked below. Actual results may vary. Be sure to conduct your own due diligence.

1. Private credit

- Overall rating: ⭐⭐⭐⭐⭐

- Risk level: 2/5

- Best for: Accredited investors who want short-term income and diversification outside of public markets

- Where to invest: Percent

Unlike public companies (which can issue bonds on the public market) and small businesses (which can receive loans from banks), it's much more difficult for private companies to get financing.

These companies must turn to private markets for loans to fund growth, operations, and more.

Because the money is harder to come by, private companies must offer investors more favorable terms. Private credit deals typically:

- Offer higher yields, usually between 9–20%.

- Have shorter durations, with typical maturities ranging from 9–24 months.

- Are secured by machinery, land, loan portfolios, or other assets.

- Are largely uncorrelated with public equity and debt markets.

Historically, private credit has only been available for institutional-level investors like investment banks, hedge funds, and insurance companies. But now, Percent has opened the door for accredited investors to access the $3.14 trillion market.

You can qualify as an accredited investor if you have $200,000 (individually) or $300,000 (jointly) in annual income, or a net worth of $1,000,000, excluding your primary residence.

Here are the fast facts about investing on Percent (as of June 2025):

- Yields: 13.76% average APY on matured deals

- Durations: 10.51 months

- Default rates: 2.58%

On Percent, you can construct your own portfolio made out of individual deals or invest in a pre-built portfolio of offerings.

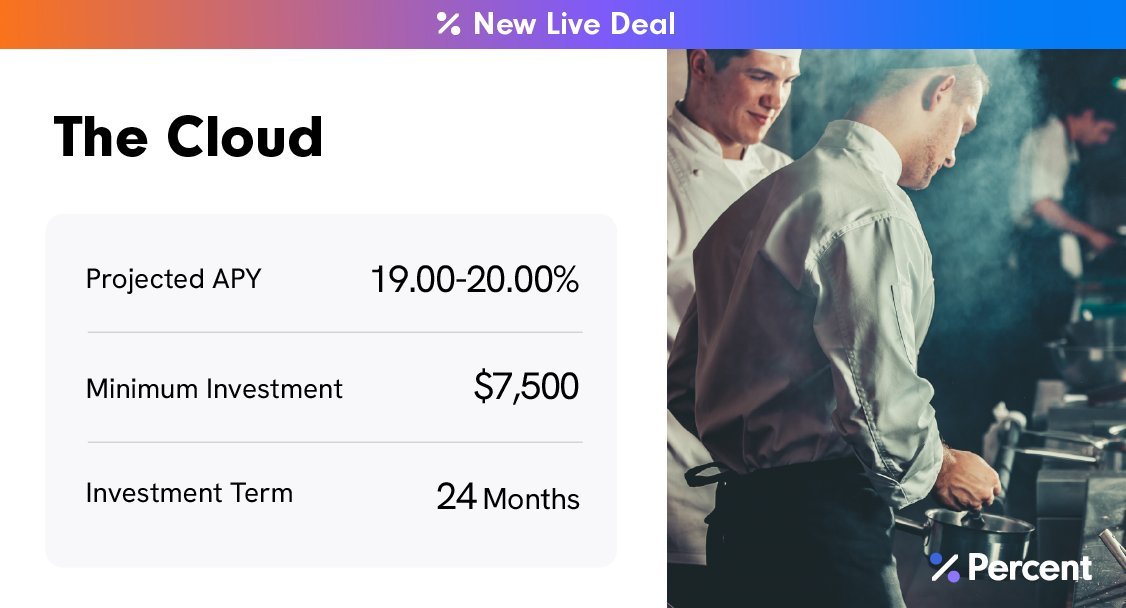

Here's an example of an individual deal:

Source: Percent

If you're an income-seeking accredited investor, try Percent and discover why 89% of new investors reinvest after their first deal. You can also get a welcome bonus of up to $500 through our links.

