How to Sell Private Company Stock and Employee Stock Options

You did it — you hit your bonus targets and earned your stock bonus at your startup.

Now what?

Earning stock or stock options at the company you work for is a great perk, but it can take years before you can turn your equity into cash. And that's assuming your company is one of the few that go on to get acquired or have an IPO.

In reality, those stock options are more like lottery tickets than they are like cash. Sometimes these stock options, which could have been worth up to 6 or 7 figures, become worthless in a few short months.

Fortunately for you, the days are gone when employees need to wait for their company to go public or get acquired before they can sell their private stocks.

Here's everything you need to know about how to sell your private company stock and stock options.

How to sell shares of a private company

Here are four ways you can sell your private stock options:

- Sell shares back to the company

- Sell shares on a secondary marketplace

- Sell shares in a tender offer or liquidity event

- Sell shares after an IPO

Read on for more about each option.

1. Sell the shares back to the company

The easiest way to sell your private shares and turn your equity into cash is to sell them back to your company. This is known as a buyback program.

Buyback programs may be ongoing, meaning you can sell your shares at any time, or cyclical, meaning they occur at set times, usually either once per year or quarter.

That said, buyback programs are not overly common at private companies. Many private companies offer stock options instead of bonuses to lower the cash burden on the company.

Chances are, your company doesn't have a buyback program, but it's worth finding out for sure because it is the easiest way to sell your shares.

2. Sell private company shares on a secondary marketplace

In recent years, a number of marketplaces have launched to connect private company employees who want to sell their shares with accredited investors who want to buy them.

The SEC allows accredited investors (individuals with $200,000 or more or couples with $300,000 or more of annual income or a net worth of $1,000,000 excluding primary residence) to invest in more speculative assets than regular investors.

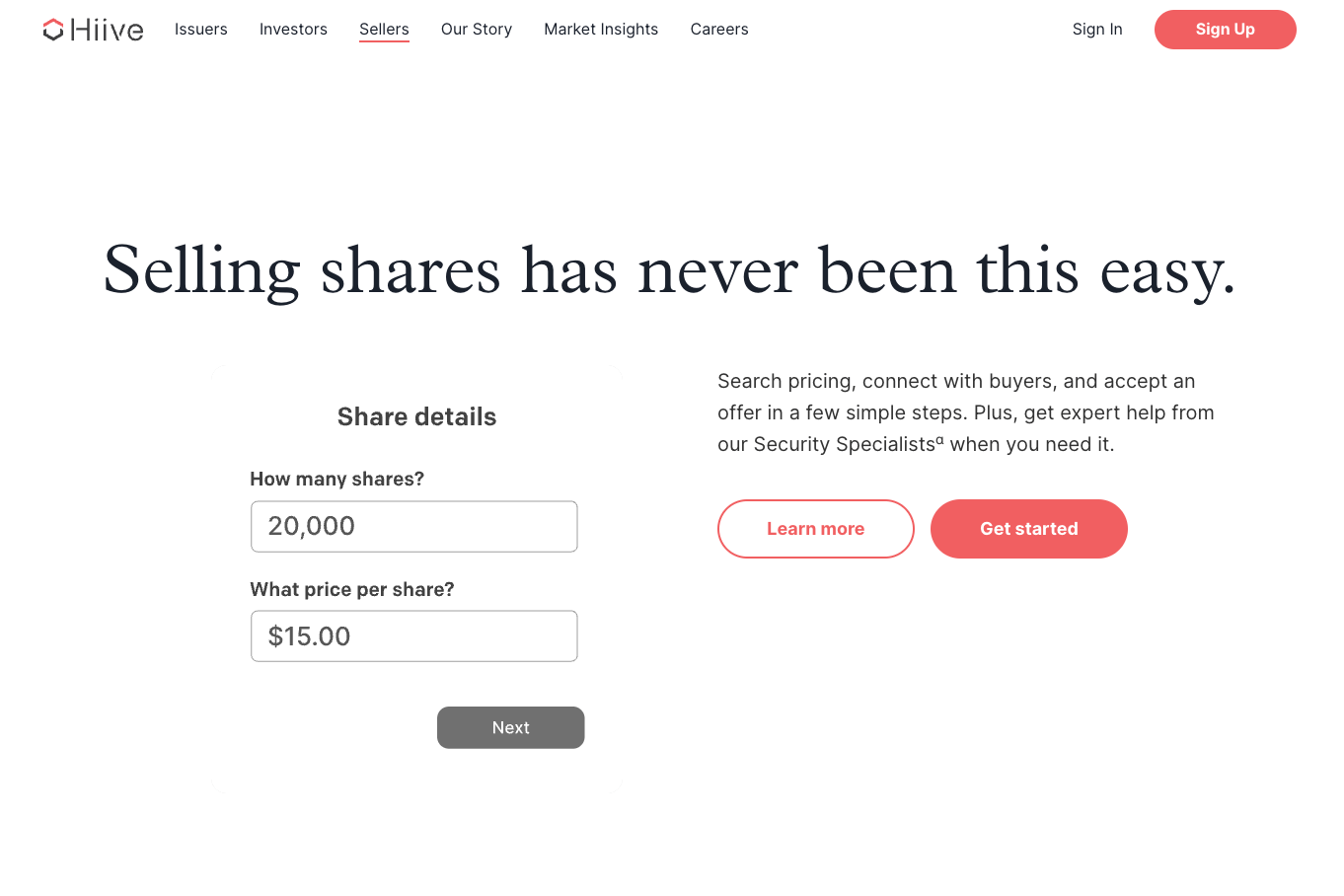

My favorite secondary marketplace platform is Hiive:

Hiive is a marketplace that connects shareholders of private companies to accredited investors who want to buy their shares.

A few benefits of using Hiive are:

- Anonymity: Review proposed bids from buyers without sharing your identity.

- Price discovery: See what prices buyers are willing to pay and what other sellers are currently asking for.

- Transparent fees: Get certainty on all fees you may have to pay before listing your shares.

You can join thousands of shareholders who have successfully sold private company shares on Hiive.

3. Sell shares in a tender offer or other liquidity event

Similar to a buyback program, a company-organized liquidity event, like a tender offer, allows employees and other shareholders to sell their private shares to outside investors.

These typically happen when an outside investor, meaning a private equity group or institutional investor, offers to buy shares from existing shareholders.

The company brings the buyer to the table, sets the valuation and share price, and brings the offer to its employees and other investors.

Tender offers do not happen frequently, and I wouldn't recommend waiting for one to happen if you want to sell some of your shares.

And even if one is organized, there's no guarantee that you'll be able to sell your shares due to restrictions or because the offer is “oversubscribed,” meaning there are more sellers than funds and certain shareholders will be prioritized.

4. Sell shares after an IPO

Historically, waiting for your private company to go public was the only way to sell your private shares.

If your company goes public, your private shares will become common shares and you will immediately realize the value of your equity. At this point, your stock or stock options will become just like any other stock you own.

It's incredibly rare for a company to grow large enough to go public. If you're an early employee at a company that eventually goes public, your rewards can be substantial.

Still, betting on this outcome and not realizing some of your equity compensation by selling some of your private shares along the way is a gamble, and one I do not recommend making if you need the money.

What to consider before selling private company stock

Here are five things you should consider before selling your private shares:

- Restrictions and policies

- Your financial situation

- Taxes

- Bid-ask spread and fees

- Funding to exercise your options

Below is more information about each.

1. Your company's policies around selling shares

If you hold shares in a private company, your company may need to give you permission before you can sell your stock.

Most companies have a “first right of refusal” clause, which gives them the opportunity to buy back your stock before other investors can.

Read your company's documentation around your stock bonus program to learn more about potential restrictions and what you're allowed to do with your stock.

Additionally, you can ask your company's HR department, CFO, CEO, or founder if they are planning on running a buyback program or a tender offer.

If they are, there will be rules and terms for the sale, and you'll be given at least 20 business days to evaluate the offer.

2. Your liquidity needs and financial situation

Once you've determined what your company restrictions are and how you can divest your shares, you need to consider your own financial situation and goals.

For example, you should consider why you want to sell your shares.

