How to Invest in Airtable Stock

Airtable is a cloud-based platform that blends the simplicity of a spreadsheet with the functionality of a database.

With it, teams can organize everything from marketing calendars to product roadmaps and store all of the relevant information in the same place. Think of it as a more flexible, collaborative version of Excel, built for the modern workflow.

That might not sound all that revolutionary, but its impact is massive. Most companies today rely on dozens of tools — CRMs, project trackers, dashboards — that don't talk to each other.

Airtable solves that problem and gives non-technical teams the power to build custom interfaces, apps, and internal tools tailored exactly to how they work.

In fact, more than 500,000 businesses — including 80% of the Fortune 100 — use Airtable's platform.

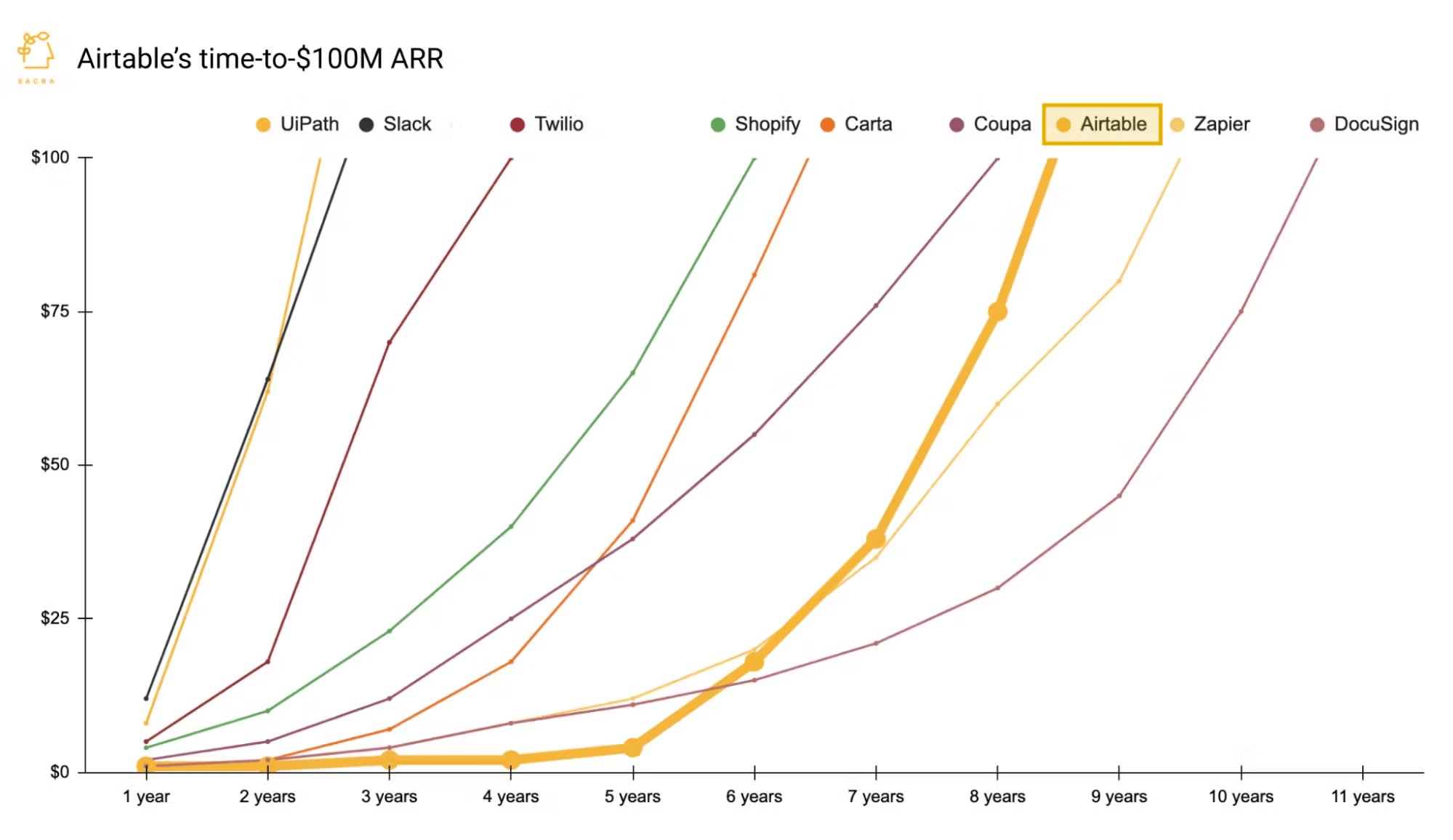

Enterprise software is one of the most lucrative markets in tech, and Airtable carved out its slice quickly. The company passed $100 million in annual recurring revenue (ARR) in just eight years and hit an $11.7 billion valuation in 2021.

