How to Buy Grammarly Stock in 2026

Grammarly is a writing tool that reviews spelling, grammar, tone, and more. It also makes style suggestions and provides feedback on your writing.

In addition to a browser version, the tool integrates across other apps and websites.

Grammarly has over 40 million users and is generating more than $700 million in annual revenue. It's also profitable, which has allowed it to grow without raising much outside funding.

Its most recent equity round was in November 2021, where it raised $200 million at a $13 billion valuation.

Its core business is obviously strong, but the company has its sights set on something bigger.

In May 2025, Grammarly raised $1 billion in debt to build a comprehensive AI-powered productivity platform through a combination of product development and M&A.* Grammarly will be one of many such tools on the platform.

In July 2025, Grammarly acquired Superhuman, an AI-enabled email efficiency tool.

The company looks poised for further growth. And there is a way for you to invest in it, if you qualify. Here's how to buy Grammarly stock in 2026.

Can you buy Grammarly stock?

Grammarly is a private company. There is no Grammarly stock symbol, and it does not trade on the public markets.

However, some Grammarly stock is available on Hiive.

Hiive is an investment platform where accredited investors can buy shares of pre-IPO companies like SpaceX, xAI, and Databricks.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

At the time of this writing, there are four orders of Grammarly stock available on Hiive:

Each of these listings was created by a current shareholder of Grammarly. These are usually employees, but may also be venture capitalists or angel investors.

After a seller lists their shares, buyers can see the price and quantity of the shares listed. Buyers can also see all of the existing bids placed by other buyers, as well as all of the recent transactions.

Once a buyer and seller agree on a price, Hiive's team facilitates the transaction and gets the shares transferred to the buyer.

To see all of the active listings for Grammarly's stock, plus all of the other companies on Hiive, create a free account with the button below:

Can retail investors buy Grammarly?

Due to SEC regulations, Hiive is only available to accredited investors, which means retail investors cannot buy Grammarly stock.

However, there are quite a few publicly traded companies that offer AI-powered productivity tools and similar software that you might be interested in.

- Microsoft (MSFT) has long been a dominant force in productivity software. Its Office 365 suite has more than 345 million paid users. It has also invested heavily in AI, primarily through its partnership with OpenAI, and has been integrating the lab's technology into many of its products like Word, Outlook, GitHub, and Teams.

- Alphabet (GOOGL), the parent company of Google, also offers popular writing and collaboration tools such as Google Docs and Gmail, both of which now include AI-powered suggestions and grammar checks.

- Adobe (ADBE), which is best known for its suite of creative software, has also made strategic moves into AI. It now offers a number of content creation tools that enable users to create better content faster than ever before.

- Zoom Communications (ZM), while best known for video conferencing, is expanding into a number of adjacent fields such as meeting notetakers, smart communications, and AI-assisted writing support.

While none of these companies are focused on cross-app writing assistance, they all offer tools that overlap (or will soon overlap) with Grammarly's value proposition.

Plus, they each have the scale and technical talent to build more direct competitors, especially Microsoft and Alphabet.

That said, Grammarly is solely focused on AI-enhanced, cross-platform writing assistance — it's not just another feature tucked inside a larger product.

That should allow it to innovate faster, refine its AI more precisely, and continue building a brand that's synonymous with effective writing.

You could also invest in a broader tech or AI-focused ETF, such as the Global X Artificial Intelligence & Technology ETF (AIQ) or the ARK Next Generation Internet ETF (ARKW).

You can invest in stocks and ETFs in your traditional brokerage account. If you're in the market for a new one, see our list of the best brokerages in 2026.

If none of these fit what you're looking for, you should wait until Grammarly's IPO.

When will Grammarly go public?

Although Grammarly has yet to announce a timeline on when it will go public, that is the company's end goal.

When asked about an IPO, CEO Shishir Mehrotra said, “I'm right now just focused on making sure we're innovating with new products, growing as fast as we can. But when we feel ready, we'll go public."

When it does go public, you'll need a brokerage account. If you don't have a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, bonds, cryptocurrencies, and more.

Who founded Grammarly?

Grammarly was founded in 2009 by Max Lytvyn, Alex Shevchenko, and Dmytro Lider — all software developers based in Kyiv, Ukraine.

