The Best Stock Investing Newsletters in 2026

Stock investing newsletters are one of the best ways to uncover new investment ideas, get expert analysis, and stay on top of the latest market news.

They're delivered straight to your inbox and typically take just a few minutes to read, making them valuable tools for busy professionals who want to stay informed and make the most of their investments.

Investment newsletters typically fall into one of two categories:

- Market news & updates

- Stock-picking & recommendation services

The list below has options for both.

Personally, I like pairing a good paid newsletter that contains education and portfolio guidance with a free newsletter that keeps me updated on the market. You can see which ones I subscribe to below.

Here's my list of the seven best stock market newsletters in 2026.

Summary of the best investing newsletters

| Our Pick | Type | Frequency | Cost |

| Stock Advisor | Stock-picking | 2x per month | $199/year ($99 intro offer) |

| Alpha Picks | Stock-picking | 2x per month | $499/year ($449 intro offer) |

| Market Bullets | Market news | Daily (M–F) | Free |

| Stock Market Guides | Options picking | 1–3x per day | $69/month |

| Ticker Nerd | Stock-picking | 1–2x per month | $199/year ($99 intro offer) |

| Morning Brew | Market news | Daily | Free |

| Moby | Stock-picking | 3x per week | $199/year ($99 intro offer) |

Keep reading for more information on each of these newsletters.

1. Motley Fool Stock Advisor: Best stock-picking newsletter overall

- Our rating:

- Category: Stock-picking

- Best for: Long-term investors who want to own individual stocks

- Cost: $199/year (introductory offer of $99 for your first year with our link)

Stock Advisor is The Motley Fool's flagship product and is one of the most popular investing newsletters in the world, with more than 500,000 subscribers.

These subscribers are after one thing: high-quality stock picks. And since its inception in 2002, that's exactly what the service has delivered.

