The 9 Largest Private Credit Funds in the World (Top Firms by AUM)

Private credit has quietly become one of Wall Street's favorite asset classes.

Goldman Sachs recently raised $21 billion for its largest private credit pool yet, adding to its total of $76 billion raised in the last five years. Ares Management raised a staggering $115.9 billion for its private credit managers over the same period.

Overall, BlackRock expects the total private debt market to reach $3.5 trillion by the end of 2028.

The money has been pouring in. And it's not hard to understand why.

Why private credit?

In short, private credit can offer investors double-digit floating interest rates and short term durations. These high, predictable returns are extremely attractive to a wide swath of income-focused investors.

Plus, the class has also shown a low correlation to public markets. This makes it particularly appealing for portfolios made up of traditional assets like stocks and bonds.

To learn more about why investors choose private credit, you can check out our more detailed section on this later in the article.

For now, you're probably wondering: who are the biggest players in the space?

The 9 largest private credit fund managers

Here's the list of the nine largest private credit funds in the world based on the total amount of assets invested in private credit.

It's worth noting that the U.S. dominates this space, though Europe has been closing the gap in recent years.

Who can invest?

The vast majority of top private credit funds are only available to institutional investors. Individual investors cannot invest with them.

However, individual investors can invest in private credit via Percent, an investment platform. More about Percent below.

1. Blackstone

- Private credit AUM*: $68.4 billion

- Total AUM: $1+ trillion

- Headquarters: New York

*AUM is the abbreviation for assets under management.

Blackstone (BX) manages over $1 trillion in assets, making it the world's largest alternative asset manager.

The company is best known for investing in real estate and private equity, though it also has substantial investments in infrastructure, energy, private credit, and more.

Blackstone's private credit portfolio, known as BCRED, has investments totaling $68.4 billion. The portfolio has exposure to 500+ companies in 50+ sectors, and 97% of its loans are senior secured debt.

The BCRED fund has generated a 10.4% annualized total return since inception.

The BCRED fund is only available to institutional investors (such as pension funds, insurance companies, banks, and hedge funds), financial advisors for the ultra-wealthy, and family offices.

Family offices

A family office is a private wealth management firm set up to manage the wealth of a single ultra-high-net-worth family or a group of families. An individual should have at least $100 million in investable assets to make a family office viable.

The BCRED fund is not available to individual investors.

2. Blue Owl Capital

- Private credit AUM: $31.5 billion

- Total AUM: $95.1 billion

- Headquarters: New York

The next largest private credit firm behind Blackstone, Blue Owl Capital (OWL), has $31.5 billion invested in the asset class.

Blue Owl was formed through the merger of Owl Rock Capital and Dyal Capital in May 2021, both of which had substantial private credit funds before joining forces.

Today, private credit is the firm's largest asset class, followed by GP strategic capital (financing and minority equity solutions to private capital managers) and real estate.

Blue Owl's private credit investment strategy includes a mixture of senior secured loans, unitranche financing, and custom credit arrangements.

The firm's private credit offerings are only available to institutional investors, alternative asset managers, and some financial advisors.

3. Bain Capital

- Private credit AUM: $13.3 billion

- Total AUM: $185 billion

- Headquarters: Boston

Bain Capital is a private investment firm that manages $185 billion, $13.3 billion of which is invested in private credit.

The firm's primary focus is private equity, but it also has sizable holdings in the public equity, fixed income, private credit, venture capital, and real estate markets.

The firm's dedicated direct lending arm is known as Bain Capital Credit. It invests in multiple forms of private credit offerings, including senior secured loans, mezzanine debt, and distressed debt investments.

Bain's clients are made up of pension funds, insurance companies, and other institutional investors, not individual investors.

4. Apollo Global Management

- Private credit AUM: $5.1 billion

- Total AUM: $651 billion

- Headquarters: New York

Apollo Global Management (APO) is a private equity firm specializing in private equity, credit, infrastructure, and real estate.

In all, the firm manages $651 billion, of which $5.1 billion is private credit. Its credit investment strategies focus on:

- Multi-sector credit

- Semi-liquid credit

- Direct lending

- First lien

- Unitranche

- Whole loans

- Private credit

As you can see, private credit only makes up one portion of its credit portfolio, but it's growing rapidly. Over the last five years, Apollo has raised an average of $49.6 million per year for its private credit managers to oversee.

Apollo allows investment from institutional-level investors and family offices only.

5. Oaktree Capital Management

- Private credit AUM: $5 billion

- Total AUM: $202 billion

- Headquarters: Los Angeles

Oaktree Capital Management is another one of the world's largest alternative asset managers, with $202 billion in AUM.

The firm specializes in credit, private equity, real estate, and public equity.

