Motley Fool Stock Advisor vs Rule Breakers: Which Is Best for You?

Every stock-picking service promises market-beating returns.

Few actually deliver. Fewer still do it for two decades straight.

That's what sets The Motley Fool apart. Its flagship newsletters — Stock Advisor and Rule Breakers — have both outperformed the market by wide margins since launching in the early 2000s.

But while they share a similar format and investing philosophy, they're designed for very different types of investors. Once you know how they differ, choosing the right one for you is straightforward.

Below, I break down the key differences between Stock Advisor and Rule Breakers — investment strategy, performance, and cost — based on my experiences using both.

Note: Rule Breakers is now only available through Motley Fool Epic, a bundled subscription that includes Rule Breakers, Stock Advisor, Dividend Investor, and Hidden Gems. All links to Rule Breakers point to Epic.

For more, see my full review of Epic.

Stock Advisor vs Rule Breakers: summary view

| Stock Advisor | Rule Breakers (via Epic) | |

| Overall rating | ||

| Service type | Stock-picking newsletter | Stock-picking newsletter bundle |

| Best for | Everyone | More aggressive, higher net worth investors |

| Monthly stock picks | 2 |

|

| Suggested portfolio size | $25k+ | $50k+ |

| Investment focus | Growth stocks | Disruptive technology stocks, growth stocks, dividend stocks |

| Risk/volatility | Moderate | Moderate-high |

| Cost | $199/year | $499/year |

| Offer | $99 for first year | $299 for first year |

Disclaimer: Ratings, recommendations, investment focus, and risk assessment are my opinion. Actual results may vary. All investors should do their own due diligence.

What is The Motley Fool?

The Motley Fool was founded in 1993 by brothers David and Tom Gardner with a simple mission: to make the world smarter, happier, and richer.

Three decades later, it's one of the most recognizable names in retail investing, providing educational content, newsletters and podcasts, investing tools, stock market analysis, and premium services to over 750,000 members.

Two of its most popular offerings are Stock Advisor and Rule Breakers.

Both are subscription-based newsletters designed to help long-term investors build wealth. They offer stock recommendations, portfolio guidance, and ongoing market commentary.

In 2024, The Motley Fool reorganized its product lineup and bundled several services into tiered subscriptions. Rule Breakers is now part of the second tier, called Epic, which also includes access to Stock Advisor, Dividend Investor, and Hidden Gems.

All of The Motley Fool's services — including Stock Advisor and Rule Breakers — are built around the same core investing philosophy.

The Motley Fool Investing Philosophy

Both Stock Advisor and Rule Breakers are rooted in long-term, fundamentals-based investing.

The Motley Fool focuses on buying and holding high-quality companies for long periods of time. They openly acknowledge how volatile the market can be, and how enduring the inevitable downturns is key to building lasting wealth.

Here are the six core principles to investing The Motley Fool Way:

- Buy 25 or more companies over time.

- Hold those recommended stocks for 5 years or more.

- Invest new money regularly.

- Hold through market volatility.

- Let your portfolio's winners keep winning.

- Target long-term returns.

These aren't just guidelines — they're expectations. If you can't stick to these rules, don't expect to get the full benefit of any of their products.

With that foundation laid, it's time to dig into the services themselves.

Stock Advisor: strategy and performance

- Overall rating:

- Best for: Everyone

- Focus: Growth stocks

- Price: $199/year ($99 for new members)

Stock Advisor is The Motley Fool's flagship stock-picking service, with over 500,000 subscribers.

Each month, subscribers receive two new stock recommendations — each backed by a detailed research report explaining the business, its upside potential, and key risks.

New members also get access to a list of the "Top 10 Stocks to Buy Now” to help you start building your portfolio right away.

Investment strategy

Stock Advisor focuses on high-quality, well-established businesses with long-term growth potential.

The team looks for companies with durable competitive advantages (moats), strong financials, and leadership teams that know how to reinvest for growth. These are often market leaders or businesses on track to become one.

Rather than chasing trends, Stock Advisor sticks to fundamentally sound companies it believes can compound value over time. The goal is to buy great businesses and hold them through market ups and downs.

Performance

The biggest draw to any stock-picking service is its performance.