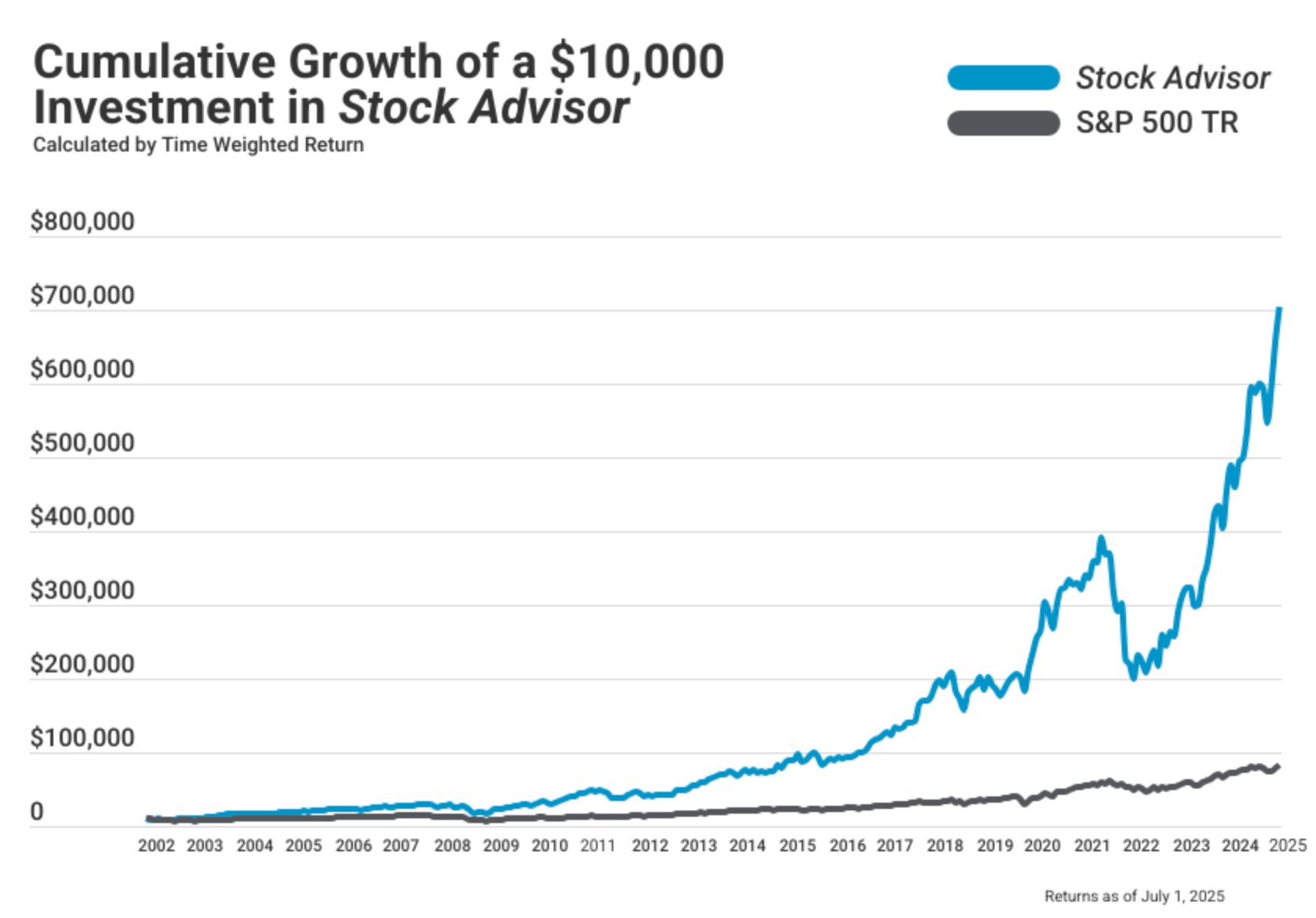

Over the last 23+ years, Stock Advisor has reportedly outperformed the S&P by 5.66x (+1,053% vs +186% as of July 2025), resulting in massive cumulative gains:

While past performance certainly doesn't guarantee future returns, there is no other service on this list with this type of long-term track record. For that reason, if you're looking for a stock-picking newsletter, Stock Advisor is the obvious first choice.

The Motley Fool is run by brothers Tom and David Gardner and their investment teams.

Together, they have an incredible eye for value, which has led to early investments in Amazon, Netflix, Gilead Sciences, Disney, Tesla, Costco, Nvidia, and many other big winners.

The investment strategy is to find high-quality stocks with sound fundamentals and hold them for 5+ years. They spot value, hold through volatility, and give each company the time for their investment thesis to play out.

What to expect:

The service will deliver two new stock picks each month along with a detailed analysis of the company, potential risks, and where they expect the company to go.

You will also gain access to GamePlan, a tool that will help you build your portfolio from scratch based on your preferred investing style (cautious, moderate, or aggressive).

Additionally, you will have access to all previous recommendations, a community of investors, and educational resources.

2. Alpha Picks: Best quant-driven stock investing newsletter

- Our rating:

- Category: Stock-picking

- Best for: Data-driven, medium- and long-term investors

- Cost: $499/year (introductory offer of $449 for your first year with our link)

Alpha Picks is a momentum-based stock-picking newsletter that was launched in July 2022. Unlike Stock Advisor, which selects stocks based on fundamental analysis, Alpha Picks' recommendations are primarily data-driven.

The Alpha Picks team leverages a proprietary algorithm. At the algorithm's core is Seeking Alpha's Quant Ratings, a system that scores stocks based on valuation, growth, profitability, momentum, and analyst estimates.

Based on these components, the Alpha Picks team selects two stocks (filtered out of the thousands of companies covered on the site) that are recommended to subscribers each month.

