Seeking Alpha Premium Review: Is It Right for You?

Seeking Alpha is used by more than 20 million investors each month to research stocks and other investments.

Unlike most investment websites, which only provide quantitative data, Seeking Alpha has a network of nearly 20,000 contributors who write in-depth research reports on their favorite investment ideas. More than 10,000 articles are produced monthly, each filled with detailed analysis and the author's opinions about the stock.

It's like having access to your own team of analysts.

While you can get started for free, you'll need to subscribe to Seeking Alpha Premium to access more than 1-2 of these articles per month. I think it's well worth the money.

I've been a Premium user of Seeking Alpha for 7 years. Outside of StockAnalysis.com, it's my favorite place to research potential investments and analyze my current holdings.

In this article, I share my experience with Seeking Alpha and how I use it for my investment research, so you can decide if it's right for you and whether it will be worth your money.

Seeking Alpha review summary

- Overall rating:

- Service type: Stock research and analysis

- Platforms: Web, iOS, Android

- Best for: Long-term, fundamental investors

- Pricing:

$299/year$269/year + 7-day free trial with this link

Seeking Alpha is a stock research platform that provides financial data, stock news, portfolio monitoring, stock alerts, and — most notably — thousands of research reports that are written by investors and analysts.

You can view a few pages of Seeking Alpha for free each month but beyond that you'll bump into a paywall to upgrade to Seeking Alpha Premium.

I prefer to use the platform directly through their website, but they also have well-designed iOS and Android mobile apps.

What is Seeking Alpha?

David Jackson, a former analyst at Morgan Stanley, launched Seeking Alpha in 2004 as a place for individual investors to share their own stock research and discuss the merits of potential investments.

As a professional analyst and investor himself, Jackson knew that investing in stocks is extremely nuanced and requires careful analysis.

When evaluating a potential investment, most of us start by looking at a company's fundamentals and financial performance, interpret those numbers, then form a narrative about why the company is undervalued or set to outperform.

It's these narratives, and our confidence in them, that ultimately determine whether we make an investment.

And while quantitative data (like revenue, margins, and profits — historical, current, and projected) can help point us in the right direction, it's up to us to draw conclusions from that data and determine how businesses will perform in the future. It's part science, part story-crafting.

That's what makes investing so difficult, and that's why I find Seeking Alpha to be so valuable.

Every research report on Seeking Alpha is arguing a narrative — buy, sell, or hold — with analysis supporting how that conclusion was reached. Even if you don't agree with the author, each of these reports adds a level of color that you won't find anywhere else.

That's why I, and 20 million other investors like me, subscribe to Seeking Alpha Premium.

Why I subscribe to Seeking Alpha

For $269/year, I get access to 18,000+ vetted analysts who write more than 10,000 articles per month.

These contributors are experienced, opinionated, and see the world from a different perspective than me, making them perfect sources of information I might otherwise overlook or miss altogether.

This has helped me:

- Find winners I would have never seen value in (like Visa)

- Avoid stocks I might have bought while the underlying business was cracking (like General Electric)

It's like having my own personal team of analysts who stress-test each of my ideas and allow me to quickly, yet thoroughly, stay on top of my investments.

But enough about me. Let's talk about all the different features you get with a Premium subscription.

Seeking Alpha Premium features

There are a ton of features included in the Premium plan.

I've broken down most of the features into 5 categories below and will briefly cover the key aspects of each feature, focusing on the features I use the most or find the most valuable.

1. Investment research & analysis

Stock analysis

As mentioned above, there are currently 18,000+ contributors producing thousands of articles per month on Seeking Alpha. The majority of these articles are stock analysis.

