TradingView Review

Trading is one of the most competitive industries in the world.

The rewards can be enormous for those with the right mix of skill, discipline, and consistency. But the competition is fierce, and you need every edge you can get.

That's why TradingView has become the go-to charting platform for over 100 million traders (including me). It combines powerful technical analysis with a clean, intuitive design that's fast and easy to use.

While I've found TradingView to be well worth the money, there are some downsides.

Here's everything you need to know about its core features, pricing, and which plan (if any) is right for you.

TradingView Review Summary

- Overall rating:

- Best for: Day and swing traders

- Platforms: Web, Desktop (Mac, Windows, Linux), Mobile (iOS, Android)

- Recommended plan: Essential ($16.95/month) or Plus ($33.95/month)

TradingView is fast, powerful, reliable, and extremely easy to use. In my experience, it's the best charting platform on the market.

That said, beginners might find the platform a bit overwhelming at first. TradingView packs in so much functionality that it takes time to learn, and there's no built-in curriculum on how to use it.

The free plan is also limited. It includes ads and restricts key features like multiple chart layouts, custom time intervals, and indicator slots.

You can test any paid plan with a 30-day free trial, but if you're going to use TradingView long-term, you'll almost certainly end up paying for a subscription.

What is TradingView?

TradingView was founded in 2011 by Constantin Ivanov (CTO), Denis Globa (CEO), and Stan Bokov (COO). They previously created MultiCharts, a desktop software for professional traders.

After having success with MultiCharts, they decided to create a web-based charting platform accessible to any retail trader with an internet connection.

And so, TradingView was born.

TradingView is a technical analysis charting platform built for active traders. The platform is available in web-based, desktop, and mobile versions.

Charting software is used by traders to predict and profit from short-term price movements. There are thousands of trading strategies, and each strategy has its own set of technical indicators it deploys.

TradingView can handle them all.

You can chart stocks, ETFs, futures, forex, cryptocurrency, and more. In total, TradingView covers more than 3.5 million instruments across 150+ global exchanges.

But here's where TradingView excels: it marries unlimited flexibility and customization with unrivaled functionality and ease of use.

I'm not the only one who loves TradingView — the platform has a 4.9-star rating from over one million user reviews.

Key features

Before jumping into TradingView's most popular features, I want to quickly cover its user interface.

TradingView easily has the cleanest, most intuitive interface of any trading platform I've used. If you're an experienced trader, you'll get comfortable with its layout in just a few minutes.

That said, beginners might find the sheer number of tools a little overwhelming at first — especially within the charting workspace. Once you understand where everything lives, though, it quickly becomes second nature.

Now, let's take a look at some of TradingView's most popular features and what makes them stand out.

1. Supercharts

TradingView's charting is unparalleled in its versatility and functionality, which is why it has amassed 100 million users.

Here are some highlights:

- 400+ built-in indicators

- 110,000+ community-built indicators

- 110+ drawing tools

- 20+ chart types

- 20+ timeframes

You can draw anything on any chart, and do it on more than 3.5 million securities on exchanges spanning 50+ countries around the world.

While all of this functionality may seem like it would be overwhelming, TradingView's design makes it feel like you have both unlimited possibilities and complete control.

Many of these features are available on the free plan, but you'll quickly bump into a paywall when you start using a combination of indicators or certain drawing tools and chart types.

2. Bar Replay

Other than the charts, Bar Replay is my favorite feature on TradingView.

Bar Reply allows you to rewind any chart to any point in time and replay the market as if it were happening live. You can watch each candle form, pause, or fast-forward through the slow parts.

It's just like paper trading, except you're using historical charts instead of live ones. But because you can fast-forward and rewind, you can skip hours of waiting for setups to appear and instantly see how each trade would've played out.

With Bar Replay, you can run through thousands of practice trades in a fraction of the time it takes when trading live. It's one of the fastest ways to sharpen your skills or refine your strategies. Plus, it helps you become more familiar with the platform.

My trading dramatically improved after I started using TradingView's Bar Replay mode consistently, and it's my most recommended feature for new traders or those looking to hone their skills.

This feature alone has paid for my TradingView Essential subscription 100x over.

