The 5 Best Websites for Historical Financial Data

Real-time financial data is everywhere, but tracking down historical stock data can be more challenging.

Whether you're building a spreadsheet, backtesting a strategy, or just trying to confirm a company's revenue in 2017, it can be surprisingly difficult to get the exact data you need.

That's why I made this list.

Below, I ranked the five best websites for accessing historical financial data. You can use the summary section below to pinpoint the website most likely to have the data you're looking for, and then read more about the website further down.

Summary of the best sites for historical financial data

| Website | Best for |

| Stock Analysis |

|

| Koyfin |

|

| EDGAR |

|

| Investor relations pages |

|

| EODHD, Massive, Marketstack |

|

1. Stock Analysis: best overall

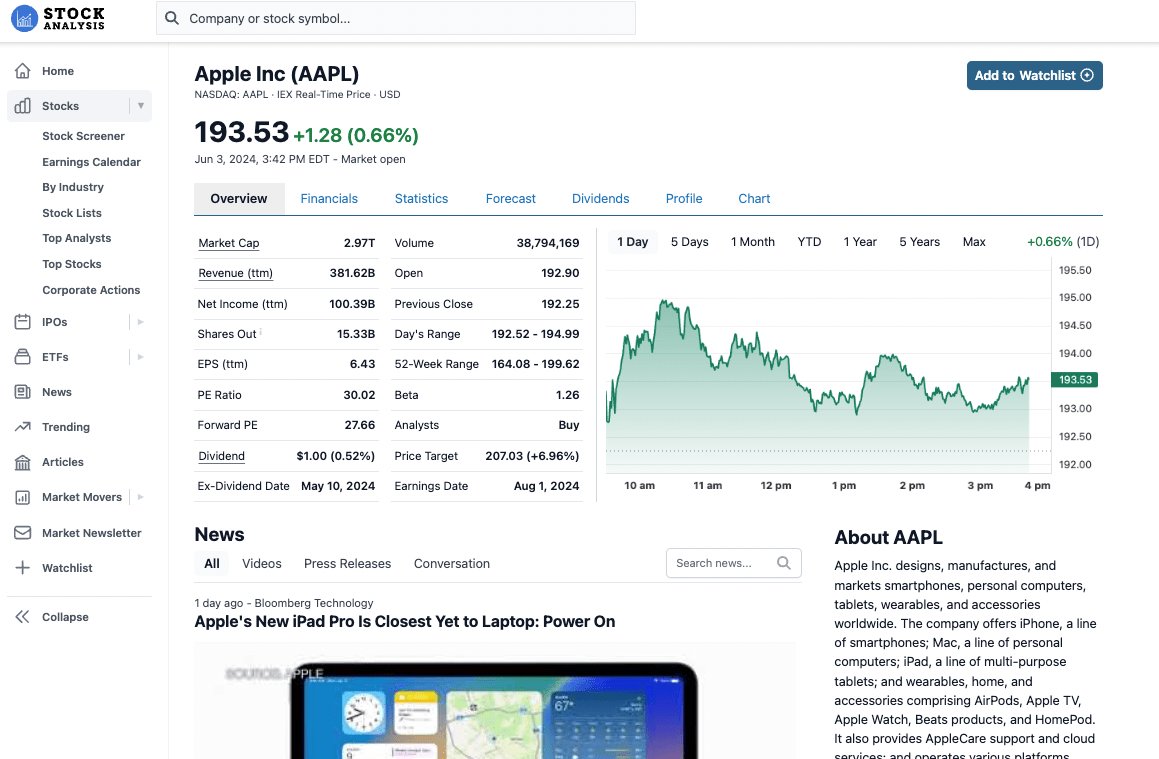

Stock Analysis is the best free stock research website you'll find.

It has financial information, statistics, and valuation metrics on over 120,000 stocks and funds. The website is easy to navigate and really fast.

There are five categories of historical financial datasets where Stock Analysis stands out: financial statements, business metrics, dividend payouts, corporate actions, and open/close prices.

