How to Buy Replit Stock in 2026

Replit is an integrated development environment (IDE) that enables developers — and, increasingly, non-technical users — to build and deploy websites and other software applications directly from their browsers.

Replit was founded in 2016, but the company's trajectory changed dramatically in 2024 with the introduction of Replit Agent, its AI-powered coding assistant.

With it, users could build fully functional apps with natural-language prompts.

The results were immediate. By July 2025, annualized revenue had surged from $2.8 million to $150 million, a 50x increase in less than a year.

It now has 40 million users and was valued at $3 billion in September 2025. And it may still be in its early innings.

But can you invest in it?

Can you buy Replit stock?

Replit is a private company, which means there's no Replit stock symbol and it doesn't trade on the NYSE or Nasdaq.

That said, its shares do trade on Hiive.

Hiive is a pre-IPO marketplace where accredited investors can buy shares of privately held, venture-backed companies.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

There are over 3,500 companies listed on Hiive, including SpaceX, Anysphere (the lab behind Cursor), and Replit:

Each of these 14 listings was created by a unique seller who sets their own asking price and quantity of shares available.

Most sellers on Hiive are current or former employees, but they could also be VCs or angel investors.

Once a listing is created, buyers can place a bid on the shares or meet the seller at their asking price. After a buyer and seller agree on a price, Hiive's team facilitates the transaction.

Buyers can see the full order book — all listings, bids, and recent transactions — for every company on Hiive.

To see the order book for Replit, create an account with the button below:

Can retail investors buy Replit?

Hiive is only available to accredited investors, so retail investors cannot directly buy shares of Replit stock.

However, regular investors can get exposure to Replit through the ARK Venture Fund.