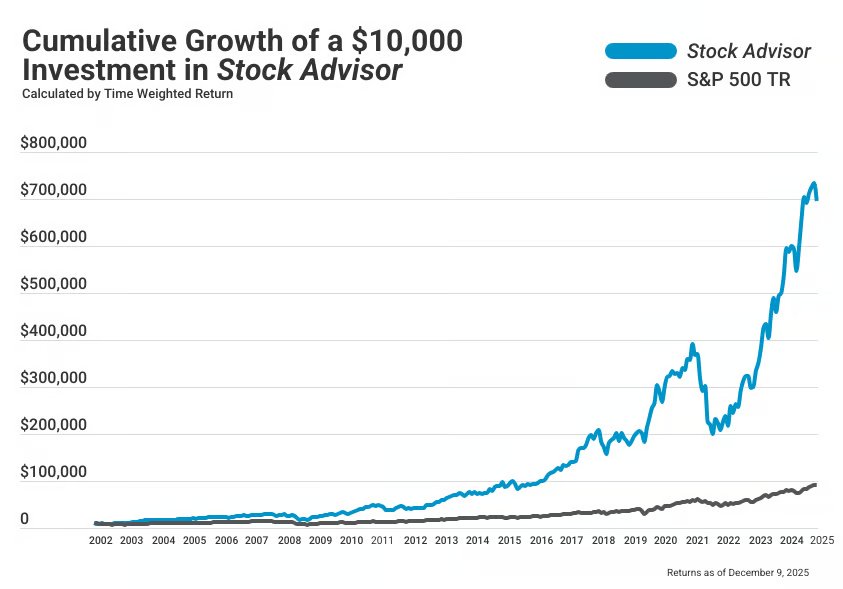

According to The Motley Fool, Stock Advisor has returned +965% since 2002, compared to +193% for the S&P 500 over the same period — an outperformance of 5x.

Source: The Motley Fool

Disclaimer: Past performance does not guarantee future results.

Some of its previous picks include:

Of course, not every pick has returns like these, but the service has a track record of identifying long-term winners and holding onto them through years of market ups and downs. Both aspects are critical.

It's one thing to pick a great stock. It's another to hold it — or even buy more of it — when the market is down. That's where most investors fall short, and where a lot of The Motley Fool's outperformance comes from (in all of its services).

Even if Stock Advisor hands you long-term winners, you'll still face drawdowns and stretches of volatility along the way.

Take 2022: the Stock Advisor portfolio dropped nearly 50%, while the S&P 500 fell far less. Holding through a drawdown like that takes serious conviction.

If you can't stomach those swings, you may be better off sticking with index funds or a more conservative asset mix.

Personally, I take a hybrid approach — combining individual stock picks (including Stock Advisor recs) with broad index and bond ETFs for a more balanced portfolio.

If you can handle the volatility, however, Stock Advisor's past performance shows how well you can be rewarded.

Stock Advisor ranks #1 on our list of the best stock-picking services.

Rule Breakers: strategy and performance

- Overall rating:

- Best for: More aggressive, higher net worth investors

- Focus: Disruptive technology stocks

- Price: $499/year ($299 for new members, price includes subscriptions to Rule Breakers, Stock Advisor, Dividend Investor, and Hidden Gems)

To access Rule Breakers, you'll need a subscription to Epic — a bundled tier that includes five stock picks each month: one from Rule Breakers, two from Stock Advisor, one from Hidden Gems, and one from Dividend Stocks.

Like Stock Advisor, each pick comes with a detailed write-up explaining the thesis, risks, and long-term outlook.

New members also get access to Stock Advisor's “Top 10 Stocks to Buy Now” list, plus another list of 10 high-conviction picks, which provide a solid starting point for building a diversified portfolio.

Investment strategy

Rule Breakers focuses on high-growth, high-upside stocks — often in emerging industries where the companies have first-mover advantages or disruptive potential.

The team uses a mix of fundamental analysis, quantitative metrics, and what they describe as a “gut feeling.” This combination helps them stay invested with conviction despite the heightened volatility these stocks typically experience.

The Rule Breakers' team isn't overly concerned with valuations. The stocks they buy are fast-growing businesses that are targeting massive markets. These are higher-risk, higher-reward investments.

Some of the core traits the team looks for:

- First-mover advantage in a growing or underpenetrated industry

- Sustainable competitive advantages

- Positive business momentum (revenue, product adoption, or market share)

Because of the high-growth focus, volatility is part of the package. You should expect to see some big losers from time to time.

The team believes, however, that their winners will more than make up for the losers over time.

