How to Invest in ByteDance, the Company That Owns TikTok

TikTok is the 5th most popular social media platform in the world.

It's used by over 1.5 billion people each month, and is one of just eight social media apps with more than 1 billion monthly active users.

TikTok's parent company, ByteDance, is the world's #1 social media company by revenue — yes, ahead of even Meta.* The company was on pace to generate around $200 billion in revenue in 2025.

*ByteDance posted revenue of $43 billion in Q1 2025 and $48 billion in Q2 2025, ahead of Meta's (META) respective $42.3 billion and $47.5 billion.

In November 2025, ByteDance was valued at $480 billion, up more than 45% from its valuation in August. This makes it the second most valuable private company in the world, behind only OpenAI.

Still, ongoing political pressure and the potential forced sale of its U.S. operations have likely pushed any IPO plans far into the future.

But that doesn't mean you have to wait. Here's how to invest in ByteDance pre-IPO.

Can you buy ByteDance stock?

ByteDance is a private company. There is no ByteDance or TikTok symbol, and no way to buy shares through a standard brokerage account.

Although the company had plans to IPO on either the NYSE or Nasdaq exchanges in 2021, this move was blocked by Chinese regulators. Since then, management has paused all conversations of an IPO.

Despite having surpassed Meta as the world's largest social media company by revenue, ByteDance is valued at less than a third of Meta's $1.5 trillion market capitalization.

The gap is largely attributable to political and regulatory risks in the U.S., where lawmakers have raised national security concerns over ByteDance's Chinese ownership (more on this below).

Until those issues are resolved — and unless the Chinese government changes its stance on overseas listings — ByteDance will likely remain private.

Fortunately, you don't need to wait for it to go public to invest in it.

How to invest in ByteDance now

How you can invest in ByteDance depends on whether you're an accredited investor or a retail investor.

Are you an accredited or retail investor?

You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000, excluding your primary residence

If you're an accredited investor, you can invest directly in ByteDance (more info below). If you don't qualify as an accredited investor, skip to the second section, which is for retail investors.

1. How to buy ByteDance stock as an accredited investor

Hiive is a secondary marketplace platform where accredited investors can buy shares of private, VC-backed companies.

There are thousands of private companies available for investment on Hiive, including ByteDance:

There are 3 listings of ByteDance stock available on Hiive right now. Shares are trading at $210.65.

Each listing on Hiive is made by a different seller who sets their own asking price and quantity of shares available. Sellers may be current or former employees, venture capitalists, or angel investors.

Buyers can accept the asking prices as listed or place bids and negotiate directly with sellers.

After registering, you can see the complete order book for every company on the platform. That includes all bids and asks, as well as the price of every recently completed order.

Hit the button below to see the order book for ByteDance:

2. How to invest in ByteDance as a retail investor

While you may not be able to directly invest in TikTok/ByteDance, you can still gain exposure, albeit in a roundabout way.

TikTok is 100% owned and controlled by ByteDance, a private Chinese technology company. ByteDance, however, has a number of outside investors, two of which are public companies.

a) Invest in Kohlberg Kravis Roberts (KKR)

Kohlberg Kravis Roberts (KKR) is a global investment firm headquartered in New York.

KKR participated in ByteDance's Series E funding round in October 2018. In total, 12 investors invested $3 billion at a valuation of $72 billion. Then, in December 2020, KKR participated in another round that raised $2 billion at a $178 billion valuation.

If we assume KKR invested $250 million in 2018 and $500 million in 2020, its stake has grown to around $3 billion based on the current valuation, about 4x its total investment of $750 million.

KKR is a $103 billion company, so this $3 billion stake in ByteDance represents 2.9% of its total business. If you're considering buying KKR to own ByteDance, you should make sure you like the other 97.1% of the company as well.

b) Invest in SoftBank Group (SFTBY)

SoftBank Group (SFTBY) is a Japanese technology and telecom conglomerate best known for its investment arm, which focuses on disruptive technology.

Its list of previous investments includes Alibaba (BABA), Nvidia (NVDA), Uber (UBER), Slack, and more.

SoftBank participated in the same two funding rounds as KKR but sold a slice of its holding at a valuation of $220 billion in March 2023.

If we assume it still holds a $1.7 billion stake, ByteDance makes up 1% of its market capitalization ($170 billion).

Similar to KKR, you could invest in SoftBank to gain some exposure to ByteDance, but you should also do your due diligence on the other 99% of its portfolio.

Who owns TikTok stock?

TikTok is owned 100% by ByteDance, a privately held Chinese technology company.

In addition to TikTok, ByteDance owns a number of other social media and entertainment apps and platforms, including:

- Douyin (this is the Chinese version of TikTok, which ranks #11 on the list of largest social media platforms)

- Lark

- Toutiao

- CapCut

- Nuverse

- Xigua Video

As of November 2021, ByteDance was partially owned by global investors (60%), employees (20%), and co-founders Zhang Yiming and Liang Rubo (20%).

Its list of global investors includes Kohlberg Kravis Roberts, SoftBank Group, Sequoia Capital, General Atlantic, Hillhouse Capital Group, and Capital Today.

TikTok in the U.S.

U.S. lawmakers have long been concerned that TikTok could be used to spy on American citizens since China requires its companies, upon request, to share any national security-related data with its government.

U.S. officials are also worried the app's algorithm could be used to subtly manipulate American public opinion.

Those fears prompted the federal government to ban TikTok from official devices in 2020. 34 out of 50 states followed suit, restricting use on state-issued phones.

TikTok has also been banned from government devices in many European countries.

At the same time, a broader effort emerged to force ByteDance to divest its U.S. TikTok operations or face a full nationwide ban. ByteDance was initially open to a partial sale, but later filed a lawsuit that argued the executive order was politically motivated.