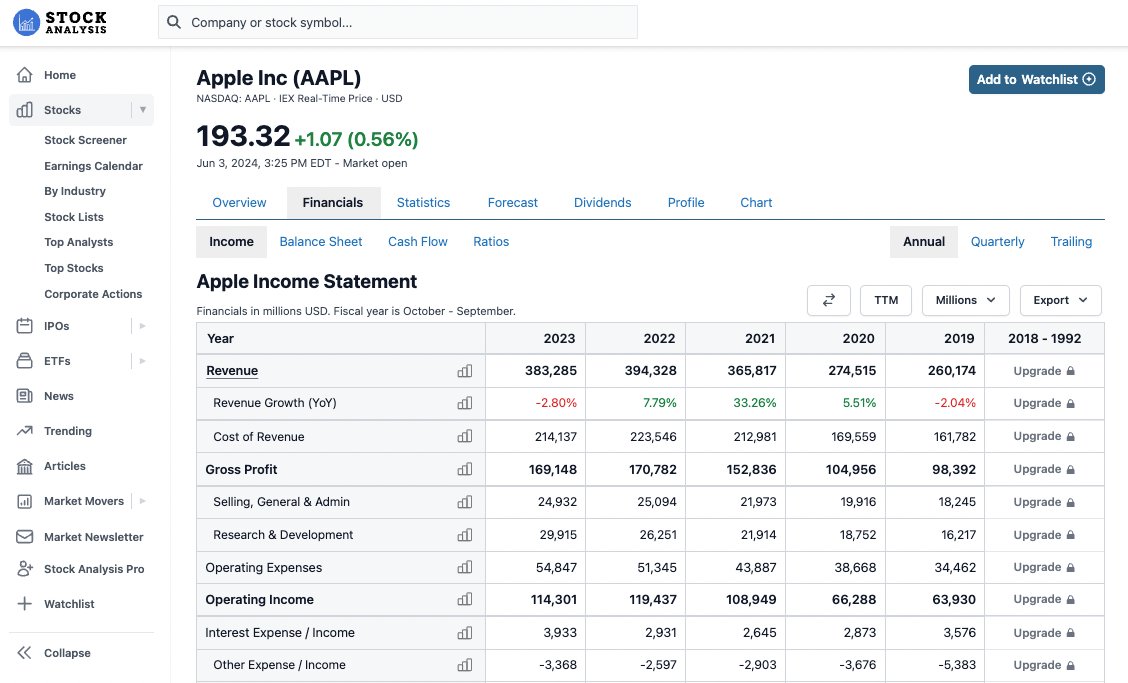

Best for historical financial statements

In addition to all our real-time data and news, Stock Analysis provides 5 years of financial statements for free:

Best-in-class data

Many finance websites save money by getting their data from second-tier providers, but not us. We wanted a website connected to institutional-grade data sources, so we built it ourselves. We pay a premium price for these connections, but we think it's worth it.

Additionally, you can unlock up to 40 years of financial statements by upgrading to Pro for $9.99/month or $79/year. Pro also comes with exports (Excel and CSV files), analyst ratings data, unlimited watchlists, and more.