Why I'd choose it: Short-duration income and diversification outside of public markets.

2. Stocks

- Overall rating: ⭐⭐⭐⭐⭐

- Risk level: 3/5

- Best for: Most investors

- Where to invest: Public

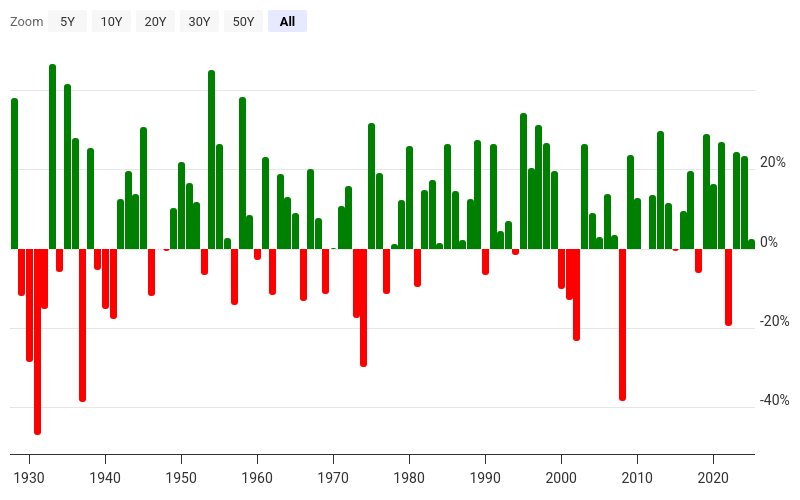

From 1926–2025, the S&P 500 averaged a return of 10.22% per year.

But that's just the average. As you can see in the image below, there is a lot of variance in returns from year to year:

Source: Macrotrends

For this reason, you should not expect to earn a 10% return each year. To capture the long-term average, you need to be invested for the long term — at least 5–10 years.

The longer you're invested in stocks, the lower your risk.

You can invest in the S&P 500 by buying an index fund like VOO or SPY.

If you'd like to chase higher returns, you can also invest in individual stocks.

An index fund (like VOO) owns a large basket of stocks, which is helpful for diversification, but it limits your upside.

Every year, a handful of high-performing stocks are responsible for the bulk of an index fund's returns. For instance, while the S&P 500 averaged about 10% since 1926, the top 25% of stocks averaged 50% per year over that same period.

If you can identify these winners in advance, and avoid the losers, you can achieve significantly higher returns.

However, this is easier said than done. Over a 10-year period, 91.4% of professional fund managers underperformed the market. If you try to beat the market (by buying individual stocks instead of index funds), the odds are stacked against you.

You will need a brokerage account to invest in stocks. I like Public, which gives you access to stocks, ETFs, Treasuries, cryptocurrency, and other alternatives on its well-designed website and mobile app.

If you want stock picks with big upside potential delivered straight to your inbox, you may want to subscribe to a paid investing newsletter. I recommend Motley Fool Stock Advisor (my favorite) or Alpha Picks (which I also subscribe to).

Why I'd choose it: Stocks are one of the most accessible asset classes and are one of the most reliable ways to generate a 10% ROI (or higher).

3. Real estate

- Overall rating: ⭐⭐⭐⭐⭐

- Risk level: 2.5/5

- Best for: Long-term investors who want to diversify their portfolios outside of public markets

