6 Ways to Invest in OpenAI (ChatGPT)

OpenAI just made history. Again.

In March 2025, the artificial intelligence lab raised $40 billion in funding, the largest private tech funding round ever. The money was raised at a $300 billion valuation, making it the second most valuable private company in the world (behind only SpaceX).

At the time of the round, OpenAI said ChatGPT had 500 million weekly users, up from 400 million in February 2025, and that it expects revenue will triple to $12.7 billion by the end of this year.

This fundraising came a few months after President Donald Trump's announcement of the Stargate Project, an unprecedented joint venture between OpenAI, Oracle, and SoftBank that may include up to $500 billion of investments in AI infrastructure.

How it got here

In November 2022, OpenAI released ChatGPT, an AI chatbot based on a large language model (LLM) that generates detailed and human-like responses to user queries.

ChatGPT went viral, reaching 100 million users in just two months, the fastest product to ever reach the milestone (at that time).

OpenAI's launch of ChatGPT — and its associated API — has ushered in a new wave of development in artificial intelligence all over the world.

Regardless of where AI goes from here, it's hard to imagine OpenAI won't play a prominent role — which is probably why you're wondering how to invest in it.

Here's how.

Can you buy OpenAI stock?

OpenAI is not a public company, which means there is no OpenAI stock symbol and it cannot be bought in your typical brokerage.

Furthermore, based on its mission, revenue trajectory, and the number of venture capital funds that want to own a stake, it may not ever need to go public.

Fortunately, you don't need to wait for its IPO to gain exposure to OpenAI and ChatGPT.

Here are six ways to invest in OpenAI stock today, while it's still a private company.

1. Buy shares from current shareholders

Hiive is a secondary marketplace where accredited investors can buy shares of private, VC-backed startups.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your primary residence.

- Be a qualifying financial professional with a Series 7, 65, or 82 license.

SpaceX, Figure AI, and Cerebras Systems are a few of the most active companies on Hiive. In all, there are more than 2,000 private companies listed on the site.

Hiive works by connecting current shareholders (typically employees, venture capital firms, or angel investors) to accredited investors. After a buyer and seller agree on a price, Hiive facilitates the transaction.

However, because of its legal structure, OpenAI's shares cannot be purchased directly. Instead, external investors must invest through a SPV, a more flexible fundraising structure that's relatively common in private equity.

For this reason, Hiive has a placeholder for OpenAI's shares but does not show any shares available for purchase on its platform. While it doesn't show anything publicly, I would be surprised if it didn't offer an alternate route for investing in the company (such as a SPV).

You can see what's available by registering for free with the button below:

2. Invest via the Fundrise Innovation Fund

The Fundrise Innovation Fund is a venture capital fund available to retail investors that invests in private technology companies.

