How to Invest in Liquid Death in 2026

Yes, it's just water.

It's hard to imagine a company that sells cans of water could be worth more than $1 billion, but that's exactly what Liquid Death has achieved.

There's nothing special about the product, which is just water. There's also nothing noteworthy about the company's supply chain or its distribution network.

Liquid Death's billion-dollar-plus valuation comes down to one thing: branding — and its effects on consumer behavior.

That branding has sent the company's revenue and valuation sky high — both more than doubled year over year. Still, Liquid Death's 2023 sales of $263 million is just a sliver of the $302 billion bottled water market. It may still be in its very early innings.

And you may be able to invest in its stock.

How to buy Liquid Death stock

Liquid Death is a private company. It hasn't become publicly traded, which means there is no stock symbol and no way for you to buy it in your traditional brokerage account. However, its shares are available on Hiive.

Hiive is an investment platform that allows accredited investors to buy shares of pre-IPO companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 companies listed on Hiive, including Liquid Death:

Disclaimer: Investing in private securities is risky, and performance is not guaranteed.

Each of these 13 listings of Liquid Death stock was created by a unique seller. Sellers may be current or former employees, venture capitalists, or angel investors.

Each seller creates a listing by offering a certain quantity of shares and setting their asking price.

After creating an account, accredited and verified buyers can see the complete order book (all bids, asks, and recent transactions) for every company on Hiive.

From there, buyers can accept a seller's asking price as listed or place bids and negotiate directly with sellers. They can add companies to their watchlist and receive notifications on the companies they follow.

Create an account with the button below and see what shares of Liquid Death are trading for right now:

Can retail investors buy Liquid Death stock?

No, retail investors can't buy Liquid Death stock while it's still a private company.

The stock won't be publicly available until after an IPO or acquisition (more on this in the section below).

Since Liquid Death's business is fueled by its unique marketing and brand, there aren't any direct alternatives that you can invest in instead.

Coca-Cola (KO) and PepsiCo (PEP), in addition to their hugely successful soft drinks, both own a number of water and other health-conscious brands:

- Coca-Cola: Dasani, Smart Water, Topo Chico, Powerade, Vitamin Water, Fairlife, Honest, and more

- PepsiCo: Aquafina, Lifewater, Gatorade, Propel, SoBe, Tropicana, and more

If you're bullish on consumers opting for healthier beverages, investing in one of these companies may make sense. Plus, if Liquid Death was ever acquired, there's a good chance it would be by one of these two companies.

That said, an investment in either one of these stocks will not perform the same as an investment in Liquid Death.

You may prefer to wait for its IPO, which could be happening soon.

When will Liquid Death IPO?

In July 2023, news broke that Liquid Death had hired Goldman Sachs for its initial public offering, which was expected to happen toward the end of 2024.

Since then, no further information has been released, and the company has raised another round of funding, likely delaying any IPO plans until at least 2025.

In March 2024, Liquid Death raised a fresh $67 million to further develop its range of products. After starting in spring water, the company has expanded into carbonated and flavored waters, as well as iced tea.

In regard to becoming publicly traded, co-founder and CEO Mike Cessario mentioned the possibility of an IPO or a strategic partnership in the future during an interview with Bloomberg following the March round, though he didn't suggest any timeline.

He stated that, for now, the company was focused on growth and improving its margins.

When Liquid Death does become publicly traded, you'll need a brokerage account to buy it. Check out our article on the best brokerage accounts in 2026.

Who founded Liquid Death?

Liquid Death was the brainchild of Mike Cessario, a former advertising creative director who serves as the company's CEO.

After spending years advertising unhealthy products, Cessario's love of fitness and health sparked an idea: what if you took something healthy and made it cool?

And thus, Liquid Death was born.

Most water brands differentiate themselves by focusing on the water itself — where it's sourced, its electrolyte content, or its PH balance. Liquid Death is just plain water.

However, all of its marketing is dripping with rebellion and danger.

When speaking about the company's twin pillars of health and environmental awareness, its messages contain verbiage such as “murdering your thirst” and “bringing death to plastics,” thanks to its recyclable aluminum cans.

In addition to the environmental benefits, the inspiration for selling it in a tall-boy can came when Cessario learned that some musicians who preferred to drink water onstage were pouring it into Monster Energy to avoid embarrassment.

He reasoned the same may be true for people at bars who wanted to drink water, and a can of Liquid Death could eliminate the self-consciousness in that moment.

Liquid Death revenue

Its relentless focus on brand has allowed Liquid Death to carve out a sizable (and growing) piece of the saturated bottled water market.

Liquid Death was launched in 2017.

There are no publicly available revenue figures for its first few years in business, but it has more than doubled sales each year for the last three years:

- 2021: $45 million

- 2022: $130 million

- 2023: $263 million

It's very likely the fastest-growing water and iced tea brand in the world.

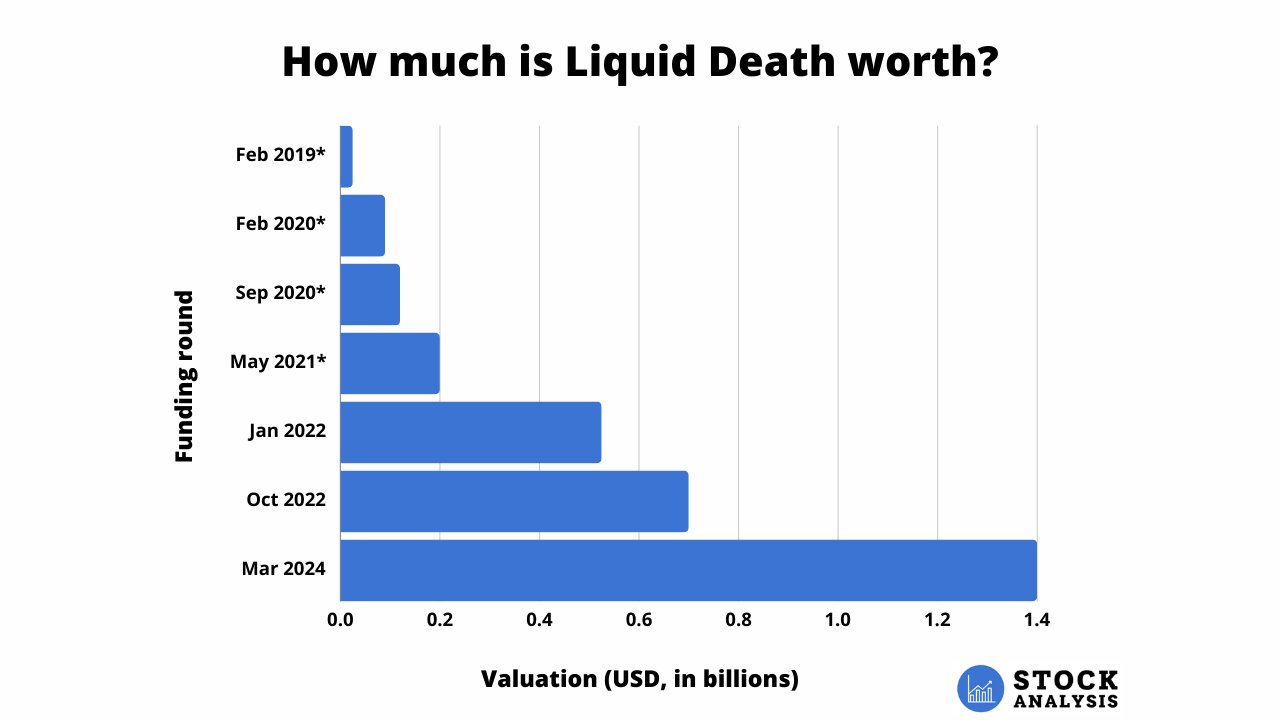

How much is Liquid Death worth?

Here's a quick overview of Liquid Death's funding rounds:

| Date | Round | Amount Raised | Valuation |

| 2019 | Seed funding | $1.6 million | |

| February 2020 | Series A | $9 million | |

| September 2020 | Series B | $23 million | |

| May 2021 | Series C | $15 million | |

| January 2022 | Series C | $75 million | $525 million |

| October 2022 | Series D | $70 million | $700 million |

| March 2024 | Venture round | $67 million | $1.4 billion |

Liquid Death has raised funds from 38 investors, including Live Nation Entertainment, SuRo Capital, TO Ventures, Deandre Hopkins, and Neal Brennan.

And here's a look at how its valuation history has grown (*estimates are mine):

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.