Stock Market Guides Review

Stocks tend to trade in patterns — but not all stocks trade in the same patterns.

For some, moving averages or range-based indicators work best. For others, certain chart or candlestick patterns are better for predicting where the stock will go next.

Your goal as a trader is to match the right strategy to the right stock. Once you do, you'll be better able to forecast the stock's next move and increase your win percentage.

That becomes your edge.

And that's what Stock Market Guides was built for — to give you an edge in your trading.

Here's everything you need to know about how Stock Market Guides works, how the technology was built, how profitable its trades are, and what you can expect as a customer.

Stock Market Guides review summary

- Overall rating:

- Description: Web-based software for finding trade setups with backtested edges

- Best for: Day, swing, and options traders

- Cost: $29/month to $95/month

Stock Market Guides is an underrated tool that may help traders increase their win percentages.

Its software shows the historical performance of every trade setup it finds, a feature you won't find anywhere else.*

*There are many other tools for finding trade ideas, but none that are so purely based on math and backtests.

You can use this information to avoid weak setups, stay out of low-probability trades, and ensure that every trade you do take has a backtested edge.

Users can receive trade alerts or access the underlying scanner itself to find their own trade ideas.

It doesn't do all the work for you, and isn't a guaranteed path to profits, but it might help you become a more consistently profitable trader.

What is Stock Market Guides?

Stock Market Guides is an algorithmic trading software for active traders. Both beginner and advanced traders are using it to improve their trading.

To build the software, the SMG team back-tested millions of trades to find which chart patterns, candlestick patterns, and indicator-based strategies brought the highest returns on certain stocks.

After determining which combinations (of stocks and strategies) led to the highest win percentages, they created a scanner to only look for those specific setups.