Its credit department, which manages $143 billion, is broken down into nine categories:

- Opportunistic credit

- High-yield bonds

- Senior loans

- Private credit

- Multi-asset credit

- Emerging markets debt

- Convertible securities

- Structured credit

- Investment grade solutions

The Oaktree Strategic Credit Fund makes up the company's private credit portfolio. The fund manages $5 billion and its Class I shares have generated a total return of 10.20% since inception.

The fund is only available to institutional investors.

6. Goldman Sachs

- Private credit AUM: $3.4 billion

- Total AUS*: $2.8 trillion

- Headquarters: New York

*Assets under supervision (AUS)

Goldman reports assets under supervision (AUS), not AUM, which includes both assets they manage and other client assets where they don't have investment control. They earn fees for advisory and other services on these assets.

Goldman Sachs (GS) is one of the biggest financial institutions in the world, generating over $52 billion in annual revenue on $2.8 trillion in assets under supervision.

The firm invests in private credit via its Asset Management division. Its private credit strategies focus on providing customized financing solutions, including direct lending, mezzanine debt, and special situations.

As mentioned in the introduction, Goldman has raised over $76 billion for its private credit funds over the last five years, behind only Ares Management and Blackstone.

All of Goldman's investment products, including its private credit funds, are only available to institutional investors and Goldman's ultra-high-net-worth clients.

However, if you have several million dollars, you may be able to access its private credit deals via one of the firm's financial advisors.

7. Golub Capital Partners

- Private credit AUM: $3.2 billion

- Total AUM: $70 billion (including leverage)

- Headquarters: New York

Golub Capital Partners is a private investment manager specializing in private credit. As of December 2023, the firm had $3.2 billion in private credit AUM.

Golub's industry expertise enables it to deliver greater flexibility to borrowers to support leveraged buyouts, refinancings, and growth initiatives.

Playing off this expertise, its private credit strategy emphasizes direct lending, typically in the form of first lien, senior secured, floating rate loans.

Its private credit fund is known as GCRED. The fund's Class I shares have an annualized distribution rate of 10.5%.

GCRED is available to institutional investors and other segments of the private wealth market via wirehouses, regional broker-dealers, private banks, RIAs, certain financial advisors, and other intermediaries.

8. Morgan Stanley

- Private credit AUM: $5.8 billion

- Total AUS: $1.7 trillion

- Headquarters: New York

Morgan Stanley (MS) has two components of its private credit division: the Morgan Stanley Direct Lending Fund and Morgan Stanley Private Credit.

Of the firm's $1.7 trillion in AUS, $5.8 billion is invested in private credit.

Both of Morgan Stanley's private credit arms specialize in providing custom financing solutions via direct lending. They typically offer senior secured loans, mezzanine debt, and unitranche financing.

While the Private Credit arm is only available to institutional investors, the Morgan Stanley Direct Lending Fund is a publicly traded offering under the ticker symbol MSDL. It is available to all investors and has an annualized dividend yield of 9.7%.

9. New Mountain Capital

- Private credit AUM: $3.2 billion

- Total AUM: $55 billion

- Headquarters: New York

New Mountain Capital is a global investment firm that manages $55 billion in assets.

New Mountain Finance Corporation (NMFC) is the firm's direct lending arm. It specializes in providing debt financing to middle-market companies, with a special focus on companies in defensive growth industries.

The company offers private credit solutions, which include senior secured loans, mezzanine debt, and unitranche financing.

As of September 2024, NMFC had a fair value of $3.3 billion and an annual return of 10% since its IPO in 2011. The fund is available to all investors.

More about private credit

What is private credit?

A private credit deal is one in which a non-bank financial institution lends funds to corporate borrowers.

Borrowers are typically mid-market private companies that may need cash for an acquisition, inventory, or restructuring.

Mid-market companies are often too large for commercial banks but too small to raise debt in public markets, which is why they turn to the private credit market.

Most private credit offerings look similar to a bridge loan — they are typically short-term (often between 9 months and 5 years), have high and variable interest rates, and are often securitized or backed by collateral.

What is a private credit fund?

A private credit fund is an investment vehicle offered by a fund manager, which raises capital from investors and invests that money into a portfolio of private credit deals.

The fund manager collects a management fee for their work, while investors benefit from having a professional perform the due diligence and make investments on their behalf.

What are the different types of private credit?

Private credit encompasses a broad category of non-publicly traded debt and credit instruments. Below are a few examples, along with their definitions.

