Stock Advisor vs Alpha Picks: Which Service Is Right for You?

If you're deciding between Motley Fool's Stock Advisor and Seeking Alpha's Alpha Picks, you're already on the right track. These are two of the best stock-picking services out there — and I've been subscribed to both for years.

But while they share a similar goal (help you beat the market), they go about it in very different ways.

That's why choosing the right one comes down to three things: performance, investing style, and cost.

In this guide, we'll break down those differences to help you figure out which service fits you best.

Side-by-side comparison

| Stock Advisor | Alpha Picks | |

| Rating | ||

| Strategy | Fundamental, qualitative investing | Momentum, quantitative investing |

| Focus | Growth stocks | Primarily growth stocks |

| Risk/volatility | Moderate | Moderate-high |

| Founded | 2002 | 2022 |

| Cost | $199/year | $499/year |

| Sign-up offer | First year for $99 | First year for $449 |

Disclaimer: Ratings, recommendations, investment focus, and risk assessment are my opinion. Actual results may vary. All investors should do their own due diligence.

Below, I cover each of the three factors — performance, investing style, and cost — in more detail for both Stock Advisor and Alpha Picks.

But first, let's quickly cover what comes with each subscription.

What's included with your subscription

Both Stock Advisor and Alpha Picks aim to do the same thing: pick stocks that outperform the market.

Each service delivers two picks per month — one every other week — along with a write-up explaining why they like the stock.

Both also offer a members-only hub where you can view all previous picks, track their performance, and revisit the original buy reports.

That said, Stock Advisor offers a bit more beyond the picks themselves:

- Best Buys Now: A list of 10 stocks you can use to start building your portfolio.

- Educational content: Access to The Motley Fool's library of articles, videos, and eBooks to help you become a better investor.

- Investor community: A private forum where members can discuss picks, share strategies, and ask questions.

By contrast, Alpha Picks keeps things simple. Beyond the regular picks, they provide basic portfolio updates from time to time, but little else.

While these extra features from Stock Advisor are a nice bonus, they're not what should sway your choice. It's more important to decide based on which track record stands out to you and which strategy matches your investing preferences.

Performance comparison

The whole point of a stock-investing newsletter is to help you find stocks that can beat the market. At the end of the day, that's what you're paying for.

We can't know how either service will perform going forward, but we can look at how they've performed so far. And, in both cases, the historical results have been impressive.

Stock Advisor

The Motley Fool is known for its long history of market-beating stock picks, and Stock Advisor is the service that built that reputation.

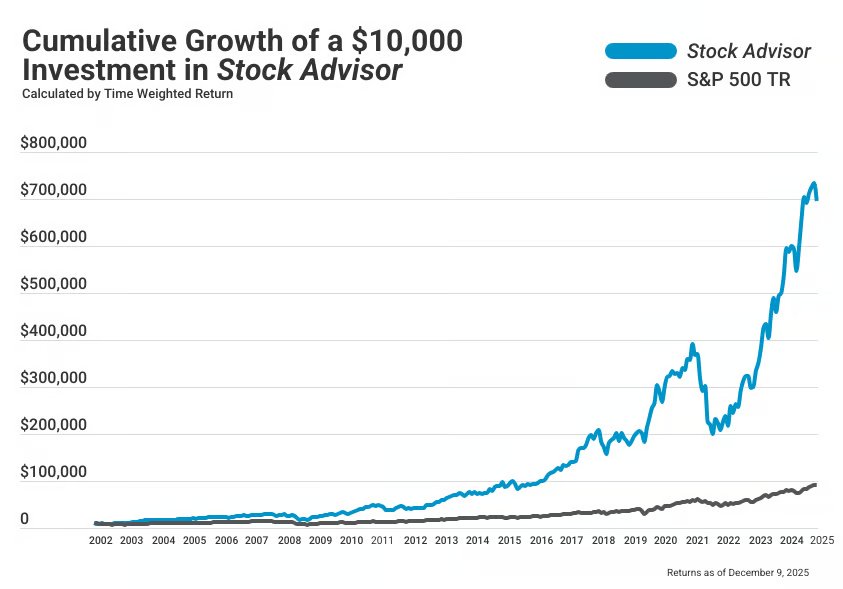

Since launching in 2002, Stock Advisor has delivered cumulative returns of +965%, compared to +193% for the S&P 500 (as of December 2025, per the company's website):

I cover its investment strategy in more detail below, but it's worth noting that a big part of that outperformance has come from a few massive winners.

