How to Invest in Chime Stock in 2025

Chime is the largest neobank, a type of fintech company that offers banking services exclusively through a mobile app and website.

By “outsourcing” the banking parts of the business, Chime can focus on what it does best: creating seamless, easy-to-use technology that can be used by millions.

The strategy is working well. Chime provides banking services to 7 million active users (some have mistakenly estimated much higher) and generates $1.5 billion in annual revenue, at a third of the cost of a traditional bank.

But you don't need me to tell you how well it's doing — you just want to know how to invest. Here's how to buy Chime stock in 2025, before its IPO.

How to buy Chime stock as an accredited investor

Chime is still a private company and is likely to remain private until an IPO sometime in 2025 (more on this below).

Until then, there is no Chime stock symbol and no way to buy it on a public exchange. However, if you qualify as an accredited investor, there is a way for you to invest Chime stock now.

On Hiive, accredited investors can buy shares of private, VC-backed startups from current shareholders.

There are over 2,000 pre-IPO companies listed on Hiive, including Chime:

As of the time of this writing, there are 18 listings of Chime stock available on Hiive.

Here's how to invest in Chime stock:

- Go to Hiive's website and click “Sign Up."

- Enter your name and basic details.

- Agree to the terms and click "Sign Up" at the bottom.

- Answer a series of eligibility questions.

- Wait for Hiive to get back to you regarding your account.

- After you receive confirmation, go to the site, log in, and search for “Chime” stock.

- Browse listings and purchase the stock. You can either accept that price and buy directly or make an offer and negotiate directly with the seller.

Learn more about Hiive in our full review, or click the button to get started right away:

Can retail investors buy Chime stock?

Until Chime has its IPO, which is expected to happen in 2025 (see the section below for more details), there will be no way for retail investors to buy its stock.

Chime has raised $2.3 billion from 34 investors, the vast majority of which are private equity and venture capital firms.

Some of the firms that led Chime's funding rounds include Sequoia Capital, General Atlantic, Tiger Global, and Dragoneer Investment Group.

SoftBank (SFTBY) is also an investor and participated in Chime's August 2021 round, which raised $750 million at a $25 billion valuation.

Technically, by buying SoftBank stock, you would have indirect exposure to Chime. That exposure, however, would be extremely diluted.

Even if SoftBank had invested $500 million of the $750 million raised in the round, its Chime stake would represent just 0.6% of SoftBank's $85 billion market capitalization.

At this point, retail investors are likely better off waiting for Chime's IPO, which is rumored to be just around the corner. More on this below.

You may also be interested in SoFi Technologies (SOFI), a digital-first bank which provides banking, lending, credit cards, and investing services and targets a similar demographic as Chime.

SoFi has been growing quickly (growing revenue at a 51% CAGR over the last 5 years) though is yet to be consistently profitable. It has a market capitalization of $15 billion.

Does Visa have a stake in Chime?

Despite having a Visa (V) logo on all of its cards, Visa does not own a stake in Chime.

Chime's banking partners, The Bancorp Bank and Stride Bank, have licenses with Visa, which allow its cards to be used everywhere Visa debit and credit cards are accepted.

Visa does earn a small fee on each of these transactions, which means it would benefit from Chime growing and issuing new cards.

However, Chime's $8 billion worth of transactions per month is a drop in the bucket for Visa, which processes over $1 trillion worth of transactions every month.

Chime IPO

On March 22, 2024, Bloomberg reported that Chime has plans to go public at some point in 2025. According to the report, Chime had not yet hired an investment bank to handle the offering.

This isn't the first time rumors of Chime's IPO have circulated.

In January 2022, it was reported that Chime had been in discussions with Goldman Sachs (GS) to handle its public offering as early as the following spring.

These plans were later put on hold as the fintech market cooled, and the company was forced to cut 12% of its staff.

Things look like they'll be different this time around. The business is more mature, having grown revenue by 30% YoY to a run rate of $1.5 billion in mid 2024. It also has posted several profitable quarters.

When it does go public, you'll need a brokerage account. If you're looking for one, check out our list of the best brokerage accounts in 2025.

Who founded Chime?

Chime was founded by Chris Britt and Ryan King in San Francisco in 2012. Britt still serves as the company's CEO, while King works in a co-founder role.

Before starting Chime, Britt worked as a Senior Product Leader at Visa for almost four years and as the Chief Product Officer and SVP of Corporate Development at Green Dot, an online-only bank, for nearly five years.

Forbes estimates Britt and King each currently own around 5% of the business.

Getting it right with Chime

Green Dot (GDOT), Britt's previous employer, went public in 2010 at a $1.5 billion valuation.