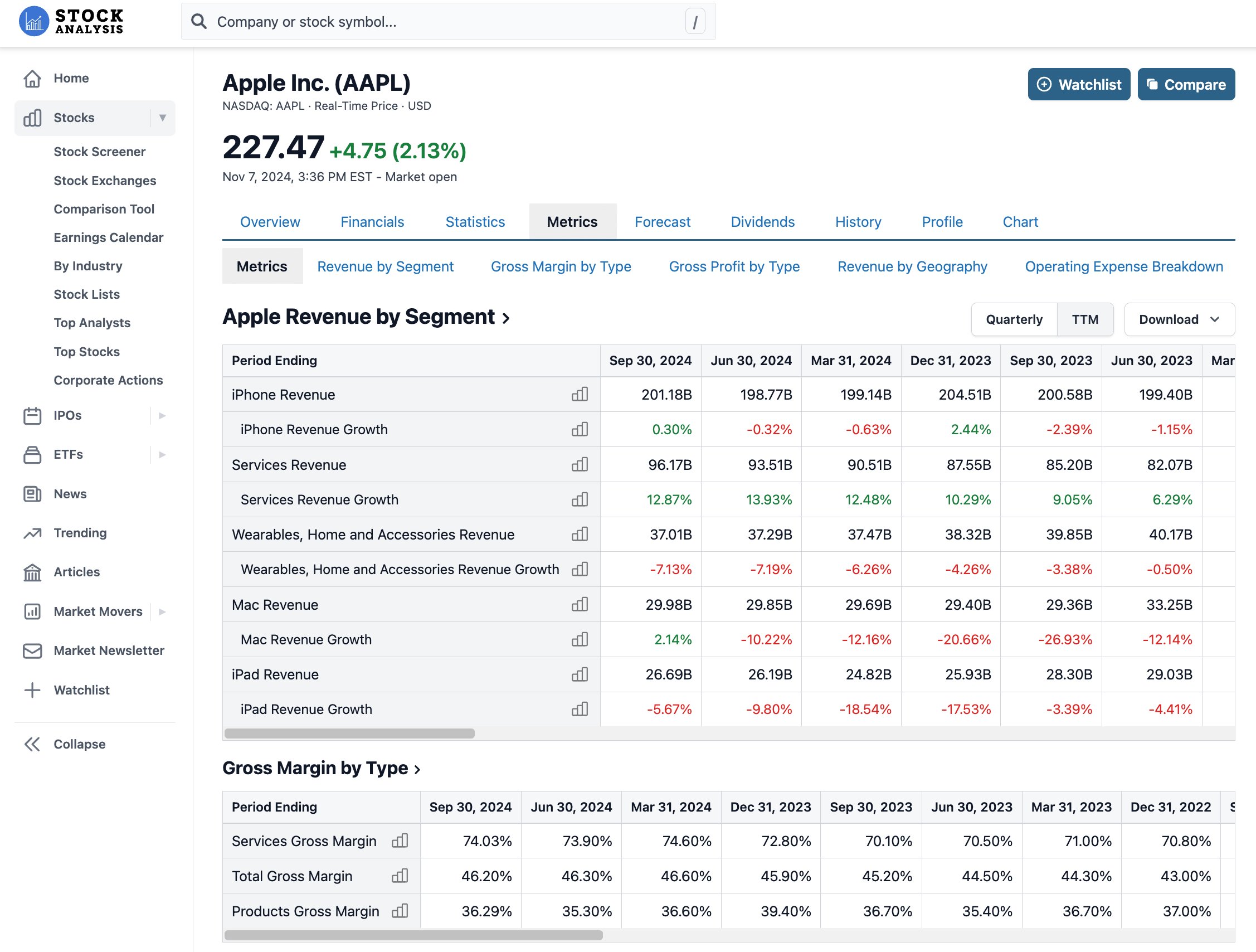

Best for business metrics

In addition to their financial statements, every company reports specific business metrics that provide valuable insights into their growth, performance, and progress on key objectives.

For instance, Nvidia reports on data center revenue, Tesla shares numbers on deliveries by model, and Apple breaks out its device sales:

You won't find this level of granularity on an income statement or balance sheet, but it's critical information to know as an investor in these stocks.

Previously, the only way to find these numbers was by digging through each company's quarterly reports on their investor relations websites (which still isn't a bad place to look — more on that below).

But now, you can view company-specific performance metrics for 50,000+ stocks all in the same place.

You can access up to 8 quarters or 3 years (TTM) of data completely free. To unlock the complete history and the ability to export and download these metrics, you'll need a Pro account.