These include:

- Nvidia (NVDA), up +85,767% since being recommended in March 2005

- Netflix (NFLX), up +55,153% since September 2004

- Amazon (AMZN), up +29,016% since August 2004

They didn't just pick great companies — they held onto them for 20+ years. That long-term conviction is central to Stock Advisor's strategy. If you're not willing to hold for a decade or more, this probably isn't the right service for you.

Alpha Picks

Alpha Picks is a much newer service, but it's already off to a strong start.

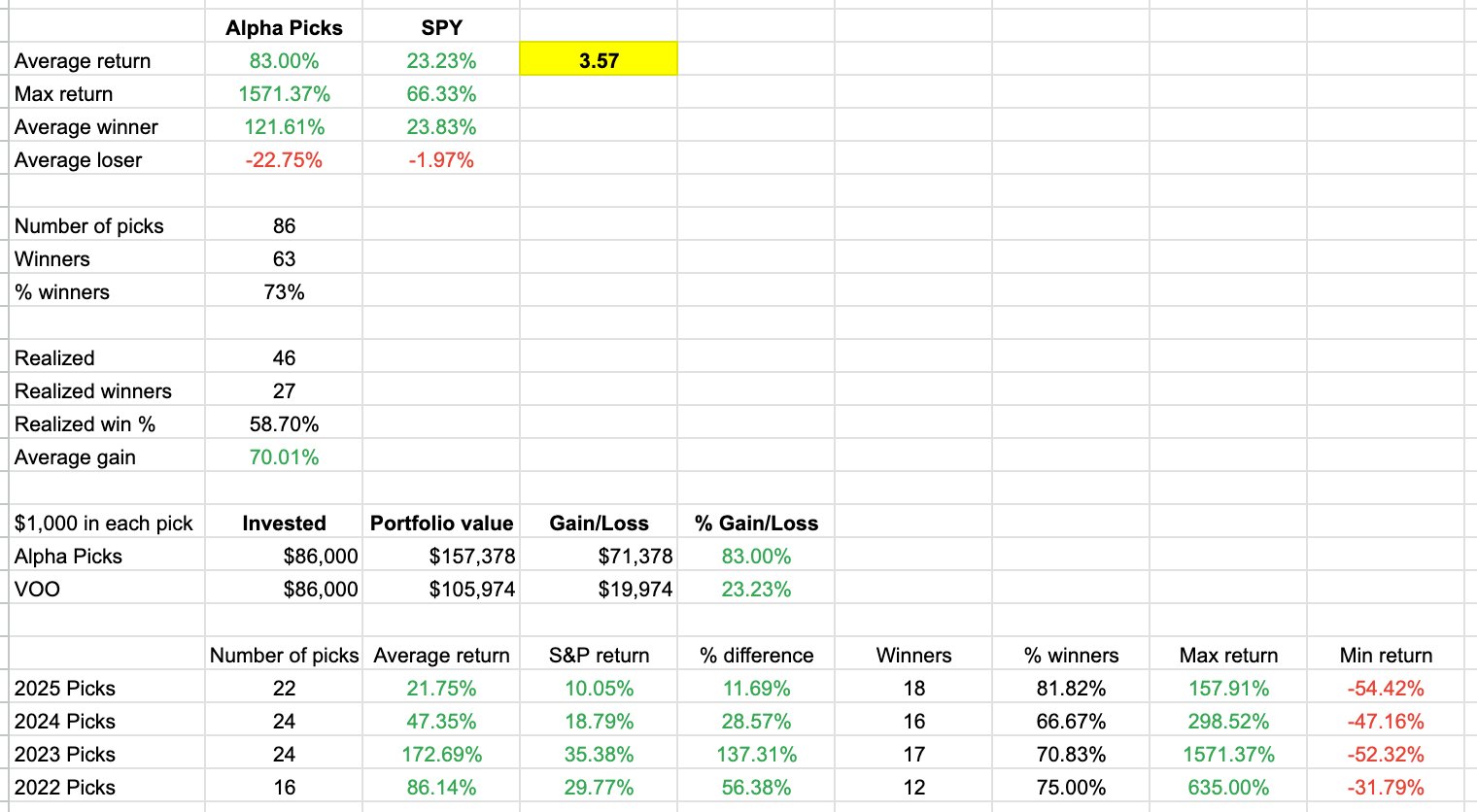

In the 3.5 years since launch, its average stock pick has returned +83.00%, more than 3.5x the S&P 500's +23.23% over the same period:

