Hiive Review: The Best Platform to Buy and Sell Private Stock?

Hiive is an investment marketplace for buying and selling private stock.

On Hiive, accredited investors can buy shares of private, high-growth startups right alongside private equity and venture capital firms, and existing shareholders (typically employees) can sell their shares.

More than 3,000 companies have shares available for purchase on Hiive, including SpaceX, Anthropic, and Waymo.

Despite a few downsides (more on those below), I haven't found a better overall platform for both buyers and sellers of private shares. Here's everything you need to know about Hiive.

Hiive review summary

- Overall rating:

- Description: A platform for buying and selling shares of private companies

- Strengths: Liquidity, transparency, low fees, ease

- Buyer fees*: None on direct transactions; up to 5% of transaction value on fund (SPV) transactions

- Seller fees:* Average ~5% of transaction value

- Minimum investment: $25,000

*Hiive only charges fees on successful transactions. There are no fees for creating an account, listing shares, or placing bids.

What is Hiive?

Hiive (formerly Hiive Markets) is an investment platform for buying and selling shares of stock in private companies.

It was founded in 2021 by senior employees of Setter Capital, a leading brokerage in the private equity and venture capital secondary market.

They set out with the goal of leveraging their existing experience while eliminating the lack of transparency traditionally associated with private market investing.

So they created Hiive, a pre-IPO marketplace that functions more like a regular stock market exchange. The site displays real-time valuations based on bid, ask, or trade prices from confirmed buyers or sellers.

Who can transact on Hiive?

To transact on Hiive, buyers must be accredited investors, and sellers must verify they have shares available to sell. You qualify as an accredited investor if you meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive's core pillars

The company is built around three core pillars:

- Transparency: No hidden prices. You can see real-time bids and asks for every company on the platform, like a regular stock exchange.

- Direct access: There is no broker standing between you and the marketplace.

- Ease of use: You can place bids, list shares, or add companies to your watchlist. After a buyer and seller agree on a price, Hiive handles the paperwork so the buyer gets their shares and the seller gets their cash.

The result? Hiive is one of the largest and fastest-growing pre-IPO marketplaces.

By the numbers:

- Investors: 12,000+

- Listed companies: 3,000+

- Monthly transaction volume: $200+ million

- Total value of live securities orders: $1+ billion

Hiive's business model

As mentioned above, Hiive places an emphasis on transparency.

Its platform resembles a traditional stock exchange: sellers create listings and set their asking prices, and buyers place bids on their shares.

All of the prices are visible, buyers and sellers send offers directly to one another (anonymously), and Hiive facilitates the transaction once they've agreed on a price.

There are several different business models used by secondary marketplace platforms like Hiive. Each takes a different approach to pricing, liquidity, and who it ultimately benefits — buyers, sellers, or the platform itself.

Linqto, for instance, operates more like a reseller than an exchange. It purchases shares from insiders or employees (usually at a discount), marks them up, and then resells them to accredited investors.

While this model can speed up transactions by eliminating back-and-forth negotiations, it also introduces a spread and means that neither buyers nor sellers get the best price for their shares.

Hiive, on the other hand, provides a platform for the two parties to meet, and then works as the transaction facilitator once an agreement is reached.

In this model, information flows freely, and the order book is completely transparent. All buyers and sellers have access to the same information, and no intermediary stands between the two.

Why is this important?

At first glance, the distinction between these models might seem minor, but it can lead to significant price differences for investors.

Platforms like Linqto are incentivized to sell shares at a markup based on what they originally paid, regardless of current market prices. In contrast, Hiive's exchange-style model allows prices to move more freely, based on real-time supply and demand.

This difference was highlighted in a Reddit thread where users questioned why Ripple shares were listed at $46 on Linqto but just $20 on Hiive.

The most likely explanation: Linqto acquired the shares at a certain price (say $40) and is aiming to resell at a profit, while Hiive's live order book reflects actual bids and asks between buyers and sellers.

Hiive's model tends to offer more accurate pricing, but it comes with tradeoffs, with one of the biggest being the minimum investment amount.

Because each deal is custom-negotiated between counterparties, Hiive typically requires a $25,000 minimum per transaction, compared to just $5,000 on platforms like Linqto. More on that below.

Buying on Hiive

Hiive is the most transparent secondary marketplace. Its live order book gives buyers detailed access to trade data, so everyone is operating with the same information.

A few key features of Hiive are:

- Anonymity: You will remain anonymous until you're ready to complete a transaction.

- Price discovery: After registering, you can browse live listings (prevailing bids and asks) for every company on the platform.

- Direct access to sellers: You can place bids or negotiate directly with individual sellers. No broker will get in between you and the sellers.