Since then, though, the company has been relatively quiet. It hasn't raised new funding since that 2021 round, and it also hasn't made any public moves toward an IPO — though that still seems to be the long-term goal.

If you're wondering how to invest in it before it goes public, here's how.

Can you buy Airtable stock in your brokerage account?

Airtable is a private company. There is no Airtable stock symbol, and you can't buy it in your traditional brokerage account.

In 2022, when asked about going public, CEO Howie Liu said Airtable would "go public once we've shown we can dominate this category.”

But in the years since, the company has kept a low profile.

It went through a series of layoffs in late 2022, framed as a shift toward deeper focus on enterprise clients and tighter financial discipline.

At the time, Liu stated that the company had “more than enough runway to get to profitability and then some,” suggesting there was no urgency to raise more funds or go public.

After that, there was little news until late 2024, when Airtable reported it was growing at 30% per year, had turned cash flow positive, and was eyeing a potential IPO in 2025.

But nothing came of it. Airtable didn't file any paperwork or show serious signs of preparing to go public — though an eventual IPO still appears to be the goal.

Retail investors will have to wait until then to buy Airtable stock. But if you're an accredited investor, you don't have to wait. Here's how to buy Airtable before its IPO.

How to invest in Airtable

The SEC allows accredited investors to invest in what it considers to be “riskier” assets, such as private companies.

Are you an accredited investor?

You only need to meet one of the following criteria to be a qualified investor:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If you're an accredited investor, the next chapter is for you.

If you don't qualify as an accredited investor, skip ahead to the second section for a few ideas on how to gain indirect exposure to Airtable.

1. How to buy Airtable stock as an accredited investor

Shares of Airtable are available for purchase on Hiive, a secondary marketplace platform for accredited investors.

There are more than 3,000 high-growth, VC-backed startups and private companies listed on Hiive, including Airtable:

Each listing on Hiive is created by a unique seller who sets their own asking price and quantity of shares. Sellers may be employees, venture capital firms, or angel investors.

As a buyer, you can either accept the listing price as listed or place a bid and negotiate directly with the sellers. After registering, you can see the complete set of active bids and asks.

Hit the button below to register and view the current offerings for Airtable:

2. How to buy Airtable stock as a retail investor

Since Hiive is only available to accredited investors, there is no way for retail investors to buy shares of Airtable stock ahead of its IPO.

However, there are a few roundabout ways to get exposure to it.

Invest in its publicly traded investors

Airtable has raised $1.35 billion from 52 outside investors.

The bulk of these investors are private equity firms or venture capitalists, but there are several publicly traded companies that own stakes in Airtable. By buying these companies, individual investors can gain indirect exposure to Airtable.

Both Salesforce (CRM) and Franklin Resources (BEN) participated in Airtable's Series F funding round in December 2021, which raised $735 million at an $11.7 billion valuation.

However, each company likely invested $200 million at most, in which case these stakes make up very small percentages of Salesforce's (0.08% of $238 billion) and Franklin Resources's (1.6% of $12.3 billion) market capitalizations.

Invest in Airtable's competitors

Perhaps a more appealing opportunity for retail investors is investing in Airtable's publicly traded competitors.

- Asana (ASAN): Asana is a work management platform that helps organizations orchestrate daily tasks and larger projects. The company generated $774 million in revenue in the last 12 months and has a market capitalization of $3.3 billion.

- Atlassian (TEAM): Atlassian develops enterprise software to help organizations plan, organize, track, and manage their daily work and projects. Its best-known applications are Jira, Confluence, and Trello. It generated $5.5 billion in revenue in the last year and is worth $42 billion.

- Monday.com (MNDY): Monday offers product solutions for work management, sales CRM, and related business verticals. Its $1.2 billion in TTM revenue has earned a valuation of $7.8 billion.

Airtable's revenue

Airtable reached $100 million in annual recurring revenue (ARR) in just over eight years, at the time making it one of the fastest companies ever to reach that milestone.

Source: Sacra.com

Around its fourth year, Airtable shifted its focus from individual users to enterprise clients — a move that fueled its hockey-stick growth trajectory.

The company reached $156 million in ARR by 2021, the most recent figure publicly disclosed.

In late 2024, Airtable's CFO said the company was growing at a 30% annual rate. If that growth has held steady since 2021, its current ARR would be around $450 million.

Who owns Airtable?

As mentioned above, there are 52 external investors in Airtable at this time.

