Stock Advisor vs Alpha Picks: Which Service Is Right for You?

Choosing a stock-picking newsletter should come down to three things:

- Performance

- Cost

- Investment style

You've done a great job narrowing down your choices so far — Motley Fool's Stock Advisor and Seeking Alpha's Alpha Picks are two of the best investing newsletters I've come across.

That said, there are a few key differences in their track records and investing styles.

Because of these differences, and depending on what type of investor you are, one of these services is likely the better option for you.

Side-by-side comparison

| Stock Advisor | Alpha Picks | |

| Rating | ||

| Strategy | Fundamental, qualitative investing | Momentum, quantitative investing |

| Focus | Growth stocks | Primarily growth stocks |

| Risk/volatility | Moderate-high | Moderate-high |

| Founded | 2002 | 2022 |

| Cost | $199/year | $499/year |

| Sign-up offer | First year for $89 | First year for $449 |

Disclaimer: Ratings, recommendations, investment focus, and risk assessment are my opinion. Actual results may vary. All investors should do their own due diligence.

Below, I cover each of the three factors — performance, cost, and investing style — in more detail for both Stock Advisor and Alpha Picks.

What's included with your subscription

Stock Advisor and Alpha Picks share the same objective: to pick stocks that outperform the market.

Both services provide two stock picks per month, delivering one new pick via email every other week, along with a report on why the stock was selected.

Alpha Picks doesn't deliver much in addition to its stock picks and their performance (other than occasional updates on the portfolio).

However, a Stock Advisor subscription also comes with access to:

- Best Buys Now: A list of 10 stocks you can use to start building your portfolio.

- Educational materials: The Motley Fool has a library of articles, videos, and eBooks to level up your investing skills.

- Online community: All members have access to a community of like-minded investors where you can talk about your portfolios and new investments.

While these features are nice, I wouldn't recommend choosing Stock Advisor just because of them.

In my opinion, you should choose based on which service's performance, cost, and investing style you prefer.

Performance comparison

The purpose of stock-picking newsletters is to provide recommendations for stocks that have the potential to outperform the market.

At the end of the day, that's what you're paying for.

We can't know for certain how these services will perform in the future, so the best we can do is look at how they've performed historically.

In both cases, the historical results have been strong.

Stock Advisor

The Motley Fool is best known for its stock picks outperforming the market.

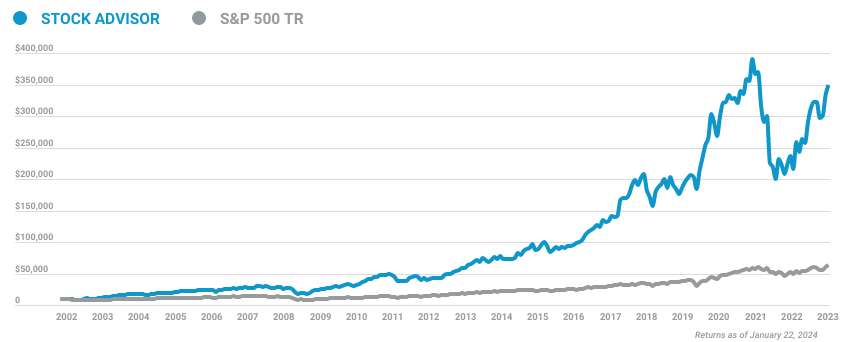

Stock Advisor, its flagship newsletter, has outperformed the market by a wide margin since its inception in 2002. As of the time of this writing, Stock Advisor has generated cumulative returns of 590% vs the S&P's 143%, according to the company's site:

I cover Stock Advisor's investment style in more detail below, but it's important to note that an outsized portion of these returns have come from a handful of huge winners.

These include:

- Nvidia (NVDA), up 37,292% since being recommended in April 2005

- Disney (DIS), up 5,195% since June 2004

- Netflix (NFLX), up 30,662% since December 2004

- Amazon (AMZN), up 20,686% since September 2004

In addition to picking great companies, the Stock Advisor team has also held each of these stocks for nearly 20 years — a key ingredient in its performance track record.

