How to Buy Kalshi Stock in 2026

Kalshi is the world's largest prediction market — an exchange where users can trade on real-world events like inflation data, sporting contests, and election results.

While the company already serves millions of users and processes over $1 billion in weekly volume, prediction markets are still an emerging industry with significant room to mature.

In addition to being a place for people to hedge and speculate, Kalshi provides real-time insights into how likely people think something is to happen. This type of forward-looking data has made Kalshi a go-to source for reporters, politicians, and investors.

Through new partnerships with CNN, CNBC, Robinhood, and Coinbase, Kalshi is also showing up in newsrooms, trading platforms, and apps.

As visibility grows, so does user activity, which improves its markets for traders and makes its data more accurate and noteworthy.

While most people use Kalshi to speculate on events, VC and PE firms have been investing in the company itself.

In December 2025, Kalshi raised $1 billion at an $11 billion valuation, which is more than double the $5 billion valuation it had received just two months earlier.

If you want to invest in it too, here's how you can.

Can you buy Kalshi stock?

Kalshi is not a public company, so there's no Kalshi stock symbol or ticker you can look up. Its shares don't trade on any stock exchange, and you won't find it in your regular brokerage account.

However, there is a way to buy its shares if you qualify as an accredited investor.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

Hiive is an investment marketplace where accredited investors can buy shares of pre-IPO companies.

SpaceX, xAI, Polymarket, and more than 3,000 other private companies have shares available on Hiive, including Kalshi:

Every listing is created by a seller who sets their own asking price and quantity of shares for sale. Sellers are typically employees, angel investors, or venture capitalists.

Buyers can place bids on shares, look through recent transactions, or add companies to their watchlist to get notified of any new listings.

Once a buyer and seller agree on a price, Hiive's team facilitates the transaction.

You can see all of the active bids, asks, and recent transactions for Kalshi by creating an account with the button below:

Can retail investors buy Kalshi stock?

No, because Kalshi is privately held, there's no way for retail investors to invest in it directly. That said, there are other ways to get exposure to the company.