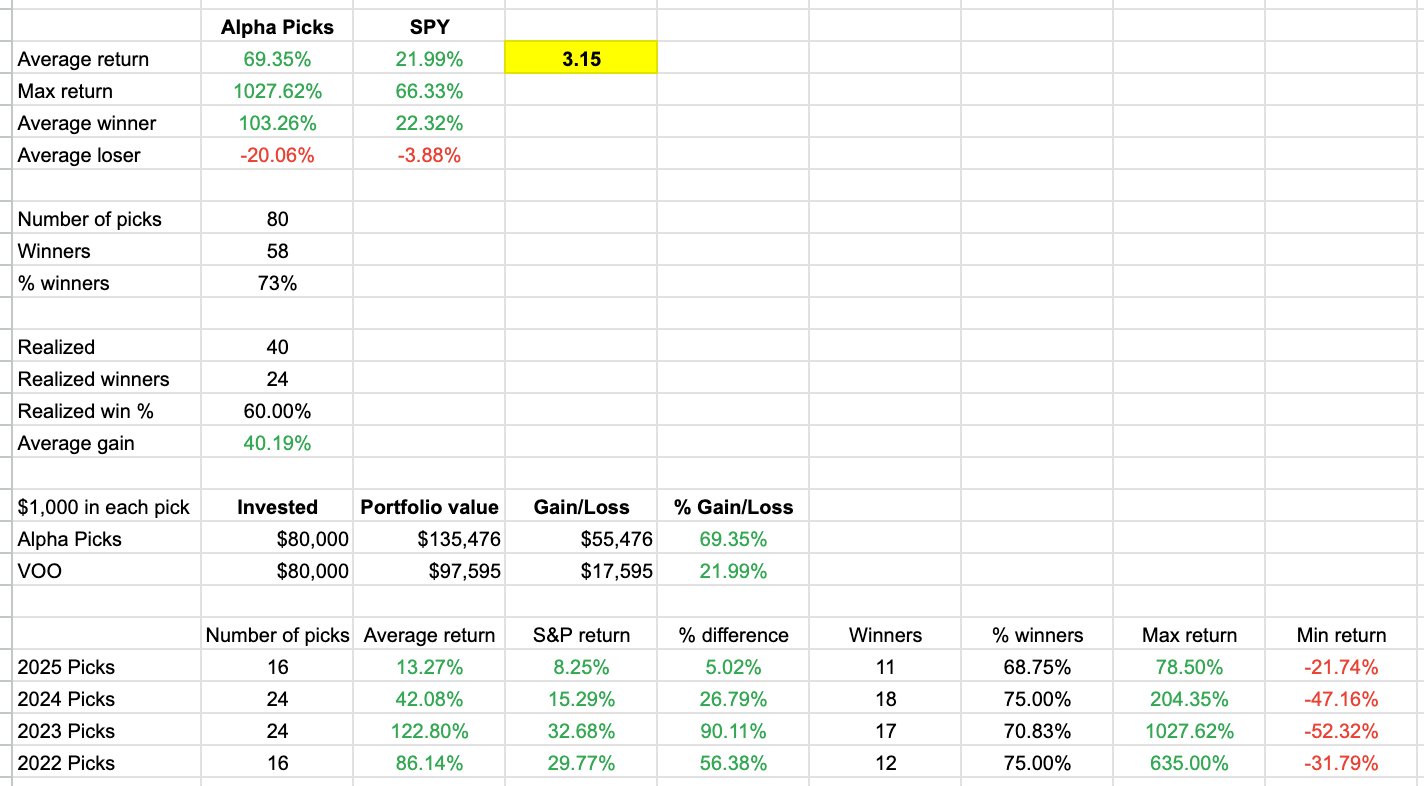

While the service is still relatively new, the performance (as of September 2025) has been excellent:

Source: Alpha Picks Review

The service has an estimated holding period of two years for each stock, a fair amount shorter than Stock Advisor's (5+ years). The strategy is also fairly aggressive, and its picks can be volatile.

For these reasons, beginner investors will likely be more comfortable with a subscription to Stock Advisor.