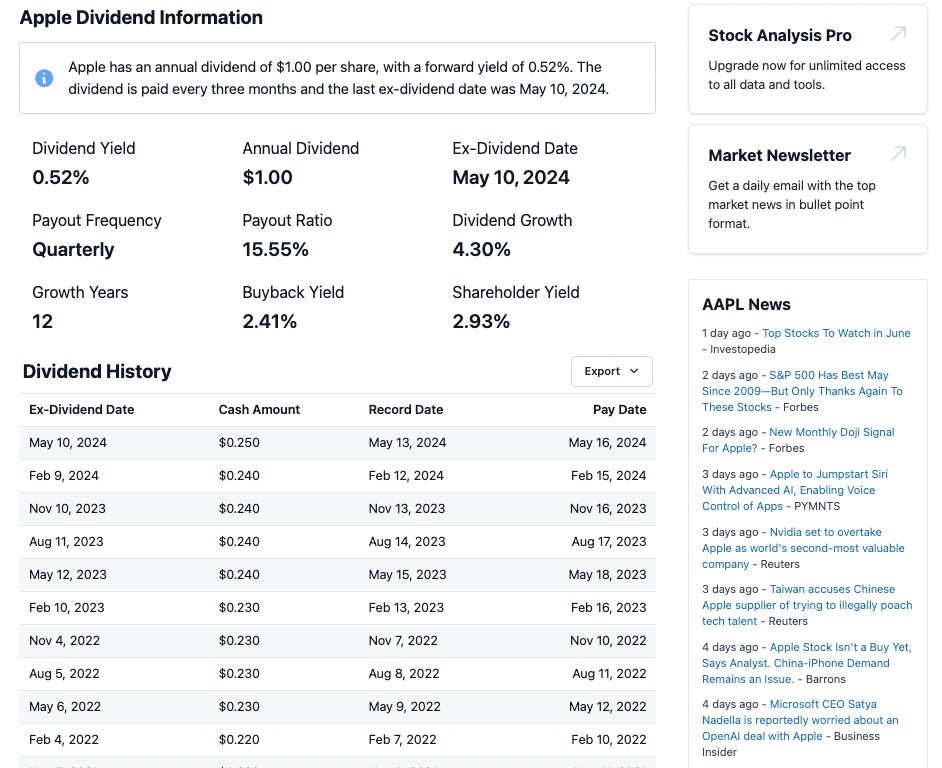

Best for dividend history

For yield-focused investors, we provide 5 years' worth of dividend history and charts for free.

With a Pro account, you can unlock a stock's full dividend history and export the corresponding charts and data.

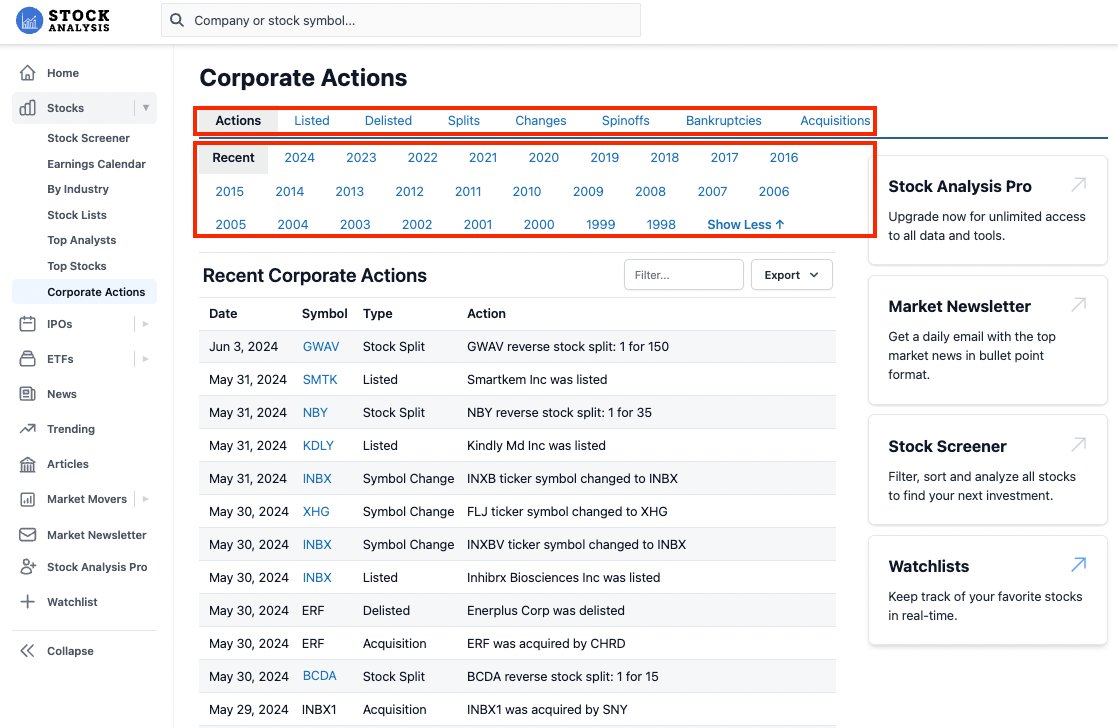

Best for corporate action history

We've also compiled a complete set of corporate actions going back to 1998. You can filter actions by type of action (listed, delisted, splits, spinoffs, etc.) or by year.