If you don't want to potentially hold stocks for 10+ years, this likely isn't the service for you.

Alpha Picks

While it hasn't been around for nearly as long as Stock Advisor, Alpha Picks has quickly generated some impressive performance figures.

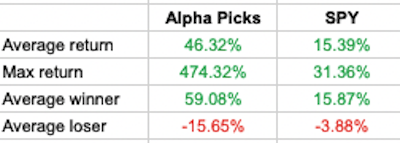

In the 18 months since its launch, the average stock pick from Alpha Picks has more than tripled the return of the S&P (46.32% vs 15.39%):

Like Stock Advisor, a few stocks are responsible for the vast majority of the outperformance so far.

- Alpha Metallurgical Resources (AMR), up 220.58% since being picked in July 2022

- M/I Homes (MHO), up 262.35% since October 2022

- Super Micro Computer (SMCI), up 474.32% since November 2022

- Modine Manufacturing (MOD), up 215.30% since December 2022

As you'll see in the investment style section below, these fast, sharp gains are exactly what the Alpha Picks team is aiming to provide.

Cost comparison

Alpha Picks recently increased its price to $499/year, significantly more than Stock Advisor's $199/year price tag.

They both have introductory offers for new members:

- New members can get their first year of Stock Advisor for $89

- New members can get their first year of Alpha Picks for $449

Stock Advisor also offers monthly pricing, though it charges $39 per month. That's 2.35x more expensive than its annual pricing.

Refund policies

The two services also have different refund policies.

Stock Advisor offers a money-back guarantee if you decide to cancel your membership within the first 30 days.

Currently, Alpha Picks does not have a refund policy or trial period.

Investment styles

Stock Advisor

Stock Advisor invests in well-established companies with sustainable competitive advantages and large growth potential.

The team uses fundamental analysis and judges companies qualitatively. This involves looking at factors such as industry trends, business performance (revenue and profit growth), management effectiveness, consumer opinions, and more.

While there is plenty of math involved in this type of analysis, the approach uses as much art as science and relies heavily on the team's collective experience and research.

They aim to hold stocks for 5+ years and, as highlighted above, rarely sell their winning stock picks.

In fact, the team regularly re-recommends previous stock picks (Tesla has been recommended 5+ times since January 2020) when attractive buying opportunities present themselves.

This reinforces their strategy of buying high-quality businesses at fair prices and holding them for the long haul.

Alpha Picks

Alpha Picks, on the other hand, invests exclusively based on quantitative (data-driven) factors.

The number one complaint about Alpha Picks is that the service recommends stocks that have already performed well.

But, as is the case with all momentum-based strategies, a stock must perform well to be a candidate for the portfolio in the first place.

While somewhat obvious, momentum strategies are based on the concept that the companies most likely to outperform in the future are those that have been outperforming recently.

Plus, because many investors believe the stock prices are now “too high” (relative to their old prices), these stocks are often undervalued relative to their underlying fundamentals.

By deploying quantitative strategies, the team can remove the natural human biases and focus exclusively on those underlying fundamentals.

While Alpha Picks aims to hold positions for at least one year, the team has no particular attachment to any of the stocks it recommends. It invests based on a hard set of predefined rules. If a stock violates those rules, it is sold.

Final verdict

To me, the value of stock-picking newsletters is determined by their performance, cost, and investment style.

When comparing Stock Analysis and Alpha Picks, it's clear that both services have performed very well historically.

However, since Stock Advisor has been around for 20 years longer than Alpha Picks and has maintained its performance through multiple market cycles, I have to give a slight edge to Stock Advisor in this category.

That said, it's important to keep in mind that past performance does not guarantee future results. It is not certain that these services will continue to perform as well.

When it comes to cost, both services have very similar pricing structures. Stock Advisor has a slightly better introductory offer and a 30-day fee-back guarantee, so it gets a slight edge in this category as well.

The decision ultimately comes down to which service's investment style better matches your own.

If you're more into long-term, fundamental-based investing, Stock Advisor is a better fit. If you prefer a strictly quantitative approach, then you should probably go with Alpha Picks.