How to Buy Lambda Labs Stock in 2026

Google, Meta, Microsoft, and Amazon have been pouring tens of billions of dollars into building out their AI infrastructure. And they're just getting started.

Each of these companies planned to invest at least $65 billion in capital expenditures in 2025, much of which is going to support AI workloads.

But what if you're not one of the biggest tech companies in the world? What if you don't have billions of dollars to spend on infrastructure but still want to develop high-performing AI and machine learning (ML) applications?

That's where Lambda Labs comes in.

Lambda offers cloud-based, on-demand access to NVIDIA's GPU instances and clusters, enabling AI developers from any organization to quickly, easily, and affordably access the best computing hardware available.

And it's working.

Lambda serves over 150,000 Cloud users across a variety of industries and recently signed a multibillion-dollar contract to supply Microsoft with AI infrastructure.

In November 2025, the company raised $1.5 billion at an undisclosed valuation, bringing its total funding to more than $2.3 billion.

Here's how you can invest in it, too.

Can you buy Lambda Labs stock?

Lambda Labs is a private company, which means there is no Lambda Labs stock symbol, it doesn't trade on a public exchange, and there's no way to buy it in a regular brokerage account.

However, its shares do trade on Hiive — a platform where accredited investors can buy shares of pre-IPO companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 3,000 private companies with shares available on Hiive, including 13 orders of Lambda:

Each of these orders is created by a unique seller who may be an employee, a venture capital firm, an angel investor, or any other existing shareholder.

Sellers then set their own asking prices and quantity of shares available. From there, buyers can accept a seller's asking price as listed or place bids on shares.

If you're not ready to buy but want to keep tabs on how certain companies are trading, you can also add companies to your watchlist and receive notifications of any new listings or successful transactions.

You can create an account on Hiive and see all available orders of Lambda Labs with the button below:

Can retail investors buy Lambda Labs?

Since Lambda Labs is still a private company and Hiive is only available to accredited investors, there's no way for retail investors to buy shares in the company directly at this time.

