How to Buy ServiceTitan Stock in 2024

ServiceTitan is a multi-billion-dollar startup that provides software to more than 11,800 home and commercial service providers.

The company's all-in-one platform includes dispatching, scheduling, marketing, reporting, and call booking to help contractors grow their businesses, improve efficiency, and enhance customer experience.

Its clients include plumbers, handymen, house painters, locksmiths, cleaners, pressure washers, landscapers, electricians, HVAC companies, and more. The company is likely doing well over $500 million per year in revenue. Business is good.

There's been speculation about ServiceTitan's IPO coming before the end of 2024, and its stock is becoming increasingly active on the pre-IPO market.

Here's how to buy ServiceTitan before its IPO.

How to buy ServiceTitan stock

ServiceTitan is a private company.

There is no ServiceTitan stock symbol, it doesn't trade on a public exchange, and there's no way for you to buy it in your regular brokerage account.

However, accredited investors can buy shares on Hiive, an investment platform that allows accredited investors to invest in private, pre-IPO, VC-backed startups.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 companies listed on Hiive, including ServiceTitan.

As of the time of this writing, there are 18 listings of ServiceTitan stock available on Hiive.

Each of these listings was created by a different seller who may be a current or former employee, a venture capitalist, or an angel investor. Every seller sets their own asking price and quantity of shares available.

After registering, buyers can see each of these listings as well as all the active bids.

They can accept a seller's asking price as listed, place their own bid, or add a company to their watchlist and get notified of any new activity. Buyers can also see the details of all recent transactions.

See what price shares of ServiceTitan are trading at on the pre-IPO market by registering for an account on Hiive.

Can retail investors buy ServiceTitan stock?

No, retail investors cannot invest directly in shares of ServiceTitan while it's a private company. However, you may not have to wait too long for the company's IPO.

In the meantime, you can also get exposure to the company via Fundrise's Innovation Fund, which invests in privately held, venture-backed technology companies.

According to investors in the fund, Fundrise invested $10 million (a sizable portion of its $127 million total) in ServiceTitan on June 26, 2023.

The fund primarily invests in AI, machine learning, and data infrastructure businesses, but added ServiceTitan to the portfolio after recognizing its significant room for growth in existing markets, adjacent markets, and international expansion.

The fund has also invested in Anthropic, Anduril, Canva, Databricks, and Twilio.

Anyone can invest in the Innovation Fund, including non-accredited retail investors, with a minimum investment of $10.

When will ServiceTitan IPO?

In December 2023, news broke that ServiceTitan had restarted its preparations to go public.

The company had initially planned to go public in 2022, but the ice-cold IPO market made it change its plans. Since then, there had been no mention of the company becoming publicly traded until a few months ago.

In the press release from December, Reuters suggested ServiceTitan may have been aiming to go public in the first half of 2024. I'm writing this in July, and no IPO date has been set.

But the company is getting the pieces in place.

In January 2024, ServiceTitan hired Michele O'Connor as its chief accounting officer. O'Connor had most recently served as chief accounting officer at Veeva Systems, and was a critical player in getting the company ready for its IPO back in October 2013.

And with the IPO market warming up, it seems the timing may finally be right. Keep an eye out for its public debut in the next handful of months.

When it does become a public company, you'll need a brokerage account to buy it. If you're in the market, check out our article on the best brokerage accounts.

Who founded ServiceTitan?

During the summer between graduating from college and heading to Silicon Valley for programming jobs, Ara Mahdessian and Vahe Kuzoyan started working on a project together.

Both of their fathers were contractors — one a plumber, the other in construction — and the pair figured they could create some simple software to help them run their businesses better.

That was in 2007. The two never left for Silicon Valley.

The company passed $100 million in ARR (annual recurring revenue) in April 2018 and $200 million in December 2020. Based on its current customer count, I estimate this number to be around $500–650 million in July 2024.

The company has raised $1.1 billion over eight rounds (more on these below).