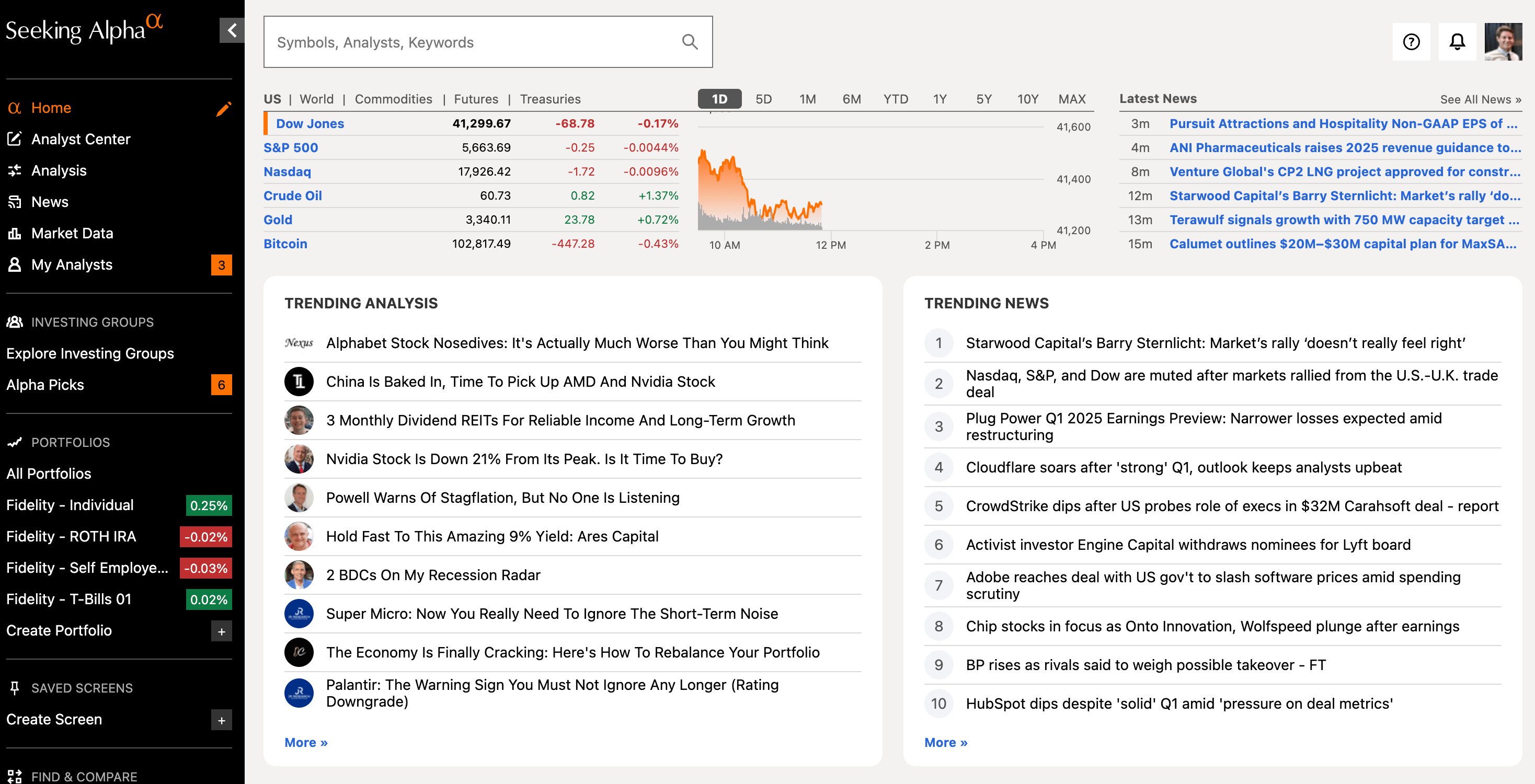

You can find these articles on the homepage or by looking up a specific ticker:

You'll notice the quality of these reports right away. Every single article is free of grammatical errors and really well thought out. Seeking Alpha has extremely high editorial standards — it's really hard to get an article published.*

*I've published several articles myself, and each one had to go through several revisions before it went live.

Just to the right of the Analysis column you'll see the latest news headlines for the stock. On the far right, you'll see a summary of the stock's Ratings, Factor Grades, Quant Rating, and more.