- Where to invest: Arrived or Yieldstreet

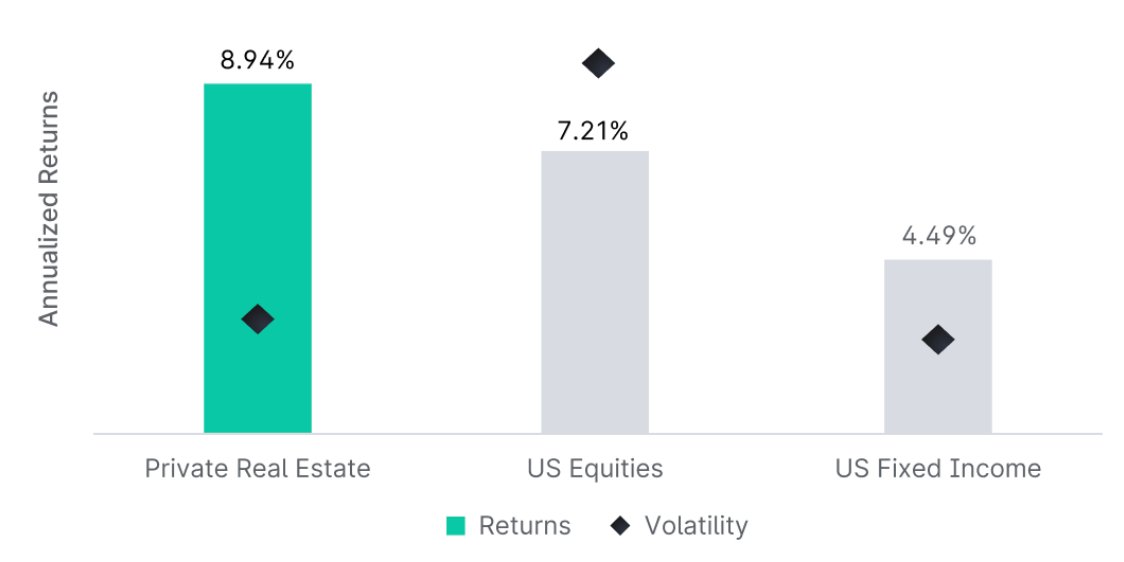

Between 2000–2022, private real estate outperformed the S&P 500 by about 1.7% per year:

Source: Yieldstreet

Real estate is also significantly more stable than stocks (notice the black diamonds in the image above). The market moves slower and doesn't swing up and down based on emotions or daily news.

Real estate investors also make money in multiple ways:

- Rental income

- Price appreciation

- Tax advantages

The primary drawback to real estate investing is the upfront capital necessary to purchase properties. Most banks require around 25% down payments on investment properties — that's $125,000 on a $500,000 house.

However, with real estate crowdfunding platforms, you can start investing in real estate with as little as $100. These platforms pool together capital from many investors, then source, analyze, purchase, rent, and manage investment properties.

Here are two options:

Arrived

For retail investors, my favorite platform is Arrived.

Arrived invests in single-family homes for both long-term and short-term rentals. As of June 2025, Arrived properties were paying annualized yields of up to 8.4%.

Yieldstreet

For accredited investors with a bit more money to invest, Yieldstreet is my most recommended platform.

It has invested more than $6 billion since its inception and has unparalleled access to real estate developers. Yieldstreet's real estate deals have also earned a 9.6% net realized annual return since its inception.

In addition to real estate, Yieldstreet offers access to 10 other private asset classes — ideal for investors who want access to even more alternative investments.

The minimum investment on Arrived is $100 and $10,000 on Yieldstreet.

Why I'd choose it: Real estate has a proven track record of creating wealth while providing consistent income. It's also more stable than the stock market, making it a good asset for diversifying a portfolio.

4. Fine art

- Overall rating: ⭐⭐⭐⭐⭐

- Risk level: 4/5

- Best for: Investors looking for diversification outside of public markets and are interested in a collectible with a track record of solid performance