That said, if the Alpha Picks team can continue picking winners at the same rate it has been thus far, investors willing to stomach the swings may be well-rewarded.

What to expect:

You will receive two stock picks per month along with an explanation of why each stock is being recommended.

You will also get alerts if any stocks in the service should be sold and regular updates on all of the portfolio holdings.

3. Market Bullets: Best free stock market newsletter

- Our rating:

- Category: Stock market news

- Best for: All investors

- Cost: Free

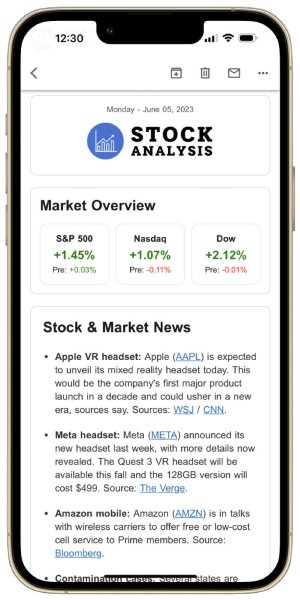

Market Bullets is StockAnalysis.com's free stock market newsletter read by 150,000+ investors every weekday.

Unlike most stock market newsletters (which tend to be unnecessarily long and hard to read), Market Bullets is written in bullet-point format, allowing you to stay on top of the latest financial news in just about two minutes per day.

Allow us to filter out the noise every morning and keep you updated on the most important developments in the stock market and global economies.

All facts, no junk, and no editorializing.

What to expect:

You will receive a free newsletter summarizing every market-moving headline, delivered to your inbox Monday-Friday, about 30 minutes before the market opens.

4. Stock Market Guides: Best options trading newsletter

- Our rating:

- Category: Options picking

- Best for: Options traders who want an alert service

- Cost: $69/month

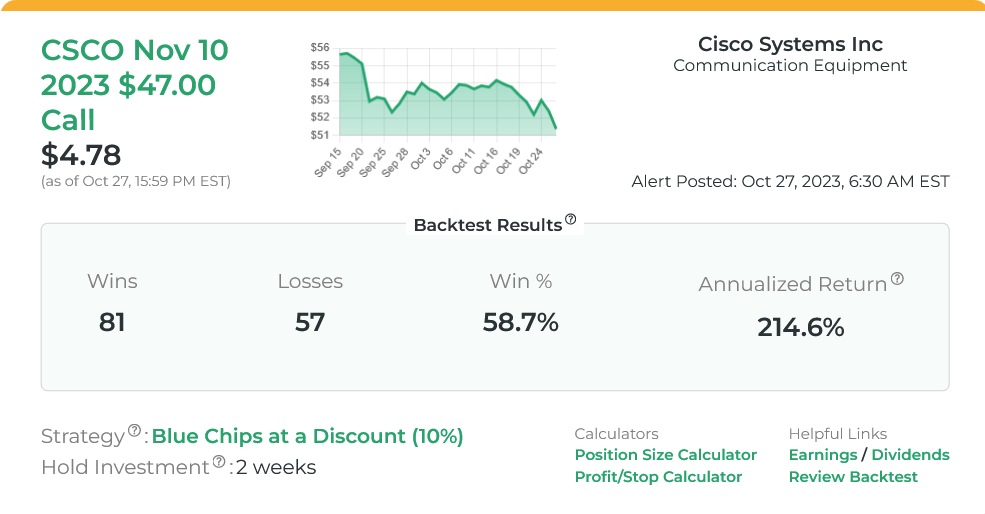

Stock Market Guides is a software that sends trade alerts on short-term stock and options picks. Its option picks are the more popular of its two offerings.

Each alert is easily implementable, even for traders who are fairly new to options trading. You get the strike price, expiration date, profit target, and how long you can expect to hold the trade.

Here's an example trade alert:

Subscribers usually get 1–3 new trade alerts per day — more if you subscribe to both the options and stock services.

