Stock Market Performance Under Republicans vs Democrats

While you may have a strong preference for one political party or another for any number of reasons, your investment portfolio doesn't need to be one of them.

The reality is that the stock market really doesn't care if there's a Republican or Democrat in the White House.

Here are a few charts that show the irrelevance of political administration on the stock market.

Stock market performance by political party

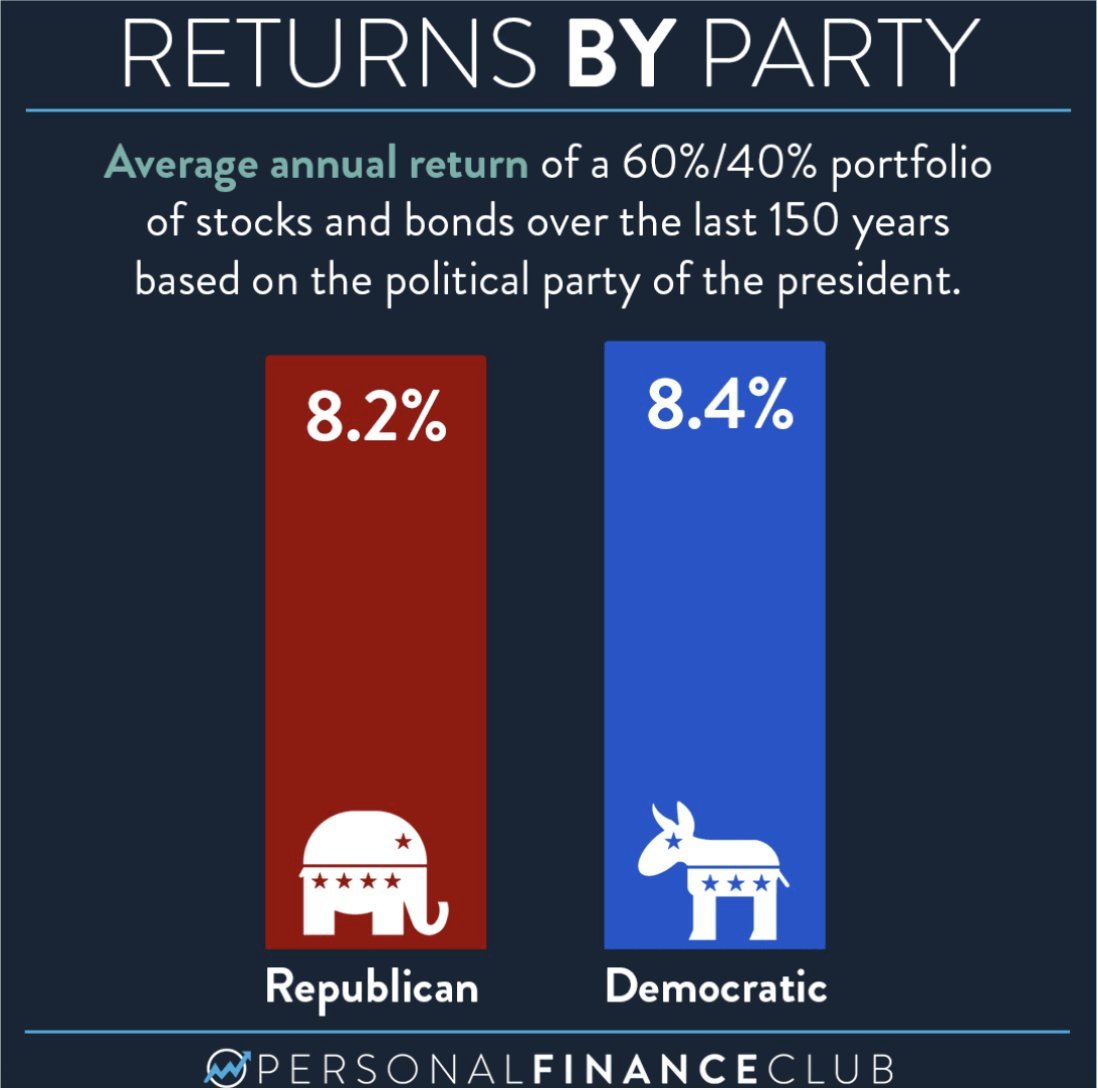

From 1871–2020, a 60/40 stock-bond portfolio performed nearly identically when Republicans or Democrats were in office:

Source: PersonalFinanceClub

This chart alone should quash any ideas you may have about only investing when your political party of choice is president.

