5 Ways to Invest in Anthropic

While ChatGPT is quite well-known, there's another AI chatbot that's gaining in popularity — Claude AI.

Claude is an AI assistant that can process huge quantities of information, help generate text or ideas, write code, and simplify tasks.

The company behind Claude — Anthropic — is an AI safety and research business founded in 2021 by former senior members of the company behind ChatGPT.

Since then, the company has raised $5 billion, including investments from Amazon and Google. It hit $8 million in monthly revenue last year and is valued at $15 billion.

Despite this size, it's still a private company. There is no Anthropic stock symbol and the company has no plans to IPO in the near future.

But you may not need to wait for it to go public before you invest.

Here are five ways to invest in Anthropic stock while it's private.

1. Buy shares directly from current shareholders

Hiive is a secondary marketplace where accredited investors can buy shares of private, VC-backed startups.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 pre-IPO companies on Hiive, including Databricks, Figure AI, and Anthropic:

As of the time of writing, there are four unique listings of Anthropic stock available on Hiive.

Each of these listings is created by a different seller. Sellers may be current or former employees, venture capitalists, or angel investors.

Each seller sets their own asking price and quantity of shares. Buyers can either accept the asking prices or place bids.

After creating an account, both buyers and sellers can see the full order book of bids and asks and see the exact prices at which Anthropic's shares are trading.

Register with the button below to see the available listings for Anthropic on Hiive:

A note on fees and minimums

Hiive does not charge fees to buyers, but there is a $25,000 minimum investment.

2. Invest in the ARK Venture Fund

Another way to gain exposure to Anthropic is to invest in Cathie Wood's ARK Venture Fund. Anthropic is the fund's largest holding, making up 8.84% of the total fund.

The fund made its investment in Anthropic in July 2023. It likely invested at a valuation between $2–4 billion, which would mean the stake has at least 3.5x in value.

The ARK Venture Fund invests in innovative companies. The fund owns stakes in both privately held and publicly traded companies. After Anthropic, its largest positions are Epic Games, Freenome, Relation Therapeutics, and Blackdaemon.

All accredited investors can invest in the ARK Venture Fund. Additionally, all retail investors can invest in the Fund via Titan or SoFi. The fund has total fees of 2.90%.

3. Invest in Anthropic's partners

Microsoft's close ties to OpenAI — which include $11 billion in investments, a profit-sharing agreement, and a 49% stake — have drawn a lot of scrutiny in the technology and antitrust worlds.

But that didn't stop Alphabet's Google (GOOGL) from jumping on a similar opportunity.

Google invested $300 million in Anthropic in April 2023, giving it a 10% stake. Anthropic also later announced it would also be using Google's cloud computing services.

This alliance is expected to supply Anthropic with funding and cloud-computing resources, while Google may get special access to the company's research and technology.

In October 2023, Google invested an additional $2 billion.

One month earlier, Amazon (AMZN) agreed to invest up to $4 billion in Anthropic in an effort to compete with its cloud rivals (Google and Microsoft) in artificial intelligence.

The deal included early access to Anthropic's technology for Amazon's employees and cloud customers. Anthropic also committed to relying on Amazon's cloud services, including training its future AI models on proprietary chips it would buy from Amazon.

4. Invest in other AI companies and funds

While it's not the same as investing in Anthropic, there are other ways to gain exposure to the generative AI industry.

As mentioned above, because of their partnerships with both OpenAI and Anthropic, investing in Microsoft (MSFT), Google (GOOGL), and Amazon (AMZN) would give you some exposure to generative AI.

That said, these are multi-trillion dollar companies, so be sure you like the non-generative AI aspects of their businesses, too.

Meta Platforms (META) has also been pouring money into its AI lab since 2013. The lab is focused on generative AI, computer vision, and human speech processing technologies.

If you're not sure which company is going to benefit the most from advancements in LLMs and generative AI, you may want to own many companies at once via an ETF.

A few options are:

- Roundhill Generative AI & Technology ETF (CHAT)

- Themes Generative Artificial Intelligence ETF (WISE)

5. Wait for the Anthropic IPO

If none of the above options fit what you're looking for, your final option is to wait for Anthropic to go public.

But you may be waiting awhile — the company has not indicated any IPO plans.

Given its monthly revenue of $8 million, which is expected to increase by 8x in 2024, and its current list of very deep-pocketed backers, Anthropic will have no reason to turn to the public markets until it's ready.

If it ever does go public, you'll need a brokerage account to buy it. And if you happen to be in the market, we recommend Public.

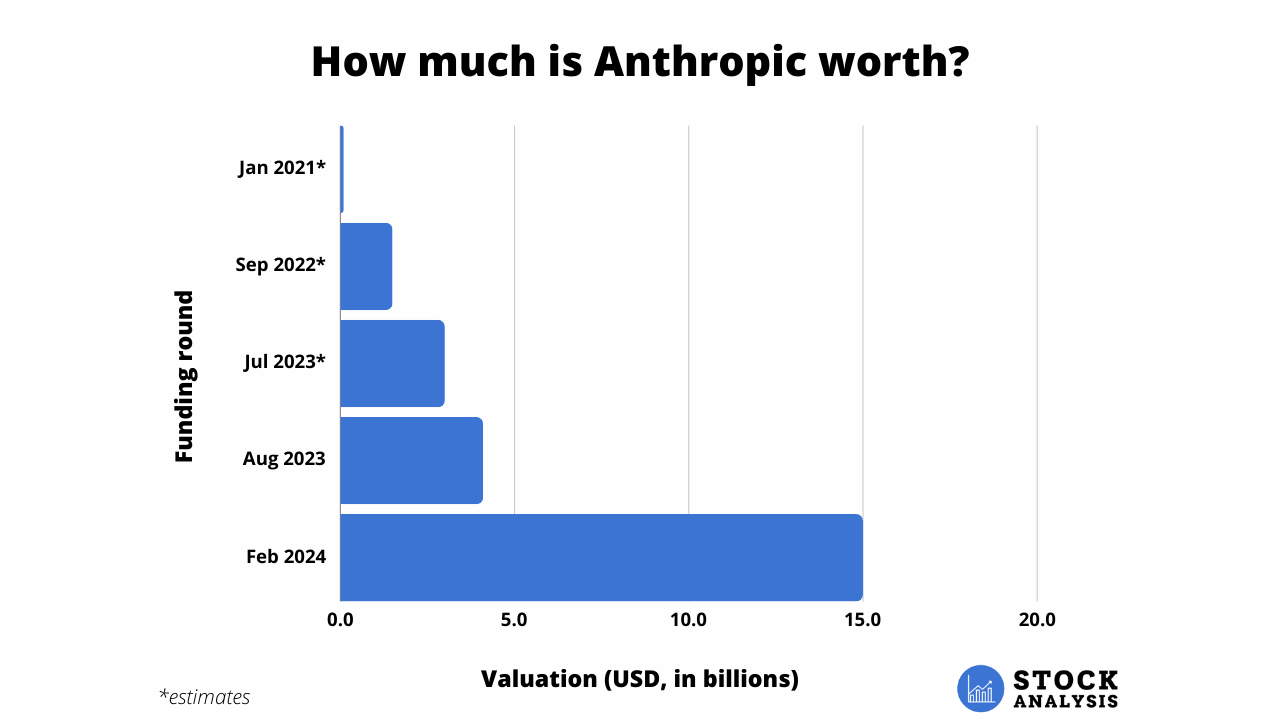

How much is Anthropic worth?

Here's a look at Anthropic's valuation history since it was founded in 2021: