How to Buy Starlink Stock Before Its IPO

In 2019, the first Starlink satellite fleet was launched into orbit.

Today, Starlink's network is made up of nearly 9,000 satellites that deliver high-speed, broadband internet to more than 8 million people (and growing) all over the world.

The company's financial results have been trending at a similarly impressive rate. Annual revenue was projected to reach $11.8 billion in 2025, up 53% from last year's record revenue of $7.7 billion.

The man behind it all — Elon Musk.

While Musk once said he'd spin off Starlink from SpaceX and take it public once the business stabilized, that no longer seems to be the plan.

In December 2025, SpaceX kicked off a secondary share sale that would value it at $800 billion. At the same time, it confirmed it was exploring an IPO in 2026 — a move that could push its valuation as high as $1.5 trillion.

If that happens, Starlink will almost certainly remain a subsidiary of SpaceX — at least for the foreseeable future.*

*Starlink will probably remain a subsidiary of SpaceX regardless of whether it goes public. More on why this is below.

Still, there are ways for investors to buy Starlink stock in 2026, before its IPO.

Can you buy Starlink stock?

Starlink is a wholly-owned subsidiary of SpaceX, which is a private company. There is no SpaceX or Starlink stock symbol, and you can't buy it in your brokerage account.

It's impossible for retail investors to buy Starlink stock before its IPO, but there are ways for both accredited investors and retail investors to invest in Starlink via an investment in SpaceX its parent company.

Here's how.

How to buy Starlink stock in 2026

If you're an accredited investor (individuals with an annual income of more than $200,000 or $300,000 for married couples, or a net worth exceeding $1,000,000 excluding your primary residence), check out the first section below.

If you're a retail investor, skip down to the 2nd section.

1. How to buy Starlink stock as an accredited investor

Starlink is a subsidiary of SpaceX, so you will need to invest in SpaceX to get exposure to Starlink.

Accredited investors can invest in SpaceX directly through Hiive, an investment platform for private, pre-IPO companies.

As of the time of this writing, SpaceX is one of the most active securities on Hiive. There are 58 unique listings of its stock:

Hiive allows you to buy shares directly from sellers, which may include company employees, founders, venture capital funds, hedge funds, or angel investors.

Investors can place bids and negotiate with sellers or accept their asking prices. Additionally, there are no fees for investors.

Check out the listings of SpaceX available on Hiive, including asking prices and shares available:

2. How to invest in Starlink as a retail investor

While there's no way to invest directly in Starlink or SpaceX right now, there are a few options for gaining indirect exposure to it.