- Where to invest: Masterworks

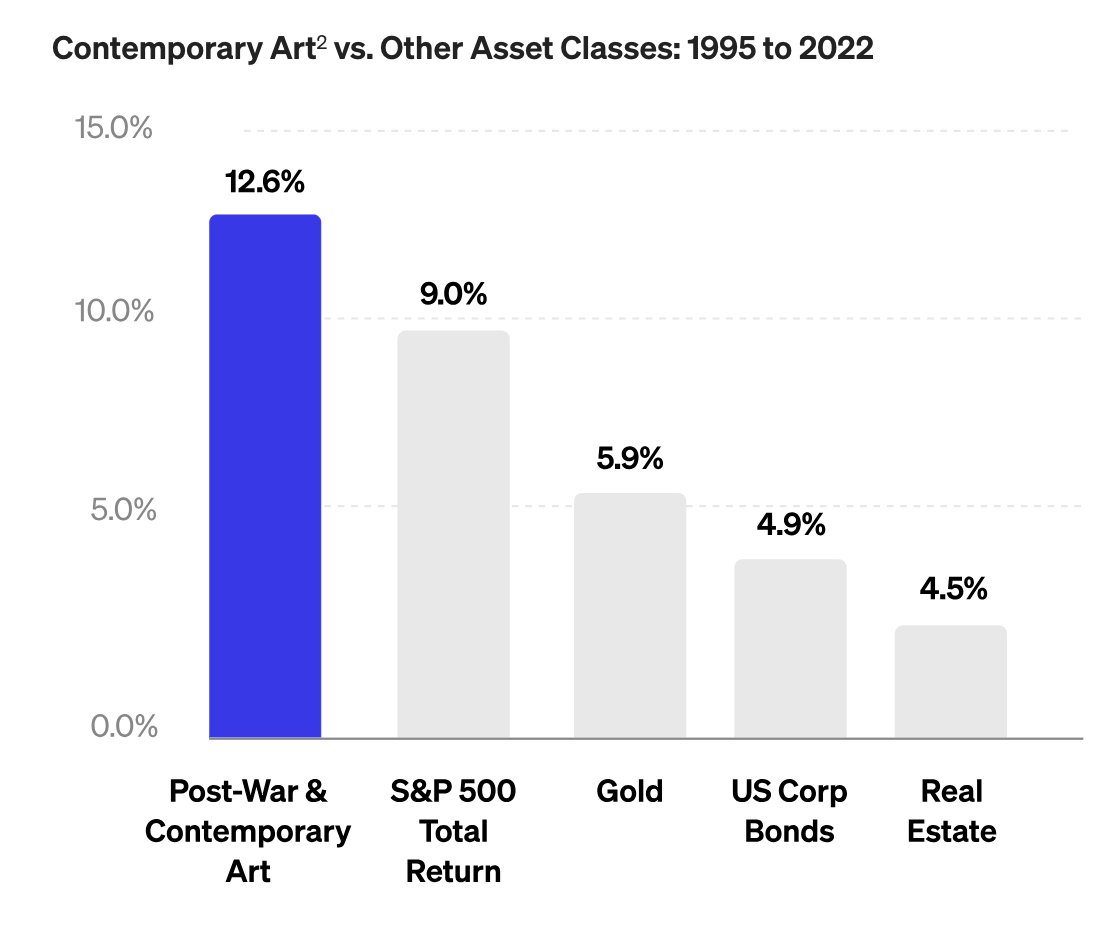

Over the last 27 years, contemporary art has outperformed the S&P 500 by 3.6% per year:

Source: Masterworks

Furthermore, art has also proven to be an excellent inflation hedge. During periods of heightened inflation, contemporary art sold at auction registered an average gain of 13.5%, versus 5.5% for stocks over the same time period.

Similar to real estate, art has historically only been available to the ultra-wealthy. But Masterworks changed that.

Masterworks is a crowdfunding art investing platform.

Its team analyzes art and predicts which artists and paintings are gaining momentum, sources and purchases artwork, and then “securitizes” the artwork, which allows users to buy individual shares in each painting.

When the company decides to sell a painting, any appreciation is distributed to its shareholders. Investors have realized net returns of 14%, 27%, and 35% from recently sold offerings.

Why I'd choose it: Art is another asset class with a strong track record of returns and has historically had a low correlation with stocks, bonds, and gold.