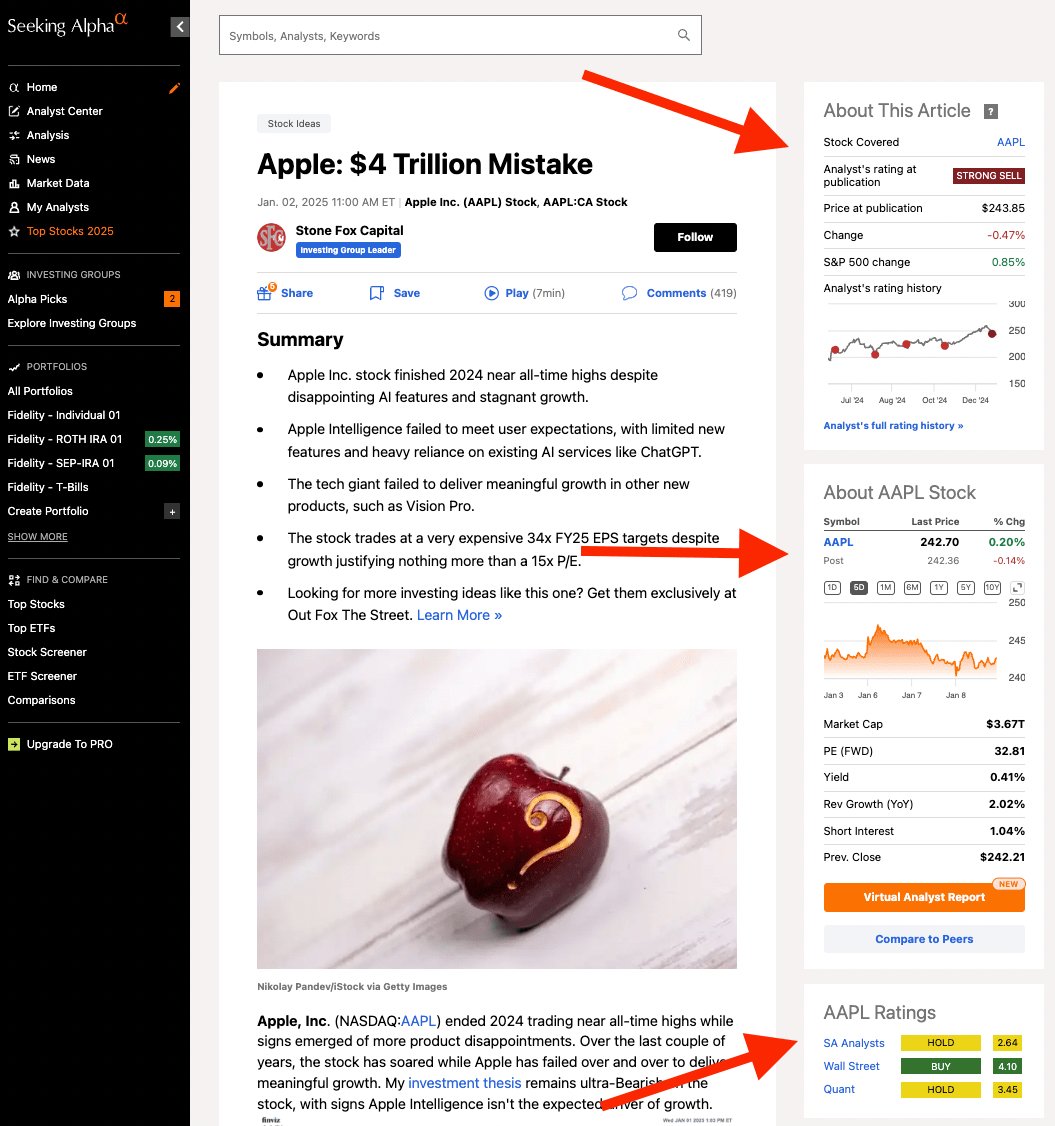

Article sidebars

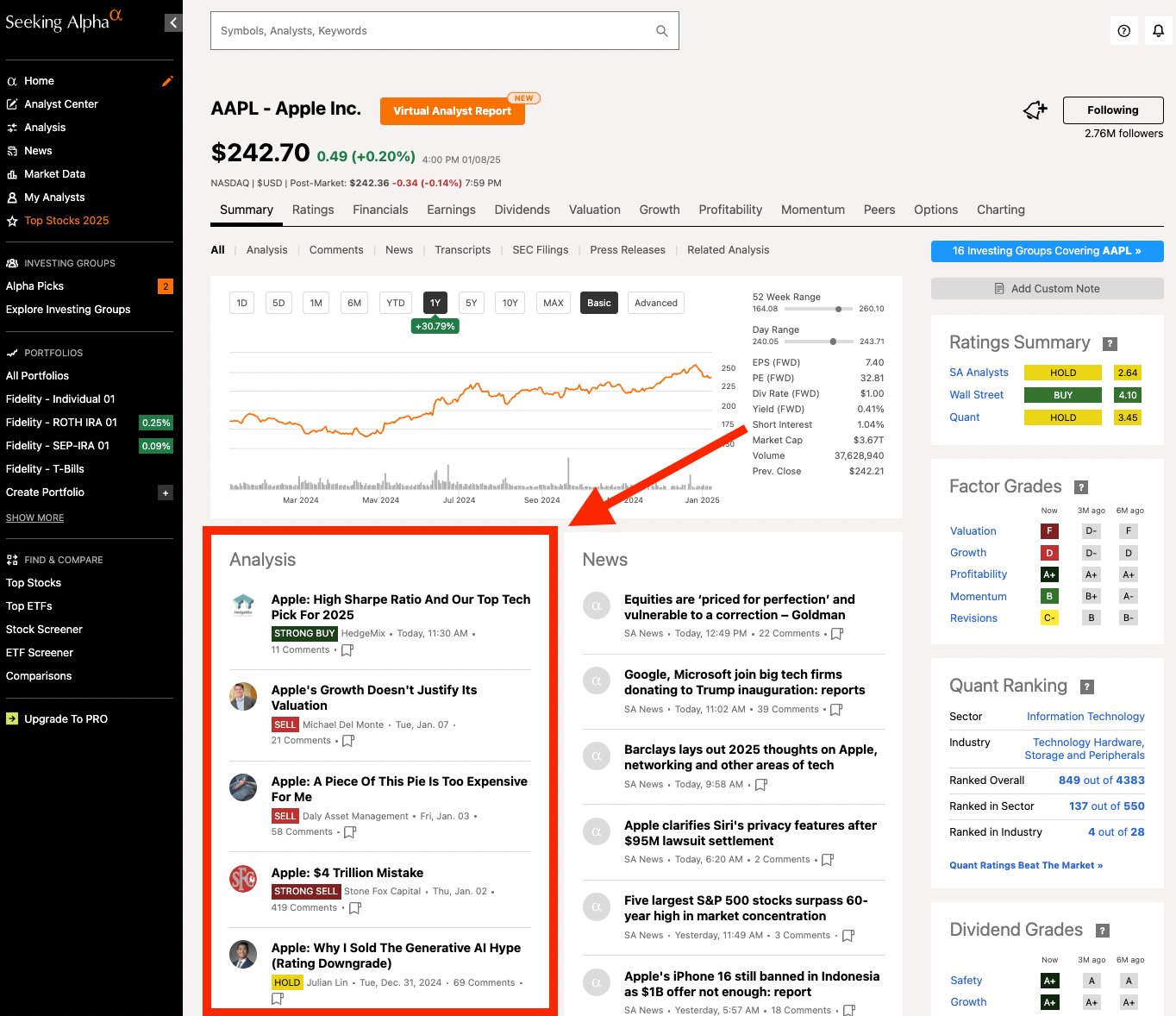

When you click on an article, the sidebar will show you the analyst's rating history, some quick facts about the stock, the stock's ratings (contributor average, Wall Street analysts, and Quant), and more:

The sidebar is usually the first thing I look at when reading an article. I mainly focus on the author's rating history to gauge their historical sentiment about the stock in question, and then I'll look for any red flags in the Ratings section. Once I get a feel for these things, I'll begin reading the article itself.