Best for historical open/close prices

When I first wrote this article, Yahoo Finance allowed you to download a stock's entire price history for free. You could export each stock's open & close and high & low prices going all the way back to the company's IPO.

While you can still view all of this information for free, you can no longer export this data without being on their $49.95/month Gold plan.

So we (at Stock Analysis) made our own version. Just like on Yahoo Finance, you can view any stock's historical price data for free.

And while we can't allow free exports (our data provider requires us to paywall exports), our plans are much cheaper than Yahoo Finance's (you can become a Pro subscriber for just $9.99/month).

More features

Stock Analysis also has many other useful features available for free, including a stock screener and market gainers and losers.

2. Koyfin: best for visualizing data and statistics

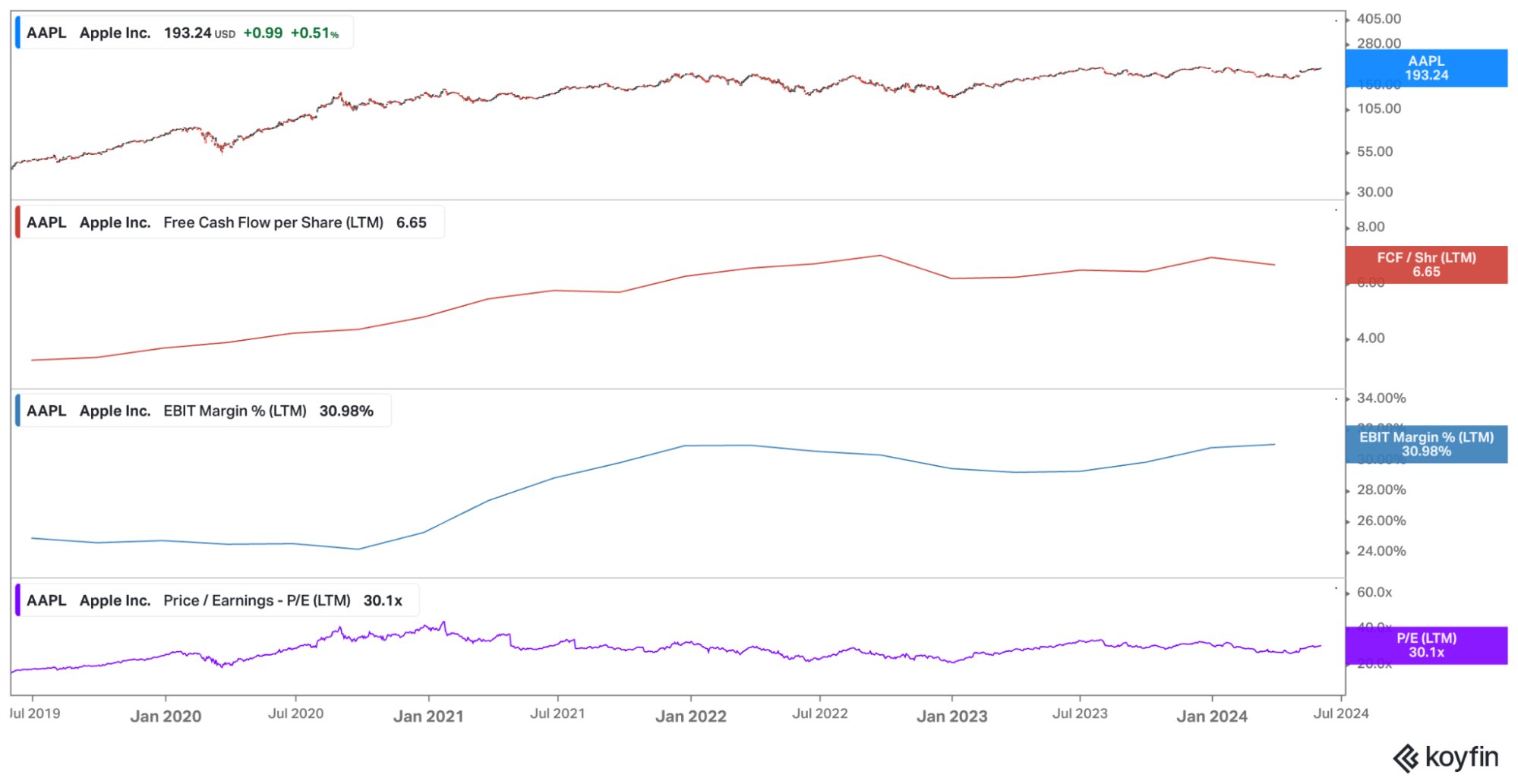

Koyfin provides access to a wide range of historical financial data, including financial statements, key valuation ratios, and other financial metrics for thousands of stocks.

Instead of only displaying this information in tables, Koyfin allows you to build custom line charts so you can visualize these metrics over time — making it instantly obvious how a business is trending.

On Koyfin, you can also compare multiple stocks at once, build customizable dashboards, and create custom templates for quickly analyzing stocks.

You can share charts and analyses with other investors in a few clicks, too.

However, while you can get some of this functionality for free, you'll quickly bump into a paywall if you start using the product regularly. It's $49/month or $468/year for their “Plus” plan, or $110/month or $948/year for their most popular “Premium” plan.

You can try it for free with a 7-day trial.

Koyfin also ranks #6 on our list of best stock research websites.