The ARK Venture Fund

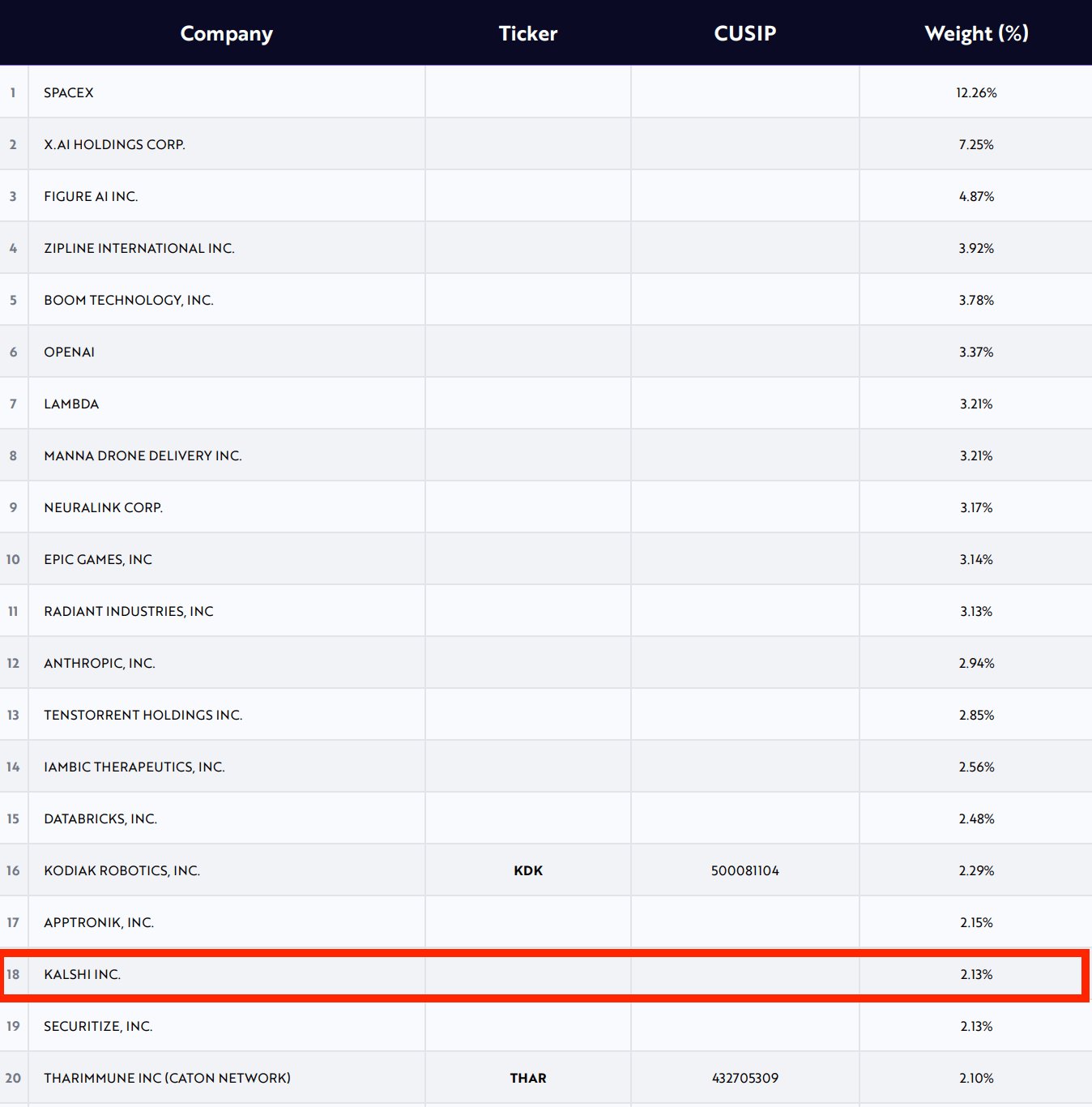

The ARK Venture Fund is an actively managed fund that invests in both public and private technology companies. Its top 10 holdings include SpaceX, xAI, and OpenAI.

The fund also holds a stake in Kalshi after participating in its December 2025 funding round. As of January 2026, Kalshi represents 2.13% of the portfolio, making it the fund's 18th-largest position.

While investing in the fund may be a fairly diluted way of gaining exposure to Kalshi specifically, it's still one of the best ways for retail investors to own stakes in a curated basket of high-growth, pre-IPO tech companies.

The fund has an annual management fee of 2.90%. You learn more about how to invest in it here.

Kalshi's publicly traded partners

While Kalshi itself isn't public, two of its key partners are, offering indirect ways to invest in Kalshi and prediction markets in general.

Its most successful partnership to date is with Robinhood (HOOD), which began offering event contracts through Kalshi in late 2024.

After a slow rollout, the product gained serious traction in 2025.

In Q3, Robinhood's prediction markets business surpassed $100 million in annualized revenue, and over 2.5 billion contracts were traded in October alone.

HOOD shares nearly tripled over the course of 2025.

However, this level of success led Robinhood to acquire LedgerX in an effort to bring its prediction markets infrastructure fully in-house.

The transition is expected to be completed by mid-2026, which, if successful, could limit Kalshi's role in the platform going forward.

Kalshi also announced a new partnership with Coinbase (COIN) in November 2025. While the service hasn't launched yet, the two companies plan to operate on a revenue-sharing basis (as Kalshi has with Robinhood).

New competition Given that sports betting drives more than 90% of its activity, it's unsurprising that Kalshi is also receiving competition from traditional sportsbooks.

FanDuel, owned by Flutter Entertainment (FLUT), is entering the prediction market space with a new platform built in partnership with CME Group (CME).

When will Kalshi IPO?

Other than a comment made by Kalshi CFO Saurabh Tejwani that an IPO is “something we will consider,” Kalshi has not mentioned any plans of going public.

Although it faces typical startup challenges (revenue, profitability, and user growth), its main hurdle is likely to be regulatory.

Prediction markets occupy a legal gray area in the U.S., which is Kalshi's biggest market. Event contracts are currently classified as financial derivatives, placing them under federal oversight by the CFTC.

Critics argue that these contracts are essentially a form of gambling and should be governed by state gambling laws.

This uncertainty makes it difficult for companies like Kalshi to scale, and any attempt to file a traditional IPO is likely to be delayed. While Kalshi has managed to remain under the CFTC's purview thus far, it continues to face wide-ranging litigation.

Until the regulatory environment becomes more settled, a public offering seems unlikely.

Who founded Kalshi?

