How to Invest in Groq Stock in 2026

Artificial intelligence needs specialized hardware to run at scale.

That's where Groq, a fast-growing AI chip startup now valued at $6.9 billion, comes in.

Unlike most chips designed for training massive AI models, Groq's processors are built for inference — the step where an AI takes what it's learned and applies it to new situations.

Think of a self-driving car recognizing a stop sign it has never seen before, or a chatbot generating a fresh response on the fly.

There are different hardware requirements for training and inference. Training is a computationally intensive process, whereas inference is faster and less resource-intensive. Groq is designing chips specifically for those purposes.

In April 2024, a video of Groq's AI chip showed its system serving Meta's LLaMA 3 model at more than 800 tokens (roughly 500 words) per second — about 5-15x faster than traditional GPU-based inference, including systems built on NVIDIA hardware.

This performance led many to view Groq as a leader in the AI inference chip submarket, a segment NVIDIA itself expects could grow into a $300 billion market over the next decade.

That view was reinforced in December 2025, when NVIDIA began licensing Groq's software ecosystem, a move that underscored both the strategic importance of inference and Groq's position in the market.*

*As part of the deal, Groq founder and CEO Jonathan Ross, along with several members of the startup's staff, joined NVIDIA.

And now, you're wondering how you can invest in it.

How to invest in Groq stock

Groq is still a private company, which means that there is no stock symbol and you can't buy it in your regular brokerage account.

However, accredited investors can buy its stock through a secondary marketplace called Hiive. This is a platform that allows buying and selling shares in over 3,000 private companies and startups, including Groq.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

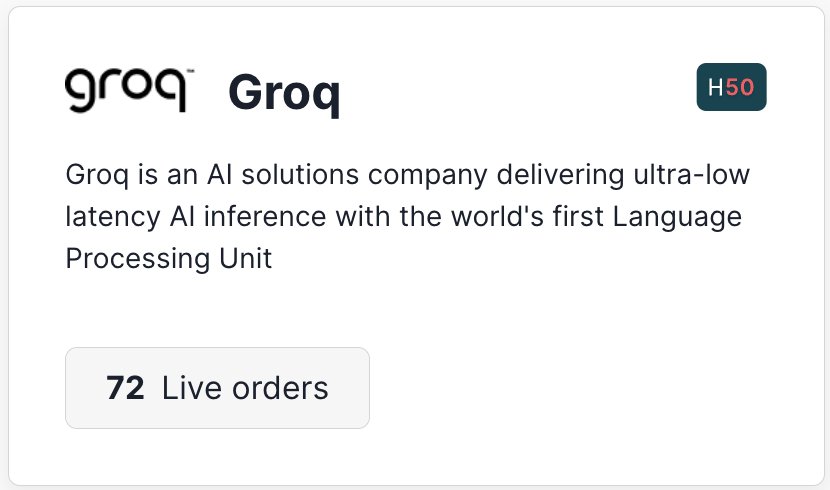

At the time of writing, there are 72 listings of Groq stock available on Hiive:

Each of these listings was created by a unique seller who may be a current or former employee, a venture capital firm, or an angel investor.

Each seller sets their own asking price and volume.

Buyers can either accept an asking price as listed or place bids and negotiate directly with a seller. They can also add stocks to their watchlist and get notified of any new listings.

After registering, buyers can see the price and volume of every bid and ask, along with the price of all recent transactions.

Register for Hiive to see Groq's full order book, including shares available and asking prices:

Can retail investors buy Groq stock?

Since Groq is a private company, there is no way for retail investors to buy its stock.

However, retail investors can gain some indirect exposure to Groq by investing in the ARK Venture Fund or Samsung.

