Ingredion Incorporated (FRA:CNP)

Germany · Delayed Price · Currency is EUR

Germany · Delayed Price · Currency is EUR | Market Cap | 6.26B -19.9% |

| Revenue (ttm) | 6.15B -2.8% |

| Net Income | 620.89M +12.7% |

| EPS | 9.52 +15.1% |

| Shares Out | n/a |

| PE Ratio | 10.08 |

| Forward PE | 9.99 |

| Dividend | 2.82 (2.87%) |

| Ex-Dividend Date | Jan 2, 2026 |

| Volume | n/a |

| Average Volume | 8 |

| Open | 98.18 |

| Previous Close | 97.70 |

| Day's Range | 98.18 - 98.18 |

| 52-Week Range | 90.46 - 126.35 |

| Beta | n/a |

| RSI | 50.57 |

| Earnings Date | Feb 3, 2026 |

About Ingredion

Ingredion Incorporated, together with its subsidiaries, engages in the manufacture and sale of sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide. The company operates in Texture & Healthful Solutions; Food & Industrial Ingredients–LATAM; and Food & Industrial Ingredients–U.S./CANADA segments. It offers starch products for use in a range of processed foods; cornstarch; specialty paper starches for enhanced draina... [Read more]

Financial Performance

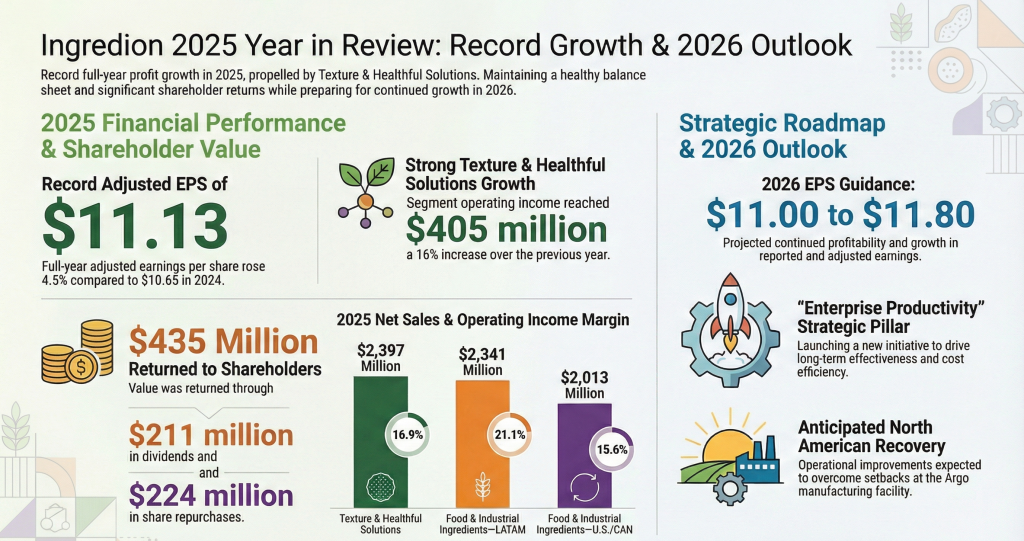

In 2025, Ingredion's revenue was $7.22 billion, a decrease of -2.84% compared to the previous year's $7.43 billion. Earnings were $729.00 million, an increase of 12.67%.

Financial numbers in USD Financial StatementsNews

Ingredion's President and CEO Sells 33k Shares Before Becoming New Board Chairman

James P. Zallie, President and CEO of Ingredion, a global supplier of specialty food ingredients, reported a notable insider sale amid ongoing shifts in the board of directors.

Ingredion Incorporated (INGR) Presents at Consumer Analyst Group of New York Conference 2026 - Slideshow

2026-02-19. The following slide deck was published by Ingredion Incorporated in conjunction with this event.

