How to Invest in xAI Stock in 2025

Elon Musk has a new startup focused exclusively on artificial intelligence.

The mission for xAI is “to understand the true nature of the universe” and to be maximally truth-seeking to help filter out and prevent the spread of misinformation.

One obvious use case for this technology is X (formerly Twitter), Musk's social media company. xAI's one live product, Grok, is a chatbot integrated with X and is only available to X's Premium+ subscribers.

In March 2025, in a move to further link the two companies, Musk announced that xAI acquired X in an all-stock deal which valued xAI at $80 billion and X at $33 billion ($45 billion less $12 billion in debt).

Musk originally purchased X for $44 billion in October 2022. Its valuation had swung wildly since the purchase, at one point being valued at less than $10 billion, though it had risen in the months following President Trump's election.

Musk described the two companies' futures as "intertwined" and said the acquisition will help them "combine the data, models, compute, distribution and talent.”

In addition to preventing the spread of misinformation, the xAI team (which includes veterans from powerhouses like Google, Microsoft, and OpenAI) also wants to create an AI capable of advanced mathematical reasoning. If successful, this could lead to solving puzzles about the Earth, our solar system, and beyond.

Unsurprisingly, there's no shortage of investors trying to get exposure to the Musk-led AI company.

In July 2025, news broke that Musk was preparing to raise a new round at a valuation of up to $200 billion. This announcement came just one month after the company raised $10 billion at an undisclosed valuation.

And you may be able to invest in it, too.

How to buy xAI stock

xAI is a private company, which means it doesn't have a stock symbol or trade on a public exchange.

However, accredited investors can buy shares on Hiive, a pre-IPO marketplace.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is an investment platform where accredited investors can buy shares of private, VC-backed startups.

Some of the most active companies on Hiive right now are SpaceX, OpenAI, and xAI:

Each listing of xAI stock is created by a unique seller who may be an employee, venture capitalist, or angel investor. Each seller sets their own asking price and quantity of shares for sale.

Buyers can see each listing, accept a seller's asking price as listed, place bids and negotiate with sellers, or add a company to their watchlist. They can also see all recent transactions (prices and quantity of shares traded).

See what shares of xAI are trading for on the pre-IPO market by creating an account:

Can retail investors buy xAI stock?

Because of federal regulations, retail (non-accredited) investors are not able to invest in private companies.

