How to Invest in Vercel Stock in 2026

Vercel is a cloud-based platform that helps developers build and launch web applications.

It handles everything from deployment to global scaling, so teams don't need to manage servers or complex infrastructure.

The company is best known as the creator of Next.js, an extremely popular open-source framework behind many of today's fastest, most interactive websites — including TikTok, Uber, OpenAI, Nike, PayPal, Walmart, Netflix, and many others.

Unlike legacy providers like AWS or Azure, which focus on back-end computing, Vercel is mostly optimized for the front end, delivering faster performance, seamless deployment, and a superior developer experience.

This focus has made Vercel the go-to platform for hosting fast, interactive websites and apps, firmly positioning itself as a key player in the next generation of internet infrastructure.

Building on that foundation, Vercel has also launched tools like v0 and AI SDK, enabling developers to easily create their own AI-powered applications.

The convergence of strong positioning, market demand, and well-timed innovation has driven remarkable business results.

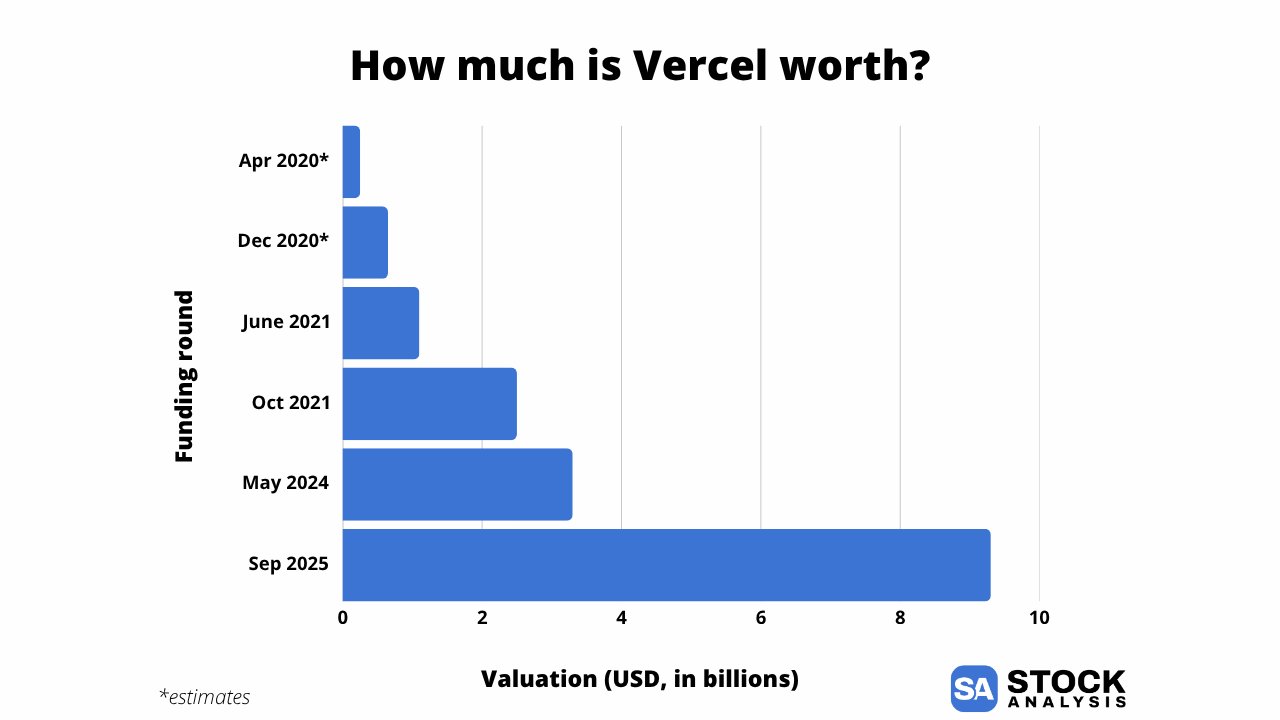

In September 2025, the company raised $300 million at a $9.3 billion valuation, almost triple the valuation it received just 18 months prior.