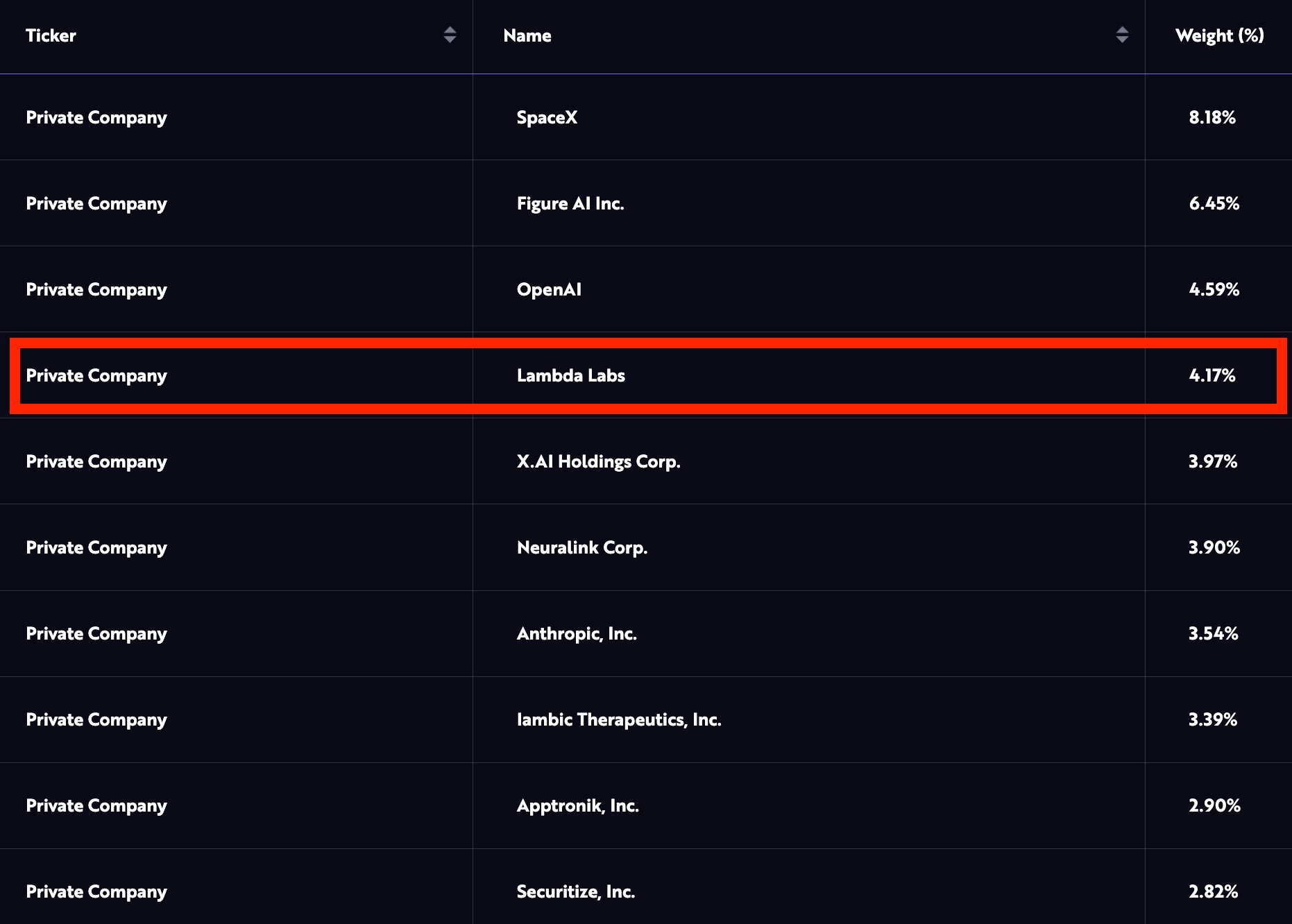

However, retail investors can get exposure to Lambda Labs through the ARK Venture Fund.

The ARK Venture Fund invests in technology companies that have the potential to disrupt and reshape industries.

Although it can invest in private and public companies, almost 80% of the fund is invested in private companies, including 9 of the top 10 holdings. Its 4th largest position (behind only SpaceX, Figure AI, and OpenAI) is Lambda Labs:

The fund is open to all investors and has an annual expense ratio of 2.90%.

Accredited investors can invest in the fund via the ARK website, while retail investors can invest via SoFi.

Alternatively, if you aren't interested in investing in the ARK Venture Fund and you're bullish on AI computing, you may consider investing in one of Lambda's publicly traded competitors.

- CoreWeave (CRWV) is a direct competitor of Lambda's that offers GPU cloud infrastructure for AI workloads. It IPO'd in March 2025, which led some to speculate that Lambda's public debut wouldn't be far behind.

- NVIDIA (NVDA) is the leader in GPU design for AI and machine learning tasks, and Lambda's primary supplier of GPUs. It's also an investor in Lambda.

- Super Micro Computer (SMCI) sells enterprise-level server solutions, including GPU-optimized servers designed for AI and machine learning applications. Like Lambda Labs, Super Micro focuses on delivering high-performance, scalable solutions for workstations and data centers.

- Advanced Micro Devices (AMD) produces high-performance processors and GPUs, which are used in AI applications similar to Lambda Labs' offerings. While AMD's focus on hardware makes it more of a competitor to NVIDIA than Lambda, its GPUs also support deep learning workloads, an alternative to Lambda's desktop products.

- Dell Technologies (DELL) also offers a variety of computing solutions, including workstations and servers equipped with GPUs for AI and machine learning.

You could also make a general investment in the semiconductor industry by buying an ETF like SOXX, SMH, or CHPS.

When will Lambda IPO?

In September 2025, news broke that Lambda was preparing for an IPO.

The company had gone as far as hiring Morgan Stanley, J.P. Morgan, and Citi to help with its public listing, and was reportedly targeting an IPO in the first half of 2026.

CoreWeave (CRWV), Lambda's biggest rival, went public in March.

But since then, there's been little movement toward its public offering. Instead, Lambda raised roughly $1.5 billion in private funding — a move that more than likely pushes any IPO plans to late 2026 or beyond.

Still, it looks like an IPO will be coming in the not-too-distant future.

When it does go public, you'll need a brokerage account to buy its stock. If you need a brokerage account, we recommend Public (check out my Public review for more information).

Who founded Lambda Labs?

Lambda Labs was founded in 2012 by brothers Stephen — the CEO — and Michael — the head of engineering — Balaban.

