Stock Advisor vs Rule Breakers

Every stock picking service promises the same thing: outperformance.

But very few actually deliver. And even fewer do it consistently.

That's what makes The Motley Fool special. Since launching Stock Advisor in 2002 and Rule Breakers in 2004, both services have consistently outperformed the market. And they've each done it by wide margins.

The problem is figuring out which of these newsletters is best for you.

While they share a similar format, structure, and investing philosophies, they were made for two very different types of investors.

Here's my complete analysis of Stock Advisor vs Rule Breakers based on my firsthand experience with both services.

Stock Advisor vs Rule Breakers: summary view

| Stock Advisor | Rule Breakers | |

| Overall rating | ||

| Service type | Stock picking newsletter | Stock picking newsletter |

| Best for | Everyone | Aggressive investors |

| Focus | Growth stocks | Disruptive technology stocks |

| Sectors | Any | Emerging technologies |

| Risk/volatility | Moderate | High |

| Cost | $199/year | $299/year |

| Offer | $89 for first year | $99 for first year |

Disclaimer: Ratings, recommendations, investment focus, and risk assessment are my opinion. Actual results may vary. All investors should do their own due diligence.

What is The Motley Fool?

The Motley Fool was founded by brothers David and Tom Gardner in 1993. They started with a simple mission: make the world smarter, happier, and richer.

30 years later, the company is helping millions of people around the world achieve their financial goals via financial education, stock market news, online communities, and premium investing services, which are used by more than 750,000 investors.

Two of the company's most popular services are Stock Advisor and Rule Breakers.

Both are investing newsletters that aim to help their members build wealth through smarter investing decisions. The services provide stock recommendations, portfolio construction advice, and stock market insights.

To date, both Rule Breakers and Stock Advisor have delivered impressive results for their members. More on that below.

The Motley Fool's investing philosophy

Before diving into the services themselves, I want to cover something both Stock Advisor and Rule Breakers have in common — The Motley Fool investing philosophy.

Both of these services are based on long-term, fundamental investing.

The Motley Fool focuses on “buying and holding quality stocks for long periods of time.” The company will be the first to admit how volatile the stock market is, and how enduring downturns is key to building wealth.

There are six components to investing The Motley Fool Way:

- Buy 25 or more companies over time.

- Hold those recommended stocks for 5 years or more.

- Invest new money regularly.

- Hold through market volatility.

- Let your portfolio's winners keep winning.

- Target long-term returns.

Those are The Motley Fool's expectations of you, regardless of which service you're considering. If you can't stick to these rules, you won't get a lot of benefit from their products.

Stock Advisor: strategy and performance

- Overall rating:

- Focus: Growth stocks

- Price: $199/year ($89 for new members)

Stock Advisor is The Motley Fool's flagship product, with over 500,000 subscribers.

The newsletter service provides two new stock recommendations per month. Each pick comes with a report explaining the business, why the stock may have potential, and the risks it faces.

In addition to the monthly stock picks, the teams also provide a list of 10 “Starter Stocks” that new members can use to start building their portfolios right away.

Investment strategy

Any stock with growth potential and robust competitive advantages is a candidate for the portfolio. Most of their picks are stable, well-established companies.

There are two teams behind Stock Advisor, each providing one stock pick per month.

One team, led by Tom Gardner, focuses on fundamental analysis and some value investing principles. The other team, led by David Gardner, uses fundamental and quantitative analysis.

By having two sets of teams that take different approaches to evaluating stocks, Stock Advisor is a more complete and diversified stock picking service than most of its competitors.

Plus, a little friendly competition ensures both teams are working hard, and might be part of the reason the service's picks have performed so well.

Performance

The biggest draw to any stock picking service is its performance.