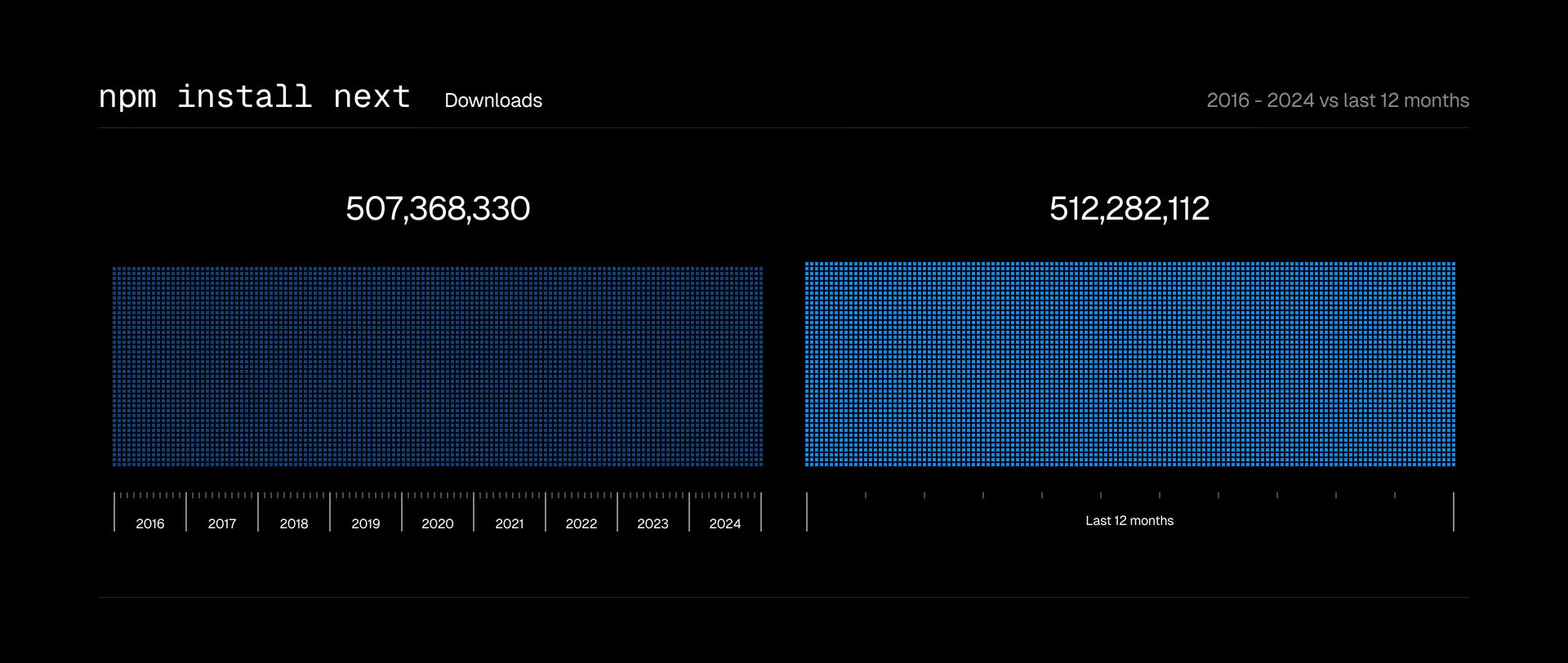

At the time of the raise, Vercel announced that its Next.js framework had been downloaded more times in the trailing twelve months than from 2016 to 2024 combined, and that revenue rose 82% over the same period.

And if you're wondering if there's a way to invest in it, there is — if you qualify.

Can you buy Vercel stock?

While Vercel is still a private company (it's not publicly traded, so there's no stock symbol to look up and buy in your brokerage account), there is a way to buy shares.

Hiive is an investment platform where accredited investors can buy shares of pre-IPO companies.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

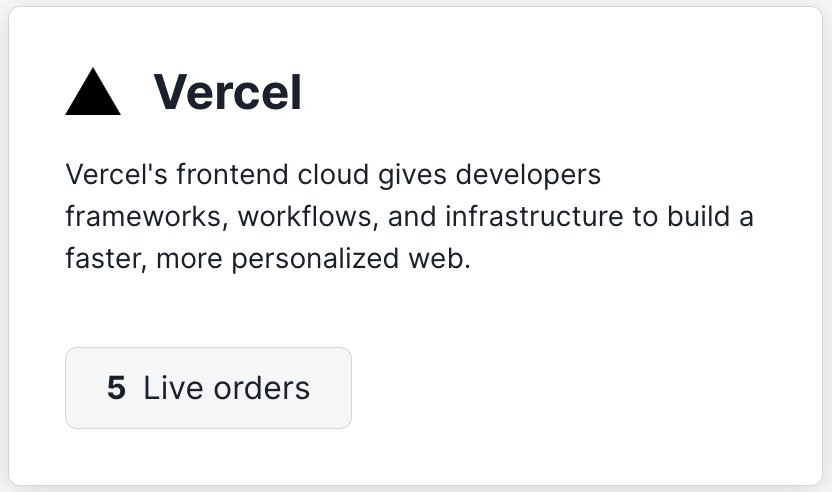

Shares of more than 3,000 private, VC-backed companies are available on Hiive, including Vercel:

At the time of this writing, there are 5 live orders of Vercel stock available.

Each of these listings was created by a distinct seller who is a current shareholder of Vercel. Sellers are typically current or former employees, angel investors, or venture capitalists.

