How to Invest in Outreach Stock in 2026

Outreach is at the intersection of artificial intelligence (AI) and customer relationship management (CRM) software.

The company provides a semiautomated sales engagement platform designed to help companies make more sales.

The platform automates a number of repetitive tasks, uses machine learning and AI to personalize prospect communications, tracks sales statistics, and more — all to create more efficient and higher-converting sales teams.

And it works.

According to a study, companies that deploy Outreach can expect an ROI of 387% over three years and a payback period of fewer than three months.

The platform now has more than 6,000 customers, and the company tripled its revenue to $250 million in 2023.

Here's how you can invest in Outreach stock.

How to buy Outreach stock

Outreach is still a private company, which means it doesn't have a stock symbol and doesn't trade on a public exchange.

That said, accredited investors can buy shares of privately held companies on Hiive, an investment marketplace for pre-IPO companies.

There are 33 listings of Outreach stock on Hiive at the time of this writing:

Here's how to invest in Outreach stock:

- Go to Hiive's website and click “Sign Up."

- Enter your name and basic details.

- Agree to the terms and click "Sign Up" at the bottom.

- Answer a series of eligibility questions.

- Wait for Hiive to get back to you regarding your account.

- After you receive confirmation, go to the site, log in, and search for “Outreach” stock.

- Browse listings and purchase the stock. You can either accept that price and buy directly or make an offer and negotiate directly with the seller.

Learn more about Hiive in our full review, or click the button to register:

Can retail investors buy Outreach stock?

No, retail investors won't be able to buy Outreach stock until it becomes a public company.

While no two companies are exactly alike, you may be interested in one of a few publicly traded CRM software companies integrating AI into their platforms:

- Salesforce (CRM) is the world's leading CRM vendor, a title it's held for 11 years. In 2023, it held 21.7% of the market share, which is more than 3x the size of its closest competitor, Microsoft. Salesforce's stock is down 7.4% YTD and trades at a 6.5x P/S ratio.

- HubSpot (HUBS) provides a business platform that includes tools for marketing, sales, services, and content management. HubSpot has been growing rapidly, with revenue up ~6x since 2017. Its stock is up 4.1% YTD and trades at 13x sales.

- monday.com (MDNY) also offers a sales CRM, though the company is best known for its work management tools used for team collaboration and project management. Its stock is up 24% YTD and is trading at a P/S of 14x.

If none of the companies above are quite what you're looking for, but you want to invest in the space in general, you may want to consider an ETF.

For example, the iShares Expanded Tech-Software Sector ETF (IGV) invested in information technology stocks. Its top 5 holdings are Microsoft, Oracle, Adobe, Salesforce, and Intuit.

None of these investment ideas will be the same as owning Outreach itself, but they will get you exposure to the space.

Still, you may decide to wait until its public offering.

When will Outreach IPO?

The company has not made any indication of when it will go public, though we may be able to speculate.

Outreach hasn't raised money since its June 2021 round (more on that below). It either 1) hasn't needed to or 2) hasn't wanted to.

In September 2023, Outreach laid off 12% of its staff, the fourth such reduction since August 2022 (5% in August 2022, 7% in February 2023, and 5% in August 2023).

When asked about the most recent round of cuts in September, a spokesperson pointed to the shifting economic environment and the company's goal of reaching profitability in 2024.

Assuming the company has grown at a similar rate as it did in 2023, it's likely at or near profitability. This is supported by the fact that the company hasn't needed to raise a round in the last three years.

If this is the case, Outreach is likely receiving pressure from its investors to take the company public.

The IPO market has been warming up lately, so it would not be surprising to see a news headline saying Outreach had filed its S-1 with the SEC before the end of 2024.

You'll need a brokerage account to buy Outreach when it becomes publicly traded. If you don't have one or are looking for a new one, check out our article on the best brokerage accounts.

Who founded Outreach?

Outreach was founded in Seattle in 2014 by Manny Medina, Gordon Hempton, Wes Hather, and Andrew Kinzer, who are all former Microsoft employees.

Today, only Medina (CEO) remains at Outreach.