- Seamless order execution: It's easy to place bids and message sellers. After striking a deal, Hiive's experts will manage the rest of the transaction process.

You can also create a watchlist of companies you're interested in and get notified anytime a new listing is made or a transaction is booked.

Buying fees

Buyers are not charged fees on direct transactions — only sellers pay fees (outlined below). There are no registration fees, transaction fees, holding fees, or management fees charged to buyers.

However, Hiive recently started offering investments via funds and SPVs. On these, buyers are charged up to 5% of the transaction value of completed purchases.

Drawbacks to buying on Hiive

The primary drawback to investing on Hiive is its $25,000 minimum transaction size.

Other platforms have lower minimum investments because they pool money together from multiple investors to acquire stakes, and then divide up the shares.

While this allows for lower minimums, pooling funds increases legal risks and makes for more complicated transactions.

Hiive's exchange-like model takes a cleaner approach. Each transaction is a full stake, and clients' funds are never intermingled.

But while it makes things simpler and more transparent, the model's high minimum is a legitimate downside and can be quite prohibitive.

Selling on Hiive

The combination of a slower IPO market and private companies choosing to stay private for longer has created an uptick in the number of secondary sellers.

While angel investors and VC firms also list shares, most of the sellers on Hiive are current or former employees who are selling their private stock to turn more of their compensation into actual cash.

When deciding which marketplace to use, sellers should consider a platform's liquidity, fee structure, pricing mechanism, and ease of transactions.

Here are a few things sellers should know about Hiive:

- Liquidity: There are thousands of investors looking for shares to buy on Hiive. After creating your listing, your shares will be discoverable by them.

- Fee structure: Sellers are only charged fees on successful transactions, typically around 5% of the total value. You will see the total amount of fees you will pay before setting your price.

- Price transparency: Many secondary marketplaces use a “fishing” system where they try to find bids and then offer those prices to sellers. This restricts the flow of information and may result in lower prices being accepted. Hiive has a live pricing chart, so you can see what prices other sellers are asking and what buyers are willing to pay.

- Ease of transaction: Once you strike a deal, Hiive's team will handle the rest of the process until you get paid.

You will also stay anonymous until you're ready to connect with a buyer.

Selling fees

Sellers are typically charged a minimum fixed dollar amount and a percentage-based fee for successful transactions. No fees are charged unless there is a successful (closed) transaction.

On average, seller fees are typically around 5% of the total transaction value. On a $50,000 sale, this would equate to fees of $2,500, leaving you with $47,500.

Importantly, you don't need to pay anything up front. You only pay when you get the money from the sale.

Drawbacks to selling on Hiive

The primary drawback to selling your shares on Hiive is the fees, though this isn't unique to Hiive. You will pay fees when selling shares regardless of which platform you choose.

The main Hiive-specific downside is that there's no definitive timeline for when your shares will be bought. You're listing your shares on a marketplace where buyers may or may not bid on them, and there are no guarantees.

This marketplace model gives you the best chance of getting a fair price for your shares, but other platforms (like Linqto) may put cash in your hand faster.

If you appreciate Hiive's transparent order book and fee structure, I'd encourage you to register and see what your shares may be worth.

Pros and cons of Hiive

| Pros | Cons |

|---|---|

| Access to thousands of private, VC-backed companies | $25,000 minimum transaction size |

| Complete order book transparency for both buyers and sellers | Seller fees average 5% of transaction value |

| Seller fees are only due after successful (completed) transactions | |

| Anonymity for both buyers and sellers |

In our opinion, the pros far outweigh the cons, which is why Hiive is our top recommendation for investing in private companies.

What percentage of transactions close on Hiive?

In 2023, after accepting a bid, sellers were able to complete their sales 70% of the time. In 2024, that number increased to 90%.