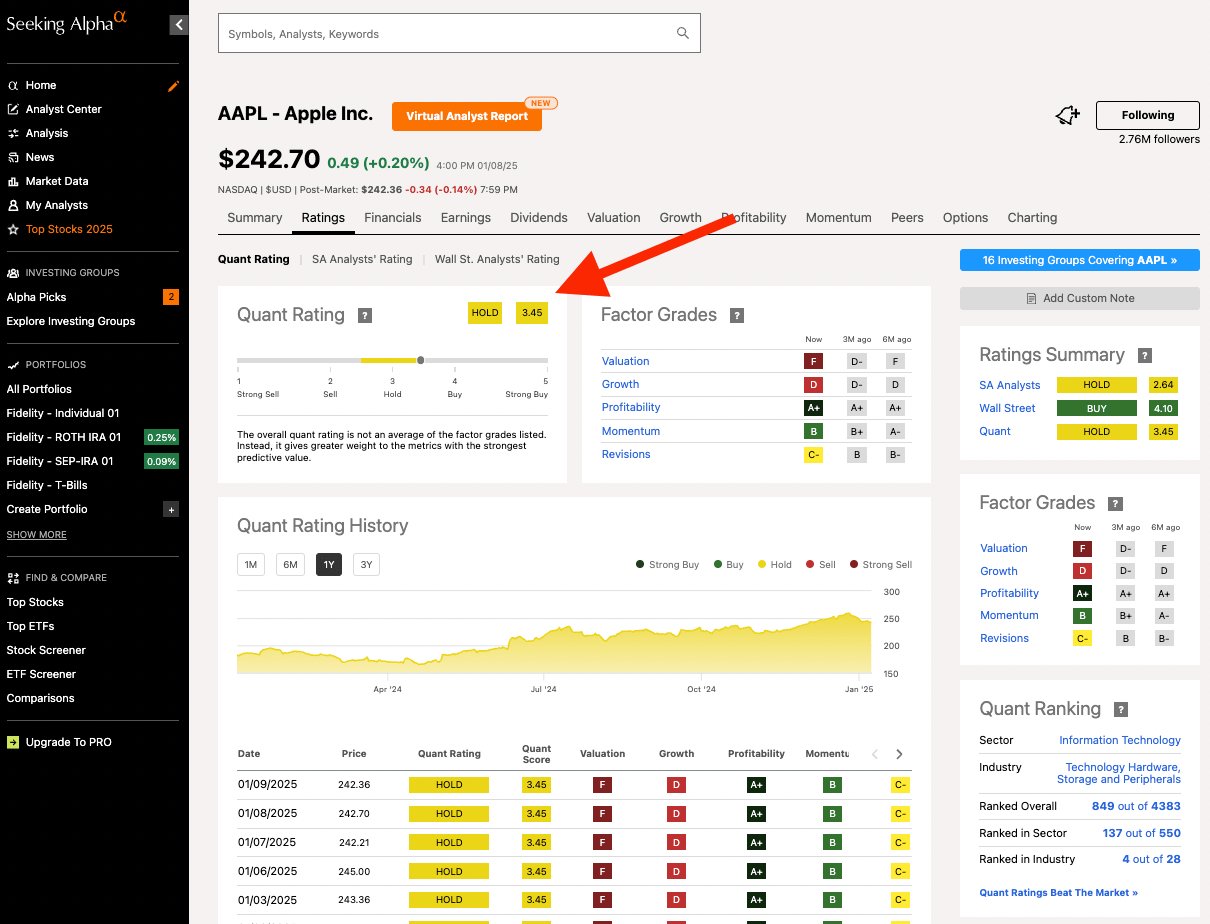

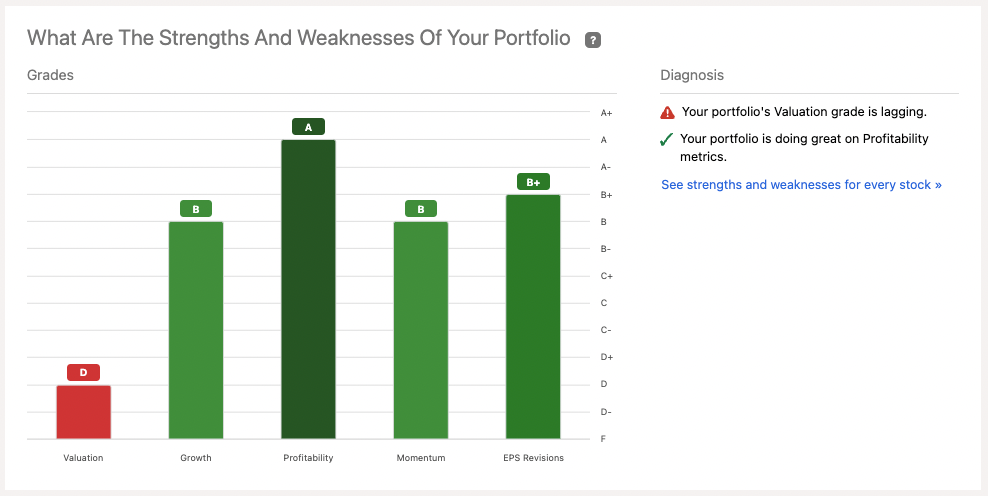

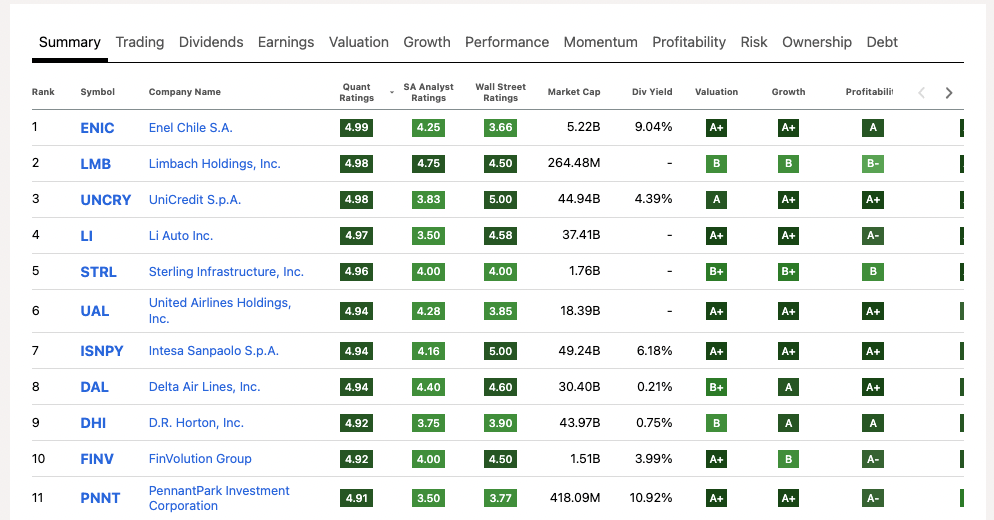

Quant Ratings & Factor Grades

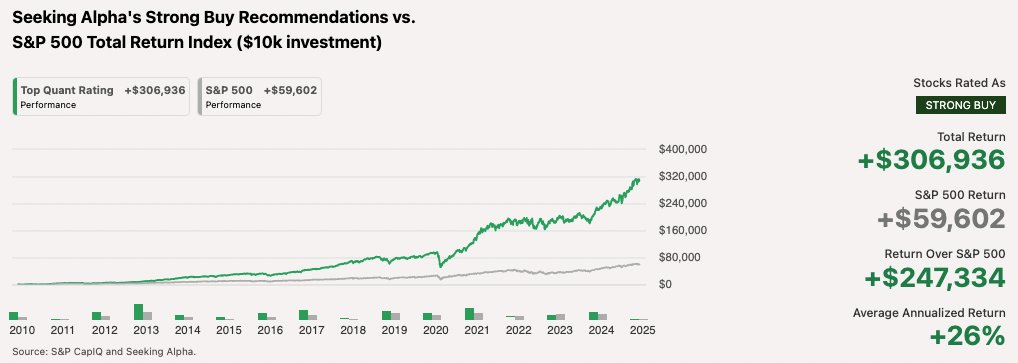

Seeking Alpha's Quant Ratings is an algorithmic system which ranks stocks based on 5 “factors”: value, growth, profitability, EPS revisions, and momentum.

The system has performed quite well:

Personally, I'm a bit of a skeptic when it comes to basing investment decisions entirely on on quantitative research.

Still, if the Quant Rating is "Strong Sell," I make sure I know why and that I'm willing to accept the risk.

The Quant Ratings are based on the 5 Factor Grades. Here's what it looks like for Apple right now:

As you can see, the system is signaling Apple's valuation is stretched right now based on its recent growth, which I tend to agree with.