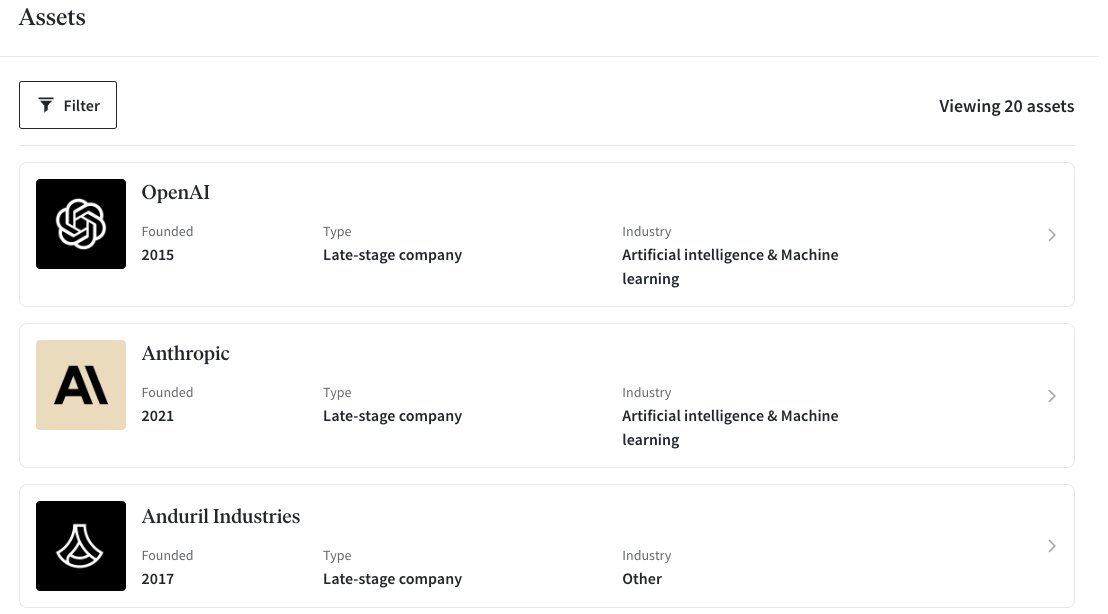

The fund's investment thesis is centered around a few themes: Data infrastructure, real estate technology, machine learning, and artificial intelligence. It currently owns stakes in 16 companies, including Anthropic, Databricks, Service Titan, Ramp, and OpenAI.

While OpenAI isn't listed publicly as one of the fund's holdings, it does show as a holding once you register and become an investor in the fund (see the image below from my investor account).

The fund has exposure to OpenAI through a special-purpose vehicle (SPV), which may prevent it from advertising the position to non-investors.

The Innovation Fund is open to all U.S. residents, has an annual management fee of 1.85%, and a minimum investment of just $10.

See my article for more information on the Fundrise Innovation Fund.

3. Invest via the ARK Venture Fund

The ARK Venture Fund is an actively managed fund that invests based on its theme of "disruptive innovation."

The fund invests in both public and private companies, though almost all of the top 10 holdings are private companies. At the time of this writing, OpenAI is the 7th largest position at 2.81%:

Other companies in the fund's top 10 include SpaceX, Anthropic, Lambda Labs, and Epic Games.

The fund is available to all investors and has a 2.90% annual management fee. You can learn more about the fund and how to invest in it via the ARK website.

4. Invest indirectly (via Microsoft)

You may also want to invest indirectly through Microsoft (MSFT), which has invested in OpenAI on multiple occasions and has a unique relationship with the lab.

- 2019: Microsoft made its first major investment in OpenAI, committing $1 billion.

- 2021: Microsoft quietly expanded the partnership with undisclosed additional investments and deeper integrations, including offering OpenAI's models through Azure OpenAI Service.

- 2023: Microsoft invested an additional $10 billion in a non-traditional deal which included:

- Funding OpenAI's compute needs on Azure

- Securing a 49% share of OpenAI's profits up to an undisclosed cap

- Having no control over OpenAI's governance

In addition to its investment stake, Microsoft is leverage OpenAI's technology by embedding OpenAI's models into its own products and services, including:

- Copilot: Microsoft integrated OpenAI's GPT models into Copilot tools across Word, Excel, Outlook, PowerPoint, and GitHub, transforming all of Microsoft's most popular apps into AI-enabled platforms.

- Azure OpenAI Service: Microsoft offers commercial access to OpenAI's models through Azure, charging businesses for cloud-based API usage.

- Bing and Edge: Microsoft's search engines are also powered by OpenAI's technology, which improves search results and answering user queries faster.

These product integrations have allowed Microsoft to charge premium prices for enhanced versions of its Office 365, GitHub, and Azure services, positioning itself as a real leader in personal and enterprise AI.

Because of the complexity of its arrangement, the equity portion of Microsoft's stake in OpenAI is not clearly defined, even in Microsoft's SEC filings.

Given that it's equity stake is not disclosed in its public filings, and that Microsoft has never acknowledged how much of OpenAI's equity it owns, it's safe to assume it owns a relatively small percentage, say 5-10% — much lower than the 49% many people incorrectly assume it owns.*

For Microsoft not to be required to disclose its equity stake, the stake must be small enough to be considered "immaterial."

Based on these numbers, its equity stake could be worth as much as $30 billion, or a little more than 1% of its $2.9 trillion market capitalization.

