Can You Buy Alef Aeronautics Stock in 2026?

Alef Aeronautics is developing the world's first flying car.

Yes, seriously.

In early 2025, the company released footage of its Model A taking off, levitating over a parked SUV, and landing on the other side.

It was a milestone moment, but Alef is still deep in the testing phase — a long way from its earlier projection of delivering vehicles by the end of 2025.

Even so, the California-based startup is widely seen as the frontrunner in the race to bring flying cars to market. In fact, it's already taking preorders.

As of August 2025, Alef had received 3,500 preorders. At $300,000 apiece, that's more than $1 billion in combined order value.

Clearly, the market is interested — and that kind of demand is exactly what gets investors interested, too.

With preorders rolling in and regulators beginning to clear a path for low-altitude air travel, many are wondering how to get in before Alef goes public.

Here's what you need to know if you're looking to invest in Alef Aeronautics today.

Can you buy Alef stock? Is Alef Aeronautics publicly traded?

Unfortunately, Alef is not yet publicly traded. There is no Alef Aeronautics stock symbol, and there's no way to buy it in your regular brokerage account.

The company won't become public until its IPO, which has yet to be scheduled. Until then, there's no way for retail investors to buy its stock.

Given its ambition — building a street-legal flying car with a $300,000 price tag — Alef will need significant capital to fund research, development, and manufacturing.

It's raised less than $5.5 million to date — nowhere near what it will take to bring a production-ready vehicle to market.

There aren't any options for gaining exposure to Alef Aeronautics at this time. However, I expect that to change once it starts raising more money.

Here are a few places to keep your eye on.

Potential ways to buy Alef Aeronautics stock in 2026

Here are two ways you may be able to gain exposure to Alef in the future.

1. Alef's website

Interestingly enough, Alef has a form on its website where potential investors can leave their name and email address, along with the amount they're thinking of investing.

There is no information about the investment terms or process.

I would assume they have a minimum investment of $50,000 or more, but without details on valuation, investor rights, or funding structure, it's impossible to know what you'd be signing up for.

They're likely only raising from serious investors — people who've done angel deals before or have experience backing early-stage startups.

2. Hiive

Hiive is an investment marketplace where accredited investors can buy shares of pre-IPO companies.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