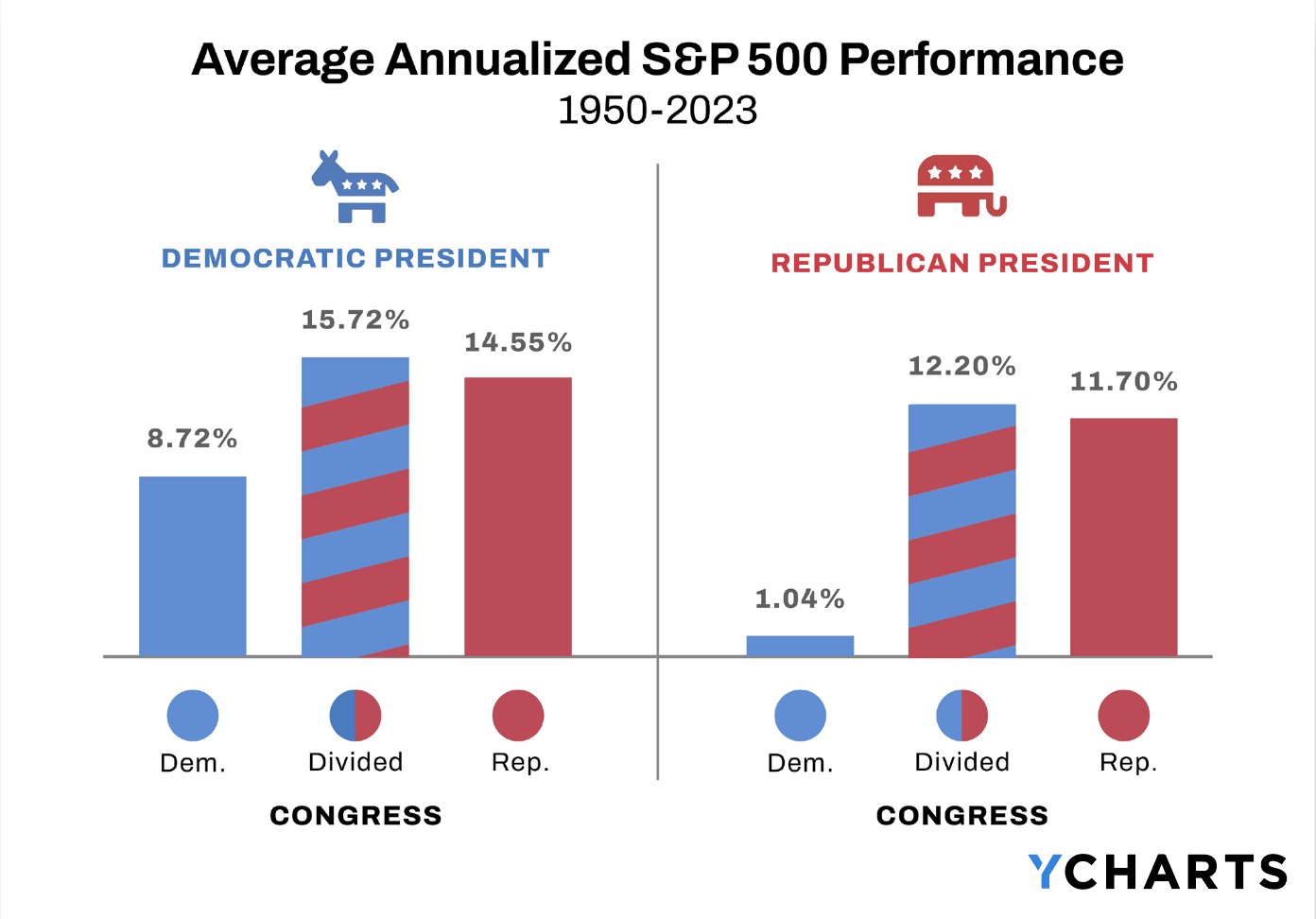

But what about Congress? Does which party controls the Senate and House of Representatives change stock market returns?