And since Microsoft (MSFT) can be purchased in any stock brokerage account, buying its stock is the simplest way for investors to gain exposure to OpenAI.

Don't have a brokerage account?

If you don't have a brokerage account, check out our overview of the 7 best brokerage accounts in 2025.

5. Invest in leading AI companies

Another option is to invest in OpenAI's suppliers. If OpenAI is successful and continues to grow, it will need to order more and more hardware.

The two companies best positioned for this are are NVIDIA, which sells the best AI chips, and TSMC, which runs the factories used to make the chips.

NVIDIA

Likely the biggest publicly traded winner in AI so far is NVIDIA (NVDA).

NVIDIA dominates the AI hardware market, supplying almost all of the most powerful GPUs that train and run large AI models.

The company's revenue has exploded alongside the demand for AI, rising from just over $10 billion in FY20 to more than $130 billion in FY24.

If you're bullish on the future of AI, like OpenAI, it's hard to imagine a world where NVIDIA isn't much bigger in the future than it is right now.

NVIDIA also has an investment in OpenAI, having participated in the October 2024 round that valued the company at $157 billion. It invested via convertible debt, however, and the exact terms are unknown.

Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC (TSM) manufactures the advanced chips designed by companies like NVIDIA, giving it a critical role as the world's leading producer of the semiconductors powering AI infrastructure.

If the demand for AI computing continues to grow, then TSMC is likely to be one of the main beneficiaries.

More companies with AI exposure

Here are a few other tech companies with exposure to AI:

- Alphabet (GOOG, GOOGL): Google has invested heavily in AI for years and may be the biggest beneficiary from AI-powered search. Their Gemini (formerly Bard) chatbot is also one of the biggest competitors to ChatGPT, plus the Google Cloud Platform will likely be running a lot of AI applications in the future.

- Amazon (AMZN): Amazon runs Amazon Web Services (AWS), which is the world's biggest cloud computing provider. A lot of future AI computing is likely to be run on their servers.

- Meta Platforms (META): Meta's artificial intelligence lab (Meta AI) was launched in 2013. Since that time, Meta has poured billions of dollars into developing generative AI, computer vision, and human speech processing technologies.

There are also other private companies you may be interested in, such as Figure AI, Anthropic, and Scale AI.

6. Invest in exchange-traded funds

Instead of buying an individual stock, you may want to diversify across a broad range of companies focused on similar technology via an ETF:

- Roundhill Generative AI & Technology ETF (CHAT): This ETF invests in companies focused on generative AI, the same technology powering ChatGPT.

- ROBO Global Robotics & Automation ETF (ROBO): This fund buys companies from around the world that are focused on robotics and automation.

- First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT): This is another global fund focusing on artificial intelligence and robotics companies.

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This fund focuses on companies involved in the development and production of robots or AI.

- iShares Exponential Technologies ETF (XT): This iShares fund invests in disruptive information technology companies.

While none of these ETFs own OpenAI, they will give you general exposure to the artificial intelligence industry.

Wait for the OpenAI IPO

The only way for retail investors to buy shares of OpenAI directly is if it went public. But, at this point, it's unknown if the lab will ever have an IPO.

While the lab was set up as a non-profit, those plans went out the window once it began taking investments from for-profit companies (like Microsoft) with commercial interest in its products.

It now has a rather ambiguous structure: OpenAI Global is a for-profit entity which is governed by OpenAI Inc, a non-profit entity.

This structure allows OpenAI to attract capital and talent and compete with leading for-profit tech companies, while also adhering to its mission “to ensure that artificial general intelligence benefits all of humanity.”

The $300-billion non-profit is on track to generate $12.7 billion of revenue in 2025.