Decoding Ingredion Inc (INGR): A Strategic SWOT Insight

Decoding Ingredion Inc (INGR): A Strategic SWOT Insight

High Dividend Packaged Foods: Relative Favorability

The packaged foods industry has broadly declined over the last year with some producers dropping over 20%; dividend yields have expanded to as much as 9.5%. However, a high dividend yield does might n...

Ingredion Inc at Consumer Analyst Group of New York (CAGNY) Conference Transcript

Ingredion Inc at Consumer Analyst Group of New York (CAGNY) Conference Transcript

Insider Sell Alert: Larry Fernandes Sells Shares of Ingredion Inc (INGR)

Insider Sell Alert: Larry Fernandes Sells Shares of Ingredion Inc (INGR)

Insider Sell: James Zallie Sells Shares of Ingredion Inc (INGR)

Insider Sell: James Zallie Sells Shares of Ingredion Inc (INGR)

Jim Zallie Takes on Chairman Role at Ingredion (INGR)

Jim Zallie Takes on Chairman Role at Ingredion (INGR)

Ingredion Incorporated: Ingredion Appoints President and CEO James P. Zallie as Chairman of the Board

Victoria J. Reich named lead director; board expresses appreciation to former chairman, Gregory B. Kenny for his serviceWESTCHESTER, Ill., Feb. 11, 2026 (GLOBE NEWSWIRE) -- Ingredion Incorporated (...

Ingredion Appoints President and CEO James P. Zallie as Chairman of the Board

WESTCHESTER, Ill., Feb. 11, 2026 (GLOBE NEWSWIRE) -- Ingredion Incorporated (NYSE: INGR), a leading global provider of ingredient solutions, today announced that its board of directors has unanimously...

Ingredion: Defensive, High-Yield, Undervalued, And Transforming For Growth

Ingredion is reiterated as a Buy, supported by strong financial health and robust free cash flow exceeding guidance. INGR advances strategic pillars—protein and clean label ingredients—while completin...

INGR: UBS Raises Price Target While Maintaining Neutral Rating | INGR Stock News

INGR: UBS Raises Price Target While Maintaining Neutral Rating | INGR Stock News

Barclays Raises Price Target for Ingredion (INGR) to $128 | INGR Stock News

Barclays Raises Price Target for Ingredion (INGR) to $128 | INGR Stock News

Ingredion (INGR) Rating Reiterated at Equal-Weight by Stephens & Co. | INGR Stock News

Ingredion (INGR) Rating Reiterated at Equal-Weight by Stephens & Co. | INGR Stock News

Ingredion Incorporated 2025 Q4 - Results - Earnings Call Presentation

Ingredion Inc (INGR) Q4 2025 Earnings Call Highlights: Navigating Challenges and Celebrating Growth

Ingredion Inc (INGR) Q4 2025 Earnings Call Highlights: Navigating Challenges and Celebrating Growth

Ingredion shares dip after Q4 sales fall, full-year earnings rise

Ingredion (NYSE: INGR) shares were trading near $117, down about 0.5% intraday following the company’s release of fourth quarter and full-year 2025 results on Wednesday. The stock remains below its 52...

Ingredion anticipates $11–$11.80 EPS in 2026 while advancing clean label and protein fortification growth

Ingredion Incorporated (INGR) Q4 2025 Earnings Call Transcript

Ingredion Q4: Poised For Lackluster First Half, But It Is Getting Interesting

Q4 2025 Ingredion Inc Earnings Call Transcript

Q4 2025 Ingredion Inc Earnings Call Transcript

Earnings Summary: Ingredion Q4

The Q4 earnings report for Ingredion (NYSE: INGR) was released on Tuesday, February 3, 2026 at 06:03 AM. Here's what investors need to know about the latest announcement. Earnings Ingredion missed es...

Ingredion (INGR) Projects FY26 Adjusted EPS Between $11.00 and $11.80

Ingredion (INGR) Projects FY26 Adjusted EPS Between $11.00 and $11.80

Ingredion (INGR) Posts Record Annual Earnings Despite Q4 Revenue Miss

Ingredion (INGR) Posts Record Annual Earnings Despite Q4 Revenue Miss