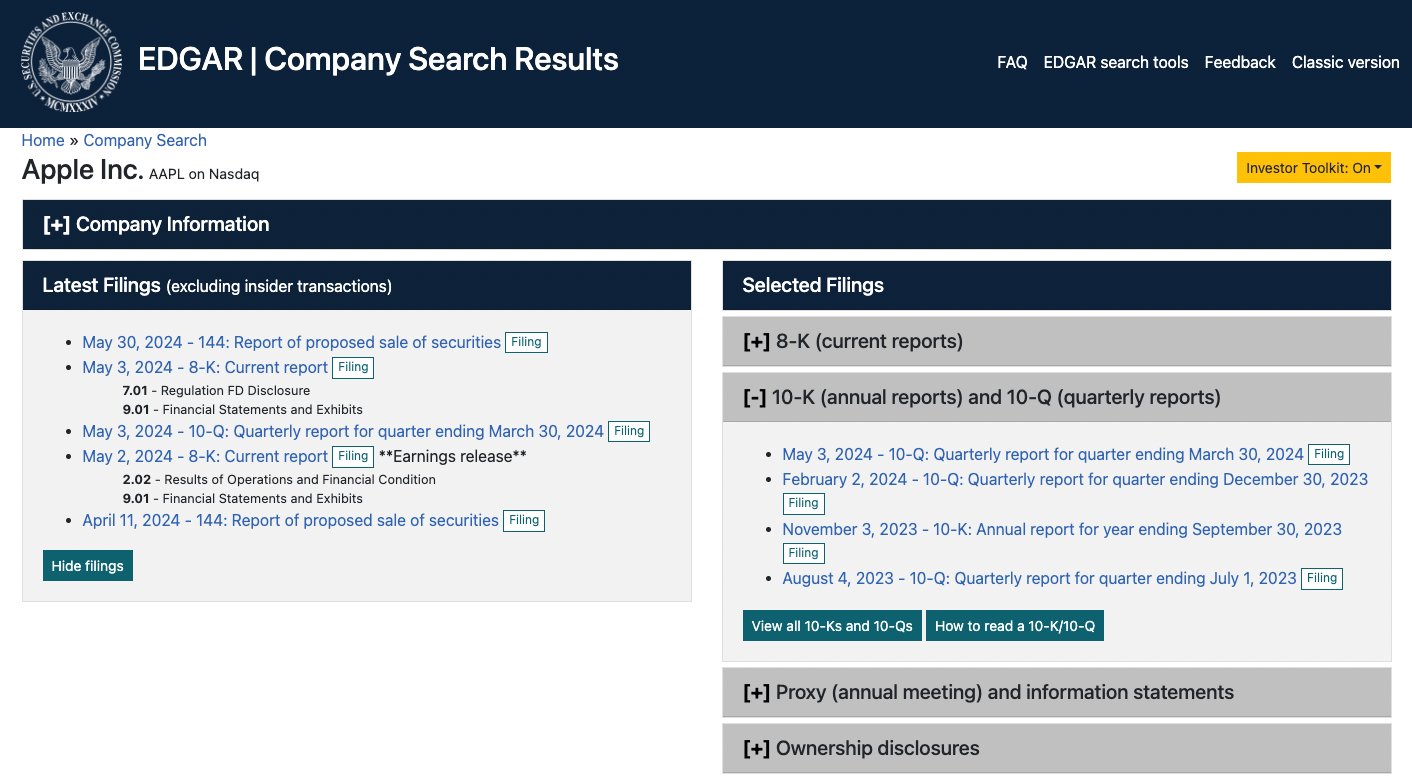

3. EDGAR (SEC): best for granular research and direct access to 10-Ks

Every publicly traded company in the United States is required to file annual (10-K) and quarterly (10-Q) financial reports with the Securities and Exchange Commission (SEC).

These reports are audited, standardized, and — most importantly — packed with detailed financial and business information.

All of them are publicly accessible for free through the SEC's EDGAR database — short for Electronic Data Gathering, Analysis, and Retrieval.

Just enter a ticker symbol, and you'll see its full filing history: earnings reports, proxy statements, insider transactions, registration documents, and more. If it was filed with the SEC, it's there.

