How to Buy Chainalysis Stock in 2024

Last year, more than $10 billion was lost in the U.S. due to scams and fraud. This number is up almost 200% since 2020.

Crypto scams alone accounted for $3.94 billion in scams last year, up 53% year-over-year. The real number is likely even higher, as these crimes often go unreported.

These figures, while staggering, are not hard to believe given the anonymous, cross-border, and largely unregulated nature of the industry.

More regulation and compliance measures are needed, especially if traditional financial institutions are going to adopt decentralized technology.

That's where Chainalysis comes in.

Chainalysis provides blockchain data and software services to government agencies, financial institutions, exchanges, and insurance and cybersecurity companies.

It has also developed many industry best practices for auditing, compliance, investigation, and risk management, plus regularly assists in some of the highest-profile criminal cases in the blockchain industry.

While Chainalysis is still a private company, there is a way for accredited investors to buy its stock right now.

How to buy Chainalysis stock

Hiive is an investment marketplace where accredited investors can buy shares of private, VC-backed companies from existing shareholders.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 private companies listed on Hiive. Some of the most active companies are Databricks, Figure AI, and Chainalysis:

Each of the 14 listings of Chainalysis stock was created by a unique seller. Each seller sets their own asking price and quantity of shares available. Sellers may be current or former employees, venture capitalists, or angel investors.

Buyers can either place bids or accept a seller's asking price as listed. They can also add stocks to their watchlist and get notified if there are any new listings or transactions.

After registering for Hiive, you will be able to see the complete order book — every bid, every ask, and all recent transactions — for every company.

Register for Hiive to see the current order book for Chainalysis, including asking prices and shares available:

Can retail investors buy Chainalysis stock?

Unfortunately, there is no way for retail investors to buy shares of Chainalysis. Hiive is only available to accredited investors.

In the press release announcing its Series F funding round, Chainalysis noted that Blackstone (BX) had increased its investment in the company, indicating it had also invested in a previous round.

Another public company, Bank of New York Mellon (BK), was also mentioned as having participated in the round.

Technically, you could gain exposure to Chainalysis indirectly by investing in either of these two companies. However, both of their stakes are likely very small relative to their market capitalizations of $160 billion and $43 billion, respectively.

If you're a retail investor and want to buy Chainalysis stock, you're probably better off waiting for it to go public.

When will Chainalysis IPO?

There are over a dozen “unicorns” — private companies with valuations of $1 billion or more — in the crypto industry right now.

While many of these companies may prefer to stay private, as public companies are subjected to strict regulatory requirements and more scrutiny, some of the more established companies on this list could be ready to go public sometime this year.

Chainalysis may be one of them.

Chainalysis reported having 150 customers paying more than $100,000 in revenue each year. These contracts make its revenue more predictable and less tied to the performance of bitcoin and other cryptocurrencies.

Couple its SaaS business model with the demand for trust and safety in the industry, and Chainalysis could make a splash at a public stock offering.

All that said, the company has made no indication it will go public this year. But if it does, you'll need a brokerage account to buy it — here are our top-rated options.

Who founded Chainalysis?

Michael Gronager co-founded Kraken's crypto exchange in 2011. In 2015, Gronager left Kraken to start Chainalysis, where he remains as co-founder and CEO.

His fellow co-founders are Jan Møller and Jonathan Levin.

Møller initially served as the company's CTO but left in 2019. Levin is currently the company's Chief Strategy Officer, drawing on his background as an economist and his experience consulting on national security and the future of finance.

The exact ownership structure and how much of Chainalysis each of the co-founders owns is not publicly known.

How much is Chainalysis worth?

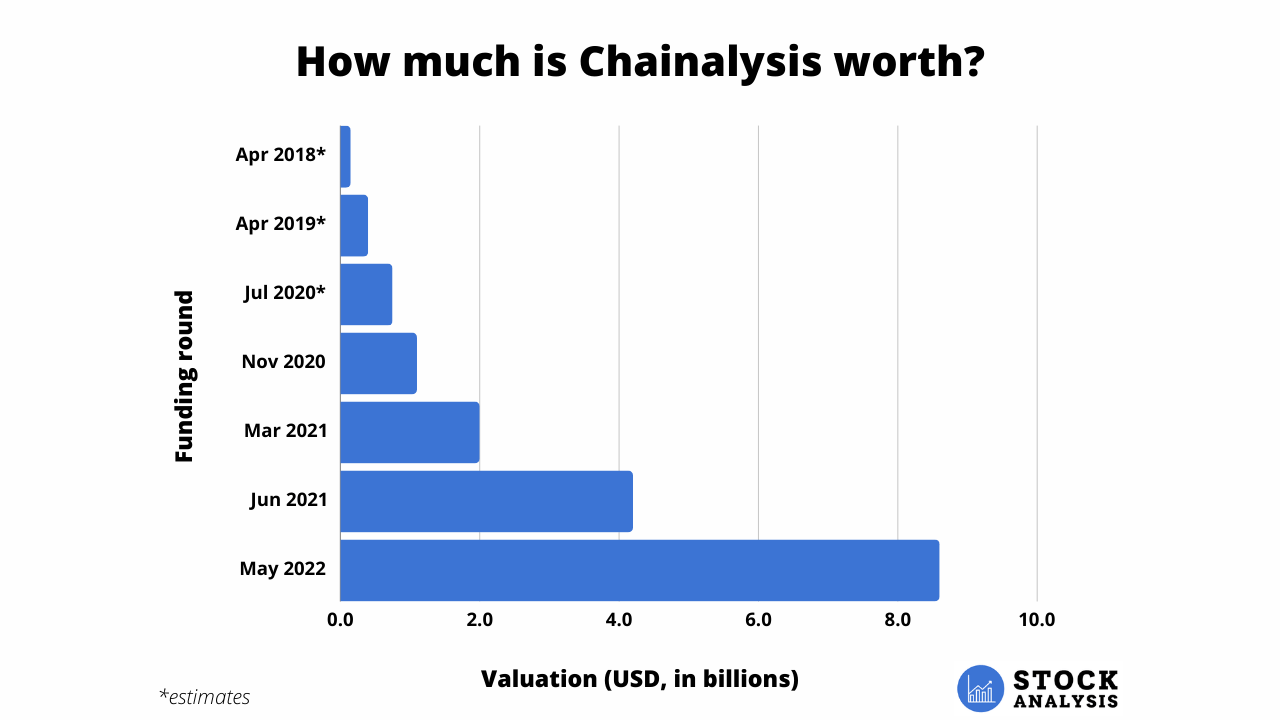

Chainalysis most recently raised $170 million at a valuation of $8.6 billion in May 2022.

Here's a look at how its valuation has changed over time:

Despite its most recent funding round valuing the company at $8.6 billion, recent reports show shares of Chainalysis may be trading at a valuation of around $2.5 billion.