How to Buy BitGo Stock in 2026

Since its founding in 2013, BitGo has been a leader in the world of digital asset storage.

BitGo is best known for its advanced security features like multi-signature wallets and cold storage. Its reputation for security, integrity, and reliability has attracted a number of major clients across multiple categories.

A few notable clients include CoinDesk, Bitstamp, eToro, Bitcoin IRA, Baanx, Pantera, Nike, and more. In total, BitGo has more than 1,500 clients in over 50 countries.

BitGo also processes approximately 20% of all global Bitcoin transactions by value.

The company remains well-positioned to capitalize on the growing interest in digital assets shown by institutional investors.

But you already know that. You're here to learn how you can invest in BitGo.

Here's how.

How to buy BitGo stock as an accredited investor

BitGo is a private company. It does not have a stock symbol, and it does not trade on a public exchange. However, accredited investors can still invest in its stock.

Hiive is a platform where accredited investors can buy shares of private, venture-backed companies. BitGo is one of the most active securities on Hiive right now.

As of the time of this writing, there are 18 listings of BitGo stock:

Here's how to invest in BitGo stock:

- Go to Hiive's website and click “Sign Up."

- Enter your name and basic details.

- Agree to the terms and click "Sign Up" at the bottom.

- Answer a series of eligibility questions.

- Wait for Hiive to get back to you regarding your account.

- After you receive confirmation, go to the site, log in, and search for “BitGo” stock.

- Browse listings and purchase the stock. You can either accept that price and buy directly or make an offer and negotiate directly with the seller.

Learn more about Hiive in our full review, or click the button to get started right away:

Can retail investors buy BitGo stock?

As mentioned above, BitGo is a private company. That means there's no way for retail investors to invest in its stock.

Despite some speculation about it possibly going public in 2024, the company itself has made no indication of such plans. Unfortunately for retail investors, it seems BitGo is content to remain a private company for now.

While the company hasn't provided much information on who its investors are, it seems the vast majority are VC firms or private companies like Galaxy Digital.

That said, Goldman Sachs (GS) participated in BitGo's Series B in October 2018. By investing in Goldman Sachs stock, you could technically get some indirect exposure to BitGo. However, the round raised just $15 million.

Even if Goldman Sachs had invested $10 million of that, a stake that's now likely worth 5x more, this investment would still be a tiny fraction of Goldman's entire business.

A $50 million stake in BitGo would be just 0.02% of Goldman's $194 billion market capitalization.

For that reason, buying Goldman Sachs stock would be a very diluted and inconsequential means of gaining exposure to BitGo.

If you're a retail investor, you're likely better off looking for other investments or waiting for the company to go public.

Who founded BitGo?

BitGo was founded in 2013 by Mike Belshe and Ben Davenport.

Belshe previously worked at HP, Netscape, and Google, where he was one of the early hires on the Google Chrome team. He also co-founded Lookout Software (which was acquired by Microsoft in 2004) with former Netscape CTO Eric Hahn.

Belshe still serves as the company's CEO. Davenport was the company's CTO before moving into an advisory role in 2018.

BitGo history

Here's a timeline of some of the most important events in the company's history:

- June 2014: BitGo received its first round of funding — $12 million — in a round led by Redpoint Ventures.

- August 2016: Bitfinex, a digital currency exchange that used BitGo software, announced it had suffered a security breach. BitGo itself was not compromised but had processed withdrawals for the hacker.

- October 2018: The company raised $15 million from Goldman Sachs and Galaxy Digital.

- May 2021: Galaxy Digital announced its $1.2 billion acquisition of BitGo, which eventually fell through in August 2022. The deal soured after BitGo missed a July 31 deadline to turn over audited financial statements.

- August 2023: BitGo received $100 million in its Series C, which valued the company at $1.75 billion. At the time, BitGo had seen 20% growth in assets under custody (AUC), a 60% increase in new clients, and 40x growth in assets staked year-over-year.

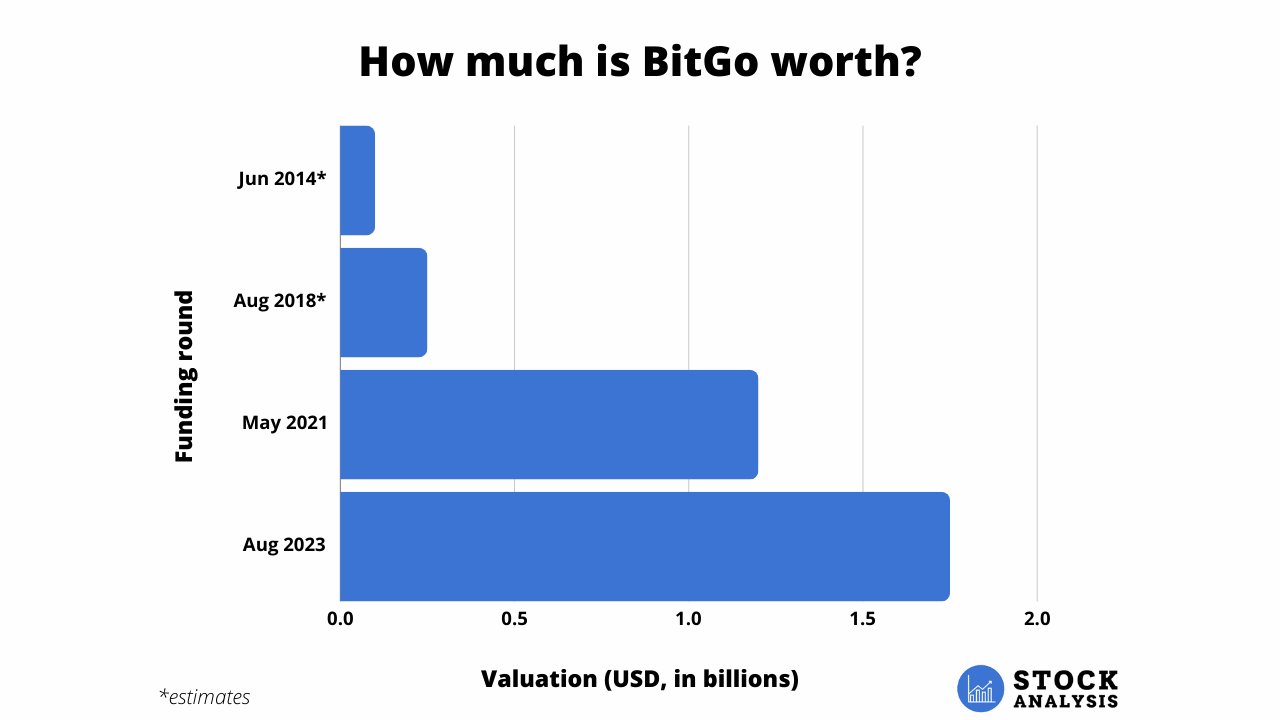

How much is BitGo worth?

BitGo's most recent valuation was set on the $100 million it raised in August 2023, which valued the company at $1.75 billion.

Prior to that round, the only other publicly disclosed information regarding the company's valuation was the $1.2 billion of cash and stock Galaxy Digital offered back in May 2021. The deal fell through after BitGo failed to deliver audited financial statements by the agreed upon deadline.

To give a more complete picture of how its valuation has changed over time, I stitched together multiple articles to estimate the valuations it received in its June 2014 and October 2018 funding rounds.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.