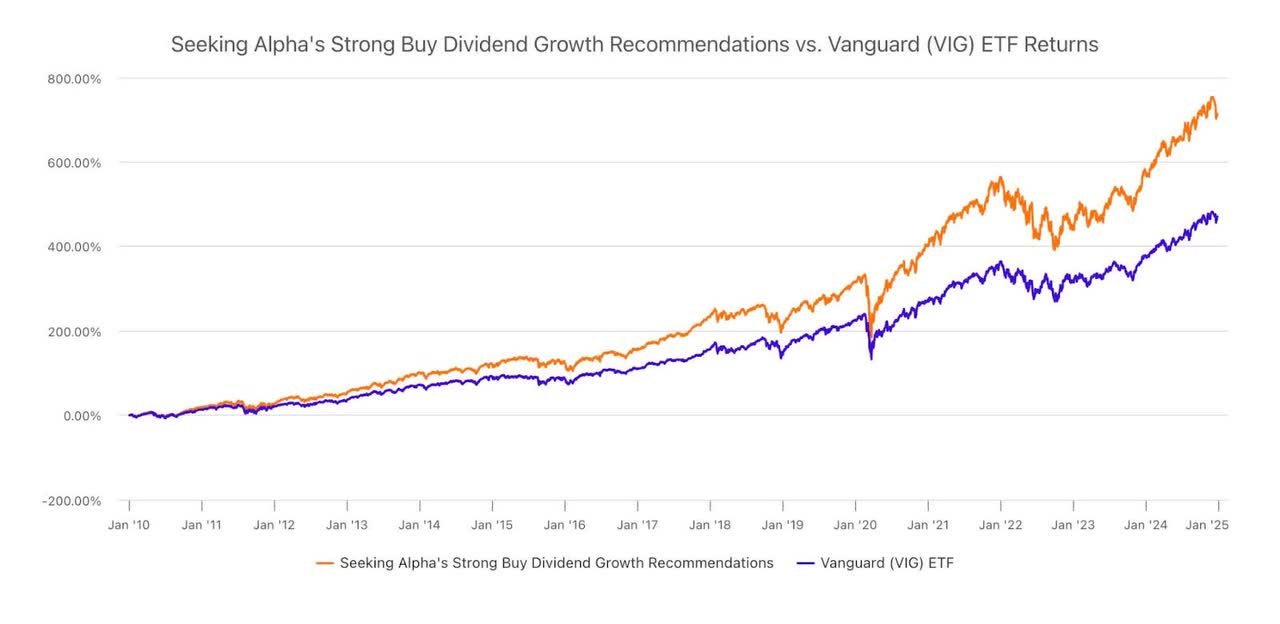

Dividend Grades

Similar to its Factor Grades, Seeking Alpha has a grading system for dividends based on 4 criteria: safety, growth, yield, and consistency.

It, too, has outperformed its benchmark:

Like Factor Grades, I don't use this to make buy decisions, but it does help me find potential areas of weakness and identify risks I otherwise wouldn't see.

Like Factor Grades, I don't use this to make buy decisions, but it does help me find potential areas of weakness and identify risks I otherwise wouldn't see.

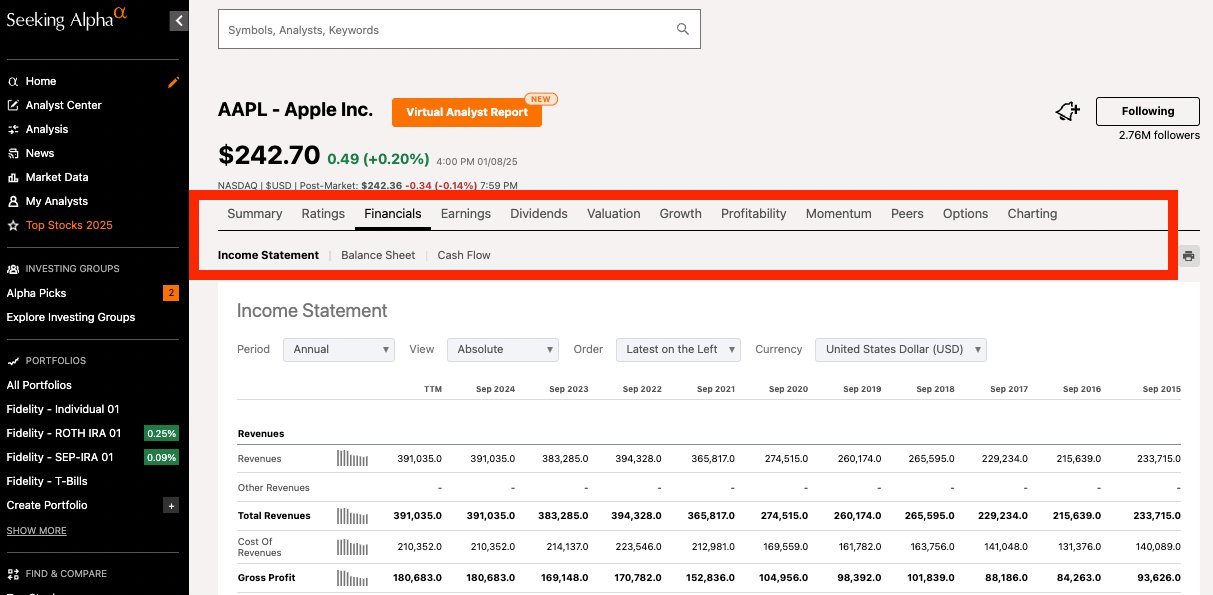

Financial data

To complete the Seeking Alpha offering, the site also provides 10 years of financial statements, earnings and dividend information, more details on its Factor components, options chains, and a charting feature:

As a long-term investor, Seeking Alpha has everything I need to complete my research.