a) Invest in the ARK Venture Fund

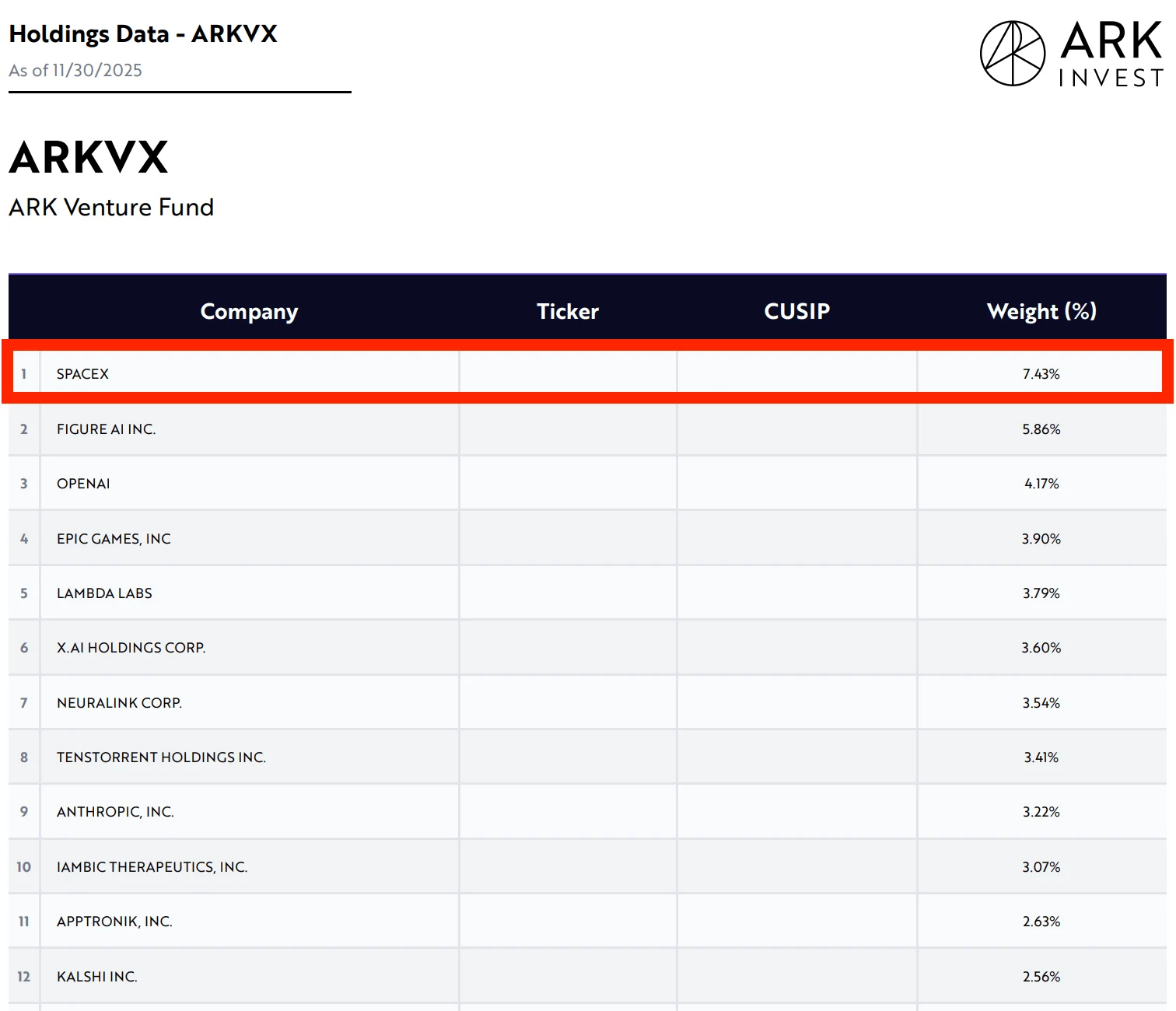

At 7.43%, SpaceX is currently the largest holding in Cathie Wood's ARK Venture Fund.

The fund invests in what they believe are the most innovative companies in the world. Along with SpaceX, its top 10 holdings include Figure AI, Neuralink, OpenAI, xAI, Anthropic, and Groq.

While the ARK Venture Fund can invest in both public and private companies, 14 of its top 15 holdings are private companies. If you're interested in private tech investing, the ARK Venture Fund is one of the best ways to access the market.

The fund is available to both retail and accredited investors; however, due to certain regulations, retail investors have to invest in the fund via SoFi. Accredited investors can invest via the ARK website.

While the ARK Venture Fund is the best way for retail investors to gain exposure to Starlink/SpaceX, there are two other ways to gain indirect exposure to the company.

b) Invest in Starlink's investors

Two public companies have participated in SpaceX's previous funding rounds and own stakes in SpaceX and Starlink: Alphabet (Google) and Bank of America.

Alphabet (GOOGL) first invested in SpaceX in January 2015, committing $900 million at a $12 billion valuation. It invested a second time in December 2021, at a valuation of $100 billion.

Together, these investments are worth about $28 billion*, roughly 7% of SpaceX and Starlink.

*Since its newest share sale hasn't been completed, these figures are based on its previous $400 billion valuation.

While this is a sizable stake, Alphabet is a $3.9 trillion company, so its $28 billion stake in SpaceX represents less than 1% of its total business.

So if you don't like the other 99% of the business, I wouldn't recommend buying shares for Starlink exposure alone.

Bank of America (BAC) invested $250 million at a valuation of ~$30 billion in November 2018. At today's valuation, this investment is likely worth around $3.3 billion.

Again, this stake in SpaceX and Starlink represents just 0.85% of Bank of America's total market capitalization, so I wouldn't recommend buying shares solely for its investment in Starlink.

If you like Google and/or Bank of America and want to invest in their stock anyway, getting exposure to Starlink could be viewed as an added bonus.

c) Invest in Starlink's partners and competitors

SpaceX, like all Musk-run companies, develops the vast majority of its parts internally.

There are, however, a handful of companies with whom SpaceX does business that may directly benefit from any future success the company has:

That said, I'm not sure which of these companies (if any) are supplying parts for Starlink, specifically.

The most direct Starlink partnership came in 2021 when Shift4 Payments (FOUR) announced a 5-year partnership with Starlink to process its customer payments.

You could also consider investing in Starlink's publicly traded competitors.

While Starlink is the world's first and largest satellite-based broadband provider, there are several other players in the space. Here are a few of the biggest ones:

- Kuiper Systems: This Amazon (AMZN) project aims to compete directly with Starlink. The project successfully launched its first satellites into Earth's low orbit in April 2025 and then launched another batch in June 2025. Kuiper was first announced in 2019 and plans to launch a total of 3,236 satellites.

-

HughesNet: This satellite internet provider is owned by EchoStar (SATS). However, due to inferior technology, its subscriber base has shrunk to less than 1 million — though the subsidiary still accounts for ~10% of EchoStar's $15 billion in annual revenue.

-

Viasat: Viasat (VSAT), a competitor of HughesNet, has a subscriber base of 257,000 customers — a big decline from the 603,000 subscribers it had in September 2020 before Starlink became widely available. After peaking at $5.3 billion in 2019, Viasat's market capitalization fell to under $2 billion before rebounding in mid-2025 due to growth in its Defense and Advanced Technologies segment.