Direct lending

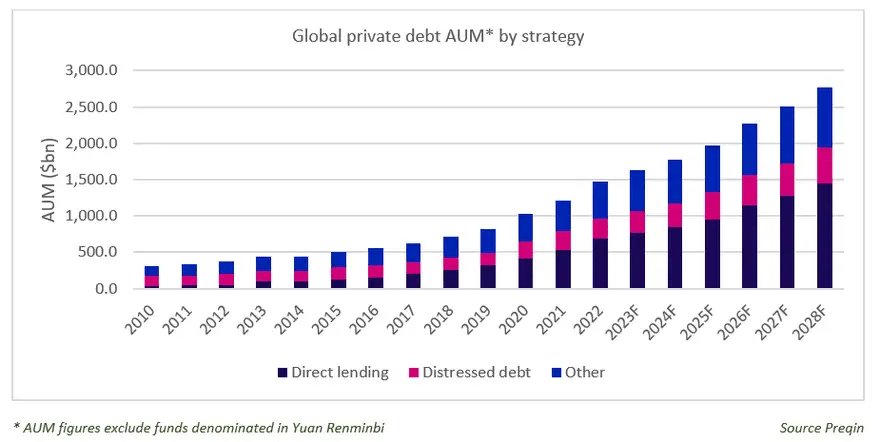

Direct lending occurs when private credit funds extend loans directly to businesses or borrowers. Direct lending accounts for 31.8% of all private credit capital.

Distressed debt

Distressed debt involves investing in the debt of financially troubled companies.

Other forms

These include:

- Mezzanine financing: A hybrid of debt and equity, often used in private equity deals.

- Structured credit: Bundled and securitized credit assets, including collateralized loan obligations.

- Venture debt: Debt extended to early-stage, venture-backed startups.

Here's a breakdown of the global private debt market by strategy, which shows the split between direct lending, distressed debt, and other approaches:

Source: Irish Funds / Preqin

Why invest in private credit?

Private credit is a popular investment for several reasons, primarily:

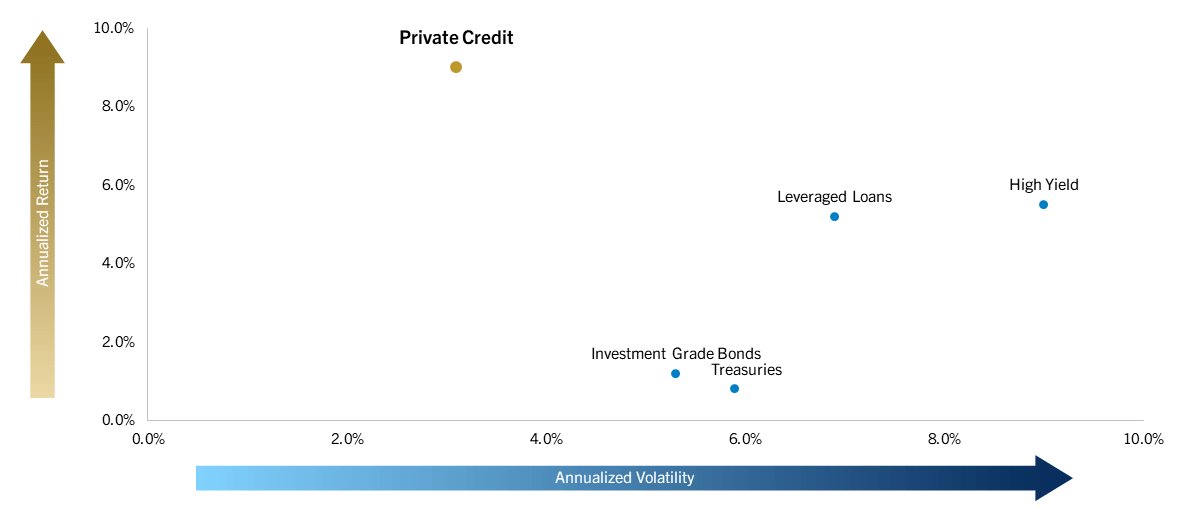

- Relatively high risk-adjusted returns: As you can see in the chart below, private credit has generated annualized returns of almost 10%, with minimal volatility.

- Portfolio diversification: Private credit's nearly double-digit returns, consistent income, and low volatility add stability to almost any portfolio.

- Floating interest rates: While private credit is fairly illiquid, most offerings last from between nine months to five years, and have floating interest rates.

Here's a look at private credit's annualized returns and volatility compared to traditional fixed income:

Source: Golub Capital

Plus, the historical default rate of private credit assets is around 2%, lower than the 3.6% default rates in the high-yield bond market.

How can you invest in private credit?

Unfortunately, unless you're an ultra-high-net-worth individual, the only two funds available to you from this list are Morgan Stanley's MSDL and New Mountain Capital's NMFC.

But those aren't your only two options for investing in private credit.

Percent is an investment platform that gives accredited investors access to the private credit market.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

With Percent, you get all the benefits of private credit:

- Yield potential: The current weighted average interest rate on Percent is 18.13%.

- Largely uncorrelated: Short-term fluctuations in the stock market have little effect on the private credit market, making for lower volatility. While there's still default risk, the default rate on Percent is just 2.41%.

- Short-term investments: Deals on Percent have an average maturity of 10.02 months.

You can start building your own private credit portfolio today with as little as $500. Plus, you can earn up to $500 as a welcome bonus after making your first deal on Percent.

Learn more about the investment platform in our Percent review.