Linqto Review: The Fastest and Easiest Way to Invest in Pre-IPO Companies?

Linqto is the fastest and simplest way to invest in today's hottest private startups — companies like SpaceX, Databricks, Lightmatter, and Stripe.

Transactions are simple, deals are guaranteed to close, and Linqto has the lowest investment minimums of any pre-IPO marketplace.

But it also has a few drawbacks.

Here's everything you need to know before investing on Linqto.

Linqto review summary

- Overall rating:

- Description: A marketplace for buying and selling shares of pre-IPO companies

- Best for: Accredited investors who want to invest in private startups

- Fees: None (shares are sold at a premium)

Because of its business model and low minimum investment of $2,500, Linqto is the easiest and fastest platform for acquiring shares of private companies.

However, it has two main drawbacks:

- There is a lack of transparency on the current market value of its shares.

- It charges moderately sized premiums on buying and discounts on selling, usually around 20%.

There's a workaround for its lack of transparency, but the premiums/discounts it charges are the cost of doing business on Linqto.

That said, many investors find those prices worth paying to quickly and easily own shares of private companies they otherwise wouldn't be able to access.

What is Linqto?

Linqto is an investment platform where accredited investors can buy shares of pre-IPO companies and existing shareholders can sell their shares.

After opening your account and verifying your status as an accredited investor, you can fund your account and start investing in private companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

At the time of this writing, there are 88 companies available on Linqto, including SpaceX, Ripple, Cerebras Systems, Groq, Anthropic, Stripe, and more. You can see the entire list of available companies here.

Linqto was founded in 2010 and launched to the public in 2020.

CEO Bill Sarris, who co-founded Linqto with his wife, is a fintech expert who previously worked for Microsoft and Intuit.

By the numbers

- Users: 1,300,000+

- Companies available: 88

- Total investments made: $515,500,000+

Linqto's business model

Linqto has a different business model than most of its competitors.

Instead of connecting buyers and sellers and acting as the facilitator/broker of the transaction, both buyers and sellers transact with Linqto itself.

Here's how it works:

- Linqto acquires shares from a seller (typically at a discount).

- After receiving the shares, Linqto (after marking them up) lists them on its marketplace.

- Buyers buy the shares directly from Linqto.

There are pros and cons to this model, which are discussed in the next two sections.

Benefits of investing with Linqto

1. Speed and closure guarantee

Because Linqto already owns the shares before selling them, transactions happen much faster than on its competitors' platforms.

For example, Hiive — one of Linqto's top competitors — acts as a facilitator of transactions.

After a seller lists their shares on that platform, buyers can place bids. Once a buyer and a seller agree on a price, Hiive starts working on behalf of the seller, connecting with the seller's company to get permission to sell the shares to the outside buyer.

Because the seller's company hasn't given express consent for the seller to sell their shares, only 54% of transactions in 2023 were approved.* And even the transactions that are approved take at least a few weeks to settle.

*Since Linqto already owns the shares, deals are guaranteed to close. And they close instantly — as soon as you have deposited the funds for the transaction.

2. Low investment minimums

Additionally, Linqto's model allows it to sell shares in much smaller quantities than its competitors. The minimum is $2,500 compared to, for example, $25,000 on Hiive.

Because Hiive's team needs to do a lot of time-consuming paperwork to complete a transaction and only makes 4–5% per transaction, its model precludes it from working on smaller transactions.

This isn't the case on Linqto, which already has ownership of the shares it's selling.

Drawbacks of investing with Linqto

1. Pricing

Linqto makes money by selling shares for a profit over the price it paid for them. This means buyers will almost always buy shares for above market price.

For example, if Linqto acquired SpaceX shares for $200/share and the current market value is $220/share, it might list them for $240/share or more when it sells them.

Additionally, it will sell its shares at a premium to the purchase price regardless of the current market price.

For example, a Reddit user asked why shares of Ripple were listed for $46/share on Linqto and $20/share on Hiive.

The answer is likely due to Linqto acquiring the shares when Ripple was trading at a higher price, somewhere around $40/share, and still wanting to turn a profit on those shares. It doesn't matter that the shares are now only worth $20 each.

2. Lack of transparency

Linqto only shows the pricing for its shares, not the current market value of those shares.

So, in the example above, a Linqto user would see Ripple trading for $46/share and not the current price of $20/share.