While 10-Ks and 10-Qs aren't exactly light reading, they often contain highly specific data points you may not find anywhere else.

For instance, if you're trying to find the difference in Apple's gross margin between its products and services or how much of its revenue comes from China, you can hunt down this information in these reports.

EDGAR can feel clunky compared to modern websites, but it's one of the most powerful (and overlooked) tools for investors doing deep research.

U.K. investor? Check out Companies House.

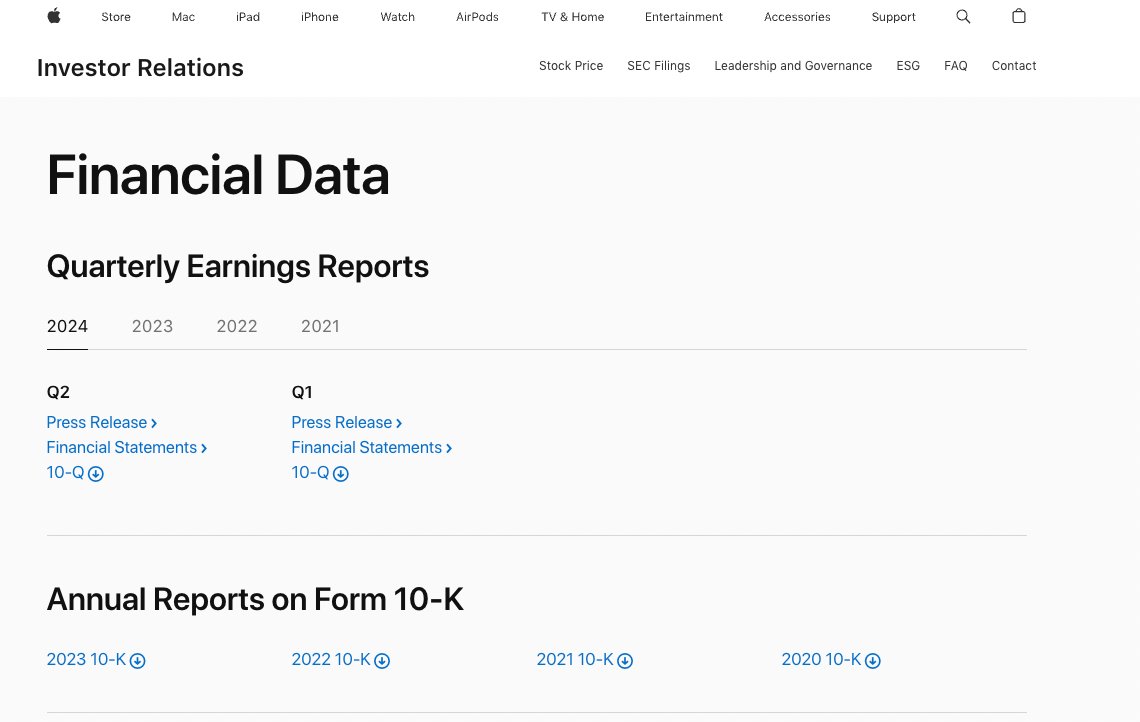

4. Investor relations pages: best for company-published reports

Nearly every public company also publishes its annual and quarterly reports on its own website, usually in an "Investor Relations" (IR) section (e.g., see Apple's Investor Relations page).