5. Paying off high-interest debt

- Overall rating: ⭐⭐⭐⭐⭐

- Risk level: 0/5

- Best for: Those with credit card or other high-interest consumer debt

- Where to invest: Your own credit card(s)

Ok, this one isn't really an “investment,” per se, but it deserves to be on this list.

If you're carrying a balance on your credit card with a 21% APR, paying off that card is equivalent to earning a 21% rate of return. And that return is guaranteed.

It always surprises me how many people start investing while still having credit card debt. Other than a 401(k) match, there is no higher guaranteed return on investment than paying off your high-interest loans.

If you have any debt with an interest rate above 7–8%, I would pay that off before making any investments.

Why I'd choose it: If you have high-interest loans, paying those off is the highest guaranteed return on investment you could make.

6. Buying a business

- Overall rating: ⭐⭐⭐⭐

- Risk level: 4/5

- Best for: Anybody willing to take on the risk and extra work of owning a business

- Where to invest: LoopNet, Craigslist, and Flippa

When looking for investments, people rarely consider buying an existing business.

However, many local businesses sell for between 2–5x profits. That equates to a 20–50% annual return if the company's profits remain stable.

Yes, it's much less passive than buying a stock, but it also gives you more control over the fate of your investment. You could increase the revenue and/or profitability and greatly enhance the value of your investment.

But it's not easy, and being an entrepreneur isn't for everyone. There's more stress, work, and time required in buying and owning a business than any of the other investments on this list.

Plus, like real estate, getting started can be capital-intensive and lead to idiosyncratic risk (a lot of money tied up in a single investment with an unknown outcome).

You can find businesses to buy on sites like LoopNet, Craigslist, or Flippa. You can also walk into a local business, ask for the owner, and see if they're interested in selling or will be in the future.

Why I'd choose it: If you're not afraid to get “hands-on,” buying businesses gives you control over how valuable your investment becomes, and can lead to huge ROIs.

7. Private startups

- Overall rating: ⭐⭐⭐

- Risk level: 4.5/5

- Best for: Accredited investors who want to invest in private, VC-backed companies at past valuations

- Where to invest: Hiive and Linqto

Nowadays, as private equity investors and venture capitalists know, more and more of the real money is made before a company's IPO, not after.

While they can be very speculative, investments in early-stage tech startups can result in massive ROIs.

Hiive is a pre-IPO marketplace where accredited investors can invest alongside PE firms, VCs, and hedge funds. There are over 2,000 private startups on Hiive including SpaceX, Waymo, and Anduril.

Sellers on Hiive may include venture capital firms or angel investors, but they're usually employees.

Many employees receive stock grants as part of their compensation. By selling some or all of their shares on Hiive, they can turn those grants into cash.

In exchange, buyers get to invest in private companies they'd have no access to otherwise.

Why I'd choose it: To make speculative, high-risk/high-reward investments in your favorite private companies.

8. Cryptocurrency

- Overall rating: ⭐⭐⭐

- Risk level: 5/5

- Best for: Believers in cryptocurrency and blockchain technology who don't mind the extremely speculative nature of the asset class

- Where to invest: Public and Coinbase

Cryptocurrency exploded onto the scene a few years ago, after Bitcoin climbed from around $3,500 in 2019 to over $60,000 in 2021.

Bitcoin is now worth more than $100,000.

Since then, crypto has been one of the most popular investments for those seeking high returns.

Digital currency is inherently a speculative investment. Unlike a stock, which is part ownership of a company that is producing revenue and (hopefully) profit, there is no underlying asset backing the value of a cryptocurrency.

The only way for investors to earn a profit from a crypto investment is by selling it to another investor at a higher price (who in turn is expecting to sell it to another investor at a higher price in the future).

This type of speculation is known as The Greater Fool Theory and often leads to massive swings in price.