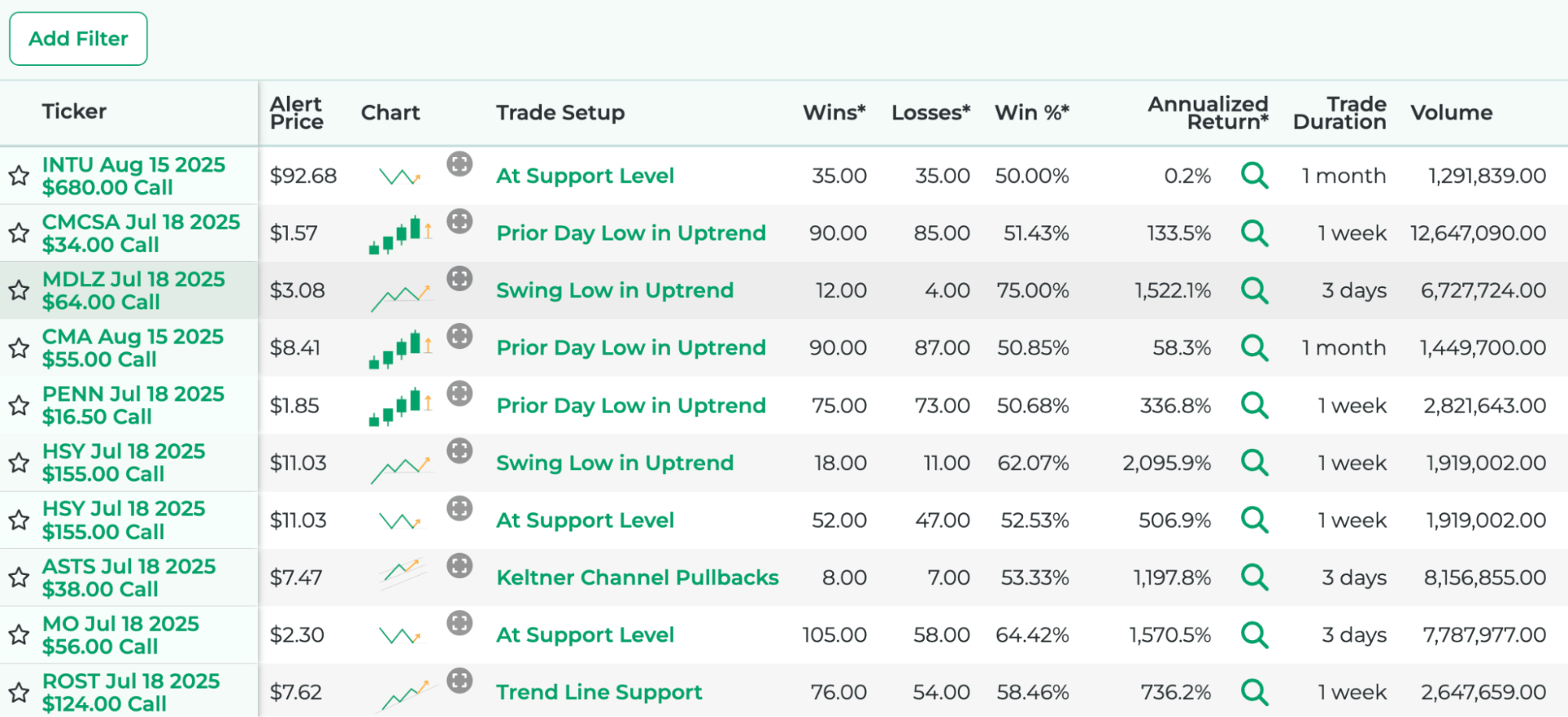

With Stock Market Guides, you can access the scanner and see these setups in real time. Here's what that looks like:

Trade alerts come by text or email, but SMG is primarily web-based and best accessed on a computer. The user interface is simple, modern, and user-friendly.

This can be a great first step in your trading process — getting a full list of trade setups that have outperformed historically. From there, you can look through each of the trades and decide which ones you want to take.

For traders who'd rather have all the work done for them, SMG also sends trade alerts.