In December 2020, a federal judge sided with ByteDance and issued an injunction blocking the executive order.

But the legal and political pressure didn't go away.

In December 2022, President Biden revived the government device ban. Then, in early 2024, Congress passed another bill threatening a full ban unless ByteDance completed a "qualified divestiture" of its U.S. operations.

The ban went into effect on January 19, 2025.

But just hours after the suspension of services, President-elect Trump offered a 90-day extension, giving ByteDance more time to divest the app.

Since then, his administration has issued additional extensions, and the current deadline is set for January 2026.

Throughout 2025, President Trump has been in discussions with multiple potential buyers for TikTok's U.S. business.

In September, he issued an order saying — among other things — ByteDance will own a less-than-20% stake in TikTok U.S. and the rest of the company will be owned by "certain investors." The order also said the business would be valued at $14 billion.*

*Analysts previously estimated TikTok U.S. may be worth between $35 billion and $50 billion.

In October, after more than a year of negotiations, U.S. Treasury Scott Bessent announced the U.S. and China were nearing a resolution to transfer TikTok's U.S. operations to a consortium of U.S. companies led by Oracle (ORCL).

How to buy the ByteDance IPO

ByteDance, China's largest startup, was rumored to have been near an IPO on the NYSE or Nasdaq back in 2021 before Chinese regulators stalled its progress.

Since then, its IPO plans have been on ice, and management has made no indication of when it will go public.

If/when ByteDance goes public, you'll be able to look up its stock symbol and buy it in your brokerage account. If you don't have a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

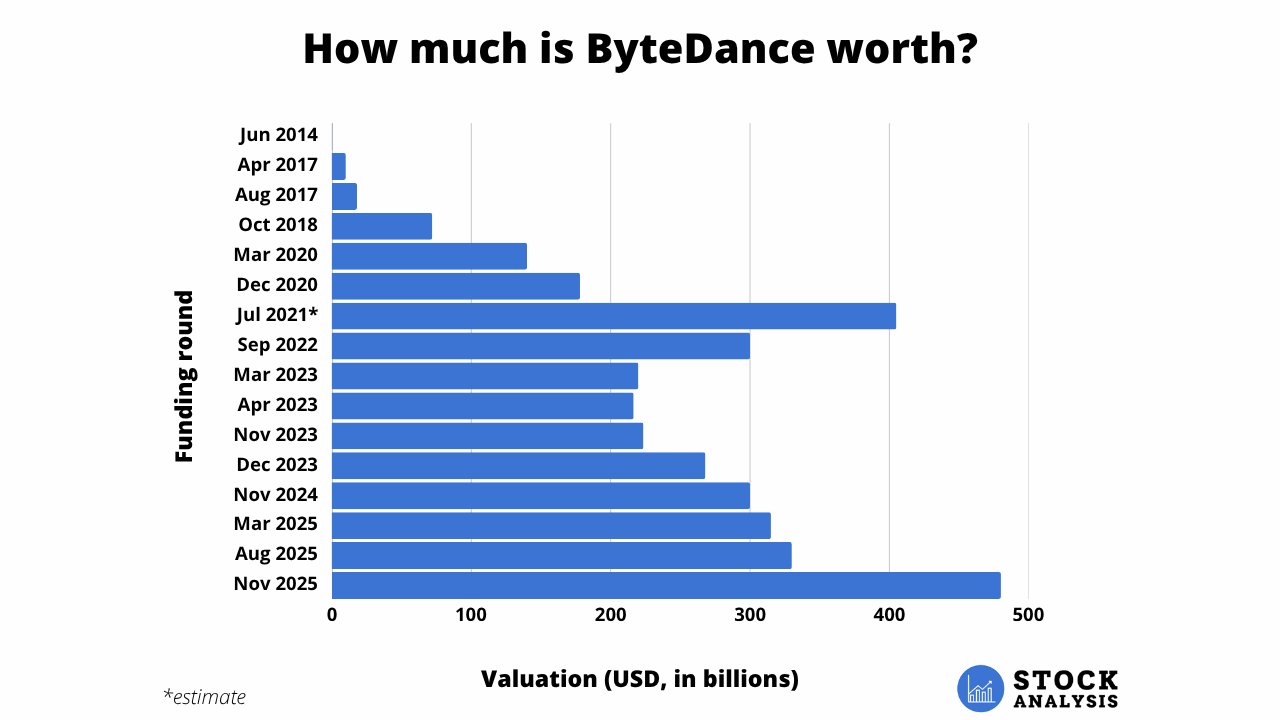

ByteDance valuation chart

In November 2025, a prominent Chinese investment firm bought a $300 million block of shares that gave ByteDance an implied valuation of $480 billion — up more than 45% from its $330 billion valuation in August 2025.

Its new valuation is also a record high.

After peaking at $405 billion in 2021 when rumors of an upcoming IPO were circulating, ByteDance's valuation fell amid regulatory crackdowns and shifting market sentiment. The recent jump signals a renewed wave of optimism.

The company has run regular share buybacks since 2017, primarily as a way to provide liquidity for investors and employees. Including its valuations at these share repurchases, here's a look at its valuation history:

How much is TikTok worth?

Remember, TikTok is just one of ByteDance's subsidiaries, all of which contribute to its $480 billion valuation.

TikTok generated $16 billion in revenue in 2023, which was ~13% of ByteDance's total revenue.

But given TikTok's growth, number of users, and global reach, I estimate TikTok accounts for ~35% of ByteDance's total valuation. This would imply TikTok is worth around $168 billion.

However, President Trump's executive order gave TikTok U.S. — one of the app's most valuable segments — a valuation of just $14 billion, likely a fraction of what it would command on the open market.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)