Personally, I don't invest in crypto, but for those who know more than I do about specific coins, projects, or events that may have a large impact on prices, it may make sense to allocate a small percentage of your portfolio to this asset class.

Why I'd choose it: If you are interested in cryptocurrency and expect it to become a bigger part of our financial system in the future, you may consider allocating a few percent of your portfolio to crypto.

However, be aware that the crypto space is full of scams and has a history of major crypto platforms going bankrupt.

For this reason, it is recommended to invest in crypto through a trusted platform that is regulated as a broker, like Public or Coinbase.

9. Collectibles

- Overall rating: ⭐⭐⭐

- Risk level: 3/5

- Best for: Hobbyists or those with a particular affinity for a category of collectibles

- Where to invest: Locally, specialty websites, or eBay

I've developed a growing appreciation for savvy collectors who deeply understand a specific category — like trains, coins, comic books, or shoes — and can spot value when they see it.

For example, one of my friends is obsessed with watches.

He started building a watch collection about 10 years ago as a hobby but has recently turned it into the best-performing portion of his portfolio. He's regularly doubling his money on his watches and has never lost money on a watch he's purchased.

The best part is: he enjoys it.

Investing in collectibles requires you to have a keen eye for value and to be genuinely interested (borderline obsessed) with a particular category. It's not for the faint of heart.

But for those who already have an obsession, it's worth considering dedicating a portion of your investment portfolio to your hobby.

Why I'd choose it: If I knew a specific category of collectibles very well (if I had an “edge”), I would not hesitate to make it a chunk of my portfolio. If done right, you can earn reliable, outsized returns and have fun doing it.

10. Junk bonds

- Overall rating: ⭐⭐⭐

- Risk level: 3/5

- Best for: Income-seeking investors comfortable with the risk/reward profiles of junk bonds

- Where to invest: Public

Corporate debt falls into two broad categories: investment-grade and non-investment-grade, also known as junk bonds. Junk bonds are those with credit ratings below BBB/BAA, indicating the bond's issuer has an elevated degree of default risk.

Junk bonds are an excellent example of how risk and returns interact — the lowest-rated bonds pay the highest interest and are most likely to default.

Issuers of junk bonds pay higher interest rates to compensate investors for taking on the additional risk. Currently, junk bonds are paying around 7.34% interest compared to about 5.54% interest on investment-grade bonds.

Since 2001, the junk-bond default rate has averaged 3.5%. During the 2008 financial crisis, defaults climbed to 5.3% for the highest-rated junk bonds (and over 13% for highly speculative debt).

While this might not seem high, that's more than one default out of every 20 junk bonds issued.

Instead of buying individual junk bonds, you could invest in a junk bond ETF (like the SPDR Bloomberg High Yield ETF JNK). You can buy this ETF in your Public account.

Why I'd choose it: If you're willing to do your due diligence and are comfortable balancing the risk/reward of these investments, you may find junk bonds to be a nice addition to your portfolio.

How we chose the best investments with 10% ROIs

When evaluating investments, we consider the following:

- Returns: How has the investment performed historically? How is it expected to perform in the future? How stable/reliable are those returns expected to be?

- Risk: How much volatility should be expected? How much confidence can we place in the expected returns? How much downside is possible? How stable is the investment?

- Duration: How long should the investment timeline be? Should the investment be held for weeks, months, or years?

- Popularity: How popular is the asset among investors? Has the asset class been around for a long time or is it relatively new?

- Accessibility: How easy is the investment to buy and sell? How simple is it to create an account and start investing? Are the recommended platforms easy to navigate?

Final verdict

That's my list of the 10 best investments that have the potential to earn you a 10% ROI or more.

Remember, every investment entails some sort of mix of risk and reward. If you're aiming for 10% returns, you're likely signing up for heightened volatility and risk, and you may end up losing money.

Because of this, be sure to diversify and perform as much due diligence as you can before investing.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)

.png)