Can You Invest in DeepSeek, the Chinese AI Startup?

DeepSeek, a Chinese artificial intelligence startup, is threatening the United States' dominance in the tech industry and sending a shockwave through Wall Street.

On January 20, the startup released a ChatGPT-like AI model called R1, which has become the most popular app on the U.S. App Store. But that's not the crazy part.

DeepSeek claims to have invested just $5.6 million to develop the model — significantly less than the hundreds of millions invested by OpenAI to build ChatGPT.

Marc Andreessen, one of the world's leading tech investors, posted on X:

"Deepseek R1 is one of the most amazing and impressive breakthroughs I've ever seen — and as open source, a profound gift to the world."

On Monday, January 27, U.S. tech stocks were hammered. This news wiped out more than $1 trillion in market capitalization from global equities, mainly big tech companies like Nvidia, Microsoft, and Alphabet (Google).

Nvidia, the world's leading AI chipmaker, was down more than 15%.

DeepSeek's low-budget breakthrough is causing investors to question the market lead that U.S. tech companies were thought to have, as well as whether DeepSeek's technology will interrupt the massive AI infrastructure investments already underway.

For these reasons, you may be wondering if you can invest in DeepSeek stock.

Can you invest in DeepSeek?

DeepSeek is a privately held Chinese startup.

There is no DeepSeek stock symbol, it doesn't trade on any public exchange, and there's no way for investors to buy stock.

However, while not possible right now, there may be a way to buy stock while it's still a private company.

Accredited investors can buy shares of private companies on a pre-IPO investment platform called Hiive.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Current or former employees, VC firms, angel investors, or any other existing shareholders who want to sell some or all of their shares can register on the platform and list their stock.

Once shares become available, buyers can place bids and try to reach a deal with the seller.

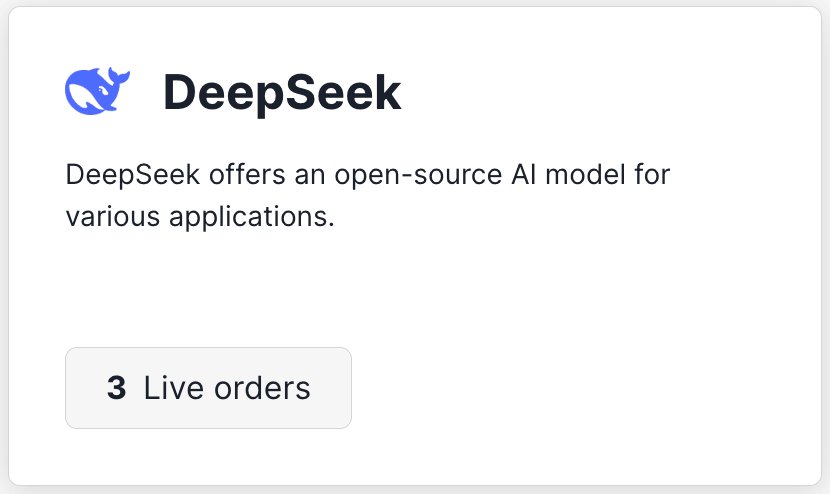

There are over 3,000 companies with shares available on Hiive (including SpaceX, Databricks, and xAI), including 3 orders of Deepseek:

You can see the full order book for DeepSeek — including all bids, asks, and recent transactions — by registering for an account on Hiive.

Is Nvidia's dominance over?

Nvidia (NVDA) has been the biggest AI winner so far.

Until now, Nvidia's high-performance GPUs have been the gold standard for handling the massive amounts of data and calculations required by AI algorithms and machine learning.

As the AI race has heated up, big tech companies and VC-backed startups have rushed to stockpile GPUs, regardless of the cost. This huge demand for its products has sent Nvidia's shares up more than 1,000% since October 2022.

However, the release of DeepSeek's R1 model may threaten Nvidia's market dominance.

The R1 model, which is similar in functionality and performance to ChatGPT's o1 model, was built at just a fraction of the cost and with limited computing resources (old Nvidia GPUs).

The U.S. has limited the sale of high-powered GPUs to China and its allies. More U.S. protectionist policy could follow, which may limit growth prospects.

Working with what it had, DeepSeek focused on optimizing its algorithms to maximize the performance of its “outdated” hardware, thus begging the question: “What will happen to Nvidia's demand if companies can start doing more with less?”

However, while this might seem like bad news for Nvidia, I'm not sure that it is.

DeepSeek was able to hack its way to get higher performance out of its cheaper hardware with a number of novel techniques.

In theory, there should be similar techniques to get the most out of Nvidia's latest hardware, which will result in even more efficient models. Nvidia could also take this approach itself.

As long as Nvidia's chips provide a valuable compute advantage, there's no reason to believe it won't remain a dominant player in the AI industry.

Who founded DeepSeek?

DeepSeek was founded by Liang Wenfeng in 2023.

In 2015, Wenfeng cofounded High-Flyer, a quantitative hedge fund that uses artificial intelligence to predict market trends.

Driven largely by the success of his hedge fund, Liang Wenfen is estimated to have a net worth of $6.6 billion.

Wenfeng started buying thousands of Nvidia GPUs in 2021, before the Biden Administration's ban took effect, to be used in a side project.

In 2023, DeepSeek was spun out of High-Flyer and became its own entity. Wenfeng was inspired by the debut of ChatGPT and has been building AI models ever since.

DeepSeek unveiled R1, its first "reasoning" model based on its V3 LLM, on January 20.

The model has performed at comparable levels to ChatGPT's o1 model, though it was reportedly trained on the equivalent of just $5.6 million rented GPU hours, a fraction of the hundreds of millions reportedly spent by OpenAI.

However, some people suspect the startup hasn't disclosed all of its costs.

Is DeepSeek being completely forthright?

The claimed $5.6 million figure of rented GPU hours likely doesn't account for a number of extra costs, including any pre-training hours, capital expenditures, energy costs, and the construction of building its own data center.

Nathan Lambert, a machine learning researcher, estimates DeepSeek's annual costs for operations are probably closer to between $500 million and $1 billion.

That figure is still well below the costs at its U.S. rivals, but is much higher than the $5.6 million put forth in the R1 paper.

Some also doubt DeepSeek is being forthright about what chips it's using in its model.

According to the R1 paper, DeepSeek purchased 10,000 Nvidia A100s before they were restricted (these are two generations older than the current Blackwell chips).

The startup also has a cluster of Nvidia H800s, which is a capped version of the Nvidia H100 (designed for the Chinese market).

In a recent interview, Scale AI CEO Alexandr Wang told CNBC he believes DeepSeek has access to a 50,000 H100 cluster that it isn't disclosing, as those chips have been illegal in China since the 2022 export restrictions.

However, given that DeepSeek has open-sourced its techniques for the R1 model, others should be able to replicate its results with the same resources.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.