Hempton and Hather co-founded FullContext, where they serve as CEO and CPO. Meanwhile, Kinzer is the founder and CEO of Tomorrow.

Who has invested in Outreach?

The company's $489 million in funding has come from 37 investors.

Some of the names on the list include:

- Sequoia Capital

- Tiger Global Management

- Vista Equity Partners

- Salesforce Ventures

- DFJ Growth

- Mayfield Fund

- Trinity Ventures

- Investlink Holdings

- Sands Capital

- Lone Pine Capital

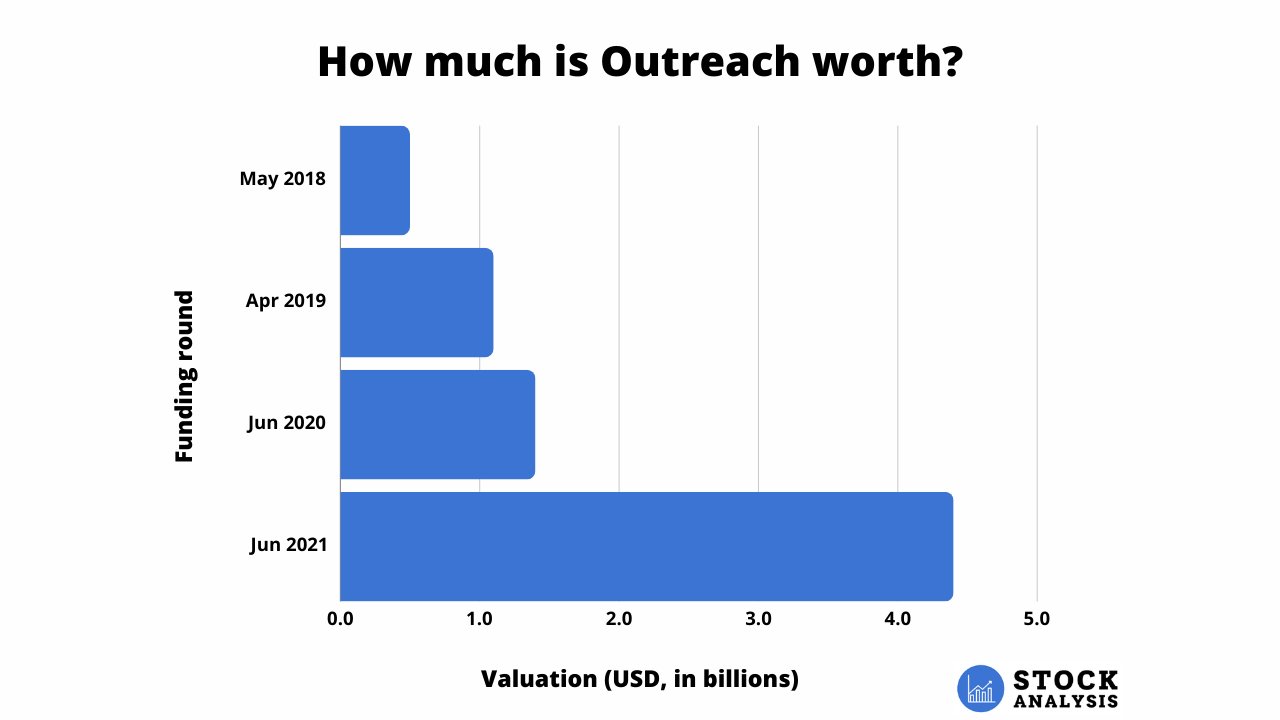

How much is Outreach worth?

Outreach has raised $489 million to date, including the $200 million it raised at its most recent round in June 2021, which valued the company at $4.4 billion.

The round came on the back of 100% YoY growth in annual recurring revenue (ARR) and news that its technology was being used by 18 of the top 25 fastest-growing public software companies.

Here's a look at how the company's valuation has changed since it was founded in 2014:

Unfortunately, there's not any more recent data on Outreach's current valuation.

However, accredited investors can see the valuation its shares are trading at on the pre-IPO market by registering for Hiive.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.