Stock Market Guides' underlying software was developed based on almost a decade of backtested data. The team ran through hundreds of trading strategies and identified which ones had the best track record.

They created the software for their own trading, but later decided to release it to the public.

What to expect:

1–3 new trade alerts per day (depending on market conditions) and market analysis from the expert team behind the service.

5. Ticker Nerd: Best newsletter for medium-term stock picks

- Our rating:

- Category: Stock-picking

- Best for: Investors wanting long-term “swing” trades

- Cost: $199/year (introductory offer of $99 for your first year with our link)

Ticker Nerd is another stock-picking newsletter that sends 1–2 picks to subscribers each month.

Ticker Nerd uses software to filter out stocks based on hedge fund trading data, Wall Street analyst ratings, and social media sentiment. Then, based on those results, the team performs fundamental and technical analysis before making recommendations.

A key difference between Ticker Nerd and Stock Advisor is that Ticker Nerd's analysis gauges multiple factors having to do with momentum and sentiment.

While the company is relatively new and there's not much to report regarding its track record, its 30-day money-back guarantee gives you time to evaluate it based on its merits once you're inside.

What to expect:

You'll receive monthly reports with 1–2 stock recommendations and accompanying analysis (which I've found to be quite a bit more thorough than some other newsletters).

6. Morning Brew: Entertaining stock market newsletter

- Our rating:

- Category: Stock market and business news

- Best for: All investors (and business people)

- Cost: Free

Morning Brew is a 7x per week newsletter that covers financial markets (stock, bond, and crypto) and business news in a way that is both insightful and entertaining.

In its own words, Morning Brew is "business news that doesn't feel like a chore."

It takes about five minutes to reach each issue, which is a bit longer than it takes to read Market Bullets, but Morning Brew covers a more diverse set of business-related topics and reports a few stories in more detail.

The team's entertaining writing style, insightful analysis, and fact-filled reporting are why it has racked up 4,000,000+ subscribers since 2014.

What to expect:

You will receive the business-focused newsletter 7x per week and can expect some news, analysis, and a few laughs from each issue.