Notable investors include Michael Dell, Ashton Kutcher, Ron Conway, Joshua Schachter, and Jawed Karim. Firms like Tiger Global Management, Silver Lake, Thrive Capital, Greenoaks Capital Partners, Benchmark, and more have also invested.

Additionally, current CEO and co-founder Howie Liu and his co-founders, Andrew Ofstad and Emmett Nicholas, along with other employees, all likely own some percentage of the company.

The exact ownership breakdown is not public information.

How to buy the Airtable IPO

Airtable executives have referenced going public multiple times over the past few years, but never with a clear timeline.

In December 2021, CEO Howie Liu said the company planned to go public in “a couple years.” About six months later, he said they would take Airtable public “once we've shown we can dominate the market.”

Then, in November 2024, CFO Ambereen Toubassy said the company hoped to be IPO-ready sometime in 2025. But nothing came to fruition.

Given the timing of Toubassy's comment, I wouldn't be surprised to see Airtable set an IPO date in 2026 if the IPO market stays warm.

When it does go public, you'll be able to look up its stock symbol and buy it in your brokerage account.

If you don't have a brokerage account, we recommend Public. On Public, you can invest in stocks, ETFs, Treasuries, corporate bonds, and cryptocurrencies, all on one of the most sleek and streamlined investing platforms.

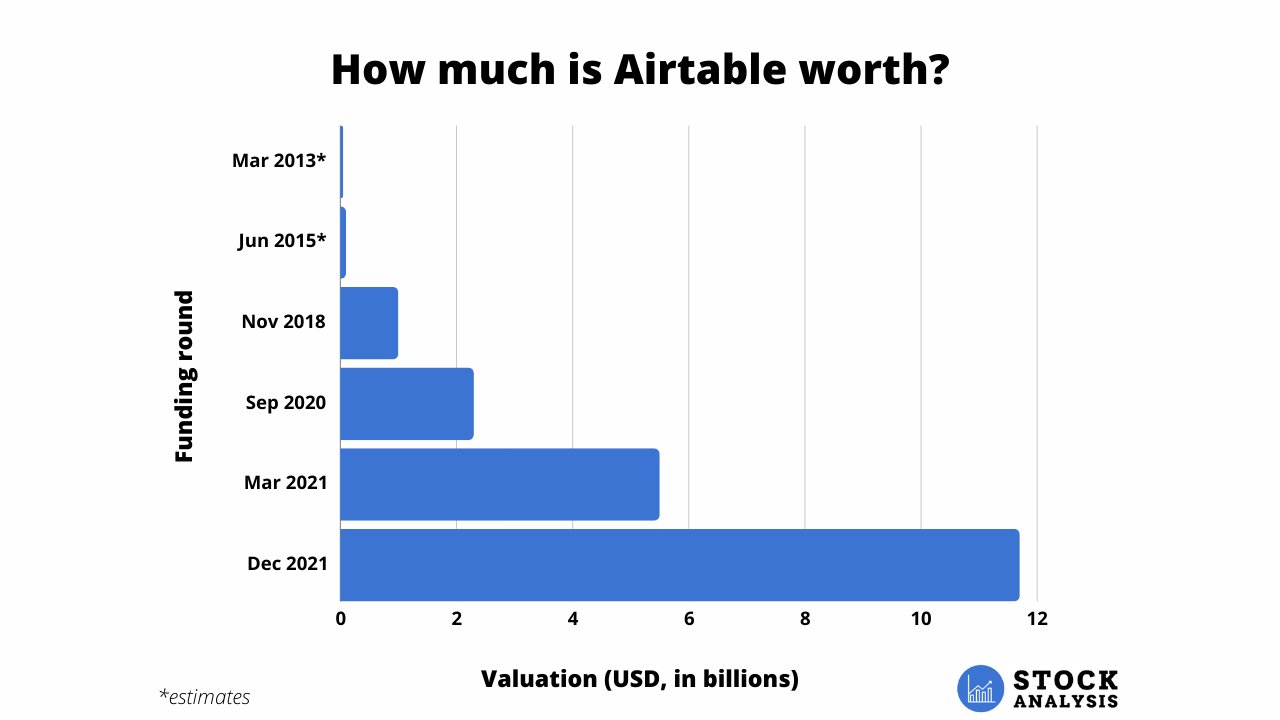

Airtable valuation chart

As mentioned above, Airtable's most recent funding round raised $735 million at a valuation of $11.7 billion in December 2021, up more than double from the $5.8 billion it had received just 9 months earlier.

Here's a look at how Airtable's valuation has changed over time:

Source: Crunchbase

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)