In 2018, Kalshi was founded by Tarek Mansour (CEO) and Luana Lopes Lara. The pair met while studying at MIT.

After graduating, Mansour and Lopes Lara went to work on Wall Street, where they noticed that, although many financial decisions were driven by predictions about future events, there was no direct way to trade the event outcomes themselves.

After identifying the problem, they noticed it everywhere. So they quit their jobs and began building the initial version of the platform.

From the outset, the co-founders knew that achieving regulatory approval was critical.

In 2020, Kalshi made history by becoming the first fully regulated event contracts exchange in the U.S., earning Designated Contract Market status from the Commodity Futures Trading Commission (CFTC).

That put Kalshi in the same league as major exchanges such as the Chicago Mercantile Exchange (CME) (the world's largest derivatives marketplace) and Intercontinental Exchange (ICE), which owns the New York Stock Exchange (NYSE).

Today, more than five years later, Kalshi has 100 employees and more than $1 billion is traded on its platform every week.

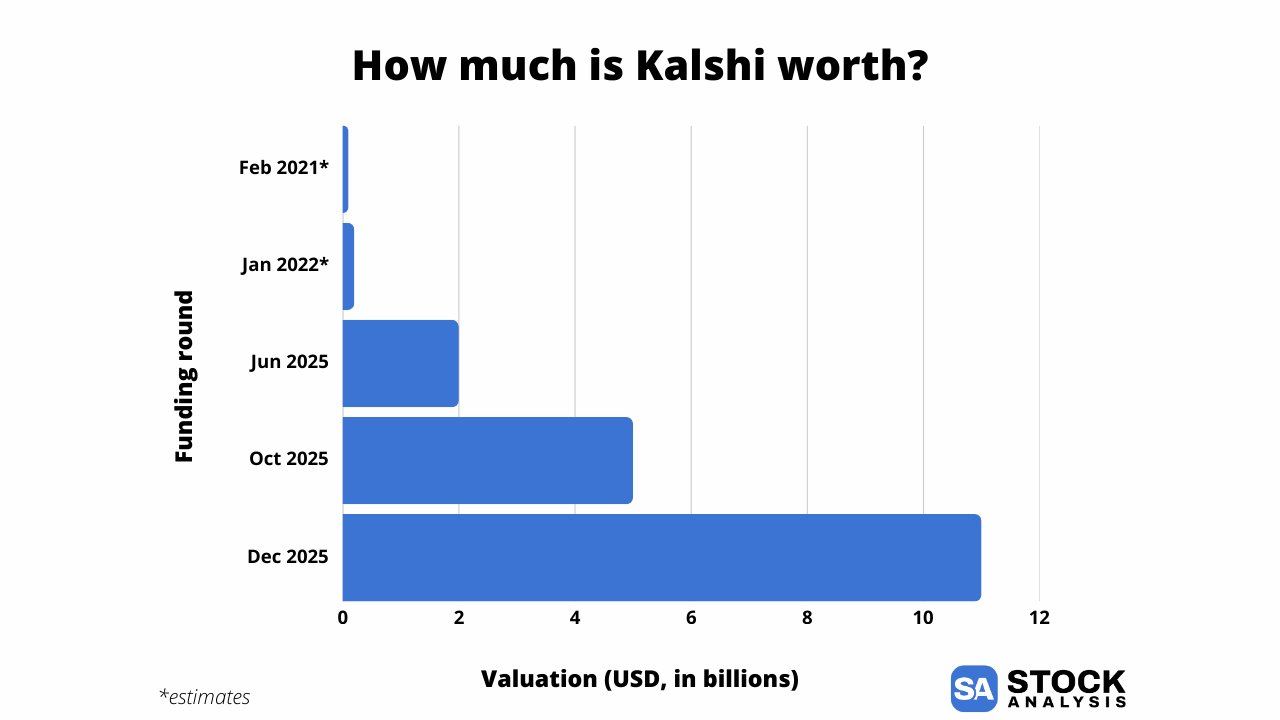

What is Kalshi's valuation?

Kalshi's most recent funding round came in December 2025, when it raised $1 billion at an $11 billion valuation.

It was the company's third raise of the year, marking a sharp acceleration in investor interest. In June, Kalshi raised $185 million at a $2 billion valuation, followed by a $300 million round at a $5 billion valuation in October.

In total, the company has raised $1.59 billion. Here's how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.