These pages often mirror what's filed with the SEC but present the information in a more digestible, polished format.

Additionally, the financial information is typically summarized, the company's key metrics are more obvious, and many companies also issue press releases to summarize key details.

Furthermore, many companies also turn their reports into PDF documents or slide decks (e.g., see PayPal's latest earnings presentation).

These typically break down performance trends, user growth, margins, forecasts, and future product plans, usually with charts and commentary from the management team.

While not as exhaustive or standardized as SEC filings, investor relations pages often offer the cleanest, most user-friendly view into the information investors care about.

5. EODHD, Polygon, Marketstack: best historical market data APIs

If you're looking to pull large amounts of data straight into a script or spreadsheet, you're going to need access to an API.

Based on their reliability, broad coverage, and pricing, my three favorites are EODHD, Massive (formerly Polygon), and Marketstack.

EODHD: most complete all‑in‑one package

- Coverage: Equities in 60+ exchanges, ETFs, mutual funds, options, bonds, FX, crypto — plus splits, dividends, fundamentals, and economic indicators.

- Data depth: Daily history back to the 1970s for most U.S. tickers and 30+ years for fundamentals.

Why we like it: You can get price and fundamentals data with one subscription. Tiered plans start at $19.99/month with a 100,000 daily call limit, so you can prototype cheaply and scale later.

Massive: fastest real‑time U.S. equities & options feed

- Coverage: Every U.S. equity and option, plus indices, forex, crypto, and futures.

- Data depth: Tick‑level trades and quotes back to 2004, minute aggregates to 1998, and daily bars to 1980 on most U.S. tickers.

Why we like it: Sub‑millisecond latency makes it ideal for intraday dashboards and backtests; the free tier handles end‑of‑day pulls, and paid plans (from $29/month) unlock real‑time plus unlimited WebSockets.

Marketstack: best budget pick for global EOD prices

- Coverage: 500,000+ tickers across 70 exchanges worldwide, including many small‑cap venues that bigger APIs skip.

- Data depth: Daily OHLC back to 2000 for most listings, with intraday intervals (1 min–1 hr) for 30,000+ tickers on paid tiers.

Why we like it: Clean JSON responses, an Excel/Google Sheets add‑in for no‑code workflows, and a solid free tier (100 calls/month). Paid plans start at $9.99/month and scale up to 1 million calls without breaking the bank.

Whichever you choose, all three offer free tiers or trial credits, so you can test them without spending any money.

Why is historical financial information useful for investors?

It's very easy to get sucked into the day-to-day fluctuations in the stock market and the latest headlines about what's “moving the markets” today.

However, long-term investors know this tends to lead to overtrading and other adverse behavior.

Instead, it's useful to take a step back, zoom out, and look at the larger trends going on within companies. The best way to do this is by looking at historical financial data and statistics to gauge how a stock is trading relative to its own history or industry.

By examining a company's trends in revenue, profit, and other metrics, long-term investors can make more informed, objective, and unemotional investment decisions.

Programmers, on the other hand, usually need historical stock market data for building and backtesting algorithmic strategies.

Disclaimer: Past performance does not guarantee future results.

Final verdict

In summary, the best website for you will depend on what type of historical stock data you're looking for, as well as whether you're willing to pay for it.

At Stock Analysis, we provide 5 years' worth of financial statements and dividend data, plus many other features, for free.

To access up to 40 years of financial data and up to 50 years of dividend data (plus exports), you'll need to go Pro for $9.99/month or $79/year.

Koyfin is a great tool for visualizing a company's financial performance, stock ratios, and other metrics over time. You can try it with a 7-day free trial.

The SEC's EDGAR database, as well as companies' investor relations pages, will give you direct access to 10-Ks and are great resources for digging deep into a company.

For programmers EODHD, Massive, and Marketstack are excellent API options.