Today, 14 years later, it has a market capitalization of just $631 million. Britt wants to avoid duplicating this outcome with Chime.

While working at Green Dot, Britt noticed one thing about the company's best customers: they all used direct deposit.

From there, the customers used their debit cards to pay virtually all of their expenses, netting the company 1–2% in interchange fees per transaction.

Direct deposit and interchange fees became the heart of Chime's business model.

Chime requires customers to set up direct deposit to access the bulk of its features, including $200 worth of free overdraft protection and a free credit card.

Another problem with Green Dot, according to Britt, is that it's “the product you get when you're down on your luck.” While Britt still wanted Chime to be a go-to provider for low- and middle-income Americans, they aren't the most profitable customers.

The bulk of people comprising Chime's customer base have incomes ranging from $35,000–$65,000, but it's making a concerted effort to move up-market (incomes up to $100,000).

To make the jump, the company plans to start offering lending services and investment accounts, which will help it compete with traditional banks.

How much is Chime worth?

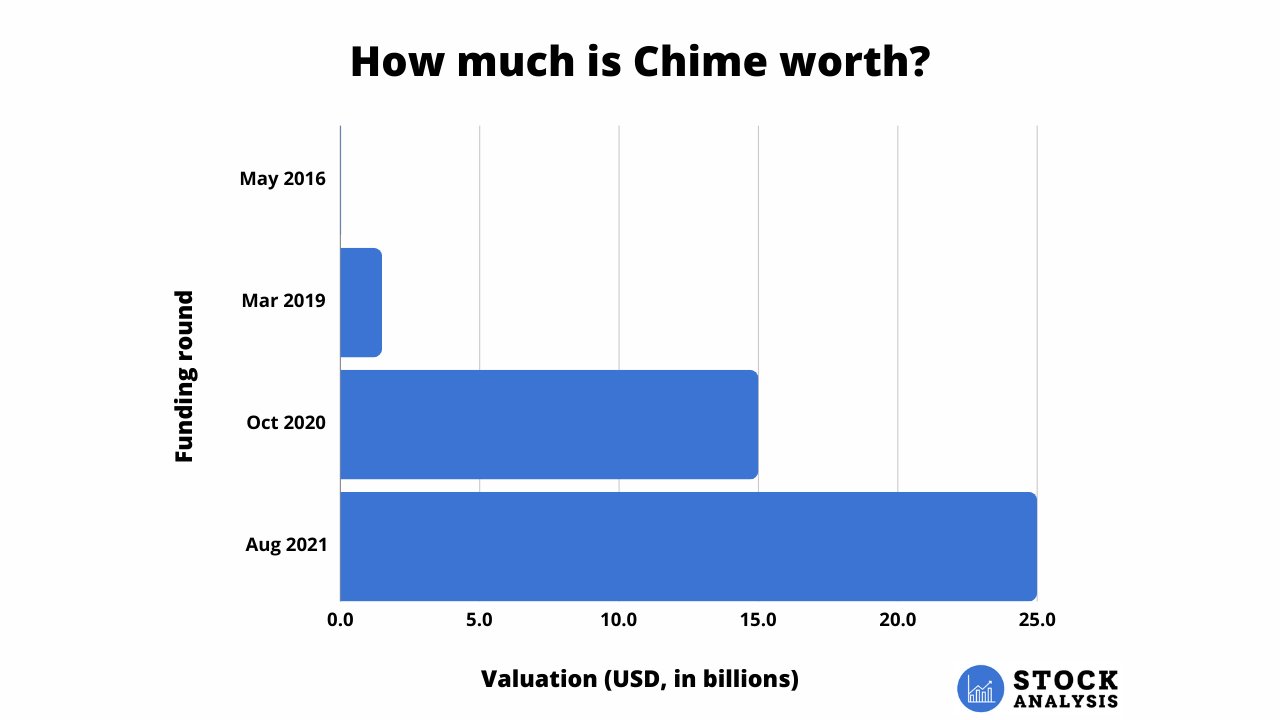

Chime's most recent funding round was in August 2021, which raised $750 million at a $25 billion valuation, as mentioned above.

In the summer of 2021, optimism around fintech companies led to sky-high valuations across the entire sector. It's very unlikely it would earn the same $25 billion valuation if it were to raise money today.

The 2021 round came on the heels of a round in October 2020, which raised funds at a valuation of $15 billion, which itself was up 10x from the $1.5 billion valuation it earned in early 2019.

Here's a look at how its valuation has changed over time:

I would estimate its current valuation is closer to $10 billion.

Accredited investors can see the valuation shares of Chime are trading at on the secondary market by registering for Hiive.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. StockAnalysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. StockAnalysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.