Because of these many rounds, Ara and Vahe likely have diluted ownership stakes. Nevertheless, the pair successfully created a company worth billions of dollars. Not bad for a summer project.

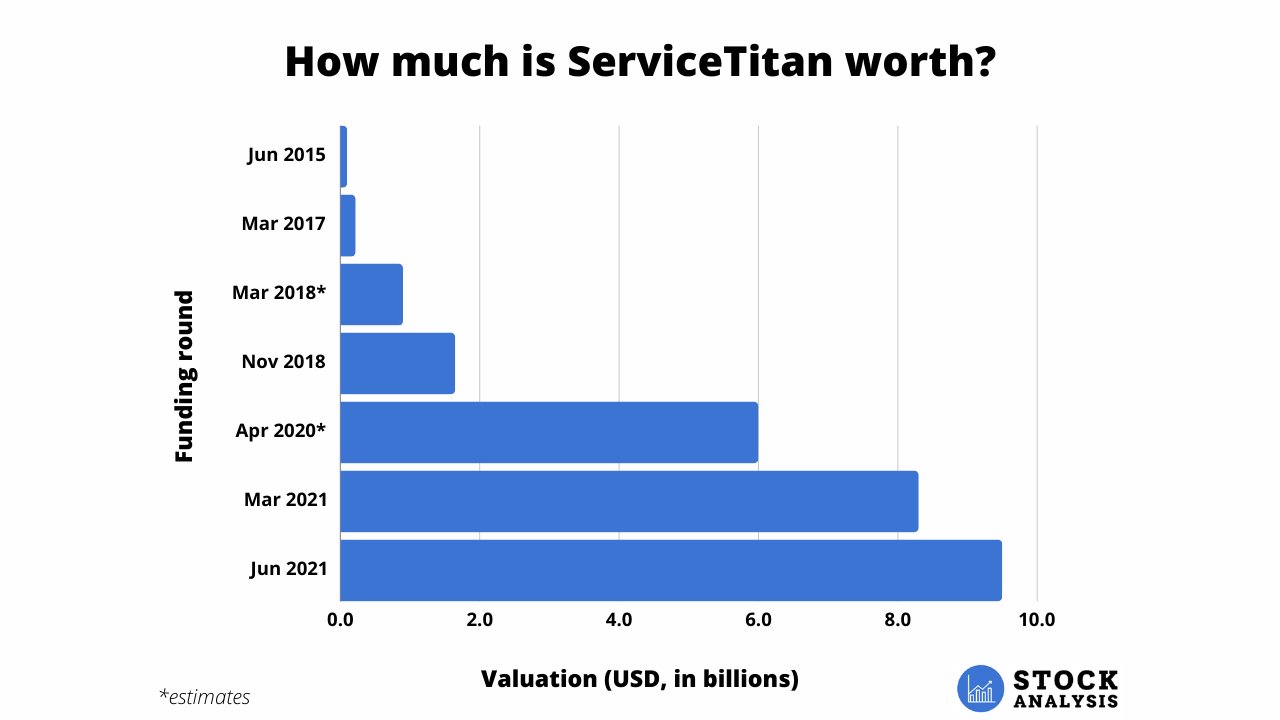

How much is ServiceTitan worth?

In June 2021, ServiceTitan raised $200 million in its series G, which valued the company at $9.5 billion.

At the time of this round, the company likely had $250 million in ARR.

Today, I estimate this figure is closer to $500–650 million. If we were to assign it the same valuation it earned in its series G, this would indicate the company is worth around $19 billion.

Here's a look at how its valuation has changed over time:

Who has invested in ServiceTitan?

ServiceTitan has raised $1.1 billion from 22 investors.

These include Thoma Bravo, Tiger Global Management, Sequoia Capital, Global Equities, Battery Ventures, Bessemer Venture Partners, Dragoneer Investment Group, Durable Capital, Iconiq Capital, Index Ventures, T. Rowe Price (TROW), and more.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.