How to Buy Turo Stock Before Its IPO

Turo is a car-sharing marketplace where users can rent cars from owners at daily rates. It's like Airbnb, but for cars.

For renters, it's cheaper, easier, and more fun than using a traditional car rental agency. For car owners, it's a great way to make some extra income or launch an entire car-renting business.

Better yet? For Turo, it's a capital-light and cash-rich business model. And it's working really well.

Turo operates in 16,000+ cities, has over 3.5 million users, and has more than 340,000 active vehicles listed on its platform. But what about financial results?

Turo generated $958 million in revenue in 2024 and was expected to cross $1 billion in 2025. It's also been profitable for the last four years.

Turo has flirted with going public more than once*, but as of now, it's still a private company.

*Most recently, Turo was preparing to IPO in 2025 but withdrew those plans in February due to soft IPO conditions.

However, there's still a way to invest in it right now, even before it goes public.

Can you buy Turo stock?

Turo is still a private company, which means it is not publicly traded, and you can't buy it in your brokerage account (yet).

The company has been eyeing an IPO since 2021 and has already locked down the ticker symbol TURO.

It's made several attempts over the years, most recently in February 2025, when it scrapped its public listing just weeks before the IPO date. Like many late-stage startups, it's holding off until market conditions are right.

With about $1 billion in annual revenue and four straight years of profitability, Turo isn't in any rush. It's in a strong position to wait until investor sentiment improves and it can command the valuation it's looking for.

While 2025 has seen some signs of life in the IPO market, Turo hasn't set a new date. There's no telling when it'll officially go public.

But there is a way for accredited investors to buy its stock today.

How to buy Turo stock

If you qualify as an accredited investor (individuals with annual income of more than $200,000 or $300,000 for married couples, or a net worth exceeding $1,000,000 excluding your primary residence), you can invest directly in Turo on Hiive.

If you're a retail investor, there are a few other ways to gain exposure to Turo. Those are covered in the second section below.

How to buy Turo stock as an accredited investor

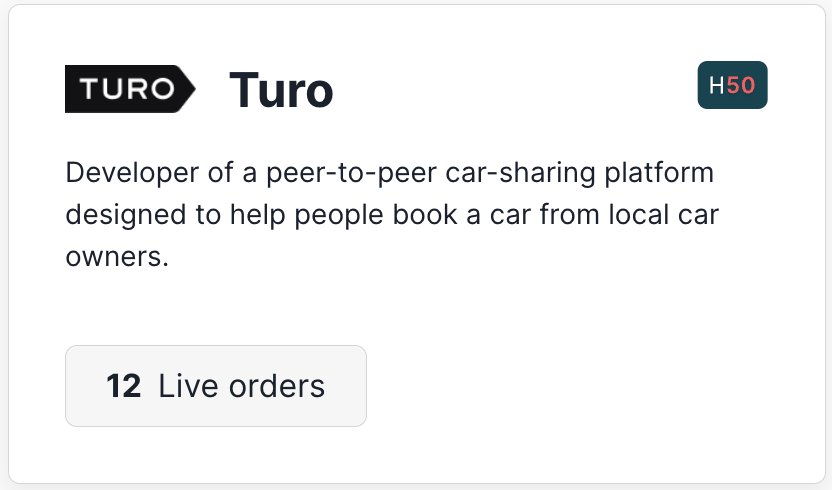

Hiive is a secondary marketplace that allows accredited investors to buy shares of high-growth, VC-backed startups and private companies, including Turo:

As of December 2025, there are 12 unique listings (with varying prices and volume offered) of Turo stock available on Hiive. The sellers may be employees, venture capitalists, or angel investors.

On Hiive, buyers can either accept the asking prices and volume offered or place bids and negotiate directly with the sellers.

Register for Hiive and start investing in private companies today:

How to invest in Turo as a retail investor

Buying Turo via Hiive is only possible for accredited investors. Here are a few ways for retail investors to get exposure to Turo or the car-sharing industry in general.

1. Invest in Turo's investors & partners

Most of Turo's 32 investors are private equity and venture capital firms, but there have been a few investments from publicly traded companies.

Google Ventures (GOOGL), Mercedes-Benz (MBGYY), American Express Ventures (AXP), and IAC (IAC) have all invested in Turo.

Technically, buying any of these companies will give you indirect exposure to Turo. However, each of these companies' stakes in Turo is likely very small relative to the size of their total business.

For example, even if Google invested $100 million, that investment would represent just 0.002% of Google's $3.8 trillion business. If you're buying Google because of its stake in Turo, make sure you like the other 99.998% of its business, too.

Retail investors are likely better off just waiting for the Turo IPO.

2. Publicly traded competitors

You may also be interested in investing in one of Turo's competitors, though none have the same business model as Turo.

- Avis Budget Group (CAR) provides car and truck rental services in the U.S. and abroad. While Turo is aiming to disrupt this industry, Avis is still a massive company. Plus, Avis owns the car-sharing app ZipCar, which resembles Turo except that the company owns all of the vehicles.

