How to Buy Waymo Stock Before Its IPO

Waymo started in 2009 as Google's self-driving car project. It later spun out as an independent company, and today, it's the clear leader in the development of fully autonomous vehicles (AVs).

Users in Los Angeles, San Francisco, Phoenix, Austin, Atlanta, and Miami* can use the Waymo app to hail autonomous taxi rides. It's like Uber or Lyft, minus the driver.

*Waymo is currently mapping 20 additional cities, including Tokyo and London. It plans to launch in at least six more cities in 2026.

In February 2026, Waymo raised $16 billion at a $126 billion valuation, nearly triple the $45 billion valuation it received in its previous round (October 2024).

The raise comes on the heels of record growth. Waymo's fleet provided 15 million rides in 2025, tripling total lifetime rides to 20 million — a figure which shows it has transitioned from proving a concept to scaling a commercial reality.

While ride-hailing is its most visible use case, the same self-driving system could power public buses, freight trucks, and even personal vehicles.

For these reasons, the autonomous vehicle market is projected to reach $614.9 billion by 2030, most of which will likely flow to just a handful of dominant players.

Given its market-leading position, it's hard to imagine a scenario where Waymo isn't one of them. And for early investors, the returns could be huge.

Here's how to buy Waymo stock in 2026, before it goes public.

Can you buy Waymo stock?

Waymo is a private company and has not indicated any plans to IPO in the near future. There is no Waymo stock symbol, and you can't buy it in your brokerage account.

Waymo has access to plenty of funding (more on that below) and has a backlog of companies that want to partner with it. At this point, there's no need for it to turn to the public markets.

But if you don't want to wait for its IPO to invest, there is a way you can invest in Waymo stock today.

How to buy Waymo stock in 2026

There are multiple ways to invest in Waymo before an IPO, though it depends on which type of investor you are.

Accredited investors can invest directly in Waymo via a platform called Hiive.

If you don't qualify as an accredited investor, there are a few other ways to invest in Waymo and the AV industry in general. These are covered in the next chapter.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is an investment platform that allows accredited investors to buy shares of high-growth, VC-backed startups and private companies, including Waymo:

There are 33 live orders of Waymo stock currently available on Hiive.

Employees, founders, venture capital and hedge funds, angel investors — anyone with shares to sell — can create a listing on Hiive. Investors can place bids and negotiate with sellers or just accept their asking prices.

Sign up to see the Waymo listings (number of shares and asking prices) available on Hiive:

Other ways to get exposure to Waymo

If you're not an accredited investor, here are a few investment ideas that can give you exposure to Waymo or the autonomous vehicle industry in general.

1. Invest in Waymo's investors

Alphabet (Google)

The most obvious way for a retail investor to invest in Waymo is via an investment in Alphabet (GOOGL), Google's parent company.

Based on my estimates (math in a later chapter), Google likely owns ~75% of Waymo. At a $126 billion valuation, that stake is worth $94.5 billion, which makes up about 2.3% of Google's $4.1 trillion business.

While this is a relatively inconsequential stake right now, if Waymo continues to be the market leader as the AV industry matures, it could grow into a major source of revenue for Google.

AutoNation & T. Rowe Price

AutoNation (AN) and T. Rowe Price (TROW) have also invested in Waymo, though the exact size of their stakes is unknown.

Given their $7.6 and $22.6 billion market caps, respectively, their stakes are unlikely to have much of an impact on their stock prices.

2. Invest in publicly traded competitors

Tesla

Waymo's closest rival in the autonomous driving race is Tesla (TSLA), which first introduced its Autopilot system in 2014.

Tesla vehicles have long been equipped with the hardware and software needed for full self-driving, but have yet to receive broad regulatory approval for autonomous driving.

CEO Elon Musk has been promising robotaxis for nearly a decade, and in June 2025, Tesla finally launched a pilot program in Austin. However, even after several months, the program still requires safety drivers aboard each vehicle.

Despite ongoing setbacks, Tesla's massive data advantage — built from billions of real-world driving miles — and its manufacturing scale could allow it to scale quickly once it solves full self-driving.

Uber

Behind Tesla, Uber (UBER) is probably the next most likely public company to succeed in providing robotaxi services.

After investing billions of dollars in developing its own self-driving tech, Uber abandoned those efforts and pivoted to partnerships.

Today, Uber manages Waymo's operations in Austin and Atlanta, and also allows riders in Phoenix to request Waymos directly through the Uber app.

Uber is also working to develop its own AVs. Beginning in 2026, Uber plans to launch its own robotaxi service in San Francisco using Lucid Motors' Gravity SUVs equipped with Nuro's self-driving system.

To support the rollout, Uber has invested $300 million in Lucid and made a separate commitment to purchase at least 20,000 Gravity SUVs.

The three companies are currently building a test fleet of about 100 vehicles. Lucid (LCID) has begun delivering units to Nuro, which is integrating and validating its autonomous system before deployment.

Once ready, the fleet will be owned and operated by Uber.

What does Waymo actually do?

Waymo was founded in 2009 as the Google Self-Driving Car Project.

The company designs and builds the hardware and software required to make autonomous vehicles. The hardware includes sensors, cameras, radar, and more. You can read more about its technology here.

Unlike Tesla, Waymo does not plan to build its own vehicles and is instead partnering with car manufacturers (like Jaguar) so it can focus exclusively on AV technology.

In addition to the hardware and software involved, Waymo must create the infrastructure required to operate in a new city. This involves mapping out the territory, such as intersections, turn lanes, curbs, crosswalks, and more.

While the technology can operate solely from its real-time sensors, this added layer of infrastructure data makes each route much safer.