This can lead to buyers paying substantially more for shares than they're actually worth. And unless they were to check the price on another marketplace, they'd never know they were overpaying for those shares.

While Linqto's pricing system may seem a bit dubious, there's a simple workaround.

And, unless you look at another marketplace, like Hiive, you'd never know you were overpaying (by more than double) for those shares.

Our tip: Check the prices on both platforms

Since Hiive's platform functions more like a traditional marketplace, its prices always reflect the most up-to-date information.

So here's what you can do: Sign up for both Linqto and Hiive and check Hiive's pricing before transacting on Linqto.

How does Linqto make money?

As stated above, there are no transaction fees for buying or selling on Linqto.

In fact, there are no fees of any kind — no upfront fees, ongoing fees, management fees, or administrative fees.

However, that doesn't mean you won't pay to use the platform.

Linqto makes money by buying shares at a discounted price (typically around 20%*), marking them up (typically another 20%*), and then reselling them to buyers at a profit.

The company doesn't actually disclose its markup, and its fee structure is less transparent than some of its competitors.

*Because Linqto doesn't disclose its markup fees, these figures are rough estimates based on informal online research into user's experiences. They are not exact numbers.

These are the tradeoffs of Linqto's model. However, its model also makes it faster and easier to buy pre-IPO shares than any other platform.

Why invest in private companies?

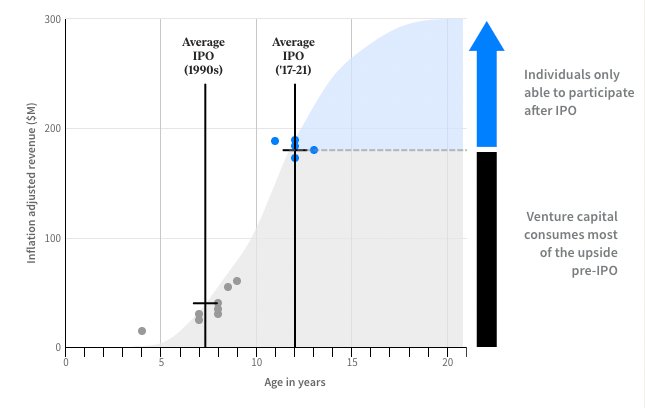

Back in the 1990s and early 2000s, companies like Microsoft, Amazon, and Google went public relatively early in their growth cycles. They had to — there weren't any other options to get funding.

Today, thanks to private markets (venture capital, private equity, and angel investing), there is no shortage of funding for private companies. This private market funding allows companies to stay private for longer.

For us individual investors who can only invest in public markets, this can be a problem — we may be missing out on the bulk of the returns.

Sources: Fundrise and University of Florida Warrington College of Business

Instead of viewing the public markets as a source of funding, they're viewed as a liquidity event — a way for the PE firms and venture capitalists to get paid for their investments, with retail investors sometimes holding the bag.

Thanks to Linqto (and other pre-IPO marketplaces), private markets are becoming more accessible to individual investors.

Linqto's competitors

Linqto isn't the only platform for investing in private companies.

Here's how it stacks up against its main competitors:

| Linqto | Hiive | Forge Global | Nasdaq Private Market | EquityZen | |

| Investment minimum | $2,500 | $25,000 | $100,000 | $1,000,000 | $10,000 |

| Main benefit | Ease of transaction | Transparency | High liquidity | Built for institutional investors | Multiple fund offerings |

| Main drawback | Shares may be more expensive | Medium investment minimum | Large investment minimums | Very high investment minimums | Low liquidity |

| Links | Learn more | Learn more | Learn more | Learn more | Learn more |

For individual investors, in my opinion, the choice comes down to Linqto or Hiive.

I recommend signing up for both. You can use Hiive for pricing transparency and to choose from a wider selection of investment options and use Linqto for faster, easier transactions when the company is trading for a fair price.

Hiive and Linqto are my top 2 recommendations for how to invest in private companies.

Final verdict

Linqto is a solid option for accredited investors who are looking to invest in pre-IPO companies.

It has a fairly broad selection of investments, low minimum investments, and quick and easy transactions.

However, you will likely pay moderately sized premiums for transacting on the platform. Be sure you know the true price of the shares you're buying or selling, not just the price Linqto is quoting.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.