Performance

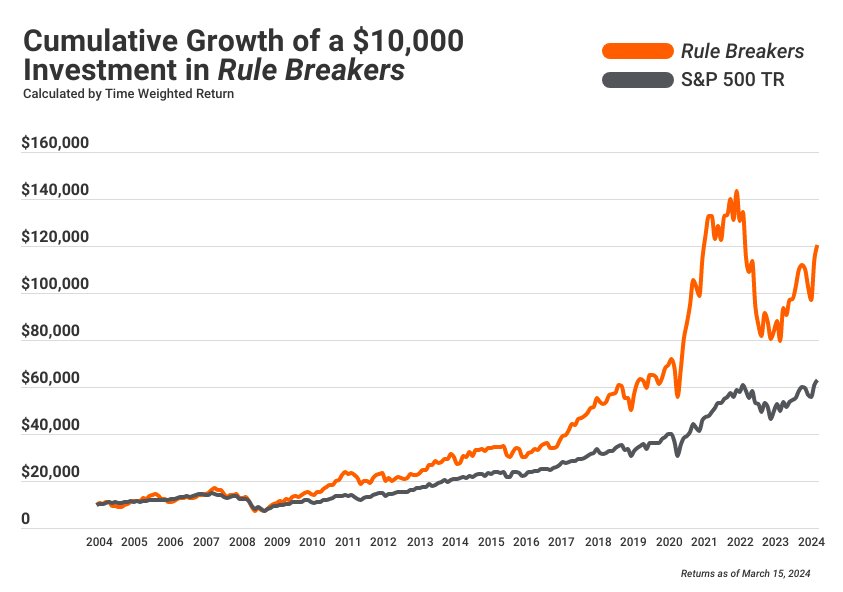

Since launching in 2004, Rule Breakers has outperformed the market by nearly 3x — returning +345% vs. +149% for the S&P 500 as of February 2025.

Source: The Motley Fool

Disclaimer: Past performance does not guarantee future results.

Some of its biggest winners include:

In total, the service has made over 140 stock recommendations that have doubled in value or more.

That said, capturing these returns requires serious conviction. As you can see in the chart above, the drawdowns can be steep, and not every pick will recover.

As always, it comes down to your risk tolerance. A common approach is to allocate a small portion of your portfolio — say 10–20% — to Rule Breakers picks, while keeping the rest in index funds, bonds, or some combination of both.

Which Motley Fool newsletter is right for you?

Here's a quick recap to help you decide:

- Stock Advisor: Choose Stock Advisor if you want high-quality growth stock recommendations with moderate volatility. It's ideal for any long-term investor, but especially beginner and intermediate investors looking to build a portfolio of well-established businesses with long-term growth potential.

- Rule Breakers: Choose Rule Breakers if you're after bold, disruptive companies with the potential for massive returns, and you're comfortable with the higher volatility that comes with them. It's better suited for more aggressive investors who want to swing for the fences with a smaller portion of their portfolio.

Keep in mind: Stock Advisor is included in the Epic subscription, which is currently the only way to access Rule Breakers. So if you want both, Epic gives you full access (plus subscriptions to Dividend Stocks and Hidden Gems).

Both Stock Advisor and Epic come with a 30-day membership-back guarantee, so you can try them out and cancel for a full refund if they're not a good fit.

Should you invest 100% of your portfolio in Motley Fool stocks?

Disclaimer: This is a personal opinion for illustrative purposes only. This is not financial advice. Do your own due diligence and determine your asset allocation based on your risk tolerance and financial goals.

Personally, I see Rule Breakers as an add-on to my core portfolio, not the foundation.

The picks are quite speculative, which makes them high-potential but also volatile and risky. Because of that, I wouldn't feel comfortable putting more than 10–20% of my portfolio into Rule Breakers stocks.

Stock Advisor, on the other hand, is more balanced.

While it still focuses on individual growth stocks — which carry more risk than ETFs — they're more established businesses, so I'd feel more confident making its recommendations a much larger part of my portfolio.

In practice, I'd be comfortable allocating up to 50–60% to Stock Advisor picks.

The rest of my portfolio goes into low-cost index funds like VOO, VTI, or VT, which offer instant diversification, lower volatility, and a dependable foundation for long-term growth.

That mix gives me a balance of high upside (and the fun of owning individual companies) while keeping my overall risk in check.

Final verdict

For most investors, Stock Advisor is the better starting point.

It's more affordable, broadly applicable, and offers a more diversified approach, all with a strong long-term track record.

But if you're looking for bolder, more disruptive stock picks and can handle the volatility, Rule Breakers may be the better choice.

Epic, which includes subscriptions to both Stock Advisor and Rule Breakers (and several other products), is quickly becoming one of the company's most popular products.

Both Stock Advisor and Rule Breakers have delivered strong results over the past 20 years. If you can stick with their recommendations through market ups and downs, it's hard to go wrong with either service.

Still unsure? Start with Stock Advisor. It's built for a wider range of investors, and you can always upgrade to Epic later and get access to Rule Breakers if you want more upside potential.