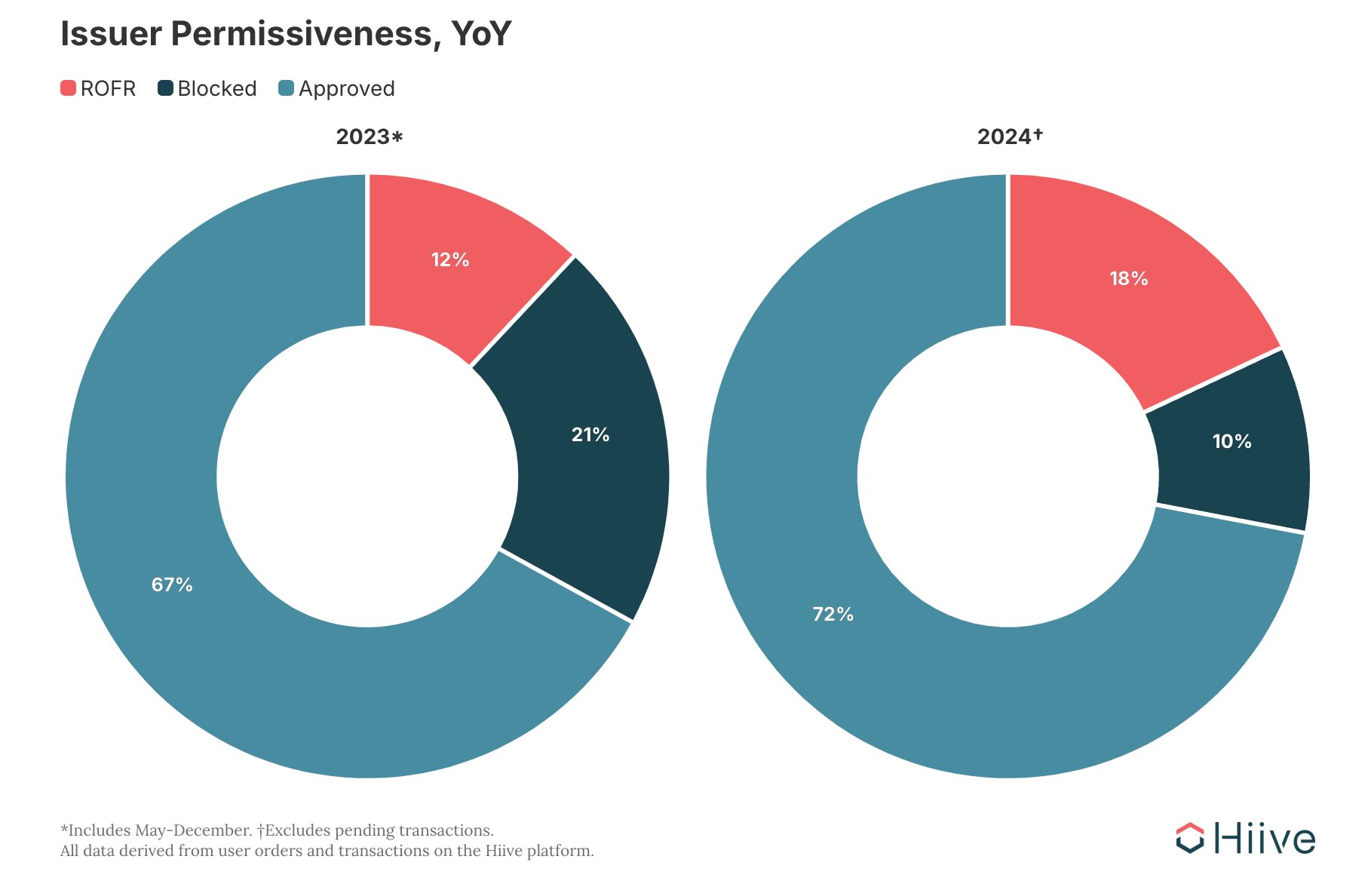

These percentages include when a company uses its right of first refusal (ROFR), which allows it to substitute itself or an existing shareholder in the place of the proposed buyer.* The ROFR increased from 12% to 18% from 2023 to 2024.

*If an investor's bid is accepted at $25/share, a ROFR allows the company or one of its current shareholders the right to match that $25/share offer and buy the shares in your place.

Excluding ROFR transactions, buyers on Hiive completed their transactions 72% of the time in 2024, up from 67% in 2023.

Source: Hiive

In 2024, just 10% of deals were blocked outright, down from 21% in 2023. Hiive expects more companies to allow their employees to sell shares in the future because it leads to higher job satisfaction.

If you're wondering how these numbers compare to Hiive's competitors, I haven't found another company that shares these figures, so it's impossible to make a comparison.

This is another example of Hiive's commitment to transparency, and may also indicate that the percentage of transactions that close is higher on Hiive than on other platforms.

Note: Hiive's most active securities are more likely to have accepted deals approved, like those in the Hiive50.

What is the Hiive50?