For these reasons, Bar Replay is why I ranked TradingView as the #1 platform on my list of the best stock market simulators.

3. Screeners & Heatmaps

After the charts, TradingView's next most popular feature is its screeners.

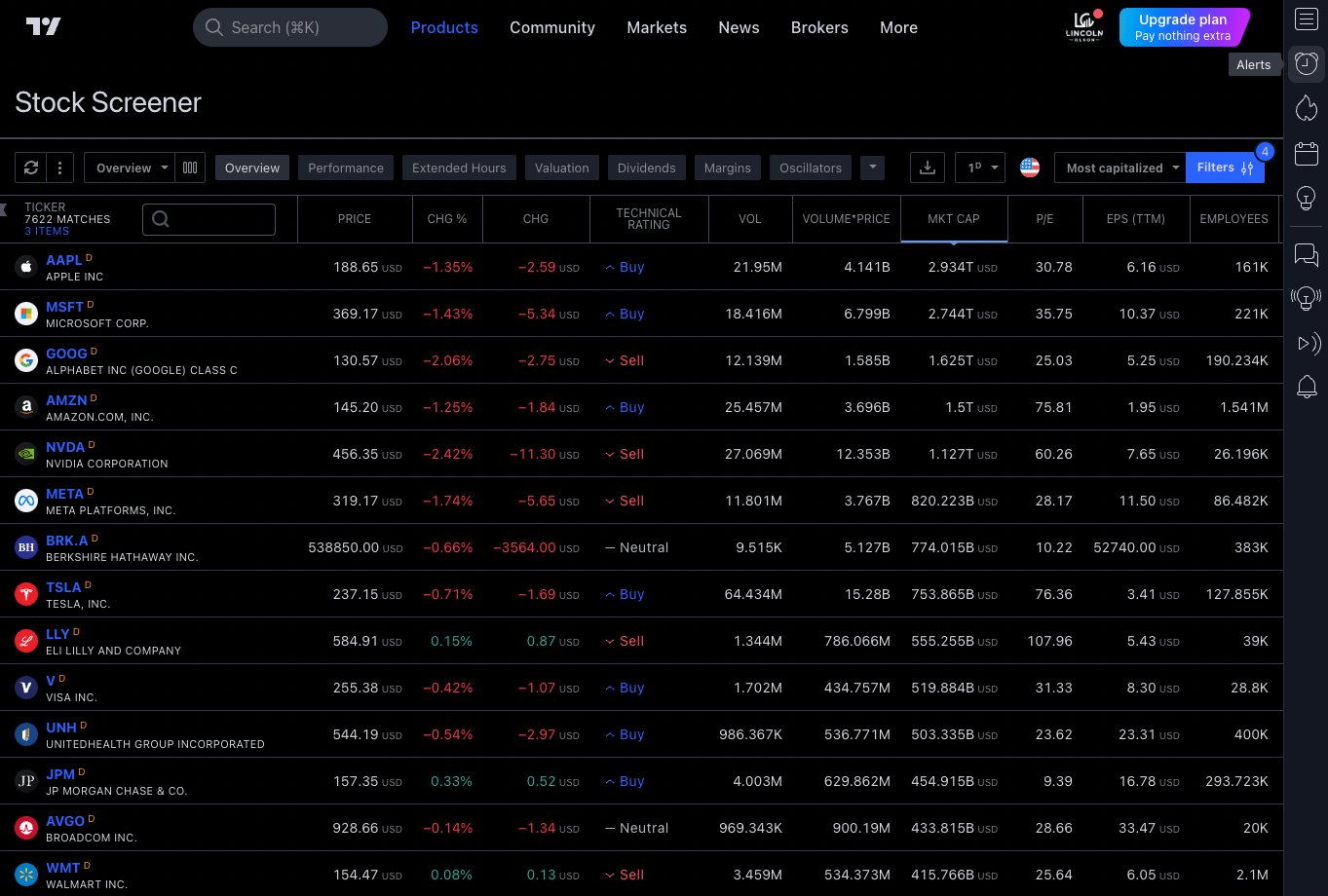

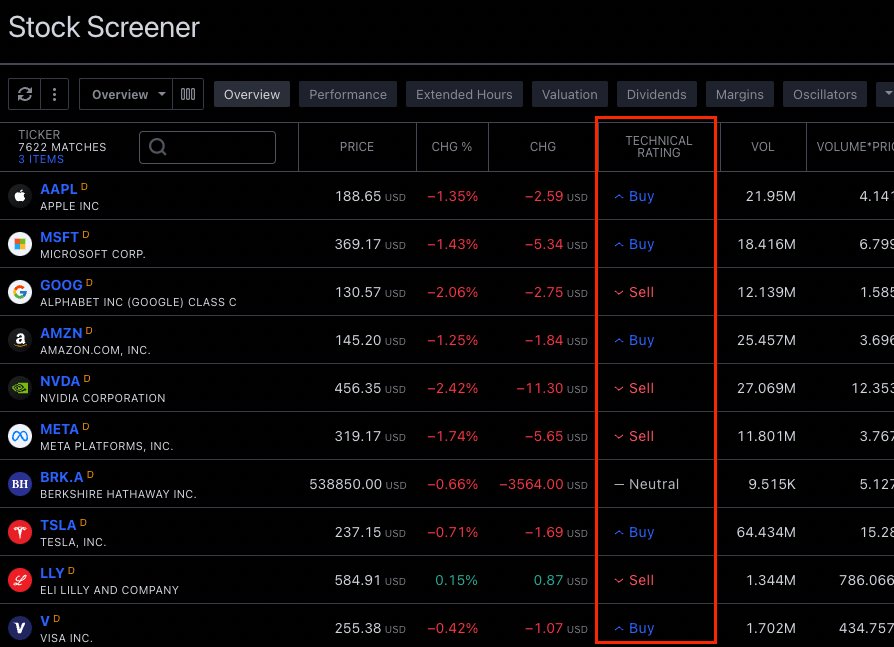

Day traders use screeners to filter thousands of securities, looking for trade ideas. There are six main screeners that cover all the major asset classes: Stock, Stock 2.0, Forex, Crypto Pairs, Crypto Coins, and ETFs.

You can filter by any quantitative data point or indicator. For example, if you wanted to find large-cap tech stocks to buy, you could filter by market cap, industry, and oversold RSI.

TradingView also provides a Technical Rating (ranging from Strong Sell to Strong Buy), which is determined by calculating the average of 13 individual indicators.

While it's a cool feature, I wouldn't put too much weight into it — at most, I'd use it as a measurement for directional bias.

One of my favorite ways to quickly get a pulse on how the markets are moving on any given day is with Heatmaps.

You can easily see how sectors are performing and how the biggest stocks in each sector are moving. I usually check this page an hour after the market opens to get a feel for investor sentiment.

Note: Since publishing this article, we (at StockAnalysis.com) have released our own S&P 500 heatmap.

4. Alerts

Most traders follow a handful of securities that they like to trade, which allows them to always be trading the best setups.

However, tracking multiple securities at once can be draining — that's where alerts come in.

Instead of constantly switching between assets and charts, most traders will set alerts at key price levels that they want to keep an eye on. Once an alert is hit, you can toggle to the security and wait for an entry/exit.

By setting more alerts, I don't have to watch my screens all day.

I can set an alert to notify me when an important level is hit and do the rest of my work without needing to monitor my charts.