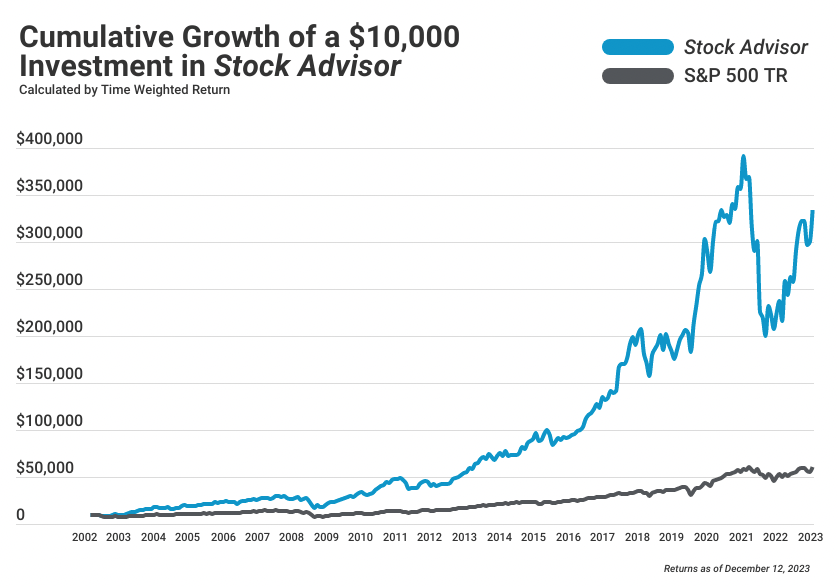

According to its site, Stock Advisor has outperformed the market by nearly 4x since its inception in 2002.

Source: The Motley Fool

Disclaimer: Past performance does not guarantee future results.

Some of its previous picks include:

- Amazon (AMZN), which has returned 19,491%

- Netflix (NFLX), which has returned 25,358%

- Disney (DIS), which has returned 5,089%

- Nvidia (NVDA), which has returned 29,854%

While most picks will not generate these types of returns, the Stock Advisor team has demonstrated an ability to find stocks with big potential and hold them for long periods of time.

Both of these aspects are difficult, but The Motley Fool's services really stand out for their ability to hold their winners for years, even through volatility.

It's easy to glance at the chart above and think outperformance comes easy, but I encourage you to take a closer look. Even if Stock Advisor provides you with winning stock picks, you will experience drawdowns and large bouts of volatility.

In 2022, for example, Stock Advisor lost ~50% while the S&P 500 was down significantly less. While seeing this volatility on a chart is one thing, experiencing it is quite another.

If you can't handle drawdowns such as these, you may want to own a portfolio of index funds and bonds instead.

You could also construct your portfolio by mixing individual stocks (like those recommended in Stock Advisor) with index funds and bond funds, which is how I invest.

Rule Breakers: strategy and performance

- Overall rating:

- Focus: Disruptive technology stocks

- Price: $299/year ($99 for new members)

Like Stock Advisor, Rule Breakers also provides two new stock recommendations and accompanying analysis each month.

Rule Breakers also provides a list of 5 “Best Buys Now” stocks to help new members get started.

Investment strategy

Rule Breakers stocks are chosen by David and his team. Similar to their approach in Stock Advisor, the team focuses on a combination of fundamental and quantitative analysis.

Additionally, David likes to leave some room for the team to have a “gut feeling” about their recommendations, something he believes is a difference-maker in having the conviction to buy and hold the stocks they're targeting.

The team has several criteria to help them identify stocks to invest in including:

- First-mover companies in emerging industries

- Companies with sustainable competitive advantages

- Stocks with momentum

The team is not afraid to invest in stocks that many investors would consider extremely overvalued. Given this approach, you should expect to see some big losers from time to time.

The team believes, however, that their winners will more than pay for any losers in the portfolio and lead to outperforming the general market.

Performance

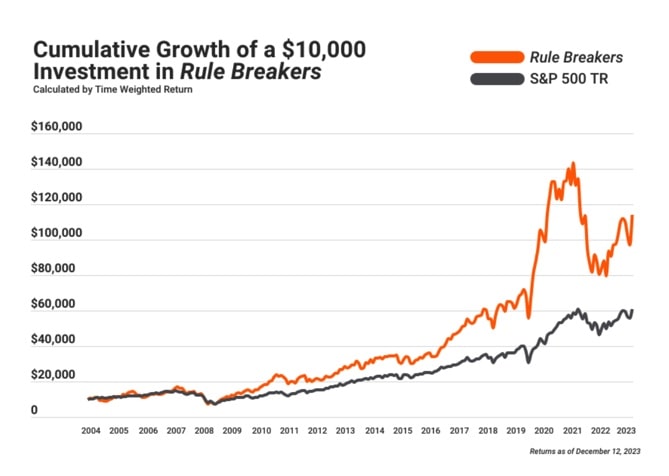

The Rule Breakers' page boasts a chart similar to Stock Advisor's, and the team has outperformed the market by 2-to-1 since its inception in 2004.

Source: The Motley Fool

Disclaimer: Past performance does not guarantee future results.

A few of Rule Breakers' best picks are:

- MercadoLibre (MELI), which has returned 11,269%

- Shopify (SHOP), which has returned 3,555%

- Tesla (TSLA), which has returned 11,991%

In all, the Rule Breakers team has made 144 stock recommendations that had returns of 100% or more.