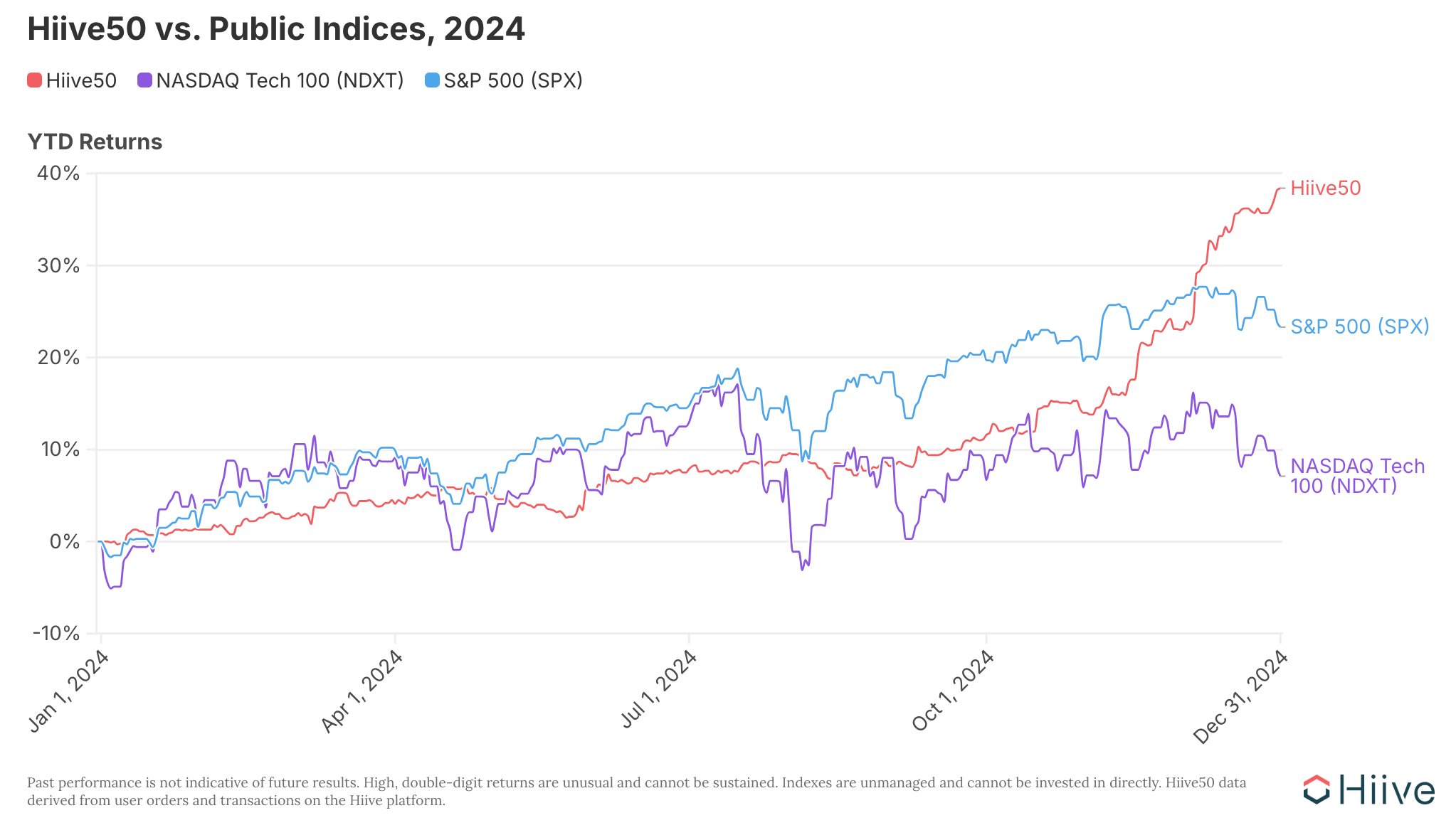

The Hiive50 is an equal-weight index of the 50 most active securities on Hiive. The index serves as a barometer for the performance of the late-stage pre-IPO market.

The Hiive50 Index outgained both the S&P 500 and NASDAQ 100 in 2024, returning 38.4%:

Source: Hiive

A few of the current members of the index include Cerebras Systems, Lightmatter, Kraken, Groq, and SpaceX. Here is the full list of constituents.

Hiive competitors

Here's a list of Hiive's main competitors and how they compare:

| Hiive | Linqto | Forge Global | Nasdaq Private Market | EquityZen | |

|---|---|---|---|---|---|

| Investment minimum | $25,000 | $2,500 | $100,000 | $1,000,000 | $10,000 |

| Main benefit | Transparency + liquidity | Lower minimum investment | Liquidity | More tools available for institutional investors | Several multi-company fund offerings |

| Main drawback | Mid-range investment minimum | Shares tend to be more expensive | Higher investment minimum + buyer fees | Primarily for institutional clients | Fewer transactions and less liquidity |

| Links | Hiive | Linqto | Forge Global | NPM | EquityZen |

Final verdict

Pre-IPO investing is becoming increasingly popular, but not all marketplaces are created equal.

Regardless of whether you're a buyer or seller, you should pay special attention to the business models and terms of the platforms you're considering using.

In our opinion, Hiive's stock exchange-like model, focus on transparency, solid liquidity, low fees, and other features make it the best overall secondary marketplace for both buyers and sellers.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.