-

Telesat: Telesat (TSAT) provides satellite internet services to corporate, telecom, and government customers and generates around $3359 million per year. It will also likely have a hard time competing with Starlink.

Beyond Starlink and Project Kuiper, OneWeb (a private company) is the only other real player in the LEO (low-earth orbit) satellite industry.

Does SpaceX own Starlink?

Yes, SpaceX currently owns and operates Starlink.

In September 2020, Elon Musk tweeted that he planned to spin Starlink out of SpaceX and take it public once its revenue growth was smooth and predictable. But Starlink is well past that milestone.

Starlink was projecting $11.8 billion in 2025 revenue, up 53% from last year and more than eightfold since 2022. Analysts also estimate it generated roughly $3.8 billion in EBITDA in 2024.

Given those numbers, it's clear Starlink could stand on its own. But its outsized role in SpaceX's business may be what's keeping it in-house.

SpaceX was expected to generate $15.5 billion in revenue in 2025, and more than 75% of that will come from Starlink. Spinning it out would strip SpaceX of its biggest growth engine and most valuable asset.

In December 2025, the company began a secondary share sale valuing it at $800 billion. Days later, it announced plans for a 2026 IPO at a potential valuation of up to $1.5 trillion. Numbers like that only make sense if Starlink stays in the fold.

When SpaceX goes public, you'll need a brokerage account to buy shares.

If you don't have a brokerage account, we recommend Public. On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

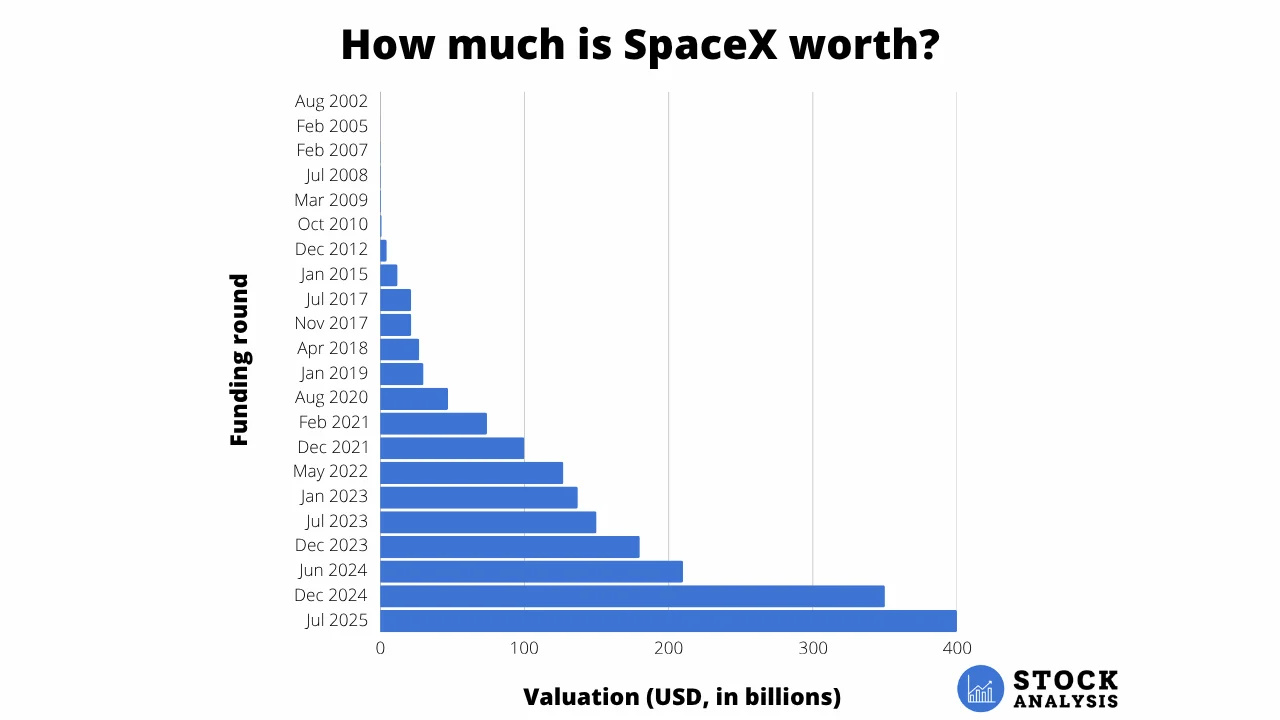

SpaceX valuation chart

Starlink is currently a subsidiary of SpaceX and, according to Musk, may be responsible for up to half of SpaceX's valuation.

In December 2025, SpaceX launched a secondary share sale — which gives current shareholders the option to sell some or all of their shares — which would value the company at $800 billion. This was double the $400 billion it received in a similar transaction just five months earlier.

Here's how SpaceX's valuation has changed over time (not including its latest share sale):

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)