5. Community

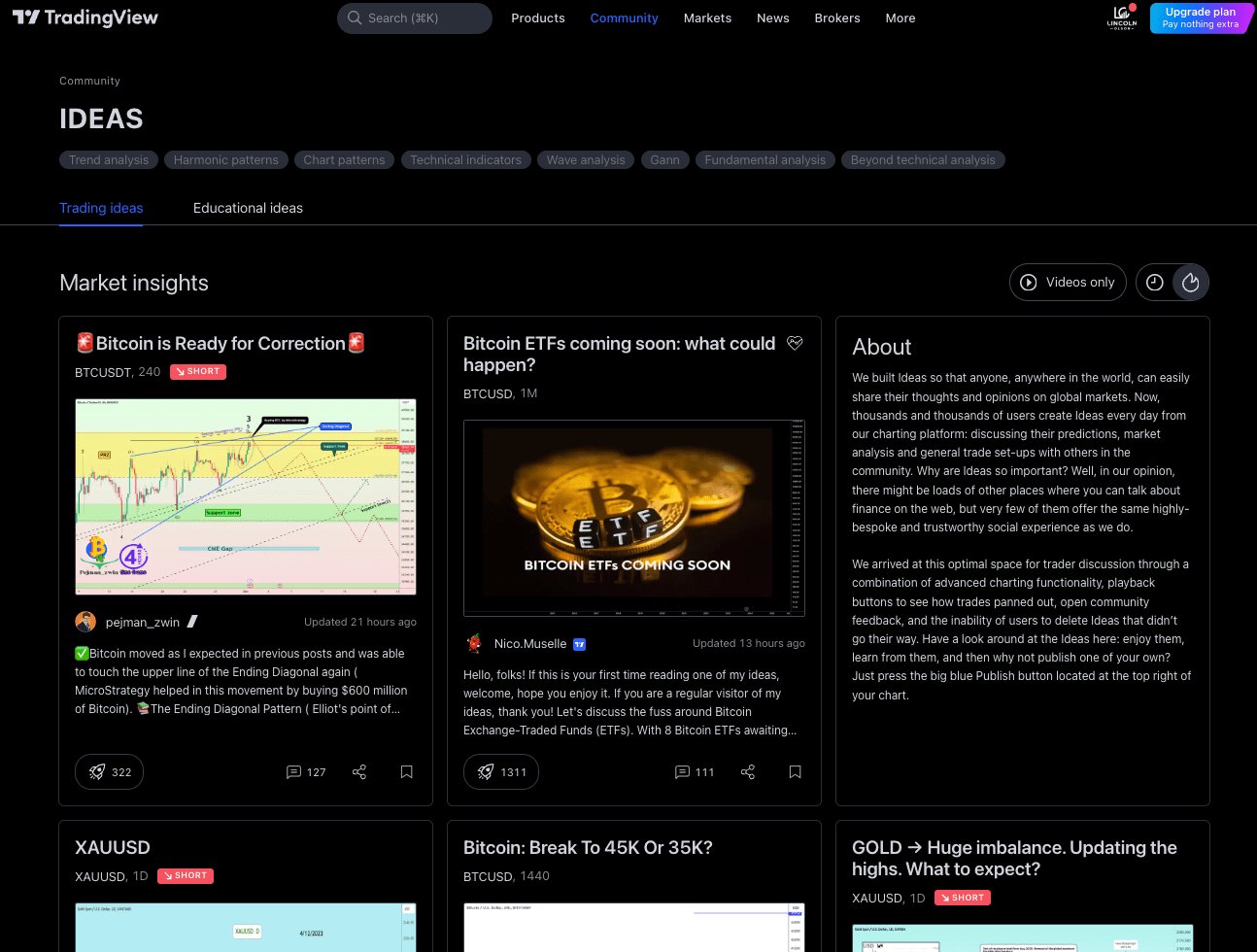

TradingView also has several community features, including trade ideas, educational content, scripts, and live streams.

Learning from more experienced traders is one of the fastest ways to level up your trading skills. In the community section, I've learned about risk management techniques, trading styles, how to read the macro environment, and more.

Plus, these resources opened my eyes to the importance of discipline, meditation, sleep habits, and other soft skills that affect your trading.

6. Broker connections

TradingView integrates with 100+ of the most popular brokerages, allowing you to place and execute trades directly from the TradingView platform instead of needing to switch between multiple apps or tabs.

You can connect a brokerage account by opening the “Trading Panel” below any chart, choosing your broker, and authorizing the connection.

After that, you can execute trades, manage positions, and monitor account data directly within TradingView's interface.

For traders who prefer a unified workflow — charting, analyzing, and trading all in one place — this feature is a major convenience.

7. Other features

Here are some other features you'll find on TradingView:

- Fundamental stock data

- Options modelling

- Custom scripting

- Chart exports

- Paper trading

- Global news

- Backtesting

- And more

Which TradingView plan is best?

TradingView has five plans: Basic (free), Essential, Plus, Premium, and Ultimate.

As mentioned above, there are many features on TradingView, and upgrading to higher plans will unlock additional features.