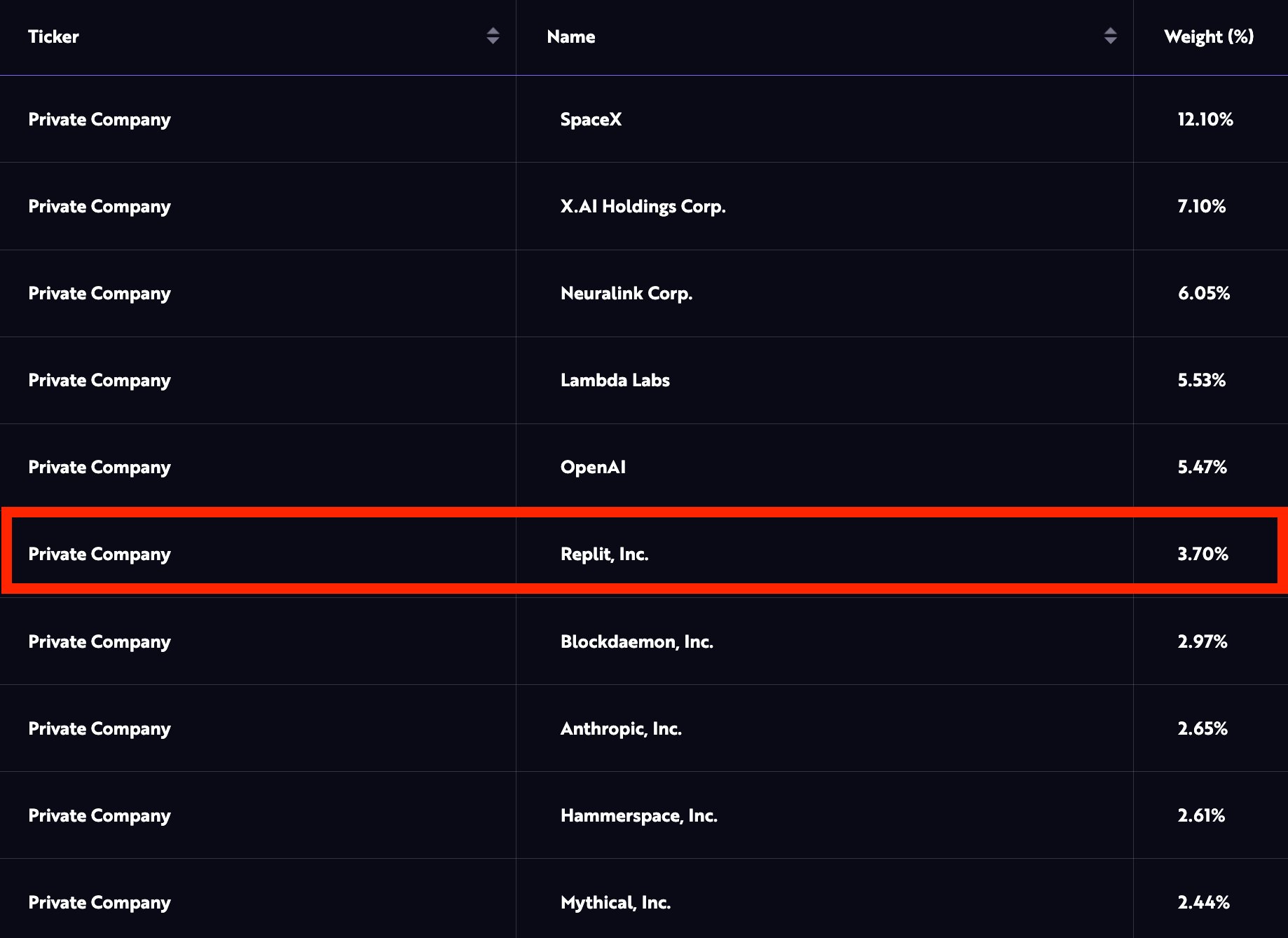

The ARK Venture Fund is an actively managed fund that primarily invests in private technology companies. Its top 10 holdings include SpaceX, xAI, Neuralink, OpenAI, and Replit:

As of August 2025, Replit makes up 3.70% of the fund — its 6th largest holding.

While investing in the ARK Venture Fund isn't the same as buying Replit stock, it will give you some exposure, and you'll also own stakes in a number of other venture-backed companies you may be interested in.

The fund is available to all U.S. investors and has an annual management fee of 2.90%. You can learn more about it and how to invest on the ARK website.

Alternatives to Replit

While Replit's primary competitors are also private companies — Cursor, Lovable, Windsurf — there are other companies that will give you exposure to the AI development and vibe-coding space.

Here are a few publicly traded companies you may be interested in:

- Microsoft (MSFT) has been a dominant force in software and development tools. GitHub, which has over 150 million users, is a code hosting and collaboration platform and is the home of GitHub Copilot, an AI coding assistant built on OpenAI's technology. Microsoft has also integrated AI across its Azure cloud platform, Visual Studio, and Office products.

- Alphabet (GOOGL), the parent company of Google, has also been making aggressive moves in AI-assisted software development. In July 2025, Google acquired the team behind Windsurf, an AI-native coding environment. Additionally, it has integrated AI coding features into Google Cloud and its developer tooling, and added AI to its Google Workspace products (Docs, Sheets, Slides, etc.).

- Amazon (AMZN), through AWS, offers CodeWhisperer, its own AI code generation tool that integrates directly into popular IDEs. They also recently launched Kiro, an AI development tool that competes directly with Replit.

- Oracle (ORCL) and IBM (IBM), while better known for enterprise software and consulting, have also rolled out AI-assisted development platforms targeting corporate IT teams.

While none of these companies are exclusively focused on browser-based vibe-coding like Replit, they are all leaning heavily into AI-enabled coding.

A few smaller players in the AI development space are GitLab (GTLB), C3.ai (AI), and Dynatrace (DT).

If none of these fit what you're looking for, you may want to wait until Replit's IPO.

When will Replit go public?

Replit founder and CEO Amjad Masad has not mentioned any plans to take the company public.

The company recently completed its Series C (raising $250 million at a $3 billion valuation) in July 2025.

If it were to follow the conventional venture path, it would need to have 1–2 more private rounds (at increasingly high valuations) before a public offering would be seriously considered.

This likely means its IPO would happen in 2027 at the earliest.

When it does go public, you'll need a brokerage account. If you don't have a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, bonds, Treasuries, and crypto, all on one of the most modern investing platforms.