Historically, the highest average annual returns have occurred during a divided Congress (where one party controls the Senate and the other party controls the House of Representatives).

Since 1950, a mix of a divided Congress and a Democratic president has resulted in the highest average annual returns:

Source: YCharts

While these results may indicate a slight preference for Democratic presidencies, the differences are negligible.

Furthermore, given that every combination has generated positive returns, there's no reason to change your investment strategy based on which party controls which branch of the government. You should stay invested regardless.

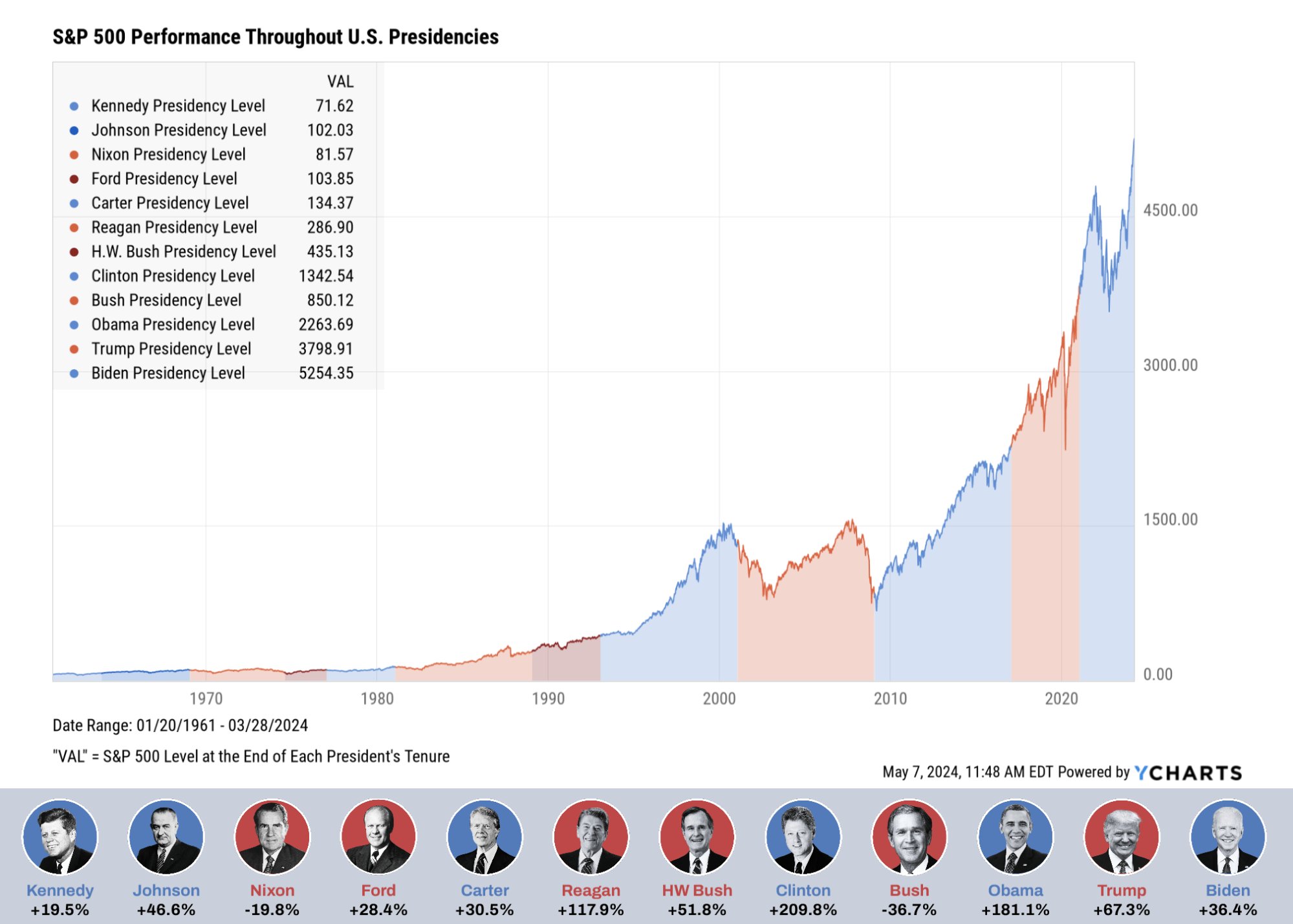

Stock market performance by president

As shown in the first chart above, the stock market has performed well irrespective of who's been in office.

Here's a look at the S&P's performance by president:

Source: YCharts

No matter which side of the aisle you typically stand on, you'll have a hard time drawing any significant partisan conclusions from this chart. In general, the market continued its upward trajectory, seemingly indifferent to who's in office.

This begs the question: how much does presidential policy actually affect the stock market?

The impact of policy on the stock market

The exact amount of impact any administration's policy has on the stock market is up for debate.

However, it's safe to say that policy has very limited control over unanticipated and uncontrollable events, which are often the biggest drivers of stock market performance.

For instance, President Bush became president shortly after the dot-com bubble burst and months before 9/11, both of which resulted in significant sell-offs, and both of which were not matters of policy.

While the Great Financial Crisis happened during his presidency, it's hard to know how much blame (if any) to assign to him. The GFC would likely have happened regardless of who was in office.

Meanwhile, President Obama's returns excelled because of the GFC, as he took office just before the market's bottom in 2010. Again, it's hard to say if this was just good timing or a result of policy decisions he made (like his spending package).

All this to say, while an administration's policy probably plays some role, it likely doesn't change how the stock market performs in the short run all that much.

In addition to a president's policy, there are many other factors that are constantly being weighed by hundreds of millions of market participants all over the world.

If the market seems indifferent to which political party is in office, it's probably because — for the most part — it is.

Elections and policy changes often lead to short-term fluctuations, both higher and lower, as investors respond to the news. For instance, the S&P was up ~2% on November 6, 2024, the day after Donald Trump won the election.

What about jobs and the economy?

An administration's policy may not have a 1:1 effect on the stock market, but certain policies do have a direct impact on the economy, which, in turn, can affect the stock market, especially in the long run.

Tax rates, social programs, tariffs, immigration policy, healthcare reform, and infrastructure investments are all highly debated policy issues that will have major effects on the economy following the 2024 election.