Like Stock Advisor, a handful of big winners are doing most of the heavy lifting:

- Celestica (CLS), up +1,009.83% since being picked in October 2023

- Powell Industries (POWL), up +507.72% since May 2023

- AppLovin (APP), returned +1,571.37%

- Super Micro Computer (SMCI), returned +635%

- Modine Manufacturing (MOD), returned +348.42%

The difference? Alpha Picks doesn't hold for decades. The team is explicitly targeting high-upside stocks they expect to move fairly quickly — something we'll dig into more in the next section on investing style.

Investment styles

While both stock-picking services aim to beat the market, they have different approaches to getting there.

Stock Advisor

Stock Advisor focuses on established businesses with durable competitive advantages and long-term growth potential.

The team leans heavily on fundamental analysis and qualitative judgment — looking at industry trends, business performance (revenue and profit growth), management effectiveness, customer sentiment, and more.

There's math involved, of course, but this approach is just as much art as it is science, and relies on the team's collective experience and research.

Stock Advisor's strategy is long-term by design. The team aims to hold positions for 5+ years, and rarely sells its winners. In fact, when a stock dips or becomes attractively priced again, they often double down. For example, since January 2020:

- Tesla has been re-recommended 5 times

- Shopify has been picked 9 times

Stock Advisor has a classic buy-and-hold strategy: find great companies at reasonable prices and hold them for the long haul.

Alpha Picks

Alpha Picks takes a very different approach. Its process is almost entirely driven by quantitative data.

Unlike Stock Advisor, this service doesn't rely on team sentiment or company storytelling. Instead, it uses a strict set of rules to identify stocks with strong momentum and healthy fundamentals.

One common complaint is that Alpha Picks often recommends stocks that have already run up. But that's the point. A stock must perform well to be a candidate for the portfolio in the first place.

Momentum strategies are built on the idea that the companies most likely to outperform in the future are those that have been outperforming recently.

Because these stocks seem expensive (relative to their past prices), they're often undervalued relative to their fundamentals.

By removing human bias and relying strictly on the data, Alpha Picks aims to surface stocks with high near-term upside.

While the team targets holding periods of at least a year, there's no emotional attachment. The service invests based on a hard set of predefined rules. If a stock violates those rules, it is sold.

Cost comparison

Pricing is another key difference between these two services — and in many ways, it reflects their target audiences.

Alpha Picks is the more expensive of the two, which makes sense given its data-driven, momentum-based strategy. It's built for more advanced investors who may have larger account balances.

Stock Advisor, on the other hand, is more affordable and has a broader appeal. It's well-suited for general long-term investors looking to build a high-conviction portfolio of quality businesses.

Here's how the two stack up on pricing, trials, and refund policies:

| Stock Advisor | Alpha Picks | |

|---|---|---|

| Standard annual price | $199/year | $499/year |

| New member offer | $99 for the first year | $449 for the first year |

| Monthly option | $39/month | Not offered |

| Refund policy | 30-day, money-back guarantee | No refunds or trial period |

Refund policies

As you can see in the table above, this is another area where the services differ.

- Stock Advisor offers a 30-day money-back guarantee, so you can try it risk-free.

- Alpha Picks does not currently offer refunds or a trial period.

If you're still on the fence, that refund window may make it easier to start with Stock Advisor and see how you like it.

Final verdict

While Alpha Picks and Stock Advisor may look similar on the surface, their investment styles cater to very different types of investors.

Stock Advisor is built for long-term, fundamentals-driven investors who want to buy great businesses and hold them for years.

Alpha Picks is better suited for more advanced investors who prefer a data-driven, rules-based approach and are comfortable acting on momentum.

That contrast should make your decision pretty straightforward — just pick the service that aligns best with how you like to invest.

If you're more into long-term, fundamental-based investing, Stock Advisor is a better fit. If you prefer a more aggressive, quantitative approach, then you may want to go with Alpha Picks.