Any Waymo vehicle can use its sensors to plot a new territory and upload the plot to its network to be used by all other Waymo vehicles.

Does Google own Waymo?

Waymo was launched by Google in 2009. It was re-branded as Waymo in 2016 but remained a self-contained project wholly owned by Google until 2020.

That changed in March 2020 when Waymo raised $2.25 billion at a valuation of $30 billion. This implies Google sold about 7.5% of its stake in Waymo, leaving it with 92.5% ownership.

Waymo raised an additional $750 million in May of 2020 and another $2.5 billion in June of 2021, though no valuation figures were released.

If we assume a $30 billion valuation at both of these rounds, that would imply Google sold another 10.8%, reducing its ownership to 81.7%.

Waymo raised another $5.6 billion at a $45 billion valuation in October 2024, then raised $16 billion at a $126 billion valuation in February 2026.

Alphabet was the lead investor in both of these rounds, however, so its stake was likely diluted to ~75%.

In addition to Alphabet (Google's parent company), investors include:

- Dragoneer Investment Group

- DST Global

- Sequoia Capital

- Andreessen Horowitz (a16z)

- Bessemer Venture Partners

- Silver Lake

- Tiger Global

- T. Rowe Price (TROW)

- Fidelity

- AutoNation (AN)

Google has another company, Wing, which is an autonomous drone delivery business that uses technology similar to Waymo's. Wing is entirely owned by Google, so the only way to invest in it is by owning Alphabet (GOOGL) stock.

However, you can invest in Zipline stock, Wing's primary competitor, on Hiive.

Waymo IPO latest

Waymo has made no indication of any plans to IPO, so the timeline is unknown at this point.

However, if you want to invest in it when it does go public, you'll need a brokerage account.

We recommend Public. On Public, you can invest in stocks, ETFs, treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

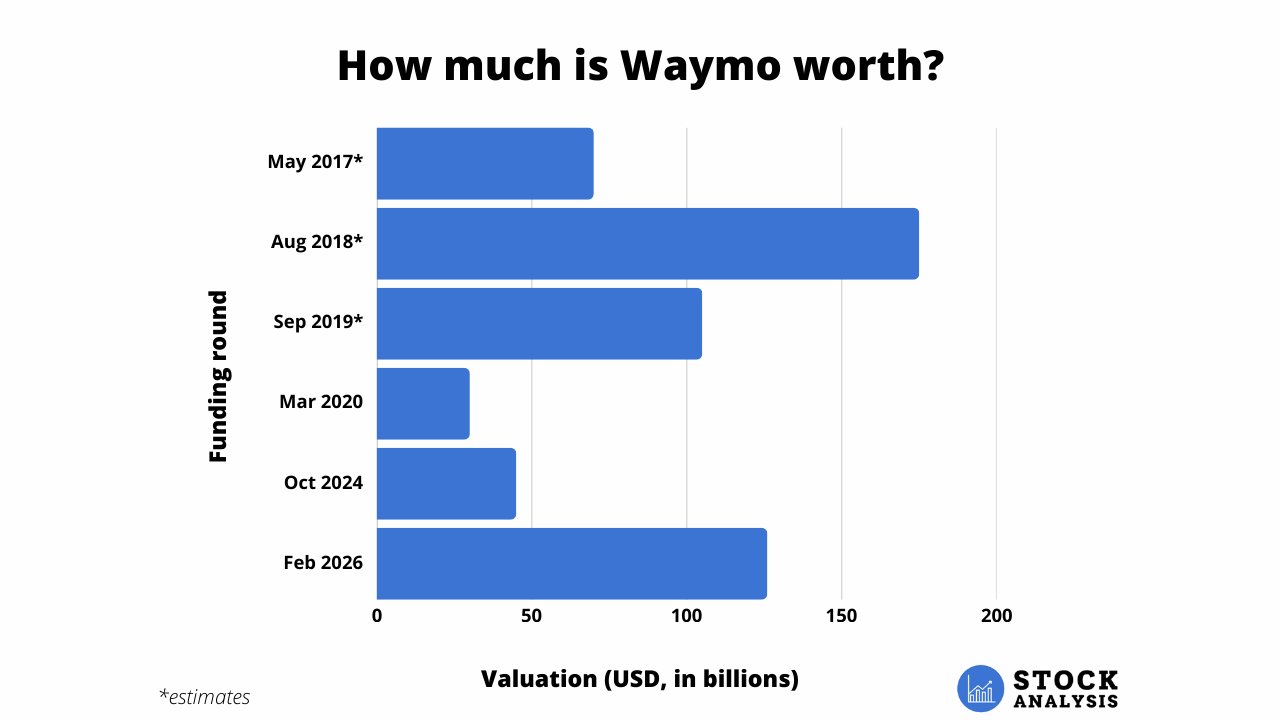

Waymo valuation chart

As mentioned above, Waymo's most recent round came in February 2026. It raised $16 billion at a $126 billion valuation.

The February round was its third external funding round. The other two came in October 2024 (when it was valued at $45 billion) and March 2020 (when it was valued at $30 billion).

Before that, Waymo was solely funded by Alphabet, so no official valuations were disclosed. However, Morgan Stanley has been publishing valuation estimates on Waymo since 2017.

Here's the history of those estimates:

- In May 2017, the firm valued the company at $70 billion.

- In August 2018, they raised that number to $175 billion, despite the project still being pre-revenue.

- In September 2019, due to Waymo's commercialization taking longer than expected, the firm's analysts reduced their estimate by 40% to $105 billion.

Including these figures, here's a look at how Waymo's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)