I've listed the most important features in the table below.

| Basic | Essential | Plus | Premium | Ultimate | |

| Cost (monthly)* | $0 | $14.95 | $33.95 | $67.95 | $239.95 |

| Charts per tab | 1 | 2 | 4 | 8 | 16 |

| Indicators per chart | 2 | 5 | 10 | 25 | 50 |

| Historical bars | 5K | 10K | 10K | 20K | 40K |

| Price alerts | 3 | 20 | 100 | 400 | 1,000 |

| Ads | Yes | No | No | No | No |

| Bar Replay | ❌ | ✅ | ✅ | ✅ | ✅ |

| Watchlists | 1 | Unlimited | Unlimited | Unlimited | Unlimited |

| Links | Free trial | Free trial | Free trial | Free trial |

*Annual plans for each subscription level are available for 16% off, equivalent to 60 days free.

To see the complete list of differences between plans, visit TradingView's pricing page.

How to choose the right plan for you

For the vast majority of traders, either Essential or Plus will be the best plan.

When choosing between Essential and Plus, you'll want to consider your trading style, how much screen real estate you have, and how many indicators you use.

- Essential: If you only trade a couple of assets and don't use many indicators, Essential is probably the right plan for you.

- Plus: If you trade many assets, set a lot of price alerts, and have multiple monitors, Plus may be a better fit.

I use Essential because I only trade with 4–5 indicators and don't need to watch more than two charts at a time.

Who is TradingView best for?

TradingView is best for active traders who are serious about their trading and are willing to make a small investment for premium charting.

If you're looking for free charting software, TradingView will work for a short period, but you'll likely bump into a paywall once you start taking your trading more seriously.

For free charting software, check out TradeStation, a brokerage built for traders.

While long-term investors and swing traders may use TradingView for some basic charting, that's not who the platform was built for. If that describes you, you can use a paid version of TradingView, but it will probably be overkill.

However, if you're an active trader — either new or experienced — and are taking the time to research whether TradingView is worth it, I highly recommend getting a free 30-day trial and deciding for yourself.

TradingView pro and con summary

| Pros | Cons |

| Fast, powerful, and easy to use | Beginners may find the feature set overwhelming |

| 400+ built-in indicators, 100,000+ community-built indicators, 110+ drawing tools, 20+ chart types, 20+ timeframes | The free plan is ad-supported and very limited, so serious traders almost certainly need a paid subscription |

| Chart on 3.5+ million securities listed on 150+ exchanges from 50+ countries around the world | |

| Sleek, minimal interface | |

| Great for new and advanced traders alike | |

| Trusted by 100 million users worldwide |

If you're still wondering whether a TradingView subscription is worth it or not, the best way to decide is to try it yourself.

You can get a free 30-day trial to any plan through our link.

Final verdict

One of the best ways to judge the quality of any product or service is by seeing how many people use it.

In this regard, TradingView's user base of 100 million users (more than 1 million of which are paying) tells you all you need to know about the platform.

I have never had a bad experience using TradingView. It has always been fast and has had every indicator I've ever searched for. I would not want to trade without it.

Try it for 30 days, and I'll bet you come to a similar conclusion.

Frequently asked questions

How much does TradingView cost?

TradingView has a range of plans, which vary in price from $0 (with ads) to $239.95 per month. The vast majority of serious traders are using either the Essential ($16.95/month) or Plus ($33.95/month) plans.

All plans can also be paid for on an annual basis for a 16-17% discount.

Is TradingView free to use?

Yes, you can use TradingView for free. However, if you want to use more than two indicators or more than one chart per layout, you'll want to upgrade to a paid plan.

Can you trade on TradingView?

Yes, TradingView partners with over 100 brokers and offers order executions from within its platform. There are more than 617,000 accounts connected on TradingView and over 59 million trades have been executed through the platform.

Is TradingView good for beginners?

Yes, TradingView is good for beginners and advanced traders alike.

While the platform is incredibly powerful, it's very well-designed and intuitive, making it feel far less intimidating than the majority of charting platforms.

Is TradingView safe?

Yes, TradingView is safe and stores very little data about its users other than a profile and a form of payment.

Additionally, its broker connections are secured with bank-level encryption.

.png)