2. Portfolio monitoring

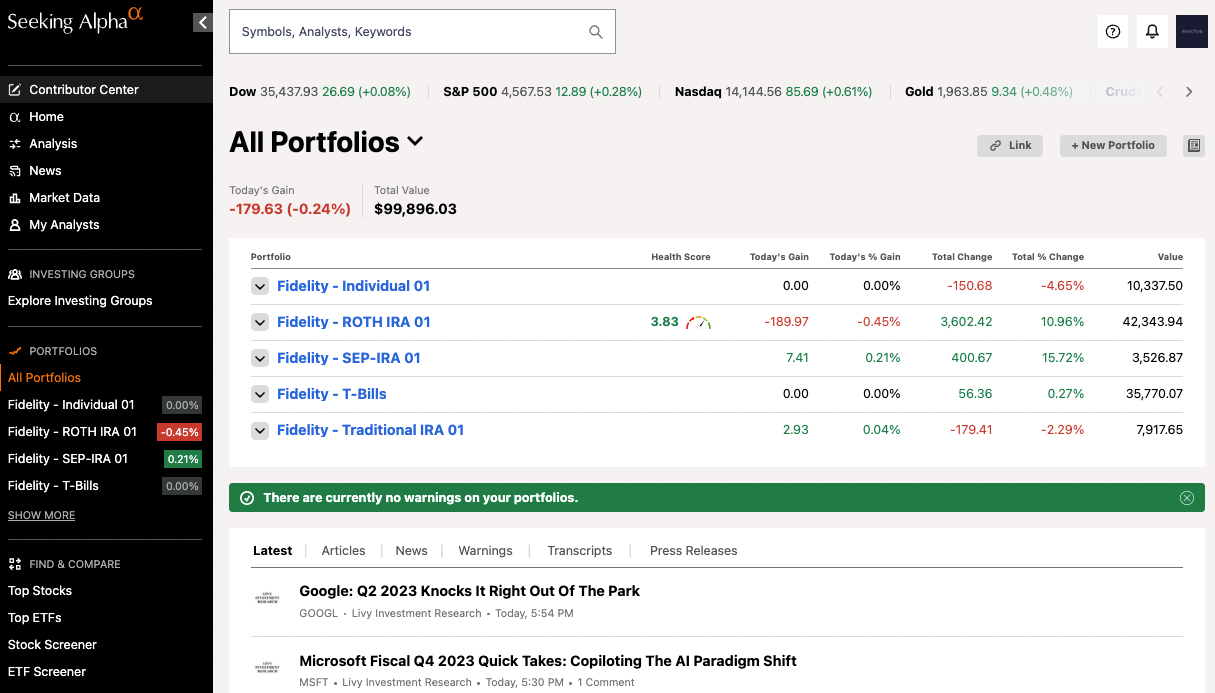

Brokerage syncing

With a Premium subscription, you can connect your brokerage accounts and easily monitor all of your holdings through the platform:

I primarily subscribe to Seeking Alpha for the investment research, not the portfolio tracking, but I do like checking the Factor Grades of all of my positions and seeing my portfolio's overall "Health Score" all from one view.

Personalized alerts

You can receive alerts on your positions and subscribe to digests of the latest reports written about your holdings.

You can also set notifications for specific stocks you want to keep an eye on, and stay abreast of the latest news and upgrades/downgrades.

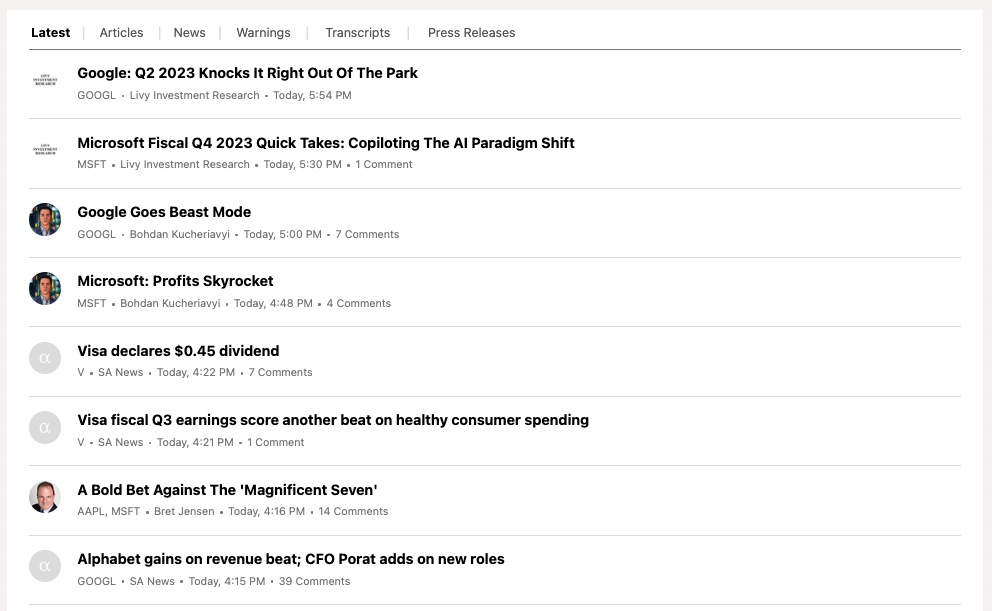

News dashboard

Seeking Alpha also provides you with a custom news dashboard which shows the latest research reports and news headlines related to every position in your portfolio:

This is a nice bonus to have as it allows you to easily stay on top of what's happening to the companies your portfolio.

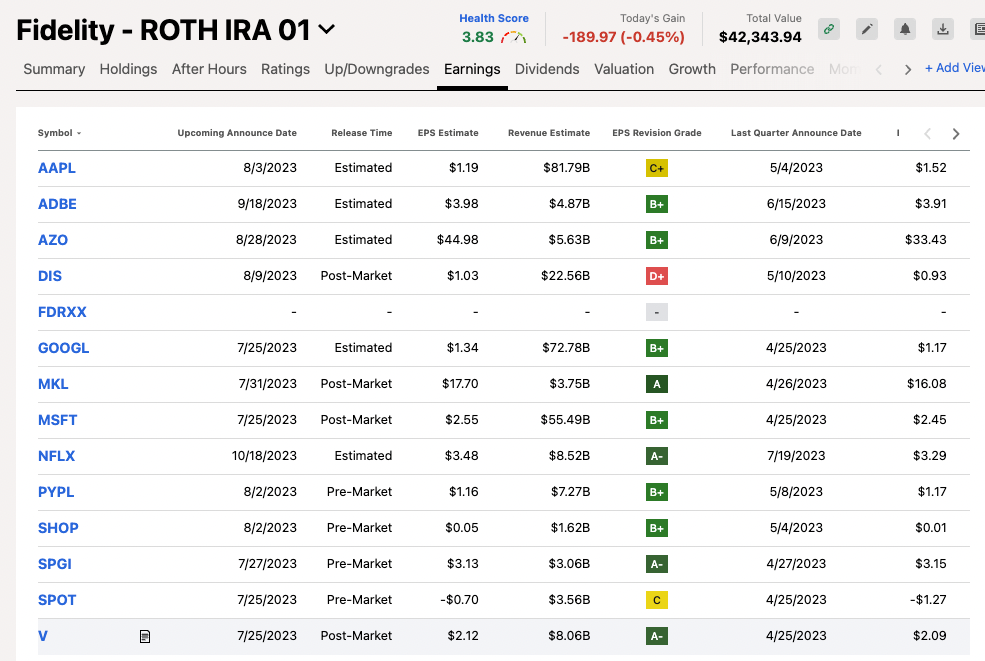

Earnings calendar

I'm not sure why, but I have a hard time staying on top of when my companies are going to report earnings.