ARK Venture Fund

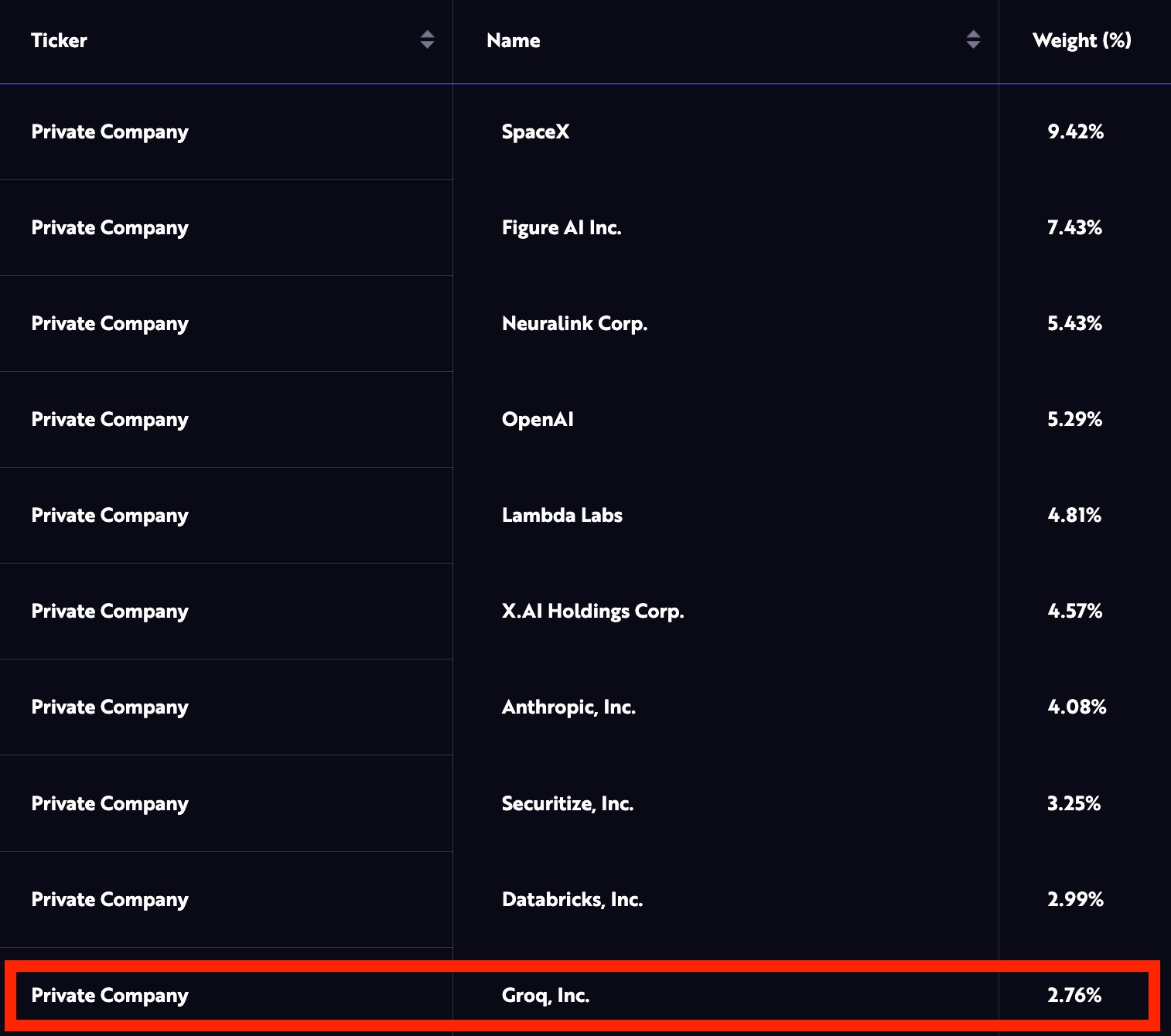

The ARK Venture Fund is a closed-end interval fund that invests in disruptive technology companies. Although it invests in both public and private companies, private companies make up ~82% of its holdings.

As of September 30, 2025, Groq made up 2.76% of the fund, the 10th largest position:

The fund is one of the best ways for retail investors (and accredited investors) to get exposure to many of the world's top private technology companies, including SpaceX, Figure AI, OpenAI, and Anthropic. There is a 2.90% annual management fee.

Retail investors can gain exposure to the fund via SoFi. You can learn more about how to invest here.

Samsung

Retail investors can also gain exposure to Groq through an investment in Samsung (KRX:005930).

In August 2023, Groq chose Samsung's Foundry unit to design and manufacture its chips. Groq has around 4,500 chips deployed but has plans to produce another 1.5 million by the end of 2025.

However, given Samsung's market capitalization of around $580 billion, its contract with Groq is likely quite inconsequential.

Samsung also participated in Groq's $750 million round, though its stake is also probably very small compared to its market cap.

Unless Groq becomes a very large company and continues to use Samsung for its manufacturing, retail investors are probably better off waiting for Groq's IPO.

When will Groq IPO?

Groq raised $750 million in September 2025. This fundraising virtually guarantees the company will not go public in the next 12 months.