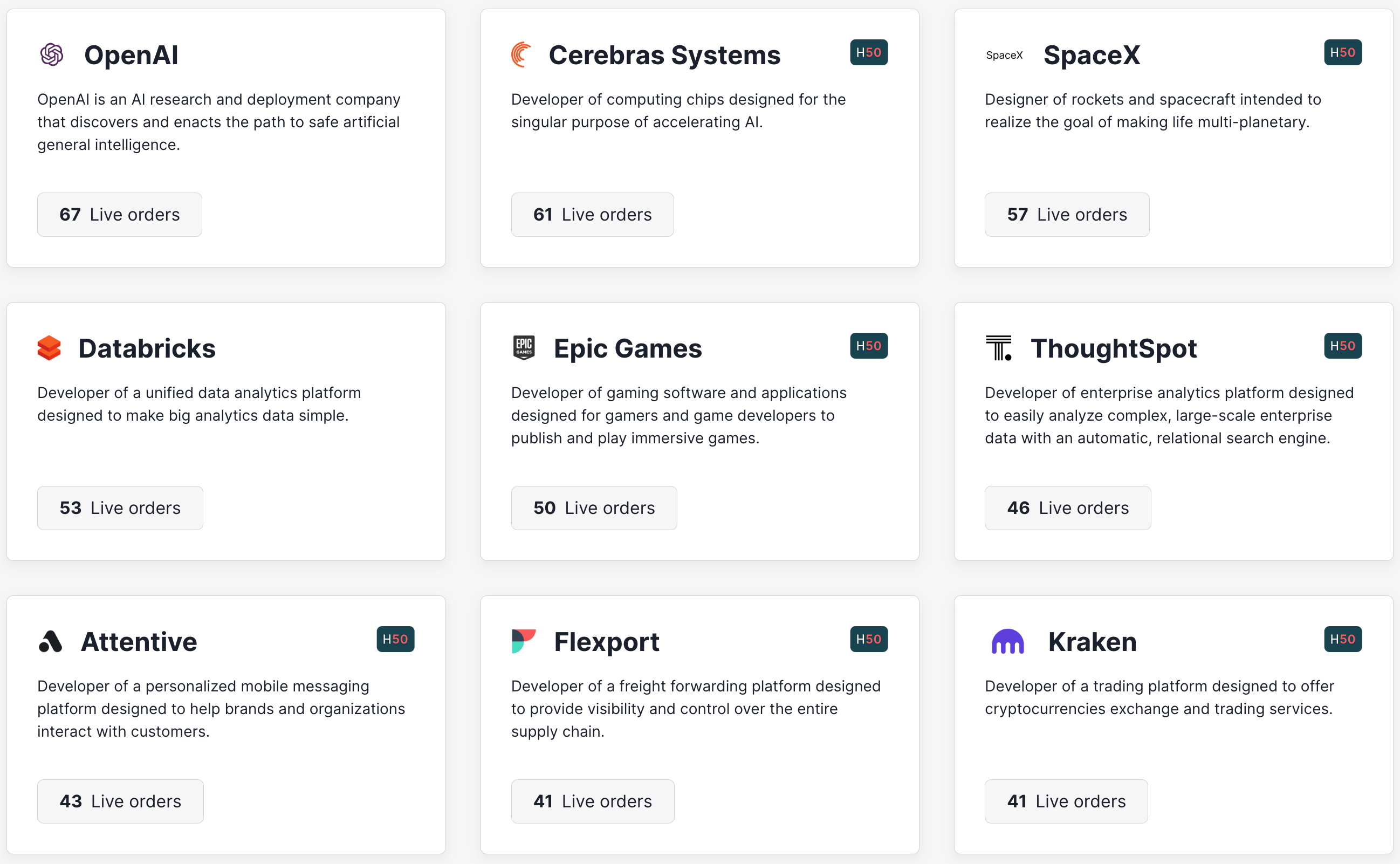

There are thousands of private companies with shares available on Hiive, including SpaceX, Stripe, and Epic Games.

Unfortunately, Alef Aeronautics is not available on Hiive at this time. However, you can register and get a notification if any of its shares become available in the future, which may happen if Alef raises more funding and expands its team.

3. Publicly traded competitors

Since Alef Aeronautics isn't publicly traded yet, one alternative is to invest in its competitors — particularly those focused on electric vertical takeoff and landing (eVTOL) aircraft or advanced air mobility (AAM).

While none are building street-legal flying cars quite like Alef, they're all working on the broader vision of next-generation air transportation.

Here are a few public companies worth watching:

- Joby Aviation (JOBY) is developing eVTOL aircraft designed for air taxi services. Backed by Toyota and Delta, Joby has already completed pilot test flights and aims to launch commercial operations by early 2026.

- Archer Aviation (ACHR) is building eVTOL aircraft for short-haul urban flights, with support from United Airlines and Stellantis. It plans to begin operations in 2026 and has already secured contracts for hundreds of aircraft.

- EHang (EH) is a Chinese company focused on autonomous passenger drones. Unlike its U.S. peers, EHang emphasizes pilotless operation and has already conducted thousands of test flights in Asia and Europe.

- Vertical Aerospace (EVTL) is a UK-based eVTOL developer working on aircraft for regional air mobility. It's partnered with major aerospace players like Honeywell and Rolls-Royce, but is still early in its flight testing.

While these companies don't offer the same consumer-focused product as Alef, they do provide investors with exposure to the general urban air mobility industry — an industry that could be worth hundreds of billions in the coming decades.

How to buy the Alef Aeronautics IPO

The Alef Aeronautics IPO date has not yet been set.

So far, the company has relied on funding from the private markets to develop its technology. My best guess is that Alef will remain a private company until it has a clear path toward selling cars and generating revenue — likely at least 2 years away.

After its initial public offering, you will be able to look up its stock symbol and buy it in your brokerage account.

If you don't have a brokerage account, we recommend Public. On it, you can invest in stocks, ETFs, bonds, and cryptocurrencies, all from the same account.

Who owns Alef Aeronautics?

Alef Aeronautics' list of investors includes Draper Associates Fund V, Tata Capital, Redwood Venture Partners, Redwood Technology Ventures, and Select Venture Partners.

Among its list of investors is Tim Draper, an early investor in Tesla and SpaceX.

While we don't know how much of the company each of these investors owns, I would guess the company's founding team still owns the vast majority, given that the total funding received is just $5.5 million.

Frequently asked questions

Below are a few more questions often asked about Alef.

How to buy Alef Aeronautics stock?

Alef stock has not been made available to the public via an IPO or SPAC, and is not currently listed on Hiive, our recommended pre-IPO investing platform.

How much is Alef Aeronautics stock?

Alef stock is not yet publicly traded and has no publicly available price per share.

What is the Alef Aeronautics stock symbol?

Alef is still a privately held company, so there is no stock symbol.

Who owns Alef Aeronautics?

Alef Aeronautics is partially owned by Jim Dukhovny, Dr. Constantine Kisly, Pavel Markin, Oleg Petrov, and 7 other investors and investment firms.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.