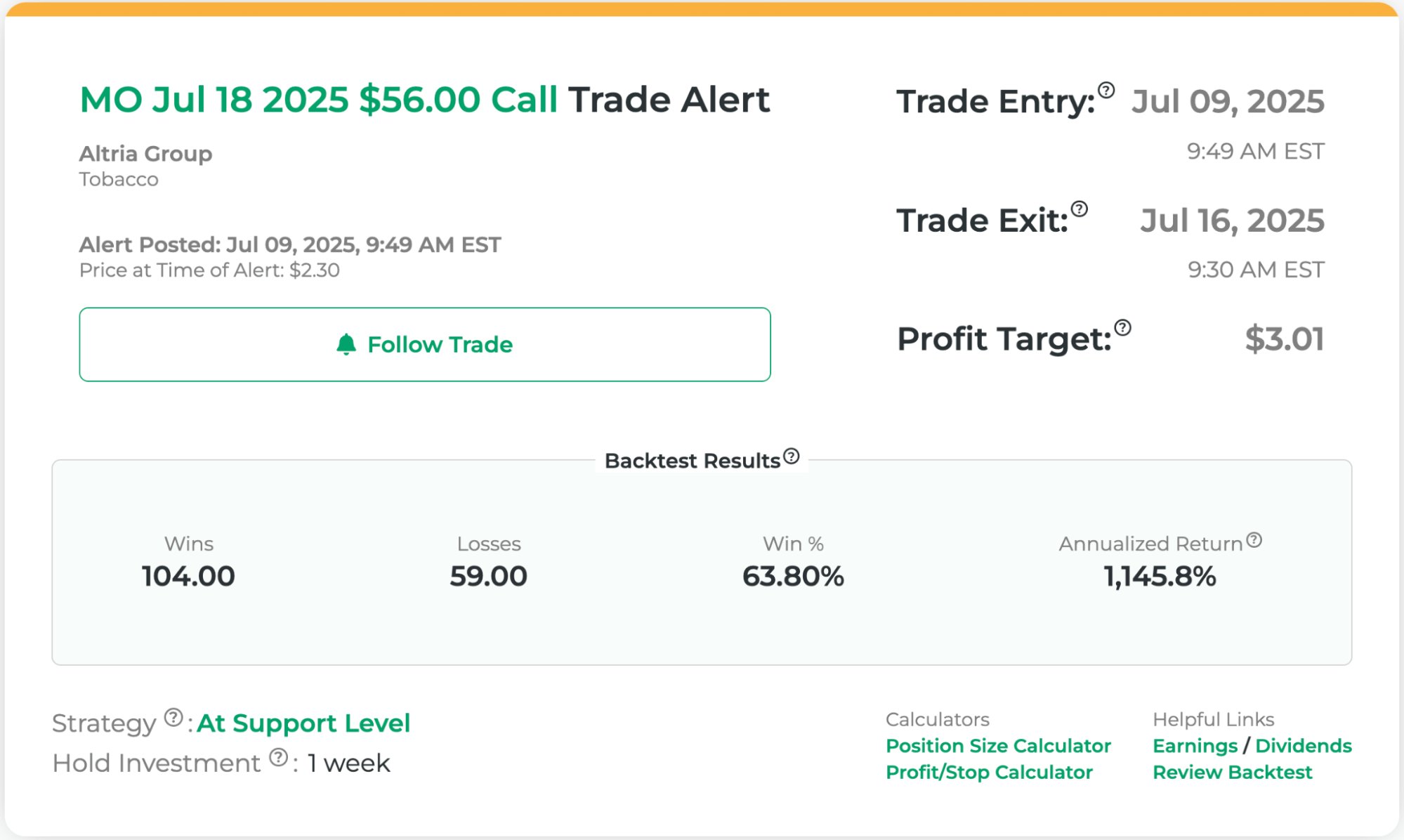

Its trade alerts — which include stock picks, swing trades, and options picks — are the exact trades the SMG team is taking. Here's an example trade alert:

Each trade alert comes with an entry and exit date, a profit target, and information on how that setup has performed historically. You can get alerts via text or email.

Subscribing to these services will also give you access to the SMG team's daily commentary, video tutorials, and more.

Services offered by Stock Market Guides

Stock Market Guides breaks its service down by type of trader:

- Long-term investor

- Swing trader

- Option trader

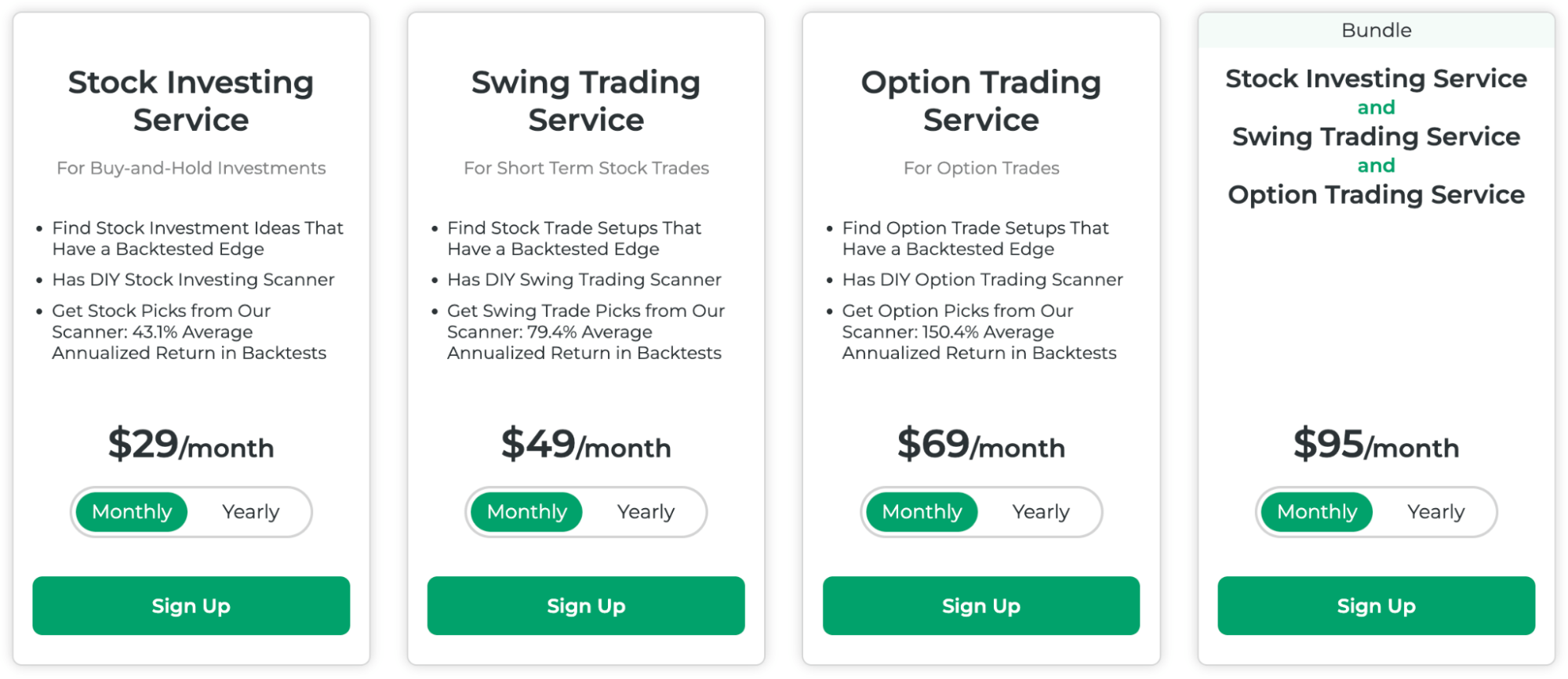

Here's a look at its product stack:

Each product — Stock Investing, Swing Trading, Option Trading — comes with both the trade alerts and the scanner for that product.

Many newer traders prefer to use the trade alerts to get their trade ideas, while more advanced traders (who want more ideas to sort through each morning) tend to use the scanner.

The scanner comes with a number of filtering options — like chart pattern, trade setup, trade duration, win percentage, and annualized ROI — so you can narrow down the results to the types of trades you're most interested in.

Zooming back out, here's a breakdown of the main features of each product, according to SMG:

| Stock Investing | Swing Trading | Option Trading | |

| Average trade length | 12–18 months | 3–7 days | 5–7 days |

| Backtested AAR* | 43.1% | 79.4% | 150.4% |

| Number of picks | Up to 2 per week | Up to 10 per week | Up to 10 per week |

| Trade alerts | ✅ | ✅ | ✅ |

*AAR is short for average annual returns.

If you'd like access to multiple products' trade alerts or complete access to the scanner, you can purchase the Bundle, which combines all of the offerings.

How much does Stock Market Guides cost?

As mentioned above, Stock Market Guides has four services, each with its own pricing.

You can choose between monthly and annual pricing for each service.

Here's a breakdown:

| Stock Investing | Swing Trading | Option Trading | Bundle | |

| Monthly billing | $29/month | $49/month | $69/month | $95/month |

| Annual billing | $197/year | $397/year | $575/year | $675/year |

Customers can save ~30–40% by choosing to pay annually.

The Swing Trading, Option Trading, and Bundle are the most popular services.

Transparency commitment

One thing that requires special note is the SMG team's commitment to transparency.

The result of every trade, win or lose, is automatically posted to the website. Both gains and losses are automatically calculated.

Additionally, the SMG team is not just selling a system — they're using it themselves, taking trades right alongside their members and sharing daily commentary.

On top of that, I've found their team to be approachable, responsive, and genuinely invested in helping each member become a better trader.

Whether you have a question about a trade alert or using the scanner, or just have a general question about trading, they're there to help.

They're also regularly releasing new educational material on how to best use the service and how to improve your trading.

Are there any downsides?

Stock Market Guides can give you a backtested edge, but it does have limitations.

For starters, just because you have a backtested edge, that doesn't mean you'll win every trade.

SMG's system is based on the results of hundreds of thousands of backtests over many years of trading, so you'll need to plan on taking many of its trades to realize the benefits of its mathematical edge.

Plus, while the scanner can identify higher-probability setups, there will still be losses — it will be up to you to manage risk, stick to your plan, and handle the emotional side of trading.

Final verdict

Stock Market Guides was built to give active traders an edge in their trading by using historical statistics to determine the highest-probability trade setups.

I've found it to be an excellent starting point for finding interesting trade ideas. Instead of scanning for setups myself, I can look at what trades the SMG scanner is seeing, what profit targets and stop loss points it recommends, and plot out the trades.

It's not a guaranteed path to profits, and it doesn't claim to be.

But it may give you an edge in the markets and help you become a more consistently profitable trader.