Do you need the cash now to pay off student loans or put a down payment on a house? Do you want to diversify your investments outside of your company's stock, especially considering your income also relies on its success?

If yes, it may be a good idea to sell some of your shares now.

However, if you expect your company's value to keep increasing, you don't need the money, and you are willing to take the risk, keeping all of your stock may result in a big payoff later.

3. The tax implications of a sale

When calculating your potential gain from a sale of your stock options, don't forget to calculate your tax liability.

Typically, you'll pay ordinary income tax on your gains from the exercise and sale of stock options.

If you sell private shares, you'll pay either long-term or short-term capital gains taxes on the increase in value, depending on if you held the shares for more than one year.

4. The bid-ask spread or other fees

If you're considering selling your shares through a secondary marketplace, be sure to factor in the bid-ask spread and other fees that may be included in the transaction.

The bid-ask spread is the difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to sell (the ask).

If you believe your shares are worth $100 each but the highest bid is $95, you will have to wait for another buyer to offer more or accept the lower price.

Additionally, marketplaces may charge either the employee or the investor a percentage fee on transactions. Read the terms and conditions and be sure they're acceptable before registering with a secondary marketplace or other broker.

5. What if you can't afford to exercise your options?

If you have been given stock options as a bonus or part of your regular compensation, you will need to convert those options into shares before you can sell them.

Depending on the strike price of the options and how many you have, you may not have enough cash to exercise your options. This is an extremely common problem that prevents many employees from selling their shares.

If this describes your situation, don't worry — there are a few solutions.

Options lending

Some banks and other financial institutions give loans to help employees exercise their options. If you opt for a bank loan, you may need to back the loan with your personal assets.

On the other hand, you can use Equitybee (an alternative to secondary marketplaces), which will give you the funding you need to exercise your options with no upfront cost.

In exchange for this funding and after successfully selling your shares, Equitybee will take 5% of the transaction value as its commission.

Cashless exercise

If your company allows for a cashless exercise, you may be able to sell eligible options without needing to pay the exercise cost out of pocket. The proceeds from the sale are used to cover the exercise cost, leaving you with the net difference.

However, like a buyback program, this is rare for companies to offer.

More about private company stock & options

What is private company stock?

Every company has a pool of equity. Once a company becomes big enough, that equity is divided into shares/stocks.

For instance, if a company has 10 shares and you buy 2 of them, you own 20% of the business.

Startups frequently offer equity in the form of private shares and stock options to compensate employees when cash is limited.

However, because these companies are not publicly traded, the shares can be difficult to sell.

How do employee stock options work?

Instead of offering cash bonuses, many private and public companies offer stock options as incentives so employees stay and participate in the growth of the company.

Stock options give you the right to buy a company's stock at a certain price within a particular time period.

For example, you may be given 5 stock options that each allow you to buy 100 shares of stock at $20 per share when your company's shares are trading for $30 per share.

In this example, these stock options are currently worth $5,000 (5 options * 100 shares * $10 per share).

How do you value shares in a private company?

Unlike regular stocks, it's hard to determine how much your private shares are worth.

The easiest way to determine how much your equity is worth is to wait for updates from your HR or finance departments.

Depending on the size of your company, you should receive information about the valuations set at the latest funding rounds, private market transactions, buyback programs, tender offers, or other off-market sources.

What should you do with your employee stock options?

So, should you sell your employee stock options now or hold on to them and hope they increase in value? If it were me, I'd do both.

Yes, your private company stock options can turn into massive sums if your company goes public, but that opportunity doesn't come without risk. Consider the “bird in the hand” adage when deciding whether to sell some of your private shares.

Your financial needs, liquidity, and risk tolerance should be the biggest determining factors of what you should do with your private company stock and stock options.

Final word

Selling shares from privately held companies is hard but not impossible.

If you have a considerable portion of your net worth tied up in your company's equity, I would encourage you to consider diversifying some of that risk by selling some of your shares.

Before you do, be sure to read your company's policies, evaluate your financial situation, and consider the tax implications of your sale.

After that, enjoy your bonus — you earned it!

.png)

.png)