Who founded Replit?

Replit was founded in 2016 by Amjad Masad, alongside his wife, Haya Odeh, and his brother, Faris Masad.

Amjad, a former Facebook engineer, wanted to build a browser-based coding environment.

Instead of writing code in a text editor, saving it in a secondary repository, and then running it on a server or public cloud, Replit would allow developers to write and ship code directly from their web browsers.

The platform made coding much more accessible and was especially useful for kids and students who were programming for the first time.

Replit grew steadily, hitting 1 million users in October 2018 and 10 million by December 2021, but struggled to monetize.

All of that changed with Replit's release of Replit Agent, its AI-powered coding assistant, in September 2024.

Replit's annual recurring revenue (ARR) jumped from $4 million at the end of June 2024 to $100 million by mid-June 2025, a 25x increase in less than a year and a 10x increase YTD.

Replit's goal is to be the full-stack coding solution for 1 billion developers. It currently has 40 million.

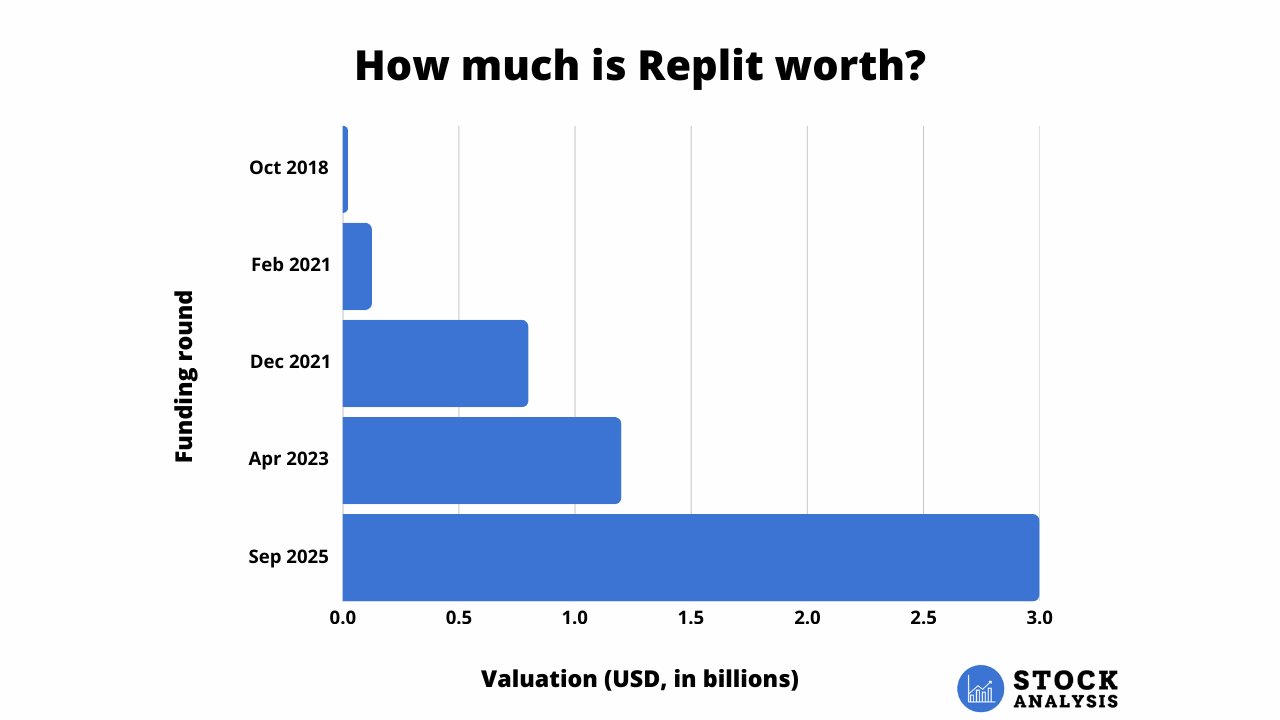

How much is Replit worth?

Replit most recently raised $250 million at a $3 billion valuation in September 2025, almost triple the $1.16 billion valuation it received in April 2023.

Here's how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.