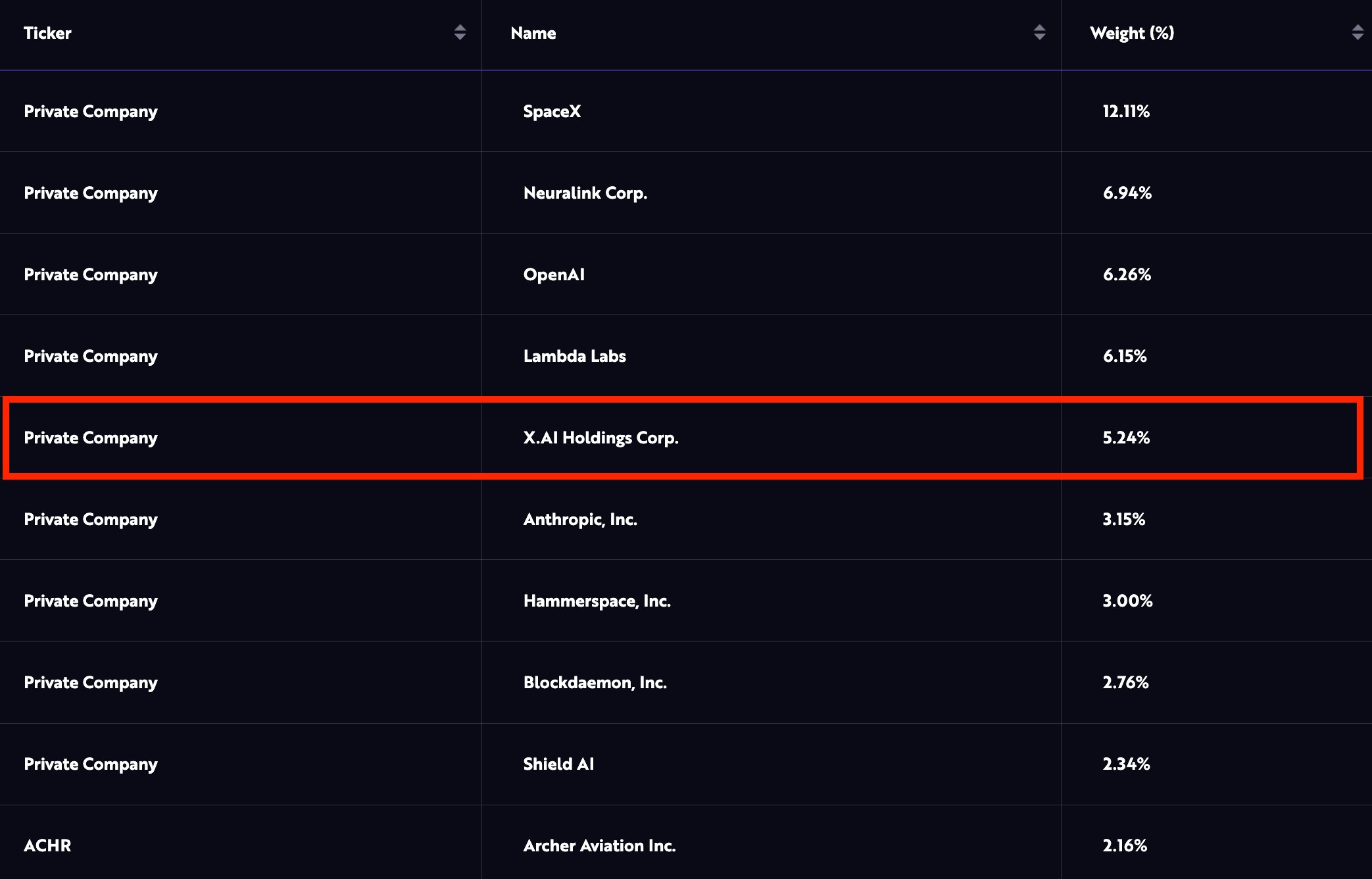

While there's no way for you to buy shares of xAI directly, you can get exposure to the company via the ARK Venture Fund. xAI makes up 5.24% of the fund, its 5th largest holding:

The Venture Fund also has stakes in a number of other private companies that may be of interest — SpaceX, Anthropic, and OpenAI are also all in the fund's top 10 holdings.

Retail investors can invest in the Fund via SoFi. Accredited investors can buy it directly from ARK's website.

Alternatives to investing in xAI

Here's a list of other AI-related investment opportunities you may be interested in.

1. Publicly traded AI companies

For retail investors, the easiest way to invest in AI is to buy publicly traded stock.

- Nvidia (NVDA) is the market leader in developing the chips used to train and run supercomputers and AI networks. Musk was recently in the headlines for asking Nvidia to ship thousands of AI chips reserved for Tesla to xAI and X instead. Notably, all $6 billion of xAI's November 2024 round was expected to be used on purchasing 100,000 Nvidia chips.

- Taiwan Semiconductor (TSM) is the sole manufacturer of Nvidia's AI GPUs. The company does not design any of its own chips; it only builds chips for its clients.

- Microsoft (MSFT) has invested $11 billion in OpenAI and is entitled to up to 49% of its profits (up to an undisclosed cap). It's also integrating the lab's technology into its existing suite of products, including Office 365 and GitHub. You can read more about their partnership in this article.

- Alphabet (GOOGL) is positioned to be the biggest winner from AI-powered search. Additionally, its chatbot (Gemini) is a competitor to OpenAI, and its Google Cloud Platform is likely to host a number of future AI applications.

- Amazon (AMZN) runs Amazon Web Services (AWS), the world's largest cloud computing provider. A significant amount of future AI computing will likely be run on its servers.

Dell (DELL) was also contracted to build half of the racks needed to power xAI's new Memphis-based supercomputer.

While none of these companies are working on the exact same problems as xAI, they either benefit from or are themselves investing heavily in artificial intelligence.

2. ETFs and private funds

If you don't want to invest in a specific stock but want exposure to the industry, here are a few options:

- The Roundhill Generative AI & Technology ETF (CHAT) invests in companies focused on generative AI.

- The Themes Generative Artificial Intelligence ETF (WISE) owns stocks that generate their revenue from AI, big analytics and data, natural language processing, or AI-driven services.

There are also funds that allow you to invest in privately held companies:

- The ARK Venture Fund (mentioned above) invests in innovative companies, regardless of whether they're publicly traded or privately held.

- The Fundrise Innovation Fund gives retail investors access to a portfolio of privately held tech companies like OpenAI, Anthropic, Anyscale, Anduril, Databricks, and more. The minimum investment is just $10.

3. Other private AI companies

Here are a few other AI-centric private companies I've written about:

All of these companies have shares available for purchase on Hiive.

For more investment ideas, check out our article on how to invest in artificial intelligence.

When will xAI IPO?

You should not expect xAI to become publicly traded in the near future. In fact, it may never become a public company.

Tesla is Musk's only publicly traded company. By keeping xAI private, he can run it independently of a board of directors and without needing to report to shareholders.

This gives him more flexibility, more regulatory latitude, and allows him to patiently work toward his grandiose vision.