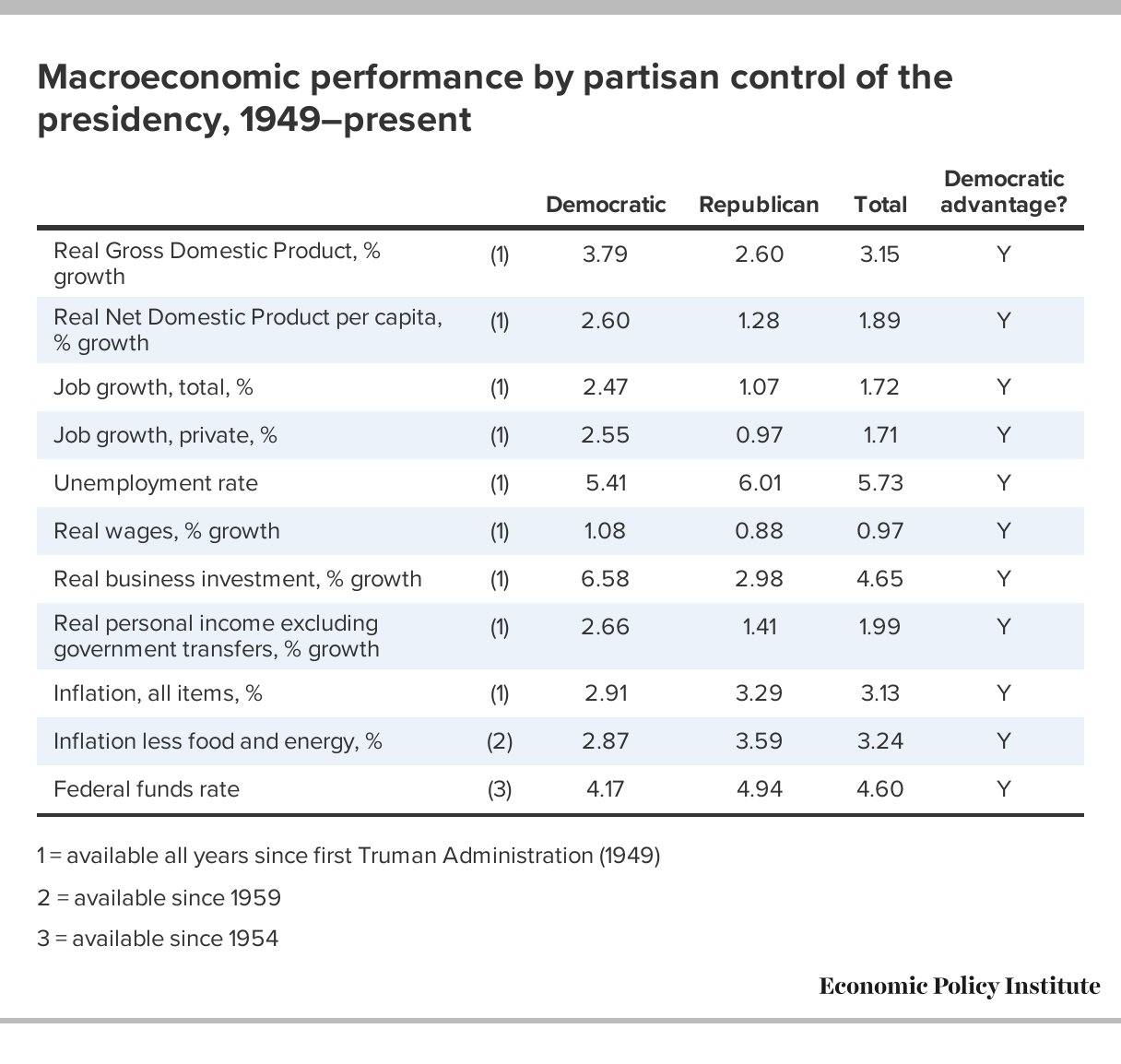

Job creation, employment, and GDP have been higher on average under Democratic administrations.

Here's a table of the differences:

Source: EPI Action

The data is pretty clear: many primary measures of economic growth have been better when the president was a Democrat.

Still, the matching of economic policy and real-time economic performance is far from perfect.

The president does not have total control over the economy and, given the size and complexity of the U.S. and global economies, it's difficult to clearly assign causality to one set of policies versus another.

There's also the problem of lag.

When a president passes a law, it may take years before the effects of that law trickle down through the economy, at which point the next candidate may already be in office (and be assigned the responsibility for its impact, good or bad).

Additionally, it could be argued that the sample size is too small. There have only been 14 presidents — 7 Democrats and 7 Republicans — since 1949, which may not be enough to produce statistically significant results.

However, one could also argue that the large role of chance should cut uniformly across presidential administrations.

In other words, the above table shouldn't be explained by saying Republicans have had all the bad luck and Democrats have had all the good luck.

In which case, the Democratic advantage in economic performance is hard to ignore.

You may be interested in my article on safe withdrawal rates.