As mentioned above, you should take a close look at the chart and decide whether you will be able to ride through the volatility necessary to capture the above returns.

This is also assuming the team keeps making winning recommendations, which is not guaranteed.

You may decide to allocate a certain percentage of your portfolio (say 10–20%) to Rule Breakers stocks while investing the bulk of your portfolio into index funds, bonds, or some combination of both.

Stock Advisor vs Rule Breakers

Below is a comparison of Stock Advisor and Rule Breakers, including their similarities and differences.

Similarities

The two services have a handful of overlapping characteristics:

- They're both stock picking newsletters

- They both provide two new stock picks and accompanying reports every month

- They have both outperformed the market since their inceptions

- Both services provide lists of “Starter Stocks” and “Best Buys Now” to help new members quickly build their portfolios

- Both services come with educational resources, stock market updates, and online community access

- Both services use the same customer support, available via email or phone

Differences

While the services follow the same format, their target audiences differ. There are a few other differences between them as well:

| Stock Advisor | Rule Breakers | |

| Year founded | 2002 | 2004 |

| Best for | Everyone | Aggressive investors |

| Who runs the service | Picks are from both Tom and David (and their teams) | Picks are from David and his team only |

| Investment approach | Growth stocks | Disruptive technology stocks |

| Risk/volatility | Moderate | High |

| Sectors | Any | Emerging technologies |

| Securities analyzed | 300+ | 200+ |

| Level of diversification | Moderately diversified | Less diversified |

Pricing

The cost of the two services also differs, further emphasizing Rule Breakers' focus on slightly more advanced investors.

- Stock Advisor: $199/year ($89 for the first year)

- Rule Breakers: $299/year ($99 for the first year)

If you're interested in subscribing to both services, The Motley Fool offers a bundle that grants members access to Stock Advisor, Rule Breakers, Everlasting Stocks ($299/year), and Real Estate Winners ($249/year) for $499/year.

Which Motley Fool newsletter is right for you?

I'll sum up everything I've said so far in a simple synopsis:

- If you're looking for a service that recommends high-quality growth stocks and moderate volatility, choose Stock Advisor. It's tailored for beginner-to-intermediate investors who want high-quality stock picks.

- If you want to add some exposure to high-flying, disruptive stocks and can stomach large price swings (both up and down), choose Rule Breakers. It was built for more aggressively minded investors who want similarly aggressive stock picks.

Rule Breakers is aiming for big winners and will require a higher risk tolerance than Stock Advisor. If that isn't what you're looking for, Stock Advisor is the better option.

When choosing between the two, remember to consider your own portfolio goals and which of these services is a better fit for your investing style.

Should you invest 100% of your portfolio in Motley Fool stocks?

Disclaimer: This is personal opinion for illustrative purposes only. This is not financial advice. Do your own due diligence and determine your asset allocation based on your risk tolerance and financial goals.

Personally, I view Rule Breakers as an “additive” service from which I can take picks and add them to my existing portfolio. Because of the risk and volatility inherent in its picks, I would not want to make Rule Breakers 100% of my portfolio.

In practice, I would not allocate more than 10–20% of my portfolio to Rule Breakers stocks.

While Stock Advisor is still making individual stock recommendations into growth stocks (which is also riskier than buying ETFs), I'd be much more comfortable making the stocks in its service a major part of my portfolio.

That said, I'd still only allocate up to 50–60% of my portfolio to Stock Advisor stocks.

For the rest of my portfolio, I'd invest in low-cost index funds (like VOO, VTI, or VT, among others) for easy diversification and reduced risk.

Final verdict

I rank Stock Advisor as a better service for a broader range of investors than Rule Breakers. That's because of its lower annual cost, more general investment approach, higher degree of diversification, and good performance.

That said, if you're specifically looking for highly disruptive stocks to add to your portfolio and can stomach the volatility, Rule Breakers may be the better choice.

Both services have performed well for about 20 years. Assuming the teams continue to pick winning stocks (which is not guaranteed) and you're able to hold them through the inevitable periods of drawdowns, it's hard to go wrong with either service.

If you're still having a hard time deciding which of the two services is right for you, I would recommend starting with Stock Advisor.

Stock Advisor was built with a wider range of investors in mind and is less expensive and easier to get started with than Rule Breakers.

Plus, if you decide you do want to add some high-flying stocks to your portfolio later on, it's always possible to add Rule Breakers to the mix down the road.