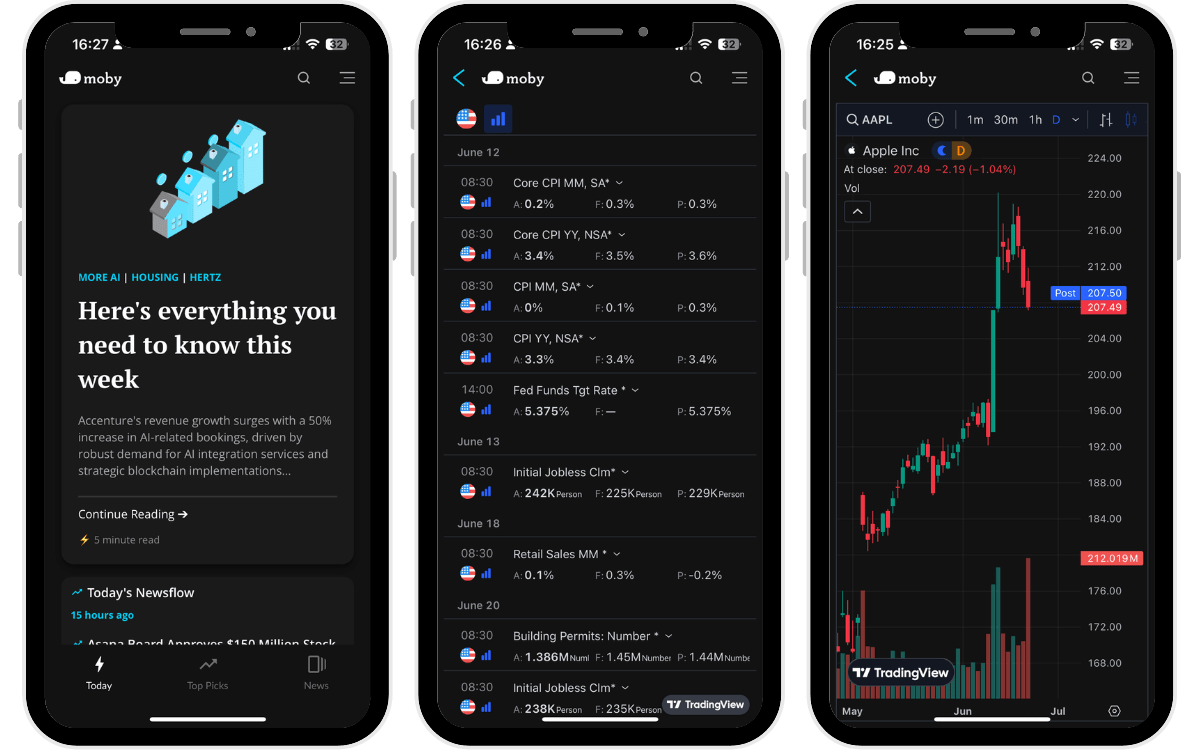

7. Moby: Best newsletter for many new stock picks

- Our rating:

- Category: Stock-picking and stock market news

- Best for: Active, medium- to long-term investors

- Cost: $199/year ($99 for new members through this link)

Moby is a market and investment research company for stock and crypto investors. The service provides you with three new stock picks per week.

Moby isn't technically an investing newsletter, as all of its investment analysis, recommendations, and market commentary are located in its mobile app.

Every research report, article, and stock recommendation is produced by the Moby team, a group of former analysts from firms such as Goldman Sachs and Morgan Stanley.

While the team has a complex process for analyzing stocks, its reports are jargon-free and easily understandable for investors of any level.

Additionally, each report is produced in written, video, and audio formats so you can consume them in any way that you'd like.

Altogether, Moby provides expert analysis in easy-to-understand formats for investors of every level.

What to expect:

You'll receive three new stock recommendations per week. You'll also gain access to Moby's other premium features, such as its Model Portfolios, Stock Screener, Political Trades tracker, and more.

What's an investment newsletter?

Investment newsletters are email-based services that provide financial education, investment recommendations, financial news, or some combination of all three.

They are written to save you time, keep you informed, and/or help you invest.

Most news-based newsletters are free, whereas the stock-picking services are typically paid.

Are stock newsletters worth it?

It depends on which newsletters you subscribe to, but I find them extremely valuable.

For instance, instead of sifting through financial newspapers and trying to figure out what information is important, Market Bullets does this work for me and delivers summaries in bullet-point format straight to my inbox each morning, completely free.

When looking for new investment opportunities, it's great to have multiple subscriptions offering recommendations of stocks to buy.

While I always do my own research before buying anything, I find it extremely valuable to have a team of analysts doing some initial legwork for me and giving me their top 1–2 stocks each month.

I've found that some stock-picking services easily pay for themselves, as stocks are one of the best ways to get 10% returns on investments.

How we chose the best investment newsletters

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good is the service? What is the newsletter's performance track record (for stock-picking services)?

- Price: Overall price, value for money, and any hidden fees.

- Usability: What the interface looks like, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of information, as well as company and brand reputation.

- Audience: Who the newsletter is for, if it's the best option available, and whether it serves the needs of its intended audience.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

Investment newsletters are my favorite way to find new investment opportunities and stay updated on the latest news moving the markets.

The best newsletters are fast and easy to read, and extremely valuable. Regardless of which one you choose, you should expect it to pay for itself (and then some).

Personally, I like pairing an investing or stock-picking newsletter (like Stock Advisor or Alpha Picks) with a free newsletter that keeps me updated on the market (such as Market Bullets or Morning Brew).*

*I subscribe to all four of these newsletters, but that might be overkill.

Don't be afraid to sign up for multiple newsletters listed above and to utilize their free trial periods. That way, you'll know exactly what to expect from each service and can make an informed decision.

.png)