At the time, Stephen was working as a software engineer at Perceptio. Perceptio created neural networks for facial recognition that ran locally on the GPUs embedded in iPhones. Apple later acquired the company.

Their idea was simple: take the same model but, instead of running it on local GPUs, offer it on the cloud. That way, customers would be able to run machine learning workloads from anywhere, without having to buy their own hardware.

Today, Lambda serves over 150,000 Cloud users, has raised over $2.3 billion from investors, and may be valued at more than $10 billion (by my estimates).

How much is Lambda Labs worth?

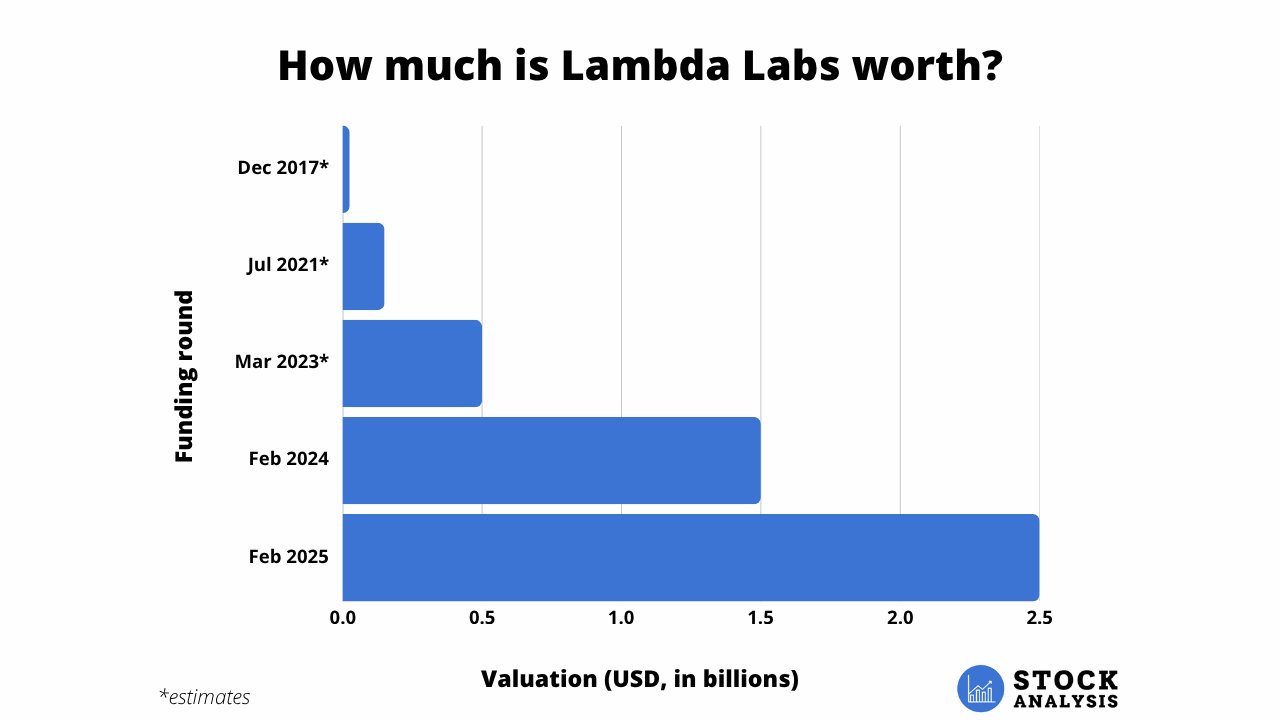

Lambda most recently raised $1.5 billion at an undisclosed valuation* in its Series E in November 2025. The round came on the heels of a multibillion-dollar deal to supply Microsoft with AI infrastructure.

*While no valuation was reported, Lambda had been in talks with investors since August about raising hundreds of millions of dollars at a valuation of at least $4 billion. Given the size of the new round and its Microsoft contract, Lambda may have raised at a $10–15 billion valuation.

Prior to this round, Lambda raised $480 million at a $2.5 billion valuation in February 2025, up from the $1.5 billion valuation it had received a year earlier.

That $1.5-billion round, its Series C, was the first time it had publicly disclosed its valuation. Prior to that round, Lambda had raised a $44 million Series B in March 2023, a $24.5 million Series A in July 2021, and a $4 million seed round in December 2017.

Here's a look at how its valuation has changed over time (estimates mine):

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.