- Uber Technologies (UBER) is a ride-hailing company with a $173 billion market capitalization. In June 2023, Uber launched Uber Carshare, a direct competitor to Turo. However, despite having the existing user base, the infrastructure, and plenty of capital, Uber Carshare was closed in September 2024.

Who owns Turo company stock?

So far, Turo has raised $523 million from 32 investors over 16 funding rounds dating back to 2011.

The vast majority of these investors are private equity and venture capital firms, along with a few venture arms of public companies (like Google, Mercedes, American Express, and IAC).

Turo was originally founded as RelayRides in June 2010 by Shelby Clark. He started the company with his Harvard Business School classmates Nabeel Al-Kady and Tara Reeves.

Andre Haddad took over as CEO of the startup and moved it from Boston to San Francisco in 2011. In 2015, he rebranded RelayRides to Turo. Haddad still acts as the company CEO.

Although the exact ownership is unknown, it's safe to assume the original founders, Haddad, and other executives and employees all own some of the company.

Turo financials

The company has been providing quarterly updates on its performance since filing its S-1 in 2022.

From these documents, we know that Turo:

- Generated revenue of $958 million in 2024, up 9% YoY

- Generated revenue of $879.6 million in 2023, up 18% YoY

- Generated revenue of $746.6 million in 2022, up 59% YoY

- Generated revenue of $469 million in 2021

Additionally, Turo has been profitable (EBITDA positive) since 2022.

How to buy the Turo IPO

Turo first hinted at an IPO in 2021 when it made a private filing followed by a public S-1 in early 2022.

Turo has since amended its S-1 nine times, repeatedly pushing back its IPO plans until it determines the timing is right. As mentioned above, Turo's profitability is allowing it to wait until the market conditions are right to make its public debut.

If you want to invest in it when it finally does go public, then you will need a brokerage account.

If you don't have a brokerage account, you can look into Public. You can invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and more, all from the same login.

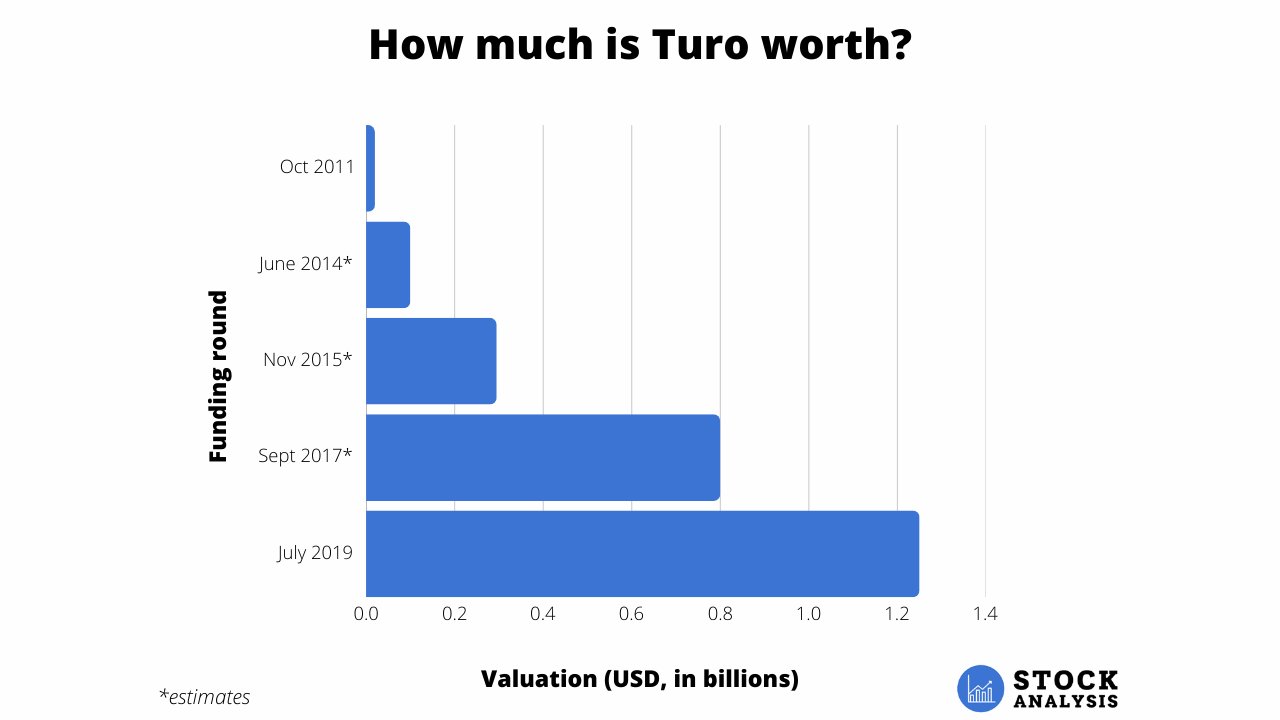

Turo valuation chart

Turo's most recent fundraising round valued the company at $1.25 billion, but that was back in July 2019. The company generated $141.7 million in revenue that year, indicating it was valued at 8.8x sales.

Based on recent trades on secondary platforms like Hiive and Forge, Turo is currently valued somewhere between $800 million and $1.3 billion.

Here's a look at how Turo's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)

.png)