Even if everything goes well, Groq will need time to grow so its investors can earn a return on their investment. I would be surprised if Groq's IPO happened before late 2026 or early 2027.

However, when it does go public, you'll need a brokerage account to buy it. If you need a brokerage, check out our article on the best brokerage accounts.

Who founded Groq?

Groq was founded in 2016 by a group of former Google engineers led by Jonathan Ross (Groq's CEO).

Ross helped invent Google's tensor processing unit (TPU), a chip specifically designed for AI and machine learning applications.

Ross admits Groq was ahead of its time and that the company nearly died several times, but OpenAI's release of ChatGPT in late 2022 started an AI frenzy that accelerated the demand for AI chips.

Who has invested in Groq?

To date, Groq has raised a little over $1.75 billion from a number of private equity and venture capital firms.

A few of the most prominent firms to have invested are Disruptive, Blackrock, Neuberger Berman, D1 Capital Partners, Altimeter, Samsung, Tiger Global, Addition Capital, Firebolt Ventures, TDK, Infinitum Partners, and others.

Groq also received a $1.5 billion commitment from Saudi Arabia in February 2025 to expand the data center it built for the country in December 2024.

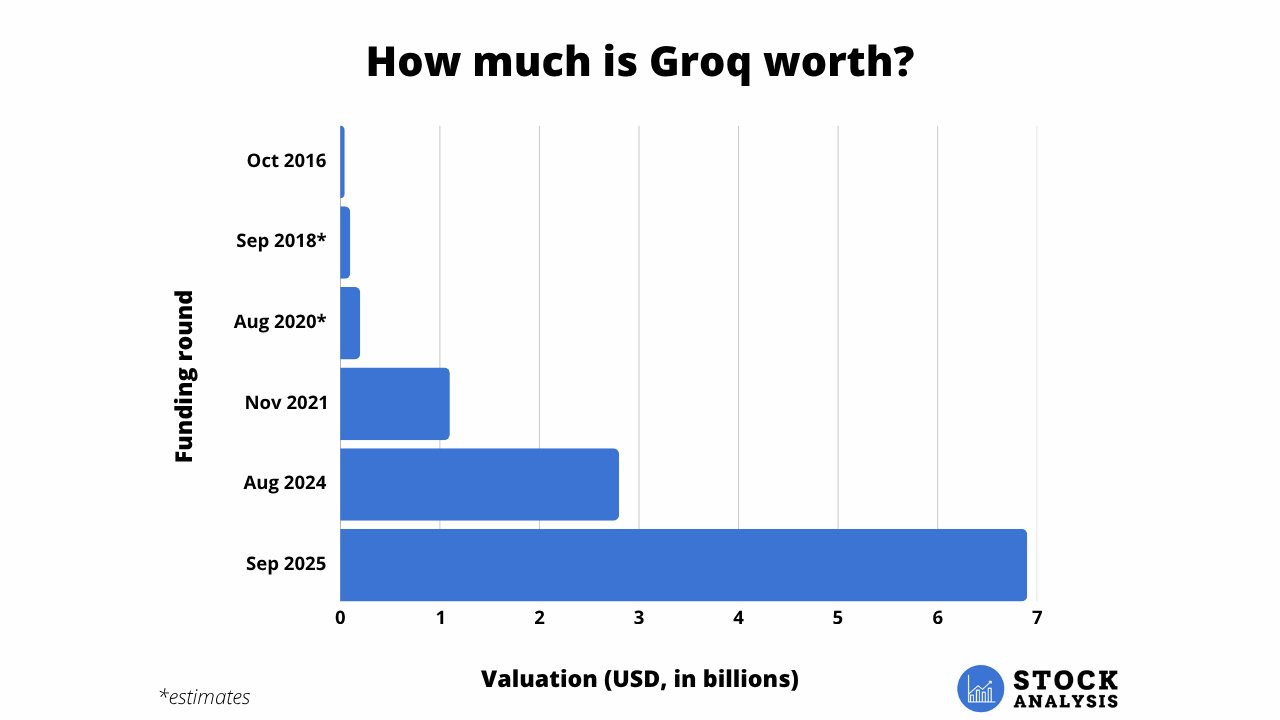

How much is Groq worth?

As mentioned above, Groq most recently raised $750 million at a $6.9 billion valuation in September 2025, more than double the $2.8 billion valuation it received in August 2024.

Here's how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.