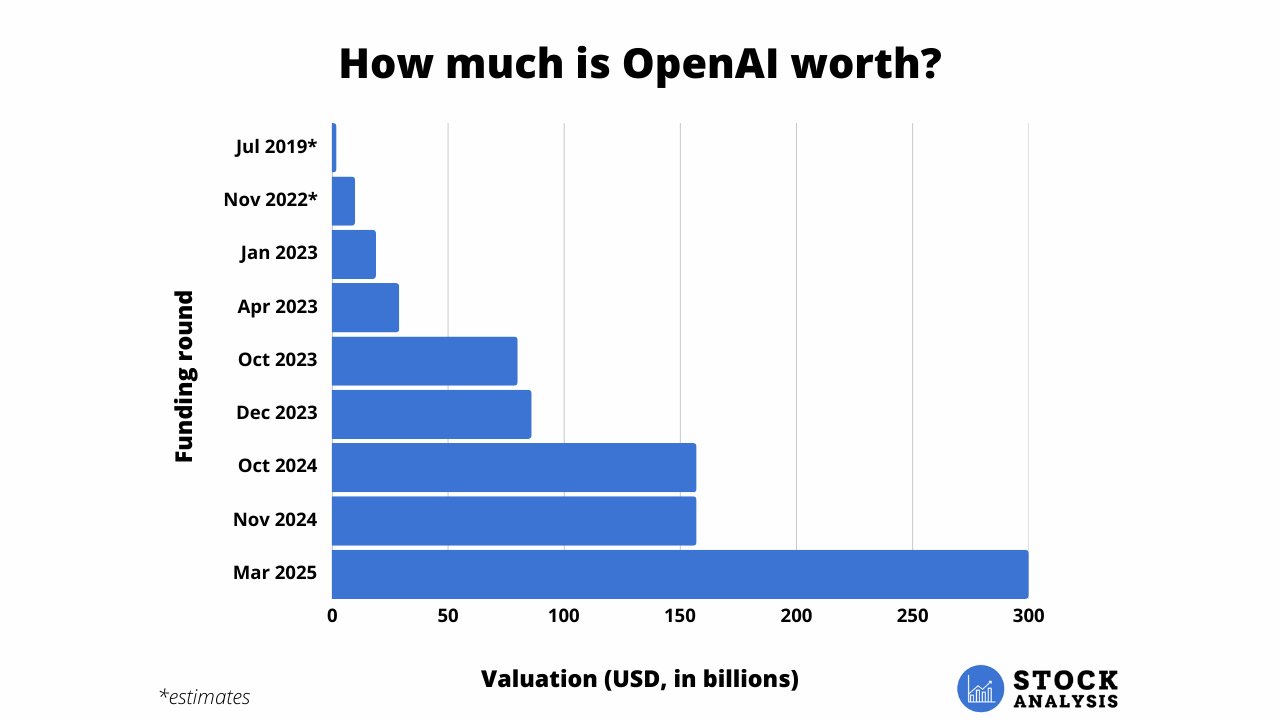

How much is OpenAI worth?

In March 2025, OpenAI raised $40 billion at a valuation of $300 billion, nearly double the $157 billion valuation it received in November 2024.

Here's a look at OpenAI's valuation history:

Its $300 billion valuation makes it the second most valuable private company in the world, behind only SpaceX.

Frequently asked questions

Below are a few more questions often asked about investing in OpenAI.

Who owns OpenAI stock?

OpenAI began with an initial seed funding of $50 million from Elon Musk, who was a co-founder of the company before leaving in 2018.

The lab has raised a total of $61.9 billion from 34 investors over 10 funding rounds.

Most recently, SoftBank, Microsoft, Coatue, Altimeter and Thrive Capital invested $40 billion at a valuation of $300 billion in March 2025.

Does Elon Musk own a stake in OpenAI?

While Elon Musk was a co-founder and originally invested $50 million to start the lab, he sold his stake to Microsoft and left the company in 2018.

Musk had reportedly committed $1 billion in support before pulling out over disagreements about the speed of OpenAI's advancements.

Since then, he has repeatedly criticized the lab for not placing enough emphasis on safe AI development and has recently filed a lawsuit claiming CEO Sam Altman breached their contract by abandoning their original mission to focus on profits.

In April 2023, Musk incorporated xAI, a rival AI firm that recently acquired X (formerly Twitter) and is valued at $113 billion.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. StockAnalysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. StockAnalysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)