How to Invest in Groq Stock in 2024

Groq is an artificial intelligence chip startup.

Its chips are specifically designed for inference, which is the process that a machine learning model uses to draw conclusions from unseen data.

An example of AI inference is a self-driving car recognizing a stop sign or a median on a road it has never driven before.

There are different hardware requirements for training and inference. Training is a computationally intensive process, whereas inference is faster and less resource-intensive. Chips for both purposes are designed accordingly.

Groq made headlines after a video of its AI chip showed that its system is serving Meta's LLaMA 3 large language model at more than 800 tokens per second.

This equates to ~500 words of text per second. The company also reported its users are achieving speeds up to 10 times faster than GPU-based alternatives.

Groq is on the leading edge of the inference chip submarket, a key part of the larger AI chip market, which the head of enterprise computing at NVIDIA expects will become a $300 billion market over the next decade.

How to invest in Groq stock

Groq is still a private company, which means that there is no stock symbol and you can't buy it in your regular brokerage account.

However, accredited investors can buy its stock through a secondary marketplace called Hiive. This is a platform that allows buying and selling shares in over 2,000 private companies and startups.

There are currently over 2,000 pre-IPO companies on Hiive's marketplace, including Groq.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

At the time of writing, there are 6 listings of Groq stock available on Hiive:

Each of these listings was created by a unique seller who may be a current or former employee, a venture capital firm, or an angel investor.

Each seller sets their own asking price and volume.

Buyers can either accept an asking price as listed or place bids and negotiate directly with a seller. They can also add stocks to their watchlist and get notified of any new listings.

After registering, buyers can see the price and volume of every bid and ask, along with the price of all recent transactions.

Register for Hiive to see Groq's full order book, including shares available and asking prices:

Can retail investors buy Groq stock?

Since Groq is a private company, there is no way for retail investors to buy its stock.

However, a retail investor could gain some indirect exposure to Groq by investing in Samsung (SSNLF).

In August 2023, Groq chose Samsung's Foundry unit to design and manufacture its chips. Groq has around 4,500 chips deployed but has plans to produce another 1.5 million by the end of 2025.

Given Samsung's market capitalization of around $370 billion, its contract with Groq is likely quite inconsequential.

Unless Groq becomes a very large company and continues to use Samsung for its manufacturing, retail investors are probably better off waiting for Groq's IPO.

When will Groq IPO?

Groq recently announced plans to raise a fresh round of capital in 2024 to help further its R&D and manufacture more of its chips. I anticipate it will raise at least $250 million.

Even if everything goes well, it's unlikely Groq would go public in 2024 after raising this round.

It will need time to grow so its investors can earn a return on their investment. This could push back Groq's IPO to at least 2025 or 2026.

When it does go public, you'll need a brokerage account to buy it. If you need a brokerage, check out our article on the best brokerage accounts.

Who founded Groq?

Jonathan Ross was an executive at Google who helped invent the company's tensor processing unit, a chip specifically designed for AI and machine learning applications.

Ross left Google and founded Groq in 2016, where he remains as CEO.

Who has invested in Groq?

To date, Groq has raised $367 million from a number of private equity and venture capital firms.

A few of the most prominent firms to have invested are D1 Capital Partners, Tiger Global, Addition Capital, Firebolt Ventures, TDK, and Infinitum Partners.

One of Groq's earliest backers, Social Capital — a venture capital firm led by Chamath Palihapitiya — has been in the news recently after the firm fired two of its partners due to a dispute over its investment in Groq.

The firm invested in Groq in 2017 and 2018 via a $60 million convertible note, a stake that has become quite valuable.

Supposedly, Social Capital partners Jay Zaveri and Ravi Tanuku formed a special-purpose vehicle behind Palihapitiya's back to invest in the company. While neither party has yet filed a lawsuit against the other, the dispute is likely headed to litigation.

It's rare to see this behavior from a well-established VC firm, but perhaps speaks to the lucrativeness of the investment. Importantly, though, this dispute will have no effect on Groq or its other stakeholders.

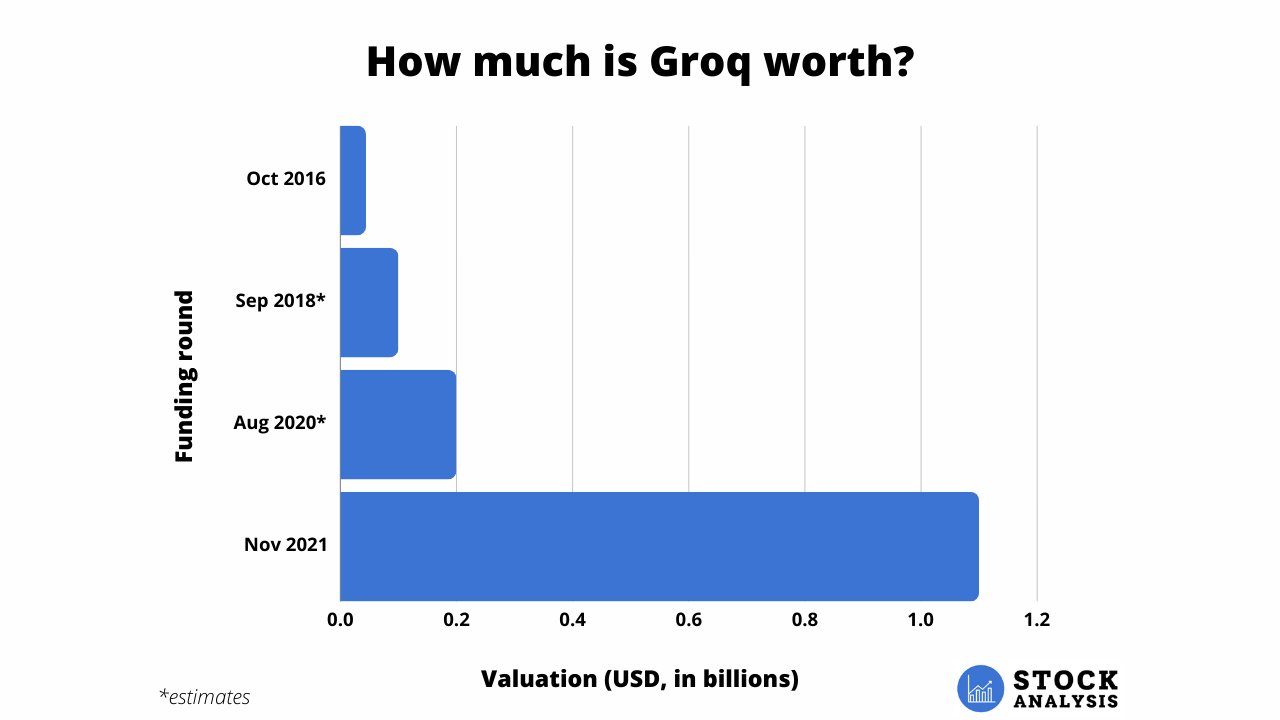

How much is Groq worth?

Groq most recently raised $300 million at a valuation of $1.1 billion in 2021.

As mentioned above, the company plans to raise a fresh round of capital in 2024, presumably at a valuation much higher than $1.1 billion.

Here's how its valuation has changed over time: