What’s the Difference Between Private and Public Equity?

An equity investment represents an ownership stake in a company.

Whenever you hear the word equity, think ownership.

For example, imagine you started a company with two of your friends. As the primary founder, you own 60% of the company — your equity stake is 60%. If your company had 100 shares of stock, you would own 60 of them.

Equity investments can be in either a private or a public company.

- An equity stake in a privately held company is a private equity investment

- An equity stake in a publicly held company is a public equity investment

The difference between a privately held company and a publicly held company is that public companies are traded on stock exchanges, while private companies are not.

Below is a detailed comparison of private versus public equity investing, including the advantages, differences, risks, and performance of both.

What is private equity?

When people talk about “private equity,” they're generally referring to private equity investing, which is an investment in a company that's not publicly traded.

Private equity firms typically invest in mature businesses and are looking to make money via turnarounds, buyouts, etc., and then eventually exit.

Venture capital (VC) is a subset of private equity investing.

VC firms typically invest in early-stage startups and other fast-growing companies. The idea is to eventually profit from an initial public offering (IPO).

Private equity investments are usually considered to be high-risk, high-reward investments, with VC investments considered to be even higher in both regards.

For example, at a successful VC firm, typically 1–2 home-run investments would compensate for the losses of an entire portfolio of 10+ companies, with plenty of profits to spare.

Side-by-side summary

| Public equity | Private equity | |

| Stock exchange listing | Yes | No |

| Company stage | Generally well-established, though not always | Can be both mature companies or early stage startups |

| Who can own shares | Anyone with a brokerage account | Founders, employees, VC firms, angel investors, accredited investors |

| Investing difficulty | Very easy | Hard |

| Trading volume | Highly liquid | Fairly illiquid |

| Financial disclosures | Required to disclose detailed financial statements quarterly | Not required to disclose any information |

| Third-party analysis | Because of the information shared quarterly, there is a lot of third-party analysis* | Since information is not readily shared, third-party analysis is very limited |

| Where to invest | Anyone can open a free brokerage account on Public | Accredited investors can buy shares of certain private companies on Hiive |

*It's worth noting that third-party analysis sometimes affects the value of a stock.

Below is more a more detailed comparison of public versus private equity.

Public vs private equity: advantages and risks

Public equities

When people mention investing in the stock market, they're referring to buying shares of public companies (public equities). These are typically well-established companies.

If you have a 401(k) or similar retirement plan through your employer, it is extremely likely you already have public equity investments.

Most commonly, people do this by investing in stocks or funds. A fund is an investment vehicle that holds a basket of stocks (or other assets) in a single security.

For example, Invesco QQQ is a fund that holds the 100 largest companies on the tech-focused Nasdaq exchange. Its top holdings are Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Nvidia (NVDA), and Meta Platforms (META).

By buying a fund, you gain broader diversification in a single investment than by investing in individual stocks. Diversification helps mitigate the risk and volatility of your investment portfolio.

Why investors choose public equities

Since all you need is a brokerage account, publicly traded stocks are easy to invest in. By investing, you can buy an ownership stake in the largest companies in the U.S. and internationally.

Because of the ease of access and the draw of being a part owner of some of the most profitable companies in the world, 61% of Americans own stocks.

Private equities

While anyone can buy public companies on the stock market, it's much more difficult to invest in private companies. Historically, only a company's founders, early-stage employees, and professional investors could invest in a private company.

For example, Apple was co-founded by Steve Jobs and Steve Wozniak.

After developing a prototype, they employed a handful of their friends to build the company's first computers. These friends/employees were granted equity in the company shortly thereafter.

After the company found some success, Mike Markkula — a multi-millionaire and former executive at Intel — invested $250,000 for a 33% stake.

Jobs, Wozniak, their friends/employees, and Markkula were the only shareholders of Apple when it was incorporated in 1977. Back then, this was the way VC investing in tech startups worked — informally, through angel investors like Markkula.

Today, venture capital (VC) firms are constantly on the lookout for hot startups to invest in. In exchange for their funding, these firms are given equity stakes in the company. The startup takes the money and uses it to grow faster.

However, these investments are highly speculative. The vast majority of startups fail, and investors are often left with 100% losses.

Plus, while public companies can be bought and sold at any time, it's typically much more difficult to buy and sell private companies.

This is known as liquidity, which is affected by the quantity of buyers and sellers, demand for the asset, and the volume of shares available on the market.

That said, when a private company succeeds, everybody — investors, founders, and employees — can make a lot of money.

If the startup continues to grow, it may become large enough to go public via an IPO.

Why investors choose private equities

Investing in private companies can result in very large returns.

That said, it's a highly speculative asset class, and investors should be prepared to potentially lose any money they invest.

Most investors who invest in private companies have a large amount of money to invest, can tolerate the risks of private equity investments, and are seeking diversification outside of public markets.

Does private equity outperform public equity?

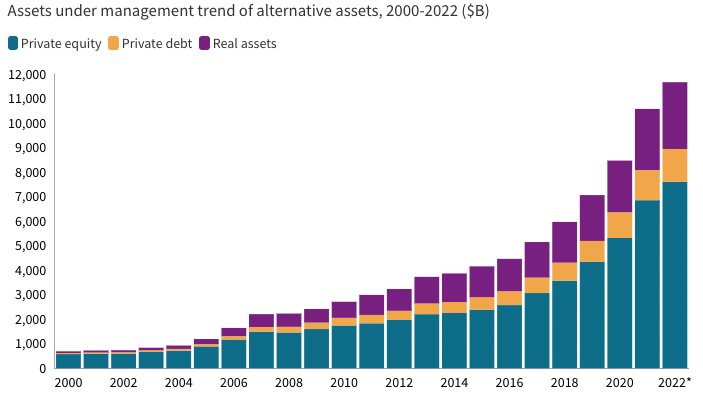

The private equity market reached $7.6 trillion in 2022, up from $3.1 trillion just five years earlier:

Source: S&P Global

Note: In the chart above, private equity refers to equity investments in private companies, whereas private debt refers to loans made to private companies.

What's causing the massive inflows? Outsized returns.

Over the last 25 years, private equity (as an asset class) earned an average return of 13.33%, outperforming public stocks by over 5% per year (the Russell 3000 averaged 8.16% over this period).

That said, here are a few things to keep in mind:

- These are historical figures. Past performance does not guarantee future results.

- 25 years isn't a long enough period to draw indisputable conclusions from. The results may be very different after 50 or 100 years of data.

- Private equity tends to have higher fees. Fees incurred (which were not included in the data above) will lower your actual returns.

- Private equity is a high risk investment. The odds of losing money in private equity are significantly higher than in stocks. Private equity is not suitable for everyone.

- Private equity is an illiquid investment. If you make an investment, your cash will likely be tied up until a liquidity event (like a sale or an IPO) or the company goes bankrupt.

How to invest in private equity

Investing in private equity used to be exclusively reserved for insiders, PE firms, VC firms, and angel investors.

However, recent changes by the SEC now allow accredited investors to buy shares of private companies.

A note on accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional with a Series 7, 65, or 82 license.

If you meet any of the above requirements, you qualify as an accredited investor and can invest in private companies.

Our favorite platform for investing in private, VC-backed startups is Hiive. For more information on this subject, you can read our article on how to invest in pre-IPO companies.

Frequently asked questions

Below are a few more questions you may have about public equities.

What is an example of a public equity?

An example of a public equity is Microsoft, which trades under the ticker symbol MSFT.

A public equity is any company that is publicly traded on a stock exchange.

Can a private company become a public company?

Yes, a private company can become a public company via an IPO.

When a company has its IPO, it sells some or all of the company to the public by listing its shares on a stock exchange.

Why invest in public equities?

The main reason for investing in public equities is to earn a return on an investment.

By buying shares of a company, you become a partial owner of the company and, therefore, have a right to a portion of its earnings.

The company may distribute its earnings through dividends or reinvest the profits back into the business to increase its future earnings.

You will also profit from any appreciation in the value of stock that you own.

Can a public company go private?

Yes, a public company can be taken private.

In order for a company to be taken private, an investor or group of investors must raise enough capital to purchase all of the company stock.

This is typically accomplished with the help of outside financing. The company is delisted from the stock exchange and shares are no longer available for purchase.

Elon Musk, along with a few other investors, took Twitter (now X) private in 2022 for $44 billion. Morgan Stanley and Bank of America loaned him $13 billion for the deal.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)