Once a listing is created, buyers can see the number of shares being offered and the asking price.

From there, they can place bids on the shares or add the company to their watchlist and get notified of any new listings or transactions.

To see the shares available for Vercel — and every other startup on Hiive — create a free account with the button below:

Can retail investors buy Vercel?

Unfortunately, since Hiive is only available to accredited investors, there is no way for retail investors to invest in Vercel.

However, there are several publicly traded companies that are building similar tools and infrastructure for the next generation of AI-powered and other complex web applications.

Here are a few players you might be interested in:

- Cloudflare (NET) provides edge computing and developer tools that compete directly with Vercel's hosting platform. Its global edge network helps developers deploy fast, secure, and scalable web applications.

- Fastly (FSLY) is focused on edge delivery and performance optimization for dynamic web content. Like Vercel, it enables low-latency user experiences, which is especially useful for apps that rely on real-time data.

- Datadog (DDOG) monitors and tracks app performance, security, and infrastructure health. While it isn't a direct competitor of Vercel, it serves the same customer base and is likely to benefit from the same macro trends (i.e., AI adoption, cloud-native development, and the shift toward edge computing).

Additionally, Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) each operate major cloud platforms — AWS, Azure, and Google Cloud — which provide the backbone for many web hosting and AI workloads.

While there's some overlap with Vercel's services, it runs as a specialized layer on top of those clouds (primarily AWS), making them more complementary partners than direct competitors.

Obviously, none of these options is the same as investing in Vercel itself. If you're only interested in owning a piece of the company, you'll have to wait for its IPO — which may not be too far away.

When will Vercel go public?

As mentioned above, Vercel raised a fresh $300 million in September 2025.

Separately, the company is in the middle of a $300 million secondary share sale to provide liquidity to any employees and early investors who may want to cash in some or all of their shares.

Based on these two events, it's unlikely Vercel will go public before 2027.

That said, its September 2025 round was a Series F, which often marks the final private raise before a company goes public. If Vercel follows a similar path, an IPO could be coming in the next couple of years.

When it does go public, you'll need a brokerage account to buy stock. If you don't have a brokerage account, we recommend Public.

With Public, you can invest in stocks, ETFs, bonds, Treasuries, and crypto.

All account holders also receive a complimentary high-yield savings account currently paying 3.8% APY.

Vercel's history

Vercel was founded in 2015 by Guillermo Rauch, an Argentinian software engineer already known for creating popular open-source JavaScript libraries like Socket.IO and Mongoose.

Rauch wanted to create a simple way to deploy modern web applications by removing the need for servers, configuration, or DevOps.

In 2016, the company (originally called ZEIT) launched its first product, Now, as a one-command deployment tool for front-end and Node.js apps. It quickly caught on among independent developers who valued speed and simplicity.

While working on Now, Rauch had also been working on Next.js, an open-source React framework.

In 2020, wanting to expand from powering individual projects to establishing an entire front-end ecosystem, Rauch rebranded the company as Vercel and made it the official home of Next.js.

Around that time, Next.js surged in popularity and became the standard for high-performance web apps, which in turn established Vercel as the go-to place for deploying them.

The rise of AI-powered web apps has only accelerated that growth, as developers increasingly rely on Next.js to build dynamic interfaces that connect to AI models.

In 2023, Vercel introduced v0, an AI web development tool that creates applications directly from natural language prompts.

That year, it also released AI SDK, a software development kit designed to allow developers to build conversational streaming interfaces in JavaScript and TypeScript.

As mentioned above, Next.js was downloaded more times in the 12 months ending September 2025 than in the entire 2016–2024 period combined.

Source: Vercel

And in June 2025, Vercel surpassed $200 million in annual recurring revenue, doubling in just 15 months.

How Next.js powers Vercel's business model

Next.js is open-source and free to use, which means Vercel doesn't make money from it directly.

However, the framework seamlessly integrates with Vercel's cloud platform — so when developers use Next.js, deploying to Vercel's hosting infrastructure is the easiest and fastest option. And that's where Vercel makes its money.

Its core business is cloud hosting and developer tools that support websites and apps built on Next.js. Customers pay for usage, bandwidth, team collaboration features, and enterprise-grade performance.

Vercel also supports other frameworks, but Next.js is what gives Vercel a built-in strategic position at the center of modern front-end development.

How much is Vercel worth?

Vercel was most recently valued at $9.3 billion in a $300 million (oversubscribed) Series F round in September 2025. This is nearly triple the $3.25 billion valuation it received in May 2024.

In total, Vercel has raised $863 million over six rounds.

Accel — a leading venture capital firm and Vercel's primary backer — has participated in each of these rounds and led or co-led three.

Here's a look at how Vercel's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.