Fortunately, Seeking Alpha's Earnings tab will show each of my stocks' next earnings report date and EPS and revenue estimates:

I use this tab a lot during earnings season, along with StockAnalysis.com's earnings calendar.

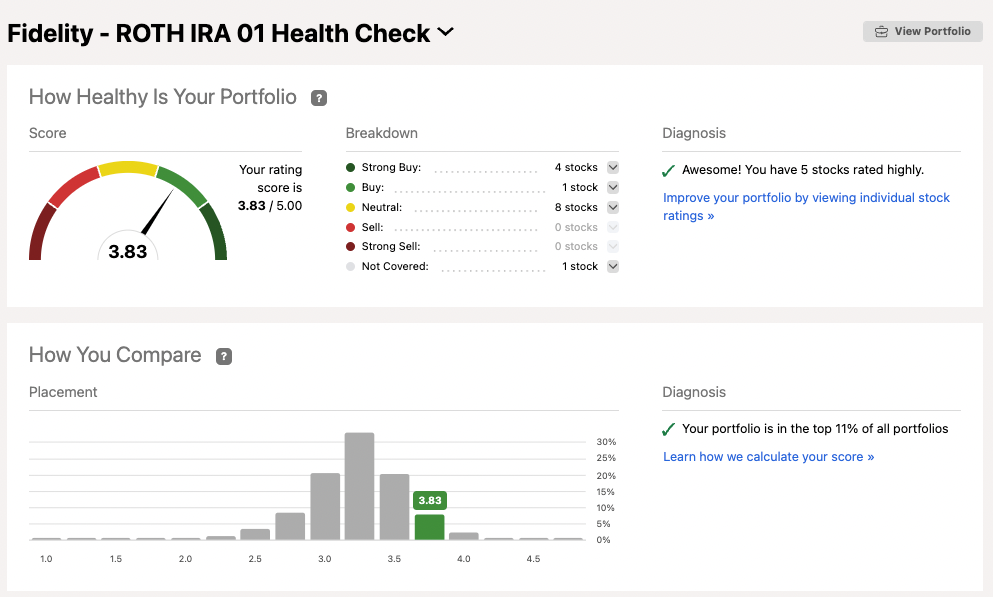

Portfolio analysis

Again, I'm not a huge fan of relying too heavily on quantitative systems, but they can be a useful tool for quickly identifying red flags. The Health Score is no different:

I'm not overly concerned with only owning "Strong Buy" stocks, but it is convenient to see what factor poses the biggest risk to my portfolio.

Right now, it's valuation:

This doesn't surprise me since I'm willing to pay premium prices for exceptional businesses and tend to hold even when valuations get stretched.

3. Stock ideas

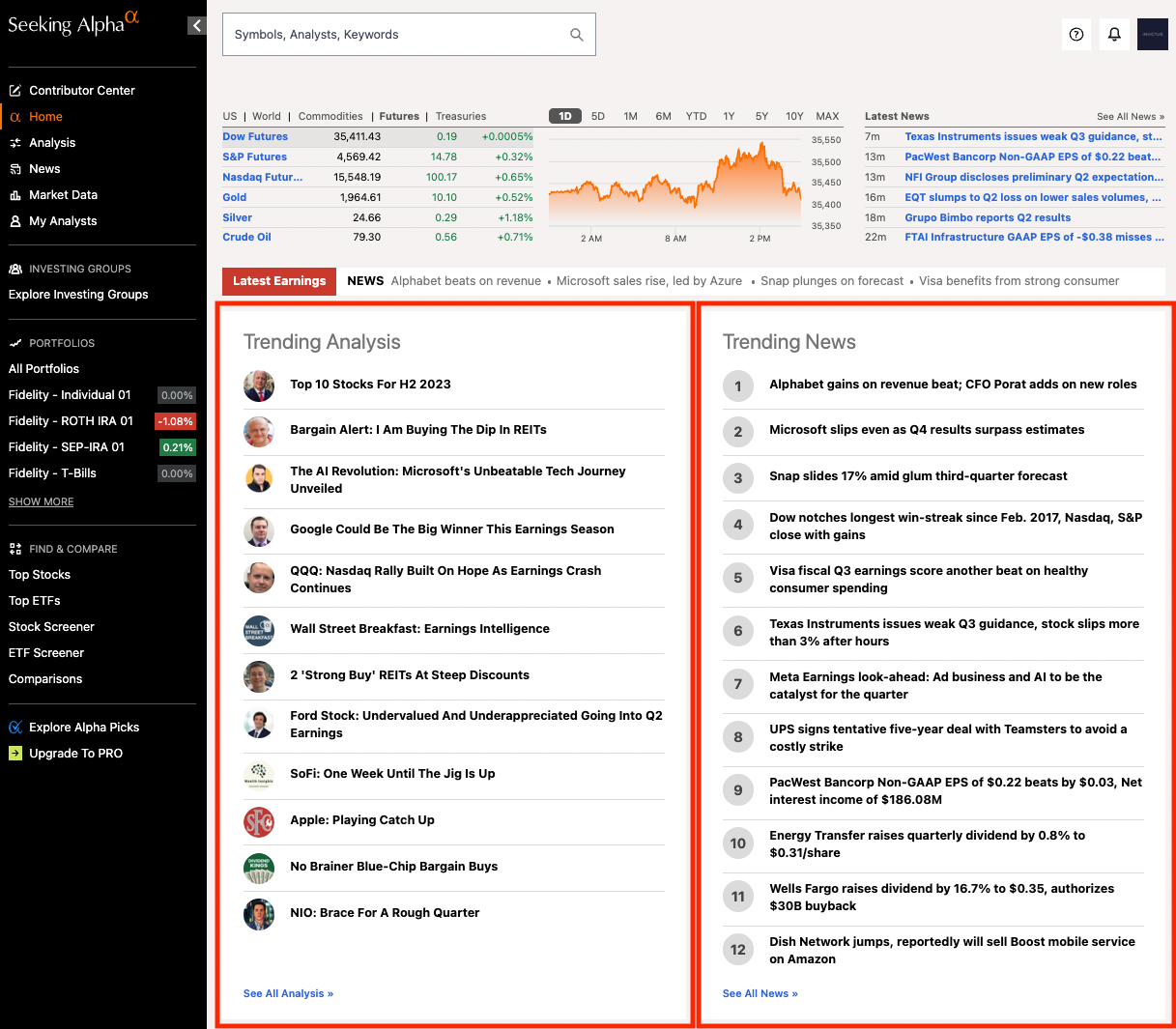

Trending analysis & news

If you want to see what research reports and news articles people are reading right now, head to the homepage:

This is one of my favorite places to find stocks I may want to add to my watchlist.