The team's original idea was to build a tool to help students improve their grammar and spelling, but quickly pivoted into building a full-fledged writing assistant that checked spelling, grammar, and tone as users typed in real-time.

Grammarly steadily grew its user base, hitting 1 million users in 2015.

The company gained momentum from there and raised $400 million in the next six years (more on those rounds below).

| Date | Userbase |

| May 2017 | ~7 million |

| October 2019 | 20 million |

| November 2021 | 30 million |

Today, Grammarly's user base stands at over 40 million, indicating the company may be worth quite a bit more than the $13 billion valuation it earned back in 2021.

Grammarly plans to leverage that existing user base by building and buying additional products to build an entire suite of AI-enhanced productivity tools.

The company is headquartered in San Francisco and has offices in Kyiv, New York, and Vancouver.

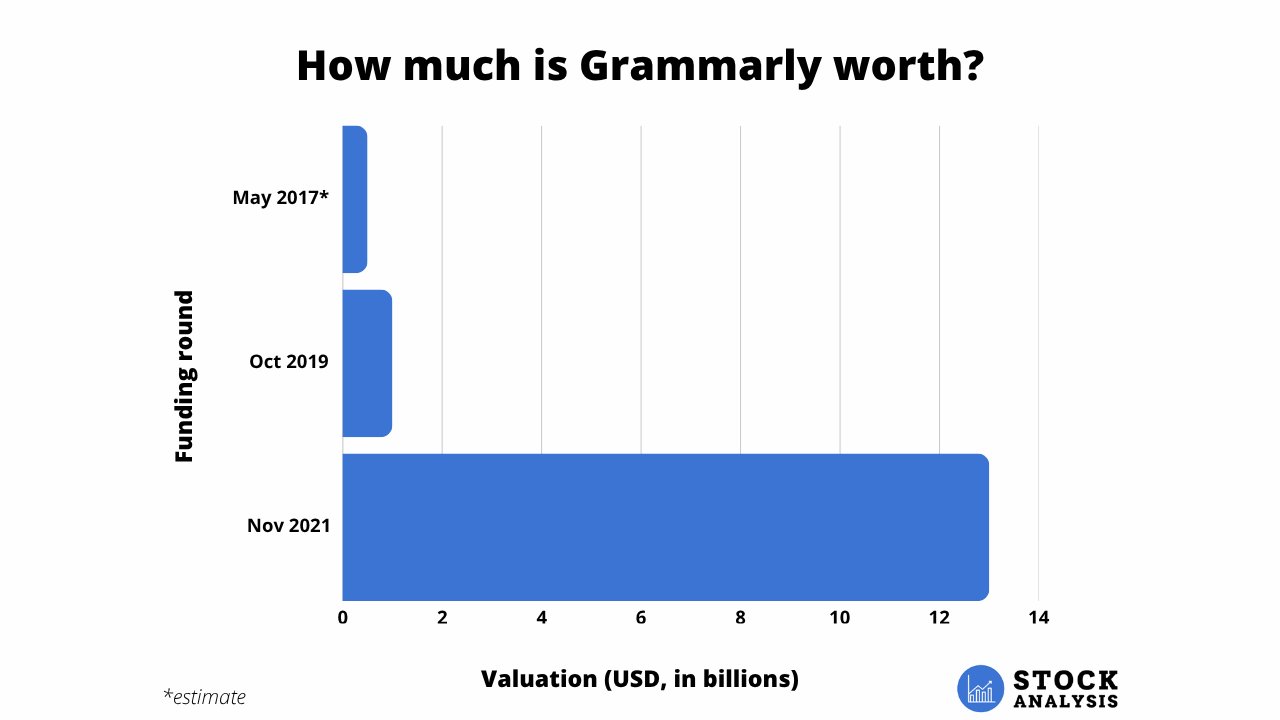

How much is Grammarly worth?

Grammarly has raised a total of $545 million over five rounds since being launched in 2009. However, valuation figures were only disclosed in two of those rounds.

- In October 2019, it raised $90 million at a $1 billion valuation.

- In November 2021, it raised $200 million at a $13 billion valuation.

Here's a chart of how its valuation has changed over time:

As mentioned above, in May 2025, Grammarly raised $1 billion in debt to build out an AI-powered productivity platform.

Two months later, in July, Grammarly acquired Superhuman, an email efficiency tool.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.