Plus, as evidenced by the $10 billion raised in June 2025 and the $12 billion raised throughout 2024, he has no issue raising funds in the private markets.

Elon Musk and OpenAI

Musk was a co-founder of OpenAI and invested $50 million to start the lab.

In 2018, Musk sold his stake to Microsoft and left the company over disputes about the company's lack of safety guardrails.

He also filed a lawsuit against Sam Altman (which has since been withdrawn), his co-founder and the current CEO of OpenAI, claiming Altman breached their contract by abandoning their not-for-profit mission.

In November 2024, Musk amended the lawsuit to expand antitrust allegations and added Microsoft, Microsoft VP Dee Templeton, and LinkedIn co-founder Reid Hoffman as defendants.

xAI is a direct competitor of OpenAI. Musk has a golden opportunity to differentiate xAI with responsible and transparent practices, areas he's publicly criticized OpenAI for in the past.

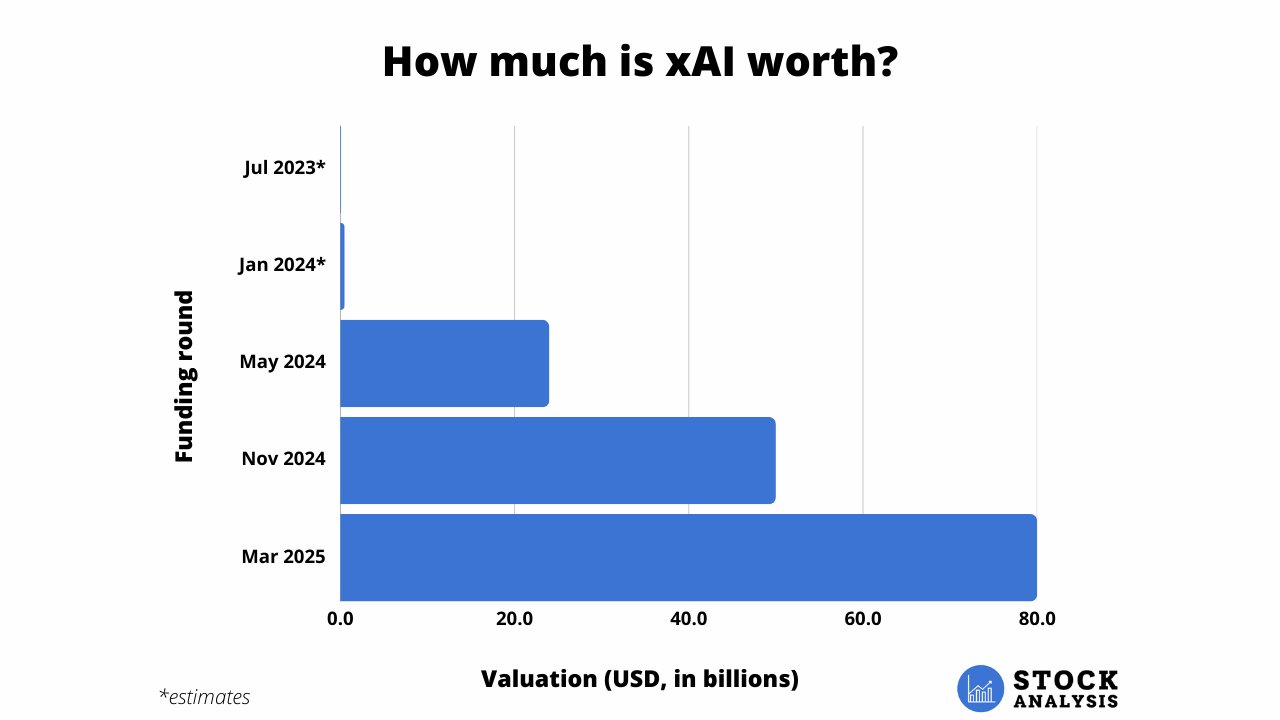

How much is xAI worth?

xAI most recently raised $10 billion in funding in June 2025, $5 billion in debt and $5 billion in equity. The valuation was not disclosed.

In July 2025, news broke that Musk was seeking a valuation of up to $200 billion in a new round.

The company's most recent external funding came over two rounds in 2024:

- In May 2024, xAI raised $6 billion in its series B, which valued the company at $24 billion. This was the largest series B in the history of venture capital.

- In November 2024, xAI raised an additional $6 billion its its series C at a valuation of $50 billion.

Then, as part of its acquisition of X (Twitter) in March 2025, xAI was given an internal valuation* of $80 billion. If accurate, it would make xAI the 4th most valuable private company in the world.

*Whether xAI would have received this valuation from external investors is unclear, and the fact that the June 2025 round was raised at an undisclosed valuation only adds to the skepticism.

Here's a look at how xAI's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.