Stock screener

If you're looking for new investment ideas, Seeking Alpha has a robust stock screener which allows you to filter by any criteria provided on the platform.

It also has a number of pre-built screeners, including its top stocks by Quant Rating and Top Rated Stocks (based on Quant, SA Authors, and Wall Street analysts):

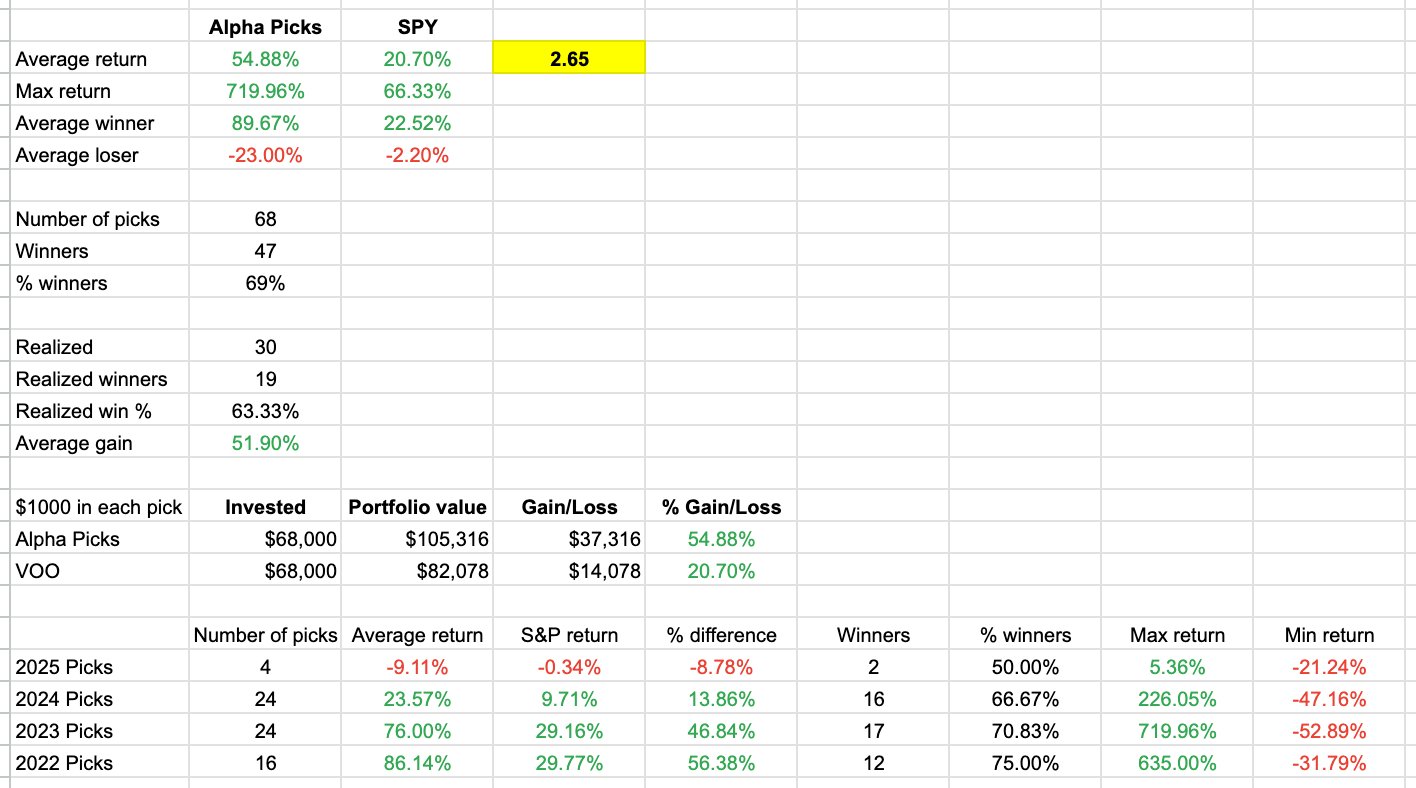

4. Alpha Picks

I also subscribe to Seeking Alpha's premium newsletter service, Alpha Picks.

Alpha Picks is an investing newsletter that provides two stock picks each month. The stocks are generated from its screener, Quant Rating system, and other analysis.

While it's a fairly new service, the early results have been great — as of March 2025, it's outperforming the S&P by a factor of 2.65x, which is why it ranks second on our list of the best investing newsletters.

You can read more about the service, including my results from investing in its stock picks, in my Alpha Picks Review.

Alpha Picks is not included in Seeking Alpha Premium and costs $499/year. Right now, you can get your first year of Alpha Picks at an introductory price of $449.

If you want both Seeking Alpha Premium and Alpha Picks, you can get Seeking Alpha's bundle for ~20% off your first year (save $159).

5. Other features

Content & education

Seeking Alpha hosts 8 investing podcasts which cover everything from daily market news to specific trading strategies.

You can also subscribe to up to 15 newsletters covering different themes or investment ideas, completely free.

It also offers educational resources, like the Investing Strategy section, which can help you create a better portfolio.

Marketplace

Finally, Seeking Alpha's most popular contributors have the option to host their own investing newsletters.

These are paid subscriptions that are not included in your Premium subscription, but you will get access to portfolios and investment ideas you won't find anywhere else.

Is Seeking Alpha Worth it?

I believe long-term investing is complicated and nuanced.

In my opinion, the best way to protect capital and generate above average returns is by reading a wide variety of reports from investors with different perspectives, and making decisions based on all the information available.

So, for me, there's not a more valuable subscription than Seeking Alpha Premium.

For $269 per year, I get access to thousands of analysts sharing their research and tools that I use every day to help me invest.

That's why I've been a paying user of Seeking Alpha Premium since 2018. And I have no plans of canceling.

.png)