The final word

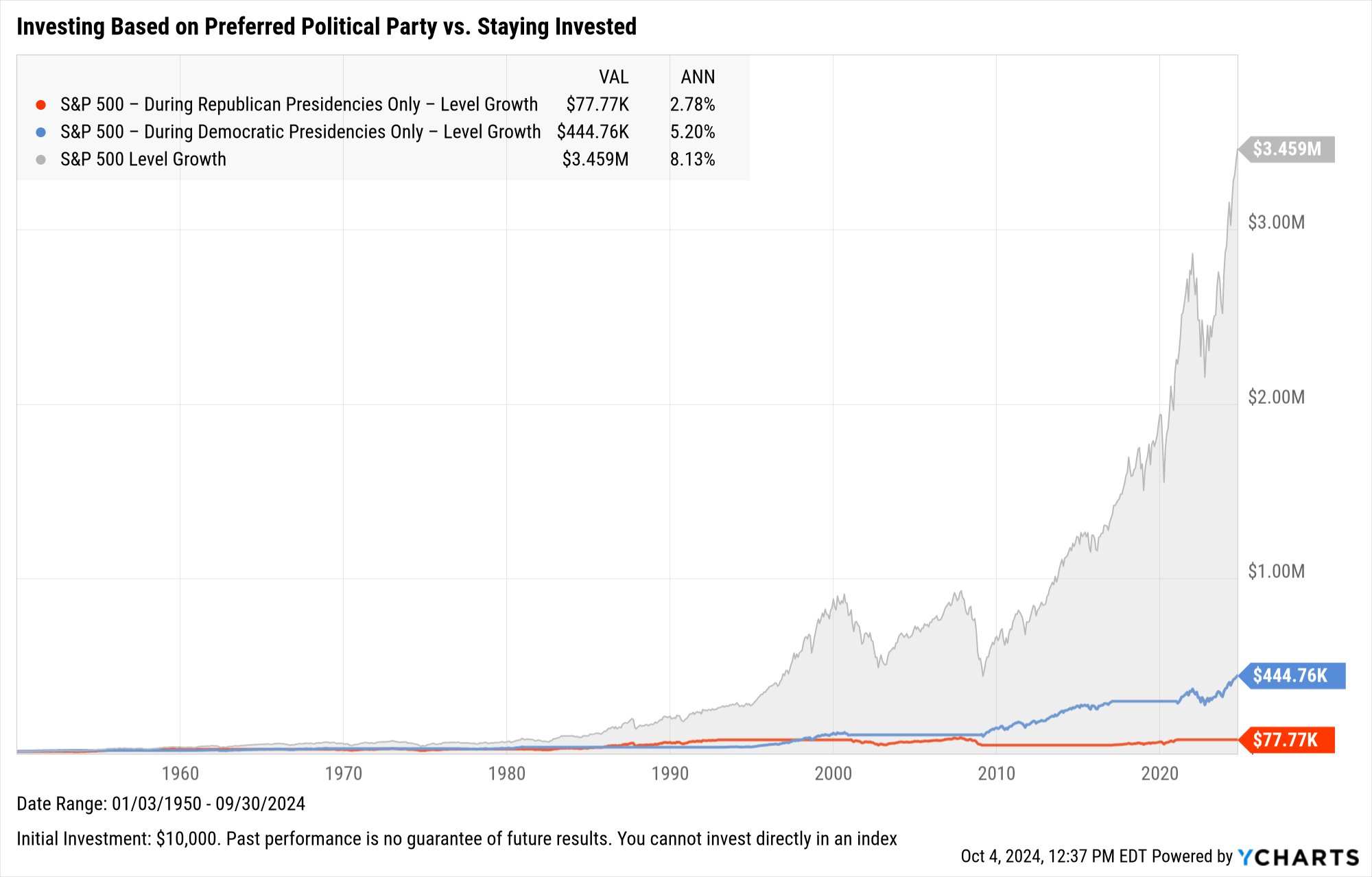

You may be tempted to only be invested or make investment decisions depending on what political party is in the Oval Office.

But, historically speaking, you would have generated substantially higher returns by staying in the market regardless of who was in office.

Source: YCharts

The market doesn't care if there's a Republican or Democrat in the White House — it has performed well under both types of political administrations.

Therefore, as investors, we shouldn't allow our personal politics to interrupt